Forex System |

- Free Forex Signals available in VIP Signals Channel on Telegram with 85% accuracy

- US Dollar Hit as Treasury Yields Fall. Fed Warns of Risky Asset Price, Will USD Rally?

- From Start To Profit | Forex Trader Motivation

- 3 Entry Strategies To Try

- Forex Account 100% Profit In Just Few Hour | Special Forex Gap Strategy in Hindi Urdu By Tani Forex

- Canadian Dollar Price Forecast: USD/CAD, CAD/JPY, EUR/CAD

- Institutional Client Development – Americas – Associate

- Como Ganhar Dinheiro com Forex – Comunidade Trader

- International Relationship Manager – Business Banking

- Gold Eyes Key Resistance With Fed Bets in Focus as CPI Nears

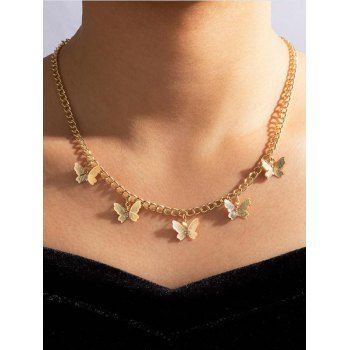

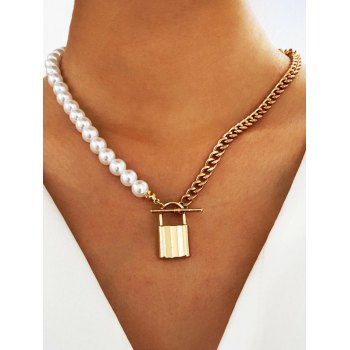

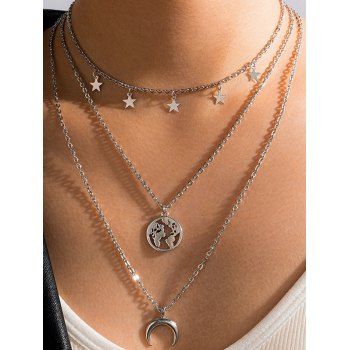

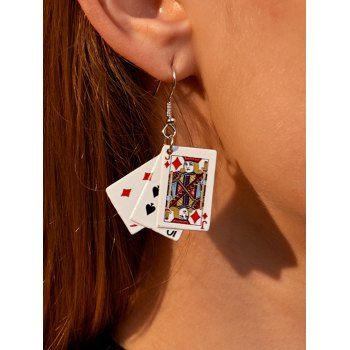

| Free Forex Signals available in VIP Signals Channel on Telegram with 85% accuracy Posted: 09 Nov 2021 12:46 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Copytrading App Link  https://copytrade.page.link/ufuX Personal Support is available on whatsapp. My WhatsApp Number You can add your old/new octafx account in my referral list through this Link. I also earn money from Bitcoin You can trade at your own without copying anyone. TarunSingh-YT Your Queries Biggest mistake in copytrading, now ready for VIP signals, best opportunity to earn source Click to rate this post! [Total: 0 Average: 0] | ||||||||

| US Dollar Hit as Treasury Yields Fall. Fed Warns of Risky Asset Price, Will USD Rally? Posted: 09 Nov 2021 12:24 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ US Dollar, Treasury Yields, USD, Federal Reserve, S&P 500 – Talking Points

The US Dollar lost ground today on news that Federal Reserve Governor, Lael Brainard, was interviewed for the top job at the central bank. She is seen as more dovish than current Chair Jerome Powell. Moreover, this likely came as a surprise to markets, creating cautious uncertainty. Treasury yields softened as a result with US 10-year yields remaining below 1.50%. Lower rates helped US equities hit another record high. The S&P 500 printed 8 straight sessions of positive gains. The best run of successive green days since 2017. While the stock market was cheering, the Federal Reserve released their Financial Stability Report. Within their framework, they were not too concerned about borrowing by businesses and households, leverage in the financial sector or funding risks for domestic banks. However, they did express a warning in the report on the prices of risky assets. Even allowing for low Treasury yields, they still see assets at high prices and that 'asset prices are vulnerable to significant decline should risk appetite fall.' The Chinese property sector also got a mention due to the size of the market and the linkages to the global economy. APAC equities were mixed with the PBOC adding liquidity to help China and Hong Kong move slightly firmer. Australia and Japan stocks were a bit weaker. The Australian Dollar was the underperformer on the day while the Japanese Yen found support Looking ahead, US PPI data will be released and Federal Reserve Chair, Jerome Powell, is scheduled to speak at a joint Fed, ECB and BoC diversity conference. US Dollar (DXY) Technical AnalysisThe US Dollar, as represented by the USD Index (DXY), has moved lower over the last few session but remains within an ascending channel. The lower bound of the channel currently coincides with the 55-day simple moving average (SMA) at 93.463 and could provide support. Recent lows at 93.818, 93.278 and 91.947 may see support. The later is also near the 200-day SMA, currently at 92.078. On the topside, previous highs at 94.620 and 94.742 are potential resistance levels.

— Written by Daniel McCarthy, Strategist for DailyFX.com To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||

| From Start To Profit | Forex Trader Motivation Posted: 08 Nov 2021 11:45 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  FREE: The Complete Price Action Strategy Checklist – http://bit.ly/2o5NO0M FREE: The Complete Price Action Strategy Checklist – http://bit.ly/2o5NO0M In this Forex trader motivation video, you’ll be hearing a compilation of advice on traders that started (often the wrong way) and ended up with massive success. FTM #20 Watch more in this series: https://www.youtube.com/watch?v=CazQG0USNfM&list=PLwmpbNUnTt6gKTyI6GqMI3LDeAMacq0Ao SUBSCRIBE TODAY: https://goo.gl/4DpLu6 Want to look cool? Check out the Desire To Trade Merch: http://bit.ly/2ySpeJ7 (use the promo code YOUTUBE10) // SOCIAL // TRADING MUST-HAVE RESOURCES // MUSIC // ABOUT ME I blog at www.desiretotrade.com and host the Desire To Trade Podcast. I was fed up with the "fake" millionaire traders and the "get-rich-quick-trading guys". That’s why you can expect more free content from me than what other people charge for! If you truly want to succeed in Forex trading, I believe you need to keep working on yourself so you can improve your strengths, but also your weaknesses. Do not focus solely on what you’re good at. // Disclaimer // AFFILIATE AFFILIATE LINKS source Click to rate this post! [Total: 0 Average: 0] | ||||||||

| Posted: 08 Nov 2021 11:23 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ What is a forex entry point?A forex entry point is the level or price at which a trader enters into a trade (buy/sell). Deciding on a forex entry point can be complex for traders because of the abundance of variable inputs that move the forex market. This article will cover how to enter a forex trade and outline the following entry strategies:

When is the best time to enter a forex trade?The best time to enter a forex trade depends on the strategy and style of trading. There are several different approaches and the three discussed below are popular approaches and are not meant to be all of the methods available. Join the DailyFX analysts on webinars to see how each of them approaches the market. Discover the benefits of using entry orders in forex trading Forex Entry Strategy #1Trend channels Trendlines are fundamental tools used by technical analysts to identify support and resistance levels. In the example below, the price shows a clear higher high and higher low movement indicating a prominent uptrend. This enables to determine a trading bias of buying at support and taking profit at resistance (see chart below). Once price breaks these key levels of support and resistance, traders should then be aware of a potential breakout or reversal in trend. Forex entry strategy based on trend channels, weekly USD/ZAR chart: Forex Entry Strategy #2Candlestick patterns Candlestick patterns are powerful tools used by traders to look for entry points and signals for forex. Patterns such as the engulfing and the shooting star are frequently used by experienced traders. In the example below, the hammer candlestick pattern can be seen as a reversal trigger entry point on EUR/USD. Identifying the hammer or any other candlestick pattern does not confirm an entry point into the trade. Entry points are just as important as identifying the candlestick pattern. Entry points further validate the candlestick pattern therefore, risking less and giving traders a higher probability of success. Hammer candlestick pattern trade entry, daily EUR/USD chart: As you can see on the chart, the hammer formation is circled in blue. It is known that the hammer signals potential reversals however, without some form of confirmation the pattern may indicate a false signal. In this case, the entry has been identified after a confirmation close higher than the close of the hammer candle. This gives a stronger upward bias to the trader and endorsement of the hammer candlestick pattern. Traders often look for multiple signs of trade validation such as indicators in conjunction with candlestick patterns, price action and news but for the purpose of this article we have isolated different strategies into their component parts for simplicity. Forex Entry Strategy #3Breakouts Using breakouts as entry signals is one of the most utilised trade entry tools by traders. Breakout trading involves identifying key levels and using these as markers to enter trades. Price action expertise is key to successfully using breakout strategies. The basis of breakout trading comprises forex prices moving beyond a demarcated level of support or resistance. Due to the simplicity of this strategy, breakout entry points are suitable for novice traders. The example below shows a key level of support (red), after which a breakout occurs along with increased volume which further supports the move to the downside. Entry is prompted by a simple break of support. In other cases, traders look for a confirmation candle close outside of the delineated key level. Forex entry strategy based on breakouts, daily USD/JPY chart: Popular Forex Entry IndicatorsThe most popular forex entry indicators tie in with the trading strategy adopted. Indicators are regularly used as support for the aforementioned entry strategies. The table below illustrates some of the best forex entry indicators as well as how they are used:

Check out 4 of the most effective trading indicators that every trader should know. Forex Entry Strategies: A Summary

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||

| Forex Account 100% Profit In Just Few Hour | Special Forex Gap Strategy in Hindi Urdu By Tani Forex Posted: 08 Nov 2021 10:43 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ In This Week GBP USD make a big Gap on Monday Morning. in this Gap many peoples makes huge profit. Tani forex special Forex Gap strategy work on this week and in just few hours account profit 100%. This is such an easy and Best Strategy of the world that works. All information about this Market Gap Strategy in this video in hindi and urdu. for more information Must Visit http://www.taniforex.com/  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] | ||||||||

| Canadian Dollar Price Forecast: USD/CAD, CAD/JPY, EUR/CAD Posted: 08 Nov 2021 10:22 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Canadian Dollar, CAD, USD/CAD, CAD/JPY, EUR/CAD Talking Points:

After a really strong month of October, the Canadian Dollar has taken a break so far in November, showing weakness against all of the US Dollar, the Japanese Yen and even the Euro. In USD/CAD, the pair has pulled back to test resistance at the 50% marker of the June-August bullish move. This showed up after October trade highlighted a falling wedge formation building in the middle of the month as sellers were slowing their approach around the 1.2300 level. As of this writing, there is some short term bullish continuation potential given the hold of higher-low support around prior resistance, but the next 150 pips higher in USD/CAD sees a number of resistance levels coming into play starting with the 1.2500 psychological level. USD/CAD Four-Hour Price ChartChart prepared by James Stanley; USDCAD on Tradingview CAD/JPYCAD/JPY was a high-flyer in early Q4 trade as there was a potent macro combo pushing both sides of the pair. On the CAD front, higher oil prices were helping to keep the currency strong and for the Yen, higher rates were spelling for more Yen-weakness, which led to a strong topside push up to a fresh six-year-high. But, after topping on October 21st, the pair has continued to pullback and this morning marks a fresh multi-week low in the pair. There is a big support level a little lower, around the 90 handle which is confluent with a couple of Fibonacci retracements around 90.25. For those looking for CAD-strength, this may be a more attractive venue than USD and there's a bull flag formation brewing on the below Daily chart. CAD/JPY Daily ChartChart prepared by James Stanley; CADJPY on Tradingview EUR/CADI highlighted this pair and this setup in late-October as EUR/CAD had finally pulled back to find a bit of resistance around 1.4435. Two weeks later, price action is still testing resistance, and while this doesn't preclude the potential for bearish continuation, it does highlight a persistence from bulls that can allow for this resistance to be implemented for topside breakout approaches. To be sure, this wouldn't be a long-term type of setup as the fundamental backdrop is seemingly at odds with bullish EUR/CAD. But, the technical setup is what it is, and sellers have had ample opportunity to push this lower over the past couple of weeks and haven't. This can keep the door open for short-term bearish CAD plays. EUR/CAD Daily Price ChartChart prepared by James Stanley; EURCAD on Tradingview — Written by James Stanley, Senior Strategist for DailyFX.com Contact and follow James on Twitter: @JStanleyFX

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||

| Institutional Client Development – Americas – Associate Posted: 08 Nov 2021 10:19 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Institutional Client Development – Americas – Associate Company: BNP Paribas Job description: , Equity Derivatives, Forex & Local Markets, Commodity Derivatives, Credit, Prime Solutions & Financing and Primary Markets… candidate will work closely with Global Market Institutional Sales to prepare client performance packages & competitive analysis… Expected salary: Location: King of Prussia, PA – Philadelphia, PA Job date: Fri, 05 Nov 2021 23:02:36 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||

| Como Ganhar Dinheiro com Forex – Comunidade Trader Posted: 08 Nov 2021 09:42 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Como Ganhar Dinheiro com Forex – Comunidade Trader, quer saber como ganhar dinheiro operando forex, Vou te ensinar como ganhar dinheiro no forex 2020 forex nunca foi tão fácil  Comunidade Forex: https://bit.ly/Comunidade_Trader Comunidade Forex: https://bit.ly/Comunidade_TraderTreinamento Gratís:https://forexparainiciantes.com/curso-gratuito/

Como ganhar dinheiro no Forex: aprenda e seja financeiramente livre O Forex nada mais é do que a negociação entre pares de moedas como o EUR/USD (Euro/Dólar Americano) e é possível movimentar várias combinações ao mesmo tempo. Libra, Dólar Canadense e Yen Japonês são algumas das opções que podem ser utilizadas. Feitas as escolhas dos pares, o trader aposta se a relação entre as duas moedas vai subir ou descer. Como ganhar dinheiro no Forex em pouco tempo? O mercado de ações e o trading de divisas são um investimento que inclui o risco de perda do seu capital e nem todos podem ganhar! Mas neste artigo vamos mostrar-lhe o que precisa de fazer para aprender Como Ganhar Dinheiro com Forex! Antes de tudo, deve saber que um profissional deve saber como ser lucrativo, e deve ainda ajustar-se a uma ou mais estratégias de trading e adaptá-las à sua personalidade e estilo de trading, sem esquecer de controlar os seus lucros e os riscos. De qualquer forma, qualquer método pode e deve ser testado antes de ser colocado em prática numa conta real de trading, forex como ganhar dinheiro,forex com pouco dinheiro,forex portugal,forex brasil,forex. Este período de testes permite praticar e conhecer a expectativa positiva ou negativa da estratégia em questão e, em particular, vários dados estatísticos importantes a serem conhecidos. No entanto, nunca se esqueça que os resultados anteriores não são 100% representativos dos resultados futuros,como se ganha dinheiro com forex,como ganhar dinheiro em forex,como ganhar dinheiro no forex,como ganhar dinheiro com o forex. Como Ganhar Dinheiro com Forex – Não Persiga as Vitórias Rápidas Uma boa maneira para começar a mudar é esquecer as metas e prioridades irreais que pode obter do trading. Obviamente, é possível que seja bastante lucrativo no espaço de duas ou três operações, obtendo lucros muito rápidos, no entanto, na realidade, o Forex Trading requer algumas análises técnicas mais elaborada para não perder seu investimento em todo. Como Ganhar Dinheiro Como Trader – Nenhum Trader Está Sempre a Ganhar Obter um lucro rápido em todas as posições é simplesmente um mito urbano. Vamos discutir como ser constantemente lucrativo mas num amplo horizonte de tempo. O que diria se lhe dissermos que estamos a falar de um espaço temporal de um ano? Alguns dos traders profissionais podem ser rentáveis praticamente todos os dias, mas mesmo eles passam por períodos de perdas. Se é um mau perdedor, e particularmente sensível no que toca a perder dinheiro, tem muito a aprender. Perguntas Respondidas no video:

#ganhardinheiroforex #forexganhardinheiro #forex #operarforex Edney Pinheiro Todos os Direitos Reservados. source Click to rate this post! [Total: 0 Average: 0] | ||||||||

| International Relationship Manager – Business Banking Posted: 08 Nov 2021 09:31 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: International Relationship Manager – Business Banking Company: HSBC Job description: excellence at all times, for all aspects of any customer, prospect or professional’s interaction with HSBC. Work in partnership… information, including KYC requirements in Group systems Resolve any/all identified issues promptly, and escalate concerns… Expected salary: Location: Mumbai, Maharashtra Job date: Mon, 08 Nov 2021 23:18:29 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||

| Gold Eyes Key Resistance With Fed Bets in Focus as CPI Nears Posted: 08 Nov 2021 09:20 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Gold, XAU/USD, Treasury Yields, Fed Rate Hike Bets, CPI – Talking Points

Gold prices moved higher overnight as markets weighed interest rate bets. Prices broke above the high-profile 1800 level last week after the Bank of England surprised markets by holding rates steady. Analysts and market-based measures predicted a high chance for a rate hike from the BoE. That challenged the broader market narrative across other central banks and weighed on Treasury yields in the United States. The 10-year Treasury yield climbed overnight but failed to break above the 1.5% mark – a psychological level. The closely watched rate is fell through the Tuesday Asia-Pacific session, allowing gold to climb. Federal Reserve rate hike bets shifted to the right last week, with rate traders pricing in a less aggressive policy path. The chance for a 25 basis point hike at the June 2022 FOMC meeting fell to 45.5% on Tuesday, down from 47.4% a week ago. That was despite a better-than-expected jobs report. The Fed's outlook is a key variable for rate-sensitive gold prices. That said, traders are focused on US inflation data due out later this week. Fed Chair Powell maintains that rising price pressures remain transitory but conceded recently that inflation has been stickier than first thought. A couple of additional months of hot inflation prints may pull rate hike bets forward, however. The October consumer price index (CPI) will cross the wires Wednesday. Analysts expect inflation to rise 5.8% on a year-over-year basis following the 5.4% rise in September. Core inflation – which strips out volatile food and energy prices – is expected to drop at 4.3%, according to a Bloomberg survey, up from 4.0%. While a hotter-than-expected print may help boost rate hike bets, it will likely take multiple prints to significantly ramp up those bets to where they would force Treasury yields to accelerate higher. Nonetheless, a figure north of 4.3% may weigh on the yellow metal. Gold Technical ForecastXAU/USD prices have been on the move higher this month, with major resistance around the 1830 level. A recent crossover between the 20- and 50-day Simple Moving Averages (SMAs) saw prices rally following the bullish signal. If XAU bulls can't breach the 1830 level, a pullback to the rising 20-day SMA may be on the cards. Psychological resistance around 1800 is a possible downside target. Gold Daily Chart

Chart created with TradingView — Written by Thomas Westwater, Analyst for DailyFX.com To contact Thomas, use the comments section below or @FxWestwater on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Contato:

Contato: Me envie sua dúvida pelo Instagram: http://instagram.com/edney_pinheiro

Me envie sua dúvida pelo Instagram: http://instagram.com/edney_pinheiro Whatsapp (pode chamar de boa): http://bit.ly/Whatsapp-Edney-Pinheiro

Whatsapp (pode chamar de boa): http://bit.ly/Whatsapp-Edney-Pinheiro Se inscreva no canal: http://bit.ly/Subscrevaexotico

Se inscreva no canal: http://bit.ly/Subscrevaexotico Timestamps

Timestamps

No comments:

Post a Comment