Forex System |

- AUD/USD Rises Post-FOMC as Australian Trade Data Approaches

- How to Trade Forex for Beginners? Start Trading with No Deposit Bonus | how to earn money online

- AUD/USD Eyes RBA Monetary Policy Statement

- Start Trade With Trade T64…Best Forex Trading Platform

- Bitcoin (BTC), Ethereum (ETH) Drift off All-Time Highs, Outlook is Still Bright

- Momentum Entry Terbaik di Pasar Forex || Best Moment to Order in Forex (Gold Trading) [ENG SUB]

- International Relationship Manager – Business Banking

- AUD/USD May Climb After China Smashes Trade Surplus Record

- Trade Support Associate

- Loan Officer

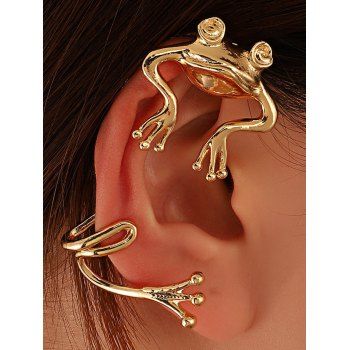

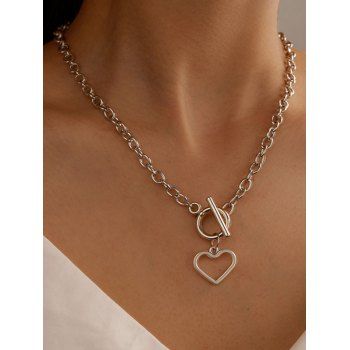

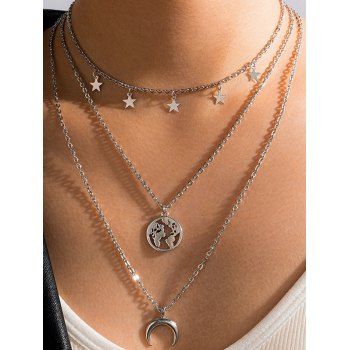

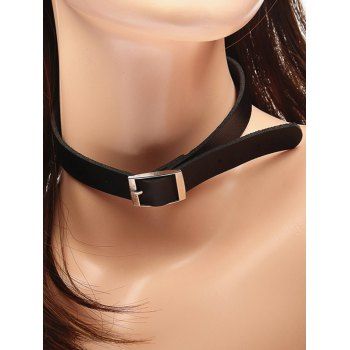

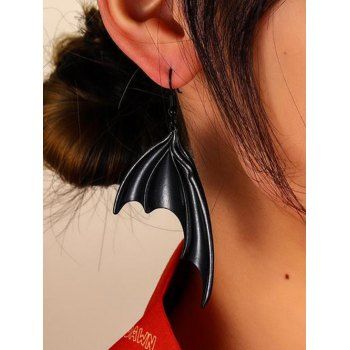

| AUD/USD Rises Post-FOMC as Australian Trade Data Approaches Posted: 13 Nov 2021 01:50 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Australian Dollar, AUD/USD, AU Trade Balance, Oil prices – Talking Points

Thursday's Asia-Pacific ForecastThe Australian Dollar is in focus for today's Asia-Pacific trading session, with Australia set to report trade data for September. Analysts expect the figure to cross the wires at A$12.2 billion at 00:30 GMT. That would be down from the A$15.07 billion in August when an energy crunch caused by surging natural gas prices in Europe and Asia helped drive coal exports. Those prices remained elevated in September, which leaves the data print open to a possible outsized beat or miss. Traders ditched the US Dollar overnight despite the Federal Reserve announcing balance sheet growth tapering. The Fed said it would begin to roll back asset purchases later this month at the monthly pace of $15 billion, which consists of $10 billion in Treasuries and $5 billion in mortgage-backed securities (MBS). The US Dollar DXY index moved lower despite a modest move higher in 2- and 5-year Treasury yields. Today will bring foreign bond investment data out of Japan for the week ending October 30. Final Japanese PMI readings for October will cross the wires later in the day. However, APAC traders will work on digesting the Federal Reserve decision. However, a modest risk-on move appears to be kicking off today's session, which is likely to continue outside of any unseen event risks. Elsewhere, oil prices are on the move lower after an overnight drop. Crude and Brent oil benchmarks accelerated to the downside after US government data showed a larger-than-expected inventory build. The weekly Energy Information Administration (EIA) report for the week ending October 29 showed a 3.29 million barrel build. That was well above the 2.22 million barrel increase analysts expected. AUD/USD Technical ForecastAUD/USD pivoted higher overnight after prices tested the 38.2% Fibonacci retracement level from the September/October move. Prices are currently grappling with the rising 20-day Simple Moving Average (SMA), with the 23.6% Fibonacci directly overhead. MACD weakness is moderating alongside a rising RSI reading, which suggests upside momentum may be strengthening. A break above the 20-day SMA and 23.6% Fib may open the door for a test of the October swing high at 0.7556. AUD/USD 8-Hour Chart

Chart created with TradingView — Written by Thomas Westwater, Analyst for DailyFX.com To contact Thomas, use the comments section below or @FxWestwateron Twitter

Source link Click to rate this post! [Total: 0 Average: 0] |

| How to Trade Forex for Beginners? Start Trading with No Deposit Bonus | how to earn money online Posted: 13 Nov 2021 01:21 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Forex trading welcome bonus available for new users, how to get the free no deposit bonus and start forex trading account. You can start forex, bitcoin,indexes, commodities trading with as little as $1! Get the reward: https://www.usdcashback.com/bonus-en/ #forextrading Enjoy Trading! source Click to rate this post! [Total: 0 Average: 0] |

| AUD/USD Eyes RBA Monetary Policy Statement Posted: 13 Nov 2021 12:48 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Australian Dollar, AUD/USD, RBA, Oil Prices Talking Points

Friday's Asia-Pacific ForecastAsia-Pacific markets are set to move higher after a rosy Wall Street session overnight. The benchmark S&P 500 index closed 0.42% higher following an upbeat jobless claims report. The US Dollar softened via the DXY index despite a drop in the rate-sensitive 5-year Treasury yield. A surprise decision from the Bank of England (BOE) played into an already weakened outlook on near-term Federal Reserve tightening. The risk-sensitive Australian Dollar saw a big drop versus the Greenback overnight, notwithstanding the broader USD strength – which was primarily due to Sterling weakness. Yesterday, Australia saw its trade surplus widen more than expected for September, although exports dropped 6% on a month-over-month basis. A drop in iron ore prices during the reference period likely weighed on outgoing cross-border transactions. The Reserve Bank of Australia's monetary policy statement will cross the wires today, which will provide updated quarterly economic projections. Earlier this week, the central bank signaled that its record low interest rate may not be on hold until 2024, as previously communicated. Rising price pressures and the removal of Covid restrictions likely encouraged policy makers to shift the cash rate target forward. However, that still leaves the RBA behind other major central banks. Elsewhere, oil prices continue to slide. Crude oil broke below the psychologically imposing 80 handle, while Brent – the global benchmark – slipped as well. OPEC and its allies opted to keep pace with its current tapering of output cuts at 400k barrels per day for December. That comes despite calls from the United States to push more supply onto markets. AUD/USD Technical ForecastAUD/USD fell below its 38.2% Fibonacci retracement overnight, but weakness eased prior to hitting the rising 50-day Simple Moving Average (SMA). That said, the Fib level may now serve as resistance as the Aussie Dollar catches a small bid in the early APAC trading hours. However, a resumption to the downside will see the 50-day SMA shift into focus. AUD/USD 8-Hour Chart

Chart created with TradingView — Written by Thomas Westwater, Analyst for DailyFX.com To contact Thomas, use the comments section below or @FxWestwater on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] |

| Start Trade With Trade T64…Best Forex Trading Platform Posted: 13 Nov 2021 12:18 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ #forextrading #trading #trading_software Start Trade With Trade T64…Best Forex Trading Platform Get Free White Lable For Forex Brokers And Businesses. Hurry Up! Grab This Deal, Limited Offer For Limited Time. forex trading,forex,forex trading for beginners,forex trading live,forex trading strategies,forex trader,day trading,forex trading course,trading,forex strategy,swing trading,forex for beginners,trading forex,live forex trade,forex day trading,what is forex trading,forex lifestyle,how to trade forex,forex trading in india,simple forex strategy,forex trading explained,forex course,forex market,fibonacci trading,forex educationtrading,day trading,day trading live,live trading,day trading strategies,live day trading,warrior trading,trading live,forex trading,stock trading,live stock trading,trading strategies,live options trading,options trading live,option trading,nifty live trading,day trading crypto,day trading for beginners 2021,momentum day trading,live trading intraday,live trading bank nifty,nifty live trading today,swing trading,day trading for beginnerstrading,day trading,day trading live,live trading,day trading strategies,live day trading,warrior trading,trading live,forex trading,stock trading,live stock trading,trading strategies,live options trading,options trading live,option trading,nifty live trading,day trading crypto,day trading for beginners 2021,momentum day trading,live trading intraday,live trading bank nifty,nifty live trading today,swing trading,day trading for beginners source Click to rate this post! [Total: 0 Average: 0] |

| Bitcoin (BTC), Ethereum (ETH) Drift off All-Time Highs, Outlook is Still Bright Posted: 12 Nov 2021 11:45 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Bitcoin (BTC), Ethereum (ETH) and Alt-Coins – Prices, Charts, and Analysis

Bitcoin is back to its Monday opening level around $63.5k and is looking for support from the multi-week bullish channel. The first half of the week saw Bitcoin, Ethereum, and a range of alt-coins post new all-time highs while the last two days have seen all of these gains eroded. I mentioned last week that the upward velocity of the trend channel would eventually prove difficult to hold on to, but as we stand, this support remains in place and is tempering further losses. It would take a clear break below this support before the chart and sentiment turn to neutral. Over the weekend, the Bitcoin Taproot upgrade is expected to take place. This upgrade will 'optimize scalability, privacy and smart contract functionality' according to a Taproot explainer article written by Bitcoin Magazine. It may be that Monday's ATH was caused by buying ahead of this upgrade and that the subsequent sell-off was caused by a lack of follow through after printing this new high. The weekend may be a volatile time for Bitcoin. Bitcoin (BTC/USD) Daily Price Chart – November 12, 2021Ethereum is clinging on to trend support, just, and price action over the next few days may see the $4,450 area tested. The chart however continues to look bullish and any further sell-off may see longer-term buyers return to the market. Wednesday's big bearish engulfing candle is negative, so for Ethereum to move higher this needs to be broken which means a new all-time high will need to be made. This may cap any short-term push higher in Ethereum and lead to a period of consolidation. Ethereum (ETH/USD) Daily Price Chart – November 12, 2021The alt-coin market – total crypto market cap minus Bitcoin's market cap – remains within the recent trend and stuck to the 9-day moving average. As I mentioned last week, this channel is wide and allows for any reasonable-sized sell-offs, highlighted by the bearish candle made on Wednesday touching support before rebounding. Crypto Total Market Cap Minus Bitcoin – November 12, 2021Chart by TradingView. What is your view onBitcoin (BTC) andEthereum (ETH) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Source link Click to rate this post! [Total: 0 Average: 0] |

| Momentum Entry Terbaik di Pasar Forex || Best Moment to Order in Forex (Gold Trading) [ENG SUB] Posted: 12 Nov 2021 11:15 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Mengambil keputusan untuk entry perlu adanya pertimbangan dari analisa agar tidak mengalami floating yang panjang. Kami memiliki beberapa trigger yang sudah teruji cukup panjang sehingga bisa anda gunakan sebagai bahan pertimbangan untuk entry. Taking Decision to order needs consideration from analysis so that we won’t face long floating. We have some triggers which have been tested in a long time therefore you can use it to take order. Info: untuk daftar Demo dan download MetaTrader bisa disini https://bit.ly/3mHAxge More info: to register for Demo and download MetaTrader can be here https://bit.ly/3mHAxge #Trading #Trader #Forex #XAUUSD #XAU #GoldTrader #Gold #TraderIndonesia #ForexTrader #DayTrading #DayTrader #AnalisaTeknikal #PriceAction #PriceActionTechnical #PAT #Technical #Fundamental #TradingAnalysis #TechnicalAnalysis #FundamentalAnalysis #AnalisaFundamental source Click to rate this post! [Total: 0 Average: 0] |

| International Relationship Manager – Business Banking Posted: 12 Nov 2021 10:46 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: International Relationship Manager – Business Banking Company: HSBC Job description: or professional's interaction with HSBC. Work in partnership with colleagues across the HSBC network to deliver exceptional standards… information, including KYC requirements in Group systems Resolve any/all identified issues promptly, and escalate concerns… Expected salary: Location: Gurgaon, Haryana Job date: Sat, 13 Nov 2021 06:46:39 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| AUD/USD May Climb After China Smashes Trade Surplus Record Posted: 12 Nov 2021 10:44 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Australian Dollar, AUD/USD, China, Trade Balance, Risk Events – Talking Points

Monday's Asia-Pacific ForecastAsia-Pacific markets are set to open on a bright note to kick off the trading week after positive Chinese trade data crossed the wires. China's October trade surplus rose to $84.54 billion USD. That was more than $20 billion over what analysts expected, according to a Bloomberg survey. A big surge in exports alongside weaker-than-expected imports was responsible for the upside surprise in cross-border transactions. The record figure suggests the appetite of global consumers is growing as Covid restrictions continue to roll back across key economies. However, weaker-than-expected imports highlighted China's domestic woes during a month when an energy crunch and a housing market slowdown weighed on sentiment. That caused Chinese policymakers to take several steps that impacted economic activity. Iron ore imports slowed in October, while coal inflows increased. Today's economic docket is rather light, which will leave traders to digest the Chinese trade data from over the weekend. Investors may also be encouraged by the passage of a major infrastructure package in the United States. On Friday night, the House of Representatives passed a $1 trillion USD economic package that contains billions in new spending for roads, bridges, ports, electric vehicle stations and other construction projects. Later this week, Chinese inflation and Australian employment data will cross the wires. The two events are potential high-impact risk drivers. Analysts expect China's October CPI to drop at 1.4% y/y, while Australia's employment change is forecasted for a +50k print, according to data from Bloomberg. China will also release new Yuan loans (Oct) later in the week. AUD/USD Technical ForecastAUD/USD is trading just under the 38.2% Fibonacci retracement from the September/October move as the APAC session kicks off. The 50-day Simple Moving Average (SMA) provided support on last week's drop. If bull's can't clear above the Fib level, a move back to the 50-day SMA may be on the cards. Prices would eye the 61.8% Fib (0.7315) below that. AUD/USD 8-Hour Chart

Chart created with TradingView — Written by Thomas Westwater, Analyst for DailyFX.com To contact Thomas, use the comments section below or @FxWestwater on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] |

| Posted: 12 Nov 2021 10:39 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Trade Support Associate Company: Oliver James Associates Job description: preferred in Economics or Finance major 5+ years of work experience in the investment/asset management or financial service… industry Experience Bloomberg trade order management systems and matching utilities preferred Experience in Middle Office… Expected salary: Location: Singapore Job date: Fri, 12 Nov 2021 23:00:50 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Posted: 12 Nov 2021 10:26 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Loan Officer Company: Job description: is required · Advanced knowledge in loan and forex is required · Certified Anti-Money Laundering Specialist (CAMS… under pressure and meet deadlines · Applications should be submitted by no later than 5:00pm, 15 April 2021. Key accountabilities… Expected salary: $100000 per year Location: Sydney, NSW Job date: Fri, 12 Nov 2021 23:45:47 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment