Forex System |

- Tesla Bounces After Gap, AMD Strikes a Meta Deal; S&P 500 Resistance

- International Relationship Manager – Business Banking

- Client Integration FIX Specialist

- 11.11.2021: USD melonjak susulan data inflasi; tinjauan untuk USD, USD/JPY, AUD/USD

- International Relationship Manager – Business Banking

- Trade Finance Officer

- US Dollar Price Action Pre-CPI: EUR/USD, GBP/USD, USD/JPY

- BankNifty Options Buy sell signal Software | Nifty Options Buying Strategy with Buy Sell Signals

- Gold Price Forecast: XAU Spikes on 6.2% CPI

- 12.11.2021: Oil prices slide – Outlook for Brent, USD/RUB, GOLD.

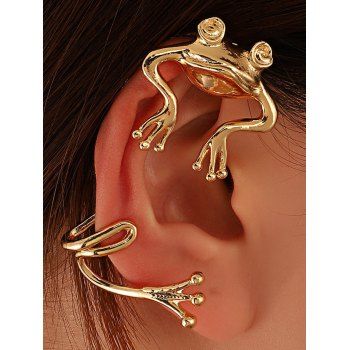

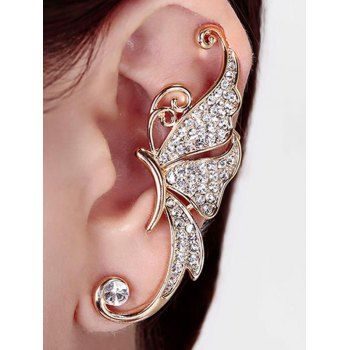

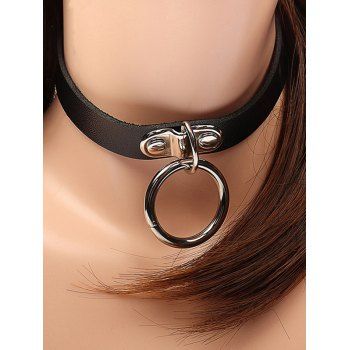

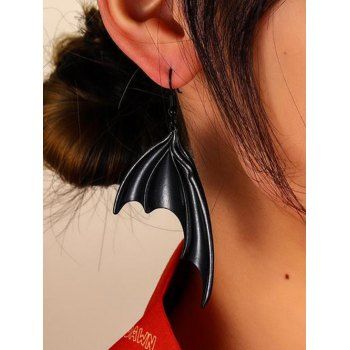

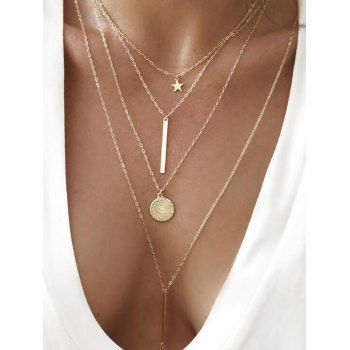

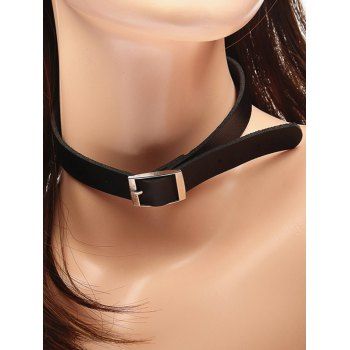

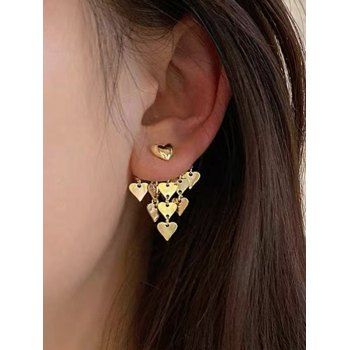

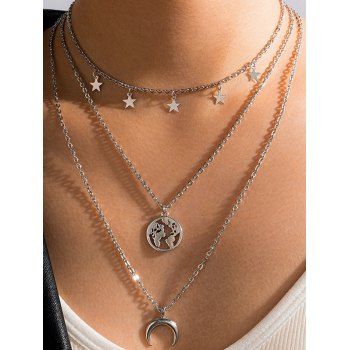

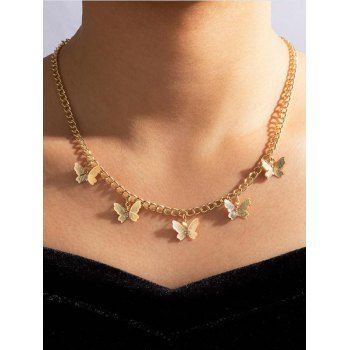

| Tesla Bounces After Gap, AMD Strikes a Meta Deal; S&P 500 Resistance Posted: 14 Nov 2021 12:26 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Talking Points:

Markets had the weekend to digest another dovish FOMC outlay and that's led to strength on the open that pretty much lasted throughout the session. One of the more notable weekend events was, again, Elon Musk's Twitter Feed. Amongst a host of interesting tweets, the Tesla CEO put out a poll asking whether he should sell 10% of his Tesla holdings, and he had multiple follow-up tweets saying that he would abide by the results of the poll. The majority said 'yes,' to the tune of 57.9% and on the this week's open, the stock gapped down on the prospect of a major shareholder selling 10% of his stake.

The gap was about 7.26% from Friday's close but almost immediately after the open the stock started to bounce and quickly clawed back a large chunk of that loss. The stock gained as much as 5.72% from that gapped-down low, a remarkable run by any stretch but especially so considering the context of Musk selling shares. Tesla Daily Price ChartChart prepared by James Stanley; TSLA on Tradingview AMC: Are Apes Planning Another Trip to the Moon?There's been some unusual options activity in AMC of recent to go along with bullish price action. Earlier today the word was making rounds that there was a $225k purchase of January calls at a 145 strike, which is more than 2x the all-time-high in the stock. While the fundamentals make such a price justification difficult, there is still an impressive short outlay on the stock and, as we saw earlier this year, short squeezes can create sharp bullish moves and the gamma hedging required from such options activity can continue to provide a bullish catalyst in the stock. AMC Daily Price ChartChart prepared by James Stanley; AMC on Tradingview AMD Jumps on Meta DealFacebook changed their name to Meta as part of a broader shift into virtual reality and the 'metaverse' that they intend to build. Today it was announced that Meta/Facebook had selected AMD to supply chips for their servers, providing another hit to Intel which lost a massive amount of business to Apple last year when they unveiled their own chip. AMD spiked higher on the news to trade at another fresh all-time-high. AMD Weekly Price ChartChart prepared by James Stanley; AMD on Tradingview S&P Holds Friday ResistanceThe S&P 500 initially gapped down to start this week's trade but that gap didn't last for long as buyers pushed prices back up towards prior resistance. At this stage, the move is built-in and frothy but devoid of a bearish trigger, setting up for reversal could be a challenge. On the driver side of the argument, tomorrow brings PPI out of the United States and Wednesday brings inflation. CPI is expected to print at 5.8% but if this surprises and touches at 6% or more, there might be a quick jolt of fear that could compel a pullback if prices have started to pullback ahead of that. As looked at in this week's forecast on equities, triggering fresh bullish exposure at current levels could remain a daunting prospect until some nearby support structure develops. From a technical point of view, this was the second consecutive daily close of a spinning top near resistance. This may be pointing at pullback potential but perhaps more pointedly, this highlights the risk of chasing at the current stretched level. Just ahead on the chart is the 161.8% extension of the September-October pullback, further highlighting near-term pullback potential in the index. S&P 500 Daily Price ChartChart prepared by James Stanley; S&P 500 on Tradingview — Written by James Stanley, Senior Strategist for DailyFX.com Contact and follow James on Twitter: @JStanleyFX

Source link Click to rate this post! [Total: 0 Average: 0] |

| International Relationship Manager – Business Banking Posted: 14 Nov 2021 12:11 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: International Relationship Manager – Business Banking Company: HSBC Job description: or professional's interaction with HSBC. Work in partnership with colleagues across the HSBC network to deliver exceptional standards… information, including KYC requirements in Group systems Resolve any/all identified issues promptly, and escalate concerns… Expected salary: Location: Gurgaon, Haryana Job date: Sun, 14 Nov 2021 03:06:05 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Client Integration FIX Specialist Posted: 14 Nov 2021 12:08 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Client Integration FIX Specialist Company: Interactive Brokers Job description: FIX Protocol Integration work will include analysis, design, development, testing, certification and quality assurance… assurance Familiar with UNIX/Linux systems and command line environments Knowledge of telecommunications equipment and network… Expected salary: Location: Singapore Job date: Sun, 14 Nov 2021 00:02:04 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| 11.11.2021: USD melonjak susulan data inflasi; tinjauan untuk USD, USD/JPY, AUD/USD Posted: 13 Nov 2021 11:56 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Dolar AS memperoleh momentum susulan keluaran data inflasi dan tuntutan pengangguran awal semalam. Ia membuat lonjakan ketara sebaik sahaja kedua-dua laporan dikeluarkan. Agak menarik , perbincangan kita semalam mengenai sama ada, adakah berbaloi untuk menjual dolar AS. Ternyata, jangkaan semalam adalah benar apabila dolar AS tidak susut ke bawah. Kami telah pun menyediakan analisis pasaran semasa untuk hari ini. Jadi, kami bersedia untuk kongsikan jangkaan kami dengan anda! Harga pengguna AS meningkat secara asas tahunan pada bulan Oktober, ia mencatatkan bacaan yang mengejutkan apabila melonjak ke paras tertinggi sejak tahun 1990. Para pedagang percaya bahawa Fed mungkin akan menaikkan kadar faedah lebih awal daripada bank-bank pusat di Eropah dan Jepun. Pihak pengawal selia di negara-negara lain turut sedang mempertimbangkan langkah yang sama. Para pelabur menjangkakan dolar AS akan membuat lonjakkan di atas paras 95 mata. Dan pada ketika ini, ia sudah pun mencapai paras 95 mata. Namun, penganalisis sebaliknya menjangkakan pembetulan. Indeks dolar AS dijangka akan membuat pengukuhan sementara pada 94.80. Yen sudah pun pulih daripada penurunan paling tajam secara asas bulanan apabila data inflasi AS meningkatkan jangkaan kenaikan kadar faedah. Sebelumnya, kami menjangkakan peningkatan bagi pasangan dolar/yen. Nampaknya, ia meningkat lebih tinggi daripada yang dijangkakan. Pasangan mata wang itu kini didagangkan pada 114 mata. Ia dijangka akan meningkat lagi ke 114.20 dan seterusnya membuat sedikit penurunan berikutan pertumbuhan yang terlalu pantas. Dolar Australia dilihat semakin lemah berbanding mata wang AS. Pasangan AUD/USD telah pun turun ke paras 0.7300. Seperti yang kita bincangkan semalam, pasangan mata wang itu mungkin menurun kepada paras 0.7280. Seterusnya, ia dijangka akan memasuki fasa pembetulan. Secara ringkasnya. Dolar AS melonjak tinggi berikutan keluaran data mengenai kadar inflasi AS yang tinggi. Inflasi tahunan pada bulan Oktober membuat kejutan apabila menyentuh paras tertinggi sejak 1990. Ia melonjak kepada 6.2% selepas data bulan September sebanyak 5.4%. Penganalisis sebelumnya menjangkakan bacaan adalah pada 5.8%. Oleh itu, pihak penganalisis menjangkakan bahawa Fed mungkin cenderung menaikkan penanda aras kadar faedah menjelang penghujung musim panas akan datang daripada paras semasa 0 sehingga 0.25%. Selain itu, pihak pengawal selia mungkin akan menaikkan kadar faedah lebih daripada sekali dari semasa ke semasa, yang akan menjadi pencetus kepada kenaikan dolar AS. 00:00 Intro 00:34 USDX 01:21 USD/JPY 01:57 AUD/USD FX Analisis: https://www.instaforex.com/ms/forex_analytics Kalender Forex: https://www.instaforex.com/ms/forex_calendar Berita Forex: https://www.instaforex.com/ms/instaforex_tv Carta Forex: https://www.instaforex.com/ms/charts Blog korporat: https://plus.google.com/u/0/108992007110283236440 #forex_news #asian_session #instaforex_tv source Click to rate this post! [Total: 0 Average: 0] |

| International Relationship Manager – Business Banking Posted: 13 Nov 2021 11:41 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: International Relationship Manager – Business Banking Company: HSBC Job description: excellence at all times, for all aspects of any customer, prospect or professional’s interaction with HSBC. Work in partnership… information, including KYC requirements in Group systems Resolve any/all identified issues promptly, and escalate concerns… Expected salary: Location: Gurgaon, Haryana Job date: Sat, 13 Nov 2021 23:47:29 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Posted: 13 Nov 2021 11:36 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Trade Finance Officer Company: Kookmin Bank Co., Ltd. Singapore Branch Job description: [Job Description] 1. Handle daily import & export, loan, guarantee, forex and money markets transactions. 2. Handle… & export, loan, guarantee, forex and money markets transactions. 2. Handle system report, following up and monitoring… Expected salary: $36000 – 48000 per year Location: Singapore Job date: Sun, 14 Nov 2021 06:58:18 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| US Dollar Price Action Pre-CPI: EUR/USD, GBP/USD, USD/JPY Posted: 13 Nov 2021 11:24 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ US Dollar Pre-CPI Talking Points:

The US Dollar has continued to pull back after last week's FOMC rate decision. Once again, the Fed sounded really dovish and Powell refused to even entertain the topic of rates. He did continue to say, however, that the bank is continuing to drive for maximum employment before making any changes to policy, even with inflation remaining at very high levels that the Fed still thinks are transitory in nature. So while markets had started to price in more than one hike next year from the FOMC, since last week's rate decision the 10-year has given up as much as 19 basis points. This is a pretty clear illustration of rate hike bets receding after another dovish FOMC outlay. There is but one pressure point and that's coming into the equation tomorrow with the release of CPI numbers from last month. The expectation is high, looking for headline CPI to bump up to 5.8%, which would be quite the jump from the 5.4% that's printed for three of the past four months. That would also add another apex to the below chart that shows how aggressively high inflation has run above the Fed's 2% target for six, going on seven months. US CPI Since 2017Chart prepared by James Stanley US DollarSo expectations are high for CPI tomorrow and despite the continued pullback in US rates, the technical posture of the US Dollar hasn't really matched that: The USD continues to trade in the same range that's held since late-September, when prices popped on the back of that FOMC rate decision (which led to rates markets getting ahead of themselves before last week). This could be setting the table for deeper pullback potential, particularly if CPI prints inside of that 5.8% with even greater potential for a deeper bearish move should CPI come in at 5.4% or less. That would speak to the Fed's 'transitory' narrative which could remove some additional pressure from the USD. The other side of the argument: We've already heard from some FOMC officials starting to question the transitory nature or, at the very least, drawing a line in the sand at some point next year for when that might come into question should the data not reflect what they want it to. If inflation surprises to the upside here, that could lead to some very fast re-pricing in a lot of markets, rates and the USD included. That could be the motivation that USD bulls have been looking for to finally leave behind the resistance zone around the 94.50 level. US Dollar Four-Hour Price ChartChart prepared by James Stanley; USD, DXY on Tradingview US Dollar Longer-TermTaking a step back on the chart and the recent range makes a bit more sense. That late-September post-Fed breakout propelled the USD into a major Fibonacci level at 94.47. A month-and-a-half later and that resistance is still holding the highs. On the side of support, there's been a continued hold around a prior zone of resistance, from a previous ascending triangle that was setting up a couple of months ago. And there's also a bullish trendline underneath price, helping to guide the move, which is essentially setting up another ascending triangle formation, which will often be approached with the aim of bullish breakouts, similar to what I had looked at during the prior scenario. There's not much for timing here, however, so the setup remains but the question is what could set the spark that shoots this higher? US Dollar Weekly Price ChartChart prepared by James Stanley; USD, DXY on Tradingview EUR/USDI highlighted a deductive scenario in EUR/USD last week when the pair stubbornly refused to even test the 1.1500 psychological level. That's led to a bounce this week and prices have already jumped up to the 1.1602 resistance area that I had been using previously. That level has again helped to hold the high, so remains as resistance for now, but sellers have had all morning to make a move and as yet, haven't, but this is likely due to the CPI release on the docket for tomorrow. Nonetheless, a bit higher is another spot of resistance at 1.1664, and that's confluent with the resistance side of the falling wedge. If price action can beast through that level and up to the 1.1709-1.1736 zone, then stronger bullish potential will avail itself. EUR/USD Daily Price ChartChart prepared by James Stanley; EURUSD on Tradingview GBP/USDSo there's a bit of two-way action in GBP/USD. I highlighted a double-bottom like setup last week as price action held support above the 1.3410 spot after a dovish Bank of England rate decision. There's also a longer-term bullish formation here, however, with the bull flag; and last week brought a wide-open opportunity for bulls to deal with that formation but, instead, with some help from the BoE they folded at a really big spot. Prices in the pair are currently holding resistance around a Fibonacci retracement at 1.3575. If this holds overnight, it keeps the door open for bullish setups in the pair, particularly focused on USD-strength around tomorrow's FOMC outlay. GBP/USD Daily Price ChartChart prepared by James Stanley; GBPUSD on Tradingview USD/JPYLife happens fast in the Forex market. USD/JPY is a pretty clear illustration of this. As rates were running higher after September FOMC, the Yen put in a massive move of weakness in a very short period of time. USD/JPY set a fresh four-year-high and perched near the 115.00 psychological level. But after last week's rate decision, there was much less motivation for higher rates themes and the pair started to set up in a descending triangle, which I highlighted on Friday. The pair has since broken down to fill in that formation, and support is now showing around the 112.70 level. This pair could be on the move in both scenarios: If CPI prints in-line or below expectations, additional UDS weakness could mesh with a continued pullback in rates. On the other hand, a beat in CPI that makes inflation look less transitory could bring the bid back to the USD, and USD/JPY as rates come back to life. USD/JPY Four-Hour Price ChartChart prepared by James Stanley; USDJPY on Tradingview — Written by James Stanley, Senior Strategist for DailyFX.com Contact and follow James on Twitter: @JStanleyFX

Source link Click to rate this post! [Total: 0 Average: 0] |

| BankNifty Options Buy sell signal Software | Nifty Options Buying Strategy with Buy Sell Signals Posted: 13 Nov 2021 10:54 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ BankNifty Options Buy sell signal Software | Nifty Options Buying Strategy with Buy Sell Signals YouTube Link:- https://www.youtube.com/channel/UC7BmxgT5_EMybwR5lIsrSTQ/featured Open An Account Through Us and Get Live Call support in WhatsApp in LIVE MARKET :- Fill up the Form:- https://alicebluepartner.com/open-myaccount/?M=WMUM262 After Fill up the form Our Representative call you soon for Account Open. About our Buy Sell Signal Software :- Features :- False Buy Sell Signal Detection – Out of numerous buy and sell signals, one can easily find out the false signals by following the RGB rule which are specially designed for false call identification. Call Entry and Exit Indication – Analyze market condition and take decision for entry and exit in any stock using our volume ribbon, star and our neutral line break theory. Multi Level Signal Filtration Technique – Our advanced multilevel filtration technique for individual stocks help traders to wisely choose the proper and 80-85% accurate buy or sell signal, so that they can make profit. Supports All Indian and Global Market Segments – Our Software supports all Indian stock market segments (Nse, Bse, Mcx Commodity, Currency, Options, Ncdex) and Global market (Forex Comex). DISCLAIMER:- This Channel DOES NOT Promote or encourage Any illegal activities , all contents provided by This Channel is meant for EDUCATIONAL PURPOSE only. #bankniftyoptions #niftyoptiontradingstrategy #optionssignalsoftware source Click to rate this post! [Total: 0 Average: 0] |

| Gold Price Forecast: XAU Spikes on 6.2% CPI Posted: 13 Nov 2021 10:22 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Gold Talking Points:

It's been a busy morning so far in US markets and this was pushed along by a really strong CPI read out of the United States, and that brought a massive bid to Gold as the yellow metal broke out and jumped to fresh four-month-highs. As looked at previously, near-term trends did not appear to favor Gold bulls. Gold prices topped last August, around the same time that US yields had bottomed, and with the Fed talking up a possible start to tightening in 2022 at the September rate decision, it appeared as if that bullish trend in Gold was going to have to remain on hold. But last week brought a fairly dovish FOMC outlay into the mix, even as the bank announced tapering, when Chair Powell refused to even broach the topic of rate hikes, instead saying that the bank is dedicated to attaining maximum employment. This is pretty much the same thing that we've heard for the past six months as inflation spiked and the Fed said it was transitory. It's that definition of 'transitory' that appears to be causing problems as this morning brought another spike to CPI, with the indicator printing at its highest level in over 30 years, at 6.2%. The Fed's continued dovishness and apparent extreme confidence that inflation is, in fact, transitory helped to push Gold prices down around the rate decision last Wednesday. But, support caught at a higher low and after a strong day on Thursday Friday led to a breach of the 1800 level. That continued through this week and into this morning's CPI print, at which point price action posted a sizable breakout beyond that 1834 level that had previously held the highs in July and September. Gold Daily Price ChartChart prepared by James Stanley; Gold on Tradingview Negative Real Rates Push Gold Prices HigherReal rates are negative in the United States and with this morning's CPI print, they became even more negative. And with a Fed that doesn't look ready to raise rates anytime soon, the backdrop for bullish Gold setups has gotten more attractive from a fundamental perspective. The big question here is now continuation potential, and that's likely going to be determined by if/how the Fed adapts, that will likely be the determinant as to whether this breakout in Gold has staying power. From a technical perspective, the matter is a bit more clear. The breakout this morning took place at a huge spot of support/resistance at 1834, a level that's already seen three separate tests since the July open. There was a lot of pressure at that level that just gave way this morning and prices propelled up to a fresh high. If Gold bulls can hold support above this level, the door remains open for bullish trend continuation potential. The next Fed event on the horizon, at this point, is the December FOMC rate decision and this is where the bank can warn of upcoming rate hikes via the dot plot matrix. From where we're standing now, that seems to be the next major driver for this theme, bigger-picture. For additional support, look to the 1845 level. If bulls remain aggressive, this prior swing high/low may be re-purposed for higher-low support in bullish continuation themes. Gold Daily Price ChartChart prepared by James Stanley; Gold on Tradingview — Written by James Stanley, Senior Strategist for DailyFX.com Contact and follow James on Twitter: @JStanleyFX

Source link Click to rate this post! [Total: 0 Average: 0] |

| 12.11.2021: Oil prices slide – Outlook for Brent, USD/RUB, GOLD. Posted: 13 Nov 2021 09:52 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ A recent spike in US inflation to a 31-year high weighed on the oil market. As a result, it sank and even entered a sideways range for some time. Today, oil prices are suffering losses amid the news that OPEC has trimmed its world oil demand growth forecast for 2021. Besides, the quotes are coming under pressure from a potential release of crude from the US Strategic Petroleum Reserve. This could hardly be predicted. That is why many traders are now confused. We have considered all aspects of the situation and are ready to share our findings with you. Brent crude oil futures entered a steep correction the day before yesterday. The reason is that US President Joe Biden asked his top economic aides to explore ways to lower energy prices and strike back at any market manipulation or price gouging in this sector. Against this background, the authorities raised the prospect of releasing crude oil from the government’s strategic petroleum reserve. This fact had a significant negative impact on oil prices. Thus, Brent crude dropped to $81.60 per barrel. Today, the oil market is expected to extend losses, falling to $81 per barrel. Meanwhile, the US dollar continued to advance in the foreign exchange market. The ruble tried to pare losses, but trade balance data exerted additional downward pressure on the Russian currency. The data showed that trade surplus amounted to $20 billion, which is 4.5 billion less than the projected figure. As a result, the US dollar gained in value. As for the dollar/ruble pair's further movement, the greenback is expected to keep trading upwards. Currently, the price is confidently heading towards the level of 72.20 rubles per dollar. Besides, the pace of the ruble’s decline may accelerate due to lower oil prices. In the meantime, gold reached the previously predicted price level and then entered a downward correction. Earlier, gold prices received support from the news on surging inflation in the United States. However, now this upside momentum has almost fizzled. Nevertheless, experts are confident that the precious metal still has a chance of extending gains, albeit after a decline to the level of $1,850 per ounce. This is necessary to cool the market, analysts say. As you can see, market volatility triggered by a surge in US inflation has eased. Therefore, trading on the last day of the week is going to be calm. Subscribe to our channel, watch daily reviews, and keep up to date with the latest news. See you! https://www.instaforex.com FX Analytics – https://www.instaforex.com/forex_analytics Forex charts – https://www.instaforex.com/charts List of official InstaForex blogs: #commodity_market #oil #instaforex_tv 00:00 Intro source Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment