Forex System |

- Business Development Assistant

- What Is a Merchant Cash Advance?

- Associate/Senior Associate – Middle Office

- I Can't Trade Forex In Indonesia ?! | Bali Forex Trading Vlog

- Window Support Engineer

- Sales Officer CA

- Graduate FX Broker

- Senior Network Security Engineer

- How to Be Socially Responsible and Make a Profit

- Senior Software Developer

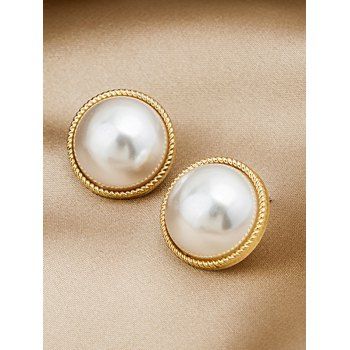

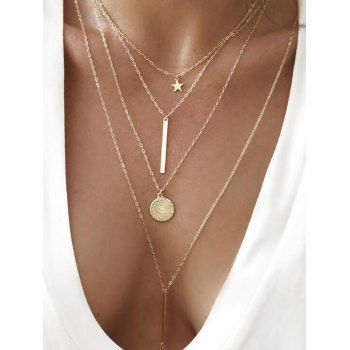

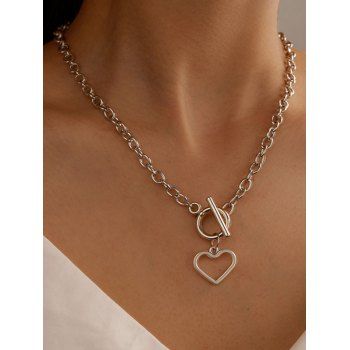

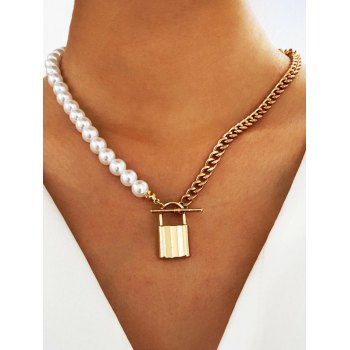

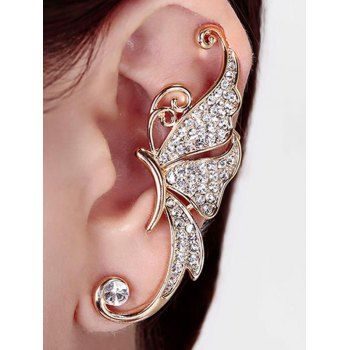

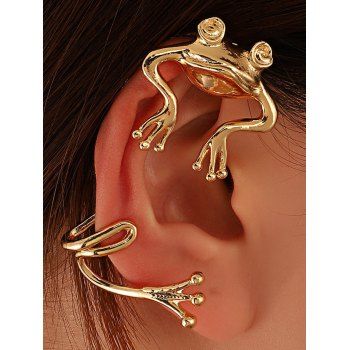

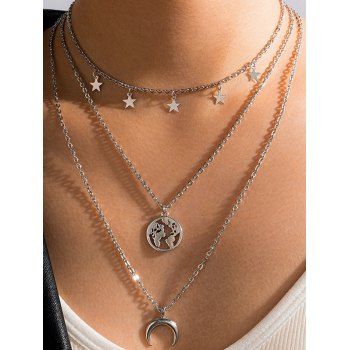

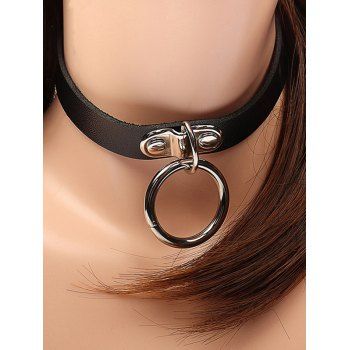

| Business Development Assistant Posted: 05 Nov 2021 12:18 AM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Business Development Assistant Company: Finixio Job description: . ● Managing databases and filing systems. ● Implementing and maintaining procedures/administrative systems. ● Liaising… remotely, so this is a must have) The ability to work under pressure and to tight deadlines Great organisational and time… Expected salary: Location: London Job date: Fri, 05 Nov 2021 04:52:27 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| What Is a Merchant Cash Advance? Posted: 05 Nov 2021 12:02 AM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Running a successful business requires regular cash flow and working capital. Every business goes through periods when sales are down and money is tight. When this happens, you may look to outside sources of funding. One of the various types of small business funding is a merchant cash advance. What is a cash advance loan?A cash advance allows you to borrow an immediate amount against your future income – the lender is “advancing” you the cash before you are paid. Technically, you are selling your future revenue in exchange for cash today, so a cash advance is different from a typical loan. Personal cash advance loans are borrowed against your next payday, when the lender debits your checking account for the amount you borrowed – with additional fees. Lenders sometimes have borrowers write a check for the loan plus fees, then cash the check after the borrower receives the money. The fees for these loans are often very high and can leave you saddled with significant debt. Cash advance loans are sometimes considered predatory. However, they can provide vital cash flow if you don’t own a credit card. There is a specific type of cash advance available – called a merchant cash advance loan – if your company needs immediate funding. What is a merchant cash advance?Merchant cash advance loans are a source of short-term funding if you cannot obtain financing from a bank or other source. These advances are borrowed against future credit card sales, and most of them are repaid – plus the associated fees – within six to 12 months. To obtain a merchant cash advance, your business must have daily credit card transactions from your patrons and proof of at least four months of credit sales. Many merchant cash advance companies require that your monthly credit card sales be between $2,500 and $5,000 – depending on the amount of the advance. This allows the lender to confirm that you can repay the advance. How do merchant cash advances work?Merchant cash advance companies will most likely work with your business if you rely primarily on debit and credit card sales. This includes retail, service shops and the restaurant industries. However, these are two structures that would allow your company to get an advance if you don’t have high debit or credit sales:

How much you will pay in fees depends on how much risk the merchant cash advance firm is taking. Generally, the factor rate will be 1.2% to 1.5%. If you take out a $40,000 advance with a 1.5% factor rate, your total payment will be $60,000 (your $40,000 advance with $20,000 in fees). A merchant cash advance is considerably more costly than traditional financing. It can also create a debt cycle that would force you to take out a second advance to pay back the first – resulting in additional fees. Editor’s note: Looking for a small business loan? Fill out the questionnaire below to have our vendor partners contact you about your needs. Merchant cash advance pros and consTaking out a merchant cash advance has these advantages and risks compared to other small business loans:

Is a merchant cash advance legal?Merchant cash advances are legal because they are not considered loans. Instead, they involve the purchase and sale of future income. And, firms offering the financing don’t have to follow regulations that traditional lenders are required to follow because the advance never lasts more than a year. The fees paid with merchant cash advances are not technically considered an interest rate. If compared to one, however, the rate paid for a merchant cash advance is significantly higher than it would be for a bank loan. The equivalent annual percentage rate (APR) for a merchant cash advance fee can be up to 200% of the advance.

The APR equivalent is so much higher than traditional financing because a bank receives a monthly percentage on the balance your business owes, not the total amount of the loan. As the loan the balance reduces, the interest paid per month decreases. However, a merchant cash advance fee is a fixed charge for providing the advance. The amount that you owe does not change, even as you pay back the advance. Banks are regulated by federal and state laws intended to protect consumers against lending practices that are considered predatory. Merchant cash advance companies are not similarly regulated because they technically buy future receivables, they do not provide a loan. As a result, they are exempt from state usury laws that would otherwise prohibit charging fees higher than standard interest rates. This lack of regulation means that if you work with a merchant cash advance company, you need to scrutinize your contract. These are some items you should look out for in the contract:

Why use a merchant cash advance?Though the steep fees of merchant cash advances mean that many financial experts discourage them, these are good reasons to consider a cash advance for your organization:

Merchant cash advances are a workaround to unavailable bank lending, particularly if your company has poor credit or is otherwise unable to obtain a traditional loan. Do merchant cash advances hurt your credit score?Merchant cash advances are typically available for your business if you have poor or no credit, but that doesn’t mean the company will ignore your credit report. The providers will complete a background credit check as part of the application. Fortunately, this generally will not impact your business credit score.

Some providers may do a hard credit check before issuing you an advance. This type of check can potentially hurt your credit score. Ask what kind of credit check companies perform before you apply for the cash advance. How do you apply for a merchant cash advance?There are merchant cash advance companies that accept applications both online and in person, but the information they ask for on your application will be similar in either case. A typical application is one or two pages. Here is what you will need to provide:

Applying for a merchant cash advance is quick, and you’re approved in hours or days. Once approved, you will need to sign a contract agreeing to the advance amount, payback amount, holdback and repayment period. Once this agreement is signed, the advance is transferred to your bank account. Alternatives to a merchant cash advanceIf you need extra cash but are wary of a merchant cash advance, consider other financing solutions that provide working capital for your small business. There are a variety of small business loan types to choose from. Lines of credit, term loans and payment processor financing are just some of the options. Business line of creditA line of credit (LOC) is similar to a credit card. You can apply for and be approved for a set amount, which you can borrow against for the term of the LOC. You can never owe more than the upper limit of your line of credit, but you can repay the amount you owe and borrow again as many times as you need. You can open a line of credit for your company for any amount, often ranging from $2,000 to $500,000. Funding is generally approved in less than a week, and repayment terms are 3-12 months. Fundbox is one lender that provides business lines of credit. Fundbox’s fast, transparent application, pricing and approval processes can offer up to $150,000 over 3-6 months. Fundbox is known for its direct communication regarding how much you’ll pay per week for its services and will automatically withdraw these fees from your bank account. Learn more in our full review of Fundbox. Short-term loanA short-term loan is an unsecured business loan offered by a private lender rather than a bank. These loans have lower interest rates and more transparency than a merchant cash advance, though lenders will review your credit history. Short-term loans generally offer up to $500,000 in one-time financing, are approved in less than a week and have repayment terms of three months to three years. Fora Financial is a top lender for short-term small business loans. With Fora, your repayment period will be at most 15 months, and you can obtain loans of up to $500,000. You can set your payment schedule to fit whatever terms work for you, and you won’t have to put up any collateral. Plus, the approval process only takes 24 hours, with funding of the loan as quick as 72 hours. You can learn more in our comprehensive review of Fora Financial. Payment processor financingIf you use a credit card processing company like Square or PayPal, you may be eligible for financing these companies offer. You can apply for the loans, which are generally under $100,000, through your online account. They usually come with a factor rate of 1.1% to 1.16% – lower than a merchant cash advance.

Final thoughts on merchant cash advancesA merchant cash advance is a quick financing option for your business. However, the repayment terms can often be expensive. Before choosing an advance or any other form of business funding, understand the details of your contract and the long-term impact it can have on the financial well-being of your company. Katharine Paljug contributed to the writing and research in this article.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| Associate/Senior Associate – Middle Office Posted: 04 Nov 2021 11:54 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Associate/Senior Associate – Middle Office Company: Pimco Asia Pte Ltd Job description: monthly metrics reporting and work with back office to resolve identified risk items 2. Participate in projects to enhance… from an accredited college/university preferred in Economics or Finance major 5+ years of work experience in the investment management… Expected salary: $69996 – 109992 per year Location: Singapore Job date: Fri, 05 Nov 2021 06:54:07 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| I Can't Trade Forex In Indonesia ?! | Bali Forex Trading Vlog Posted: 04 Nov 2021 11:31 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Can’t Trade Forex In Indonesia?? | Bali Forex Trading Vlog FREE: The Complete Price Action Strategy Checklist http://bit.ly/2wSHj8N April 11th, 2017: In this Bali Forex trading vlog, I move from Kuta ti Ubud and I realize that I can’t trade Forex in Indonesia. Oanda, the broker that I use is blocked. That makes it almost impossible to trade with Oanda in Indonesia. The place I live at in Ubud is beautiful but finding an adaptor for the plugs has been tough. Forex Trader Community (Facebook Group): http://bit.ly/2esoMYj // Music // About Me What you must know: I’m all for trading foreign exchange, but I think freedom is much more important than time spent in front of your computer. I blog at www.desiretotrade.com and host the Desire To Trade Podcast. I was fed up with the "fake" millionaire traders and the "get-rich-quick-trading guys". That’s why you can expect more free content from me than what other people charge for! If you truly want to succeed in Forex trading, I believe you need to keep working on yourself so you can improve your strengths, but also your weaknesses. Do not focus solely on what you’re good at. // Disclaimer // Get the Forex Day Trading Success Cheat Sheet for FREE! // Check out the Desire To Trade Podcast – Trading Tips & Interviews with Successful Traders: http://bit.ly/2dGNOyQ For a lot of article and tips that will help you develop Forex trading skills for more freedom: http://www.desiretotrade.com // You Might Also Like… -~-~~-~~~-~~-~- source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| Posted: 04 Nov 2021 11:23 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Window Support Engineer Company: Interactive Brokers Job description: and development end-users over the phone, by email and through a centralized ticketing system to resolve or escalate any IT issues… for reported issues related to computer systems, software, and hardware on a timely basis to meet department SLAs Use all means… Expected salary: Location: Singapore Job date: Fri, 05 Nov 2021 05:50:40 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| Posted: 04 Nov 2021 11:17 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Sales Officer CA Company: Yes Bank Job description: added products such as Trade Forex, CMS, POS, Payment gateway solutions, doorstep banking, working capital / loan needs… & OPDT and family SA Works towards catchment mapping & scoping for the CA business with the help of BRPs along with BBL… Expected salary: Location: Vadodara, Gujarat Job date: Fri, 05 Nov 2021 05:20:34 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| Posted: 04 Nov 2021 11:14 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Graduate FX Broker Company: TalentSpa Job description: — Greater London — London Job Type Permanent Posted 03 November 2021 Graduate FX Broker Location: London Our client… presentations and packs. Lead Qualification: Ensure Leads in CRM System are Valid and Complete Qualify leads to ensure that leads… Expected salary: £18000 – 22000 per year Location: London Job date: Thu, 04 Nov 2021 23:46:25 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| Senior Network Security Engineer Posted: 04 Nov 2021 11:12 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Senior Network Security Engineer Company: Interactive Brokers Job description: full end to end technology life cycle Develop and maintain technical diagrams and documentation Work with product vendors… infrastructure Network management systems Cisco ISE deployments and 1X and RADIUS/TACACS Converged infrastructure, switching… Expected salary: Location: Greenwich, CT Job date: Thu, 04 Nov 2021 23:58:16 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| How to Be Socially Responsible and Make a Profit Posted: 04 Nov 2021 11:00 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ As consumer expectations change about the businesses they support, companies of all shapes and sizes are looking for ways they can incorporate sustainable corporate social responsibility (CSR) practices while retaining their bottom lines. The question is, where can a small business begin? Before getting started, it’s important to understand corporate social responsibility and the benefits of incorporating these practices. What is corporate social responsibility?Corporate social responsibility (CSR) is the effort a business makes to take responsibility for its actions and consider, as part of its business model, how its actions impact the environment and society at large. In short, CSR is about compensating for the business’s effect on the environment and community. Corporate social responsibility can take the form of various initiatives, such as reducing the company’s carbon footprint with clean energy solutions, being proactive about labor laws and benefits, or donating to local or global charities. Generally, the initiatives fall into certain categories, including environmental responsibility, ethical responsibility, philanthropic responsibility and economic responsibility.

Why is corporate social responsibility important?Businesses of all shapes, sizes and locations are adopting socially responsible policies, and for good reason. Today’s consumer is socially conscious, and this awareness directly influences their purchasing decisions. If you’re not doing anything to achieve responsible business practices, your customers won’t buy from you. Research from GreenPrint found that nearly 80% of consumers are more likely to purchase a product labeled as environmentally friendly, with 77% of those surveyed saying they are concerned about the environmental impact of products they buy. A separate study from IBM found that on average, 70% of purpose-driven shoppers pay an added premium of at least 35% more per upfront cost for sustainable purchases, such as recycled or eco-friendly goods.

Examples of corporate social responsibilityEven within the four categories of corporate social responsibility, formulating a meaningful and impactful plan can be challenging. After all, CSR goes beyond simply making a charitable donation and calling it a day – CSR practices require daily commitment. The three companies below have made CSR a core part of their identity, to great success. Ben & Jerry’sBen & Jerry’s, celebrated for its ice cream, has made corporate responsibility the center of its overall business strategy. The company uses only fair-trade, GMO-free ingredients and was among the first companies to offer employees in same-sex partnerships equal domestic benefits. Ben & Jerry’s developed a dairy farm sustainability program in its home state of Vermont and developed a hiring program specifically to employ ex-convicts in its bakery. The company is also known for speaking out on social issues, particularly how arrests for cannabis possession affect minority communities. Dr. Bronner’sThe soap and personal care products company might be noted for its elaborate labeling. Still, the company is just as well-known for making commitments to building a better planet. In 2015, Dr. Bronner’s obtained its B corporation certification, which audits and grades businesses for environmental performance. Since that initial certification, Dr. Bronner’s has been one of the highest-scoring B corporations in the world. LegoThe bricks many of us played with as children come from one of the leading companies when it comes to investing in sustainability. In September 2020, the company pledged more than $400 million to make all of its packaging sustainable by 2025. Those funds will also be invested in projects that will turn Lego into a carbon-neutral company, educate children on environmental issues with “learning through play” initiatives, and other strategies to help the company reduce its footprint on the globe. As for the toys themselves, Lego has pledged to convert to fully sustainable production practices by 2030. What CSR looks like for small businessesFor many small business owners, the thought of being socially responsible raises questions of how much impact a small company will be able to make, and how shifting to more responsible practices might affect their bottom line. Cash-strapped businesses may fear that investing a percentage of profits into these efforts could negatively impact the rest of the company. Is it possible for a small business to be socially responsible while maintaining a healthy profit margin? Absolutely. You can contribute without suffering economically. In fact, CSR initiatives can even save you money. For example, after General Mills installed energy monitoring systems to reduce energy usage, they saved $600,000.

Small business owners should also view innovation “through the lens of sustainability.” According to Unilever’s global vice president of HR, this means creating new products or services with sustainability as its core function. The company created a new line of hair conditioner products that use less water, allowing consumers to go green and conserve. Small to midsize businesses can satisfy the socially conscious consumer by thinking sustainably from the start. And for small businesses that are already making CSR headway, make sure you’re communicating these efforts to customers. Like we said, consumers shop socially and earth-consciously. And they check the packaging before making a purchase. Research from NYU’s Stern Center for Sustainable Business found that 50% of the growth of consumer packaged goods between 2013 and 2018 came from sustainability-marketed products. Small businesses need not be overwhelmed by CSR and the deferred financial return. Begin thinking about the long term. If you demonstrate that you care, consumers will shop with you repeatedly. CSR may not boost next quarter’s financials, but it might produce a sustainable ROI.

Can CSR increase company profits?Studies have shown that companies that fully integrate CSR into their operations can expect good financial returns on their investments. Companies integrating CSR have been shown to increase sales and prices as well as reduce employee turnover. One of the reasons companies increase profits when incorporating CSR into their business model is because customers pay attention to the way companies react to social and political issues, and will often boycott companies with negative values. Companies using CSR promote positive values, which ultimately increases customer traffic and company profit. What are the benefits of CSR for companies?While it is a reality that businesses aim to maximize profits, it is still essential that they maintain a good relationship with the social environment they operate in. Companies that can demonstrate reliance on society and invest in their social responsibilities tend to have a greater chance of success. Some benefits of CSR for companies include the following:

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||

| Posted: 04 Nov 2021 10:50 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Senior Software Developer Company: Spark Systems Pte. Ltd. Job description: Responsibilities * Build best in class low latency, high performance electronic trading system. * Develop distributed… performance electronic trading system. Develop distributed and scalable solution for market connectivity gateways using FIX… Expected salary: $108000 – 216000 per year Location: Singapore Job date: Fri, 05 Nov 2021 05:50:40 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

FYI: Merchant cash advances can be quite costly. Some merchant cash advances have APRs high as 200% of your total loan amount. This can result in

FYI: Merchant cash advances can be quite costly. Some merchant cash advances have APRs high as 200% of your total loan amount. This can result in  Did you know? Your

Did you know? Your

Bottom line: Corporate social responsibility (CSR) is the environmental, ethical, philanthropic and economic commitment businesses make to positively impact the world around them.

Bottom line: Corporate social responsibility (CSR) is the environmental, ethical, philanthropic and economic commitment businesses make to positively impact the world around them. Tip: For those on a smaller financial plan, replace old machinery with energy-efficient appliances, use local suppliers, plan fuel-efficient fleet routes with

Tip: For those on a smaller financial plan, replace old machinery with energy-efficient appliances, use local suppliers, plan fuel-efficient fleet routes with

No comments:

Post a Comment