Forex System |

- How NOT to trade Forex Market. *BONUS: GIVEAWAY*

- Pricing Administrator

- S&P 500 Climbs to New All-Time High as Bullish Sentiment Prevails Ahead of NFP

- PSP Payments Manager

- Senior Analyst Programmer

- Lançamento do Milionário com Forex

- Senior Analyst Programmer

- Swiss Franc Technical Analysis: GBP/CHF, AUD/CHF, NZD/CHF

- Cambio Euro Dollaro previsioni 2021 analisi andamento Forex mediante la tecnica di WD Gann

- USD/MXN to Retain Bearish Bias Post-Fed Ahead of Banxico

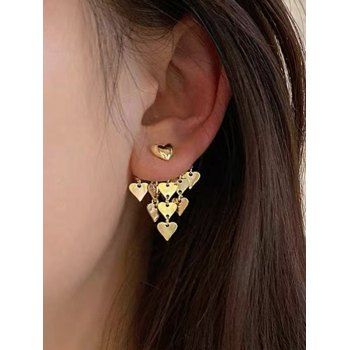

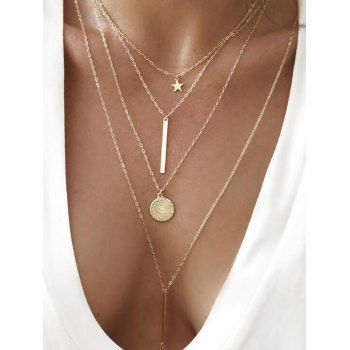

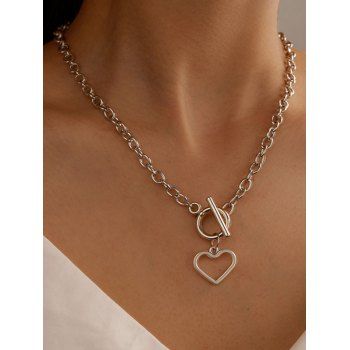

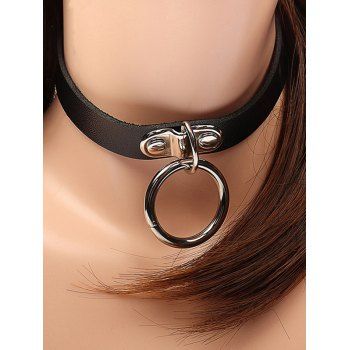

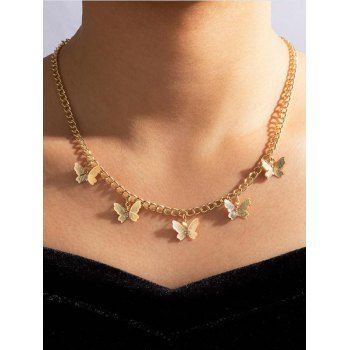

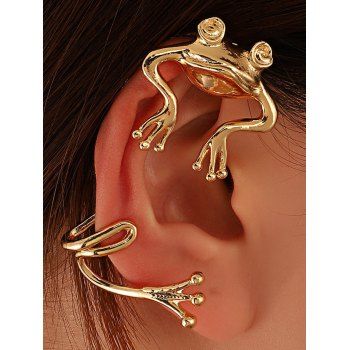

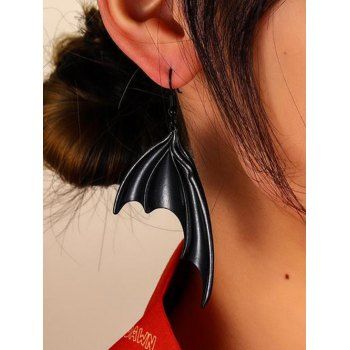

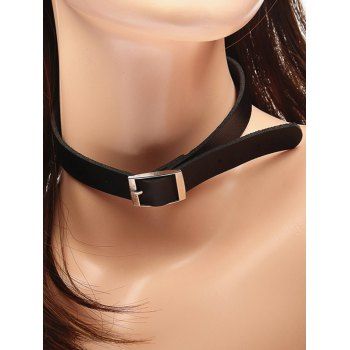

| How NOT to trade Forex Market. *BONUS: GIVEAWAY* Posted: 07 Nov 2021 12:21 AM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Forex Gambling vs Forex Trading, is there really any difference? Short answer, yes there is a huge difference… This is all about ‘How NOT to trade Forex Market’! Think about a Casino. Their edge is small but it makes them a lot of money. Sure, they might be up one day, down the next. But so long as the gamblers keep coming, they’ll always make money over time. So, how do you become the casino and stop being the gambler? The first step is to acknowledge your behavioral patterns like the ones depicted in this video. Forex addiction is a real thing. It’s hard to see the woods from the trees when you’re in the thick of it though. It’ll get you to focus on the higher timeframes and become more patience and calculated.

FOREX SIGNALS TRADING ROOM: RECOMMENDED BROKERS: FREE TRADING EDUCATION: FREE CHEAT SHEETS: FREE TOOLS: FREE TRADE IDEAS & NEWS: OUR SOCIALS: 1,500+ REVIEWS * The information provided in this video is intended for educational purposes only and is not to be construed as investment advice. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. There is a possibility you could sustain losses of some, or all of your initial investment and therefore seek independent financial advice if you have any doubts. source Click to rate this post! [Total: 0 Average: 0] |

| Posted: 06 Nov 2021 11:57 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Pricing Administrator Company: Interstate Batteries Job description: , e.g., processing price lists in current ERP system and updating customer facing part and price workbooks Maintain the… lead market data within Lead Index Report & Canadian Forex Rates 20% – Pricing Administrative support for Revenue… Expected salary: Location: Dallas, TX Job date: Sat, 06 Nov 2021 02:06:20 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| S&P 500 Climbs to New All-Time High as Bullish Sentiment Prevails Ahead of NFP Posted: 06 Nov 2021 11:44 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ S&P 500 OUTLOOK:

Most read: What is the Non-Farm Payroll Report (NFP) and How to Trade It? Bullish sentiment prevailed on Wall Street Thursday, although buying momentum slowed slightly as traders grew more cautious about the equity market rally amid non-stop gains and signs of exuberance in recent days. At the end of the trading session, the S&P 500 rose 0.42% to 4,680 while the Nasdaq 100 popped 1.25% to 16,346, a record close in both cases. The advance for the senior indices were partially fueled by falling rates across the U.S. Treasury curve after the Federal Reserve embraced a dovish stance at its November monetary policy meeting, signaling that it will not rush to raise borrowing costs despite elevated inflationary pressures. Accommodative monetary policy, strong corporate earnings, some positive seasonality and improving economic data in the services sector have all aligned to create a very benign environment for risk assets of late. These factors have helped propel major U.S. stock indices to record highs, even in the face of heightened uncertainty such as supply chain issues. However, for risk-on mood to continue, the U.S. recovery will need to gather more strength to support equity valuations. That said, investors will get a better picture of the health of the economy on Friday, when the U.S. Labor Department releases its October nonfarm payrolls (NFP) report. After weak numbers in September, traders expect to see 450,000 new jobs, although we will likely need a figure well above 500,000 to maintain momentum and revive confidence in the rebound. If the NFP results surprise to the upside, stocks may have margin to run higher over the medium term, but it is important to underscore a crucial point: the market is becoming increasingly overbought. For example, in the last 17 trading days, the S&P 500 only fell twice; all the remaining sessions were positive. In addition, its 14-period RSI has moved above 70 for the first time since early July. At that time, when the oscillator reached an extreme overbought reading, we saw a 3.5% drop shortly thereafter. Past performance is not an indicator of future outcomes, but the exuberance certainly invites caution; after all, no bull market ever follows a straight line. From a technical standpoint, the S&P 500 continues to approach the upper boundary of a short-term channel near 4,690 following recent gains. Given the index’s proximity to key resistance and its overbought condition, transitory weakness should not be ruled out. Having said that, in the event of a pullback, traders should look for support at 4,550, although a move below this floor could pave the way for a decline towards 4,460. On the other hand, if the upward momentum does not cool and the S&P 500 rises further, the first resistance to consider appears at 4,690. If bulls manage to take out this ceiling, we could see a rally towards 4,725 before the buying pressure starts to weaken. S&P 500 TECHNICAL CHARTSource: TradingView EDUCATION TOOLS FOR TRADERS

—Written by Diego Colman, Contributor

Source link Click to rate this post! [Total: 0 Average: 0] |

| Posted: 06 Nov 2021 11:36 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: PSP Payments Manager Company: Axicorp Pte. Ltd. Job description: and driven. Accountability – we step up, take ownership, and take pride in our work. Respect – we believe everyone is appreciated… also covers internal stakeholder management to enhance payments systems across the business. Major Responsibilities Identify new… Expected salary: $66000 – 78000 per year Location: Singapore Job date: Sun, 07 Nov 2021 03:03:36 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Posted: 06 Nov 2021 11:33 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Senior Analyst Programmer Company: Fidelity International Job description: and third-party products. We are system providers to key process lifecycles such as Procure to Pay (P2P/Global Procurement…, forex trading, Expense & Travel Management and treasury operations across the Globe. We own warehouses that consolidate data… Expected salary: Location: Mumbai, Maharashtra Job date: Thu, 24 Jun 2021 05:58:43 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Lançamento do Milionário com Forex Posted: 06 Nov 2021 11:19 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ O LANÇAMENTO DO MILIONÁRIO COM FOREX SERÁ DIA 17/06 às 12:00 horas ou seja QUINTA-FEIRA agora! O Link de Abertura das Vagas será disponibilizado AQUI NESTE GRUPO! APENAS 500 VAGAS COLOQUE UM DESPERTADOR PARA 11:55 para não correr o risco de perder a vaga. Pela quantidade de pessoas interessadas as vagas não devem durar 2 minutos

E a Qualquer Instante, quando se esgotarem essas 500 Vagas, o link sairá do ar e não haverá segunda chance!

BENEFÍCIOS EXCLUSIVOS DO GRUPO – Aulas Básicas para Iniciantes Dia 17/06 às 12h em ponto! Coloque no despertador, prenda papelzinho na geladeira, rabisca na parede, faça o que for! Mas não perca a hora!

source Click to rate this post! [Total: 0 Average: 0] |

| Posted: 06 Nov 2021 11:01 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Senior Analyst Programmer Company: Fidelity International Job description: grown apps and third party products. We are system providers to key process lifecycles such as Procure to Pay (P2P/Global… management, forex trading and treasury operations across the Globe. We own warehouses that consolidate data from across the… Expected salary: Location: Gurgaon, Haryana Job date: Thu, 22 Jul 2021 03:24:07 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Swiss Franc Technical Analysis: GBP/CHF, AUD/CHF, NZD/CHF Posted: 06 Nov 2021 10:42 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Swiss Franc, CHF, GBP/CHF, AUD/CHF, NZD/CHF – Talking Points

GBP/CHF Technical AnalysisGBP/CHF took a nice leg lower on Thursday following the Bank of England's decision to leave monetary policy unchanged, despite hawkish market pricing. That decision saw the cross break through multi-month trendline support, ushering in lows that have not traded since February. With the Sterling in free fall, market participants may remain wary of trying to catch a falling knife. Prior to Thursday's sharp drop, the pair was already trending lower, with confirmation coming as the 50-day moving average fell below the 200-day moving average. Traders may look to the 1.2200 level for near-term support, should the decline continue from current levels. GBP/CHF Daily ChartChart created with TradingView AUD/CHF Technical AnalysisFollowing a prolonged period of strength, AUD/CHF was on the back foot for most of October, with the pair remaining under pressure in the early days of November. Further declines have materialized as the cross fell below its 50-day moving average. On top of this, selling pressure saw a key pivot zone around 0.6800 fail to hold as well. With price moving lower, traders may look to the upper bound of the pair's previous channel for near-term support. A near-term bounce could see the pair re-test the 50-day moving average, but momentum and trend indicate that more pain may be ahead. AUD/CHF Daily ChartChart created with TradingView NZD/CHF Technical AnalysisMirroring the Aussie cross, NZD/CHF has also taken a leg lower of late, with the pair breaking through the key 0.618 Fibonacci level at 0.6510. Thursday's decline also sees the pair fall below both the 50-day and 200-day moving averages, further adding pressure to the pair. Market participants may look to see the cross trade down to support at the 0.5 Fib level at 0.6431 before bouncing. The relative strength of the cross also highlights fading momentum, potentially painting a picture of further losses for NZD/CHF. Anear-term reprieve of pressure may see a retest of the 0.6500 psychological level, and with that the 200-day moving average. NZD/CHF Daily ChartChart created with TradingView Resources for Forex TradersWhether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex. — Written by Brendan Fagan, Intern To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] |

| Cambio Euro Dollaro previsioni 2021 analisi andamento Forex mediante la tecnica di WD Gann Posted: 06 Nov 2021 10:17 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Previsioni Euro Dollaro oggi analisi tecnica andamento Forex nel breve e lungo termine. Il nuovo Set Up weekly del 21 maggio 2021 dovrà confermare l’ esito positivo del precedente ciclo temporale del 07 maggio. Osserviamo nel breve video i punti di inversione del trend di medio e lungo periodo, insieme ai vari supporti e resistenze dinamiche.  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] |

| USD/MXN to Retain Bearish Bias Post-Fed Ahead of Banxico Posted: 06 Nov 2021 09:39 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  USD/MXN OUTLOOK: BEARISH

Most read: Gold (XAU/USD), Natural Gas (LNG) & Nasdaq (NDX) – FinTwit Trends to Watch After exploding higher and reaching an eight-month high at 20.98 earlier this week, USD/MXN has started to correct lower after the Federal Reserve adopted a dovish stance at its latest policy meeting, noting that liftoff would require full employment and that board members will be very patient before raising borrowing costs despite elevated CPI readings. The position taken by the U.S. central bank led to a sharp pullback in Treasury yields, as traders began to scale back expectations that policymakers will be aggressive in withdrawing stimulus to combat rising inflationary forces. This environment has created a constructive backdrop for risk assets, boosting equities and some EM currencies. Broad-based positive sentiment prevalent in financial markets, coupled with monetary policy divergence between the Fed and Banxico, should support the Mexican peso in the near term. For added context, Banxico has already raised rates three times in 2021 and is likely to do so twice more before the end of the year to fight pervasive price pressures that threaten to de-anchor inflation expectations. In the coming week, for example, the Mexican central bank is expected to raise the overnight rate by 25 basis points to 5.00%, followed by another hike of the same magnitude in December. From a technical standpoint, after failing to clear Fibonacci and channel and resistance near 21.00, USD/MXN has fallen significantly, breaching key support at 20.45 on its trip lower. This break may accelerate the recent sell-off, but to have more conviction in the bearish narrative, we would need to witness a sustained move below the 200-day simple moving average at 20.15. If this scenario were to play out, price could be on track to test the psychological 20.00 mark in short order. On the flip side, if bulls retake control of the market and price pivots higher, the 20.45 region should be viewed as the first hurdle containing further upside. However, if buyers manage to push USD/MXN above this resistance decisively, the pair will have few obstacles to reclaim the 21.00 area heading into the second half of the month. USD/MXN TECHNICAL CHARTSource: TradingView EDUCATION TOOLS FOR TRADERS

—Written by Diego Colman, Contributor

Source link Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Free Naked Trading EA – https://bit.ly/2Ph2bRB

Free Naked Trading EA – https://bit.ly/2Ph2bRB Sign up for a 7 day free trial – https://bit.ly/2AoUmAQ

Sign up for a 7 day free trial – https://bit.ly/2AoUmAQ Tour of the Trading Room – https://go.forexsignals.com/225a-trade-room-showcase

Tour of the Trading Room – https://go.forexsignals.com/225a-trade-room-showcase Switch Markets – https://go.forexsignals.com/e254

Switch Markets – https://go.forexsignals.com/e254 Free Forex Education In Your Inbox – https://go.forexsignals.com/free-education-email

Free Forex Education In Your Inbox – https://go.forexsignals.com/free-education-email Free Naked Trading Strategy Course – https://go.forexsignals.com/4cx8-nts

Free Naked Trading Strategy Course – https://go.forexsignals.com/4cx8-nts Learn About Technical Indicators – https://go.forexsignals.com/yvb67-technical-indicators

Learn About Technical Indicators – https://go.forexsignals.com/yvb67-technical-indicators How To Trade Stocks & Options – https://www.youtube.com/channel/UC3ekhyL7yagCZZ3QDxgZywg

How To Trade Stocks & Options – https://www.youtube.com/channel/UC3ekhyL7yagCZZ3QDxgZywg Risk-on & Risk-off Cheat Sheet – https://go.forexsignals.com/riskon-riskoff-cheatsheet

Risk-on & Risk-off Cheat Sheet – https://go.forexsignals.com/riskon-riskoff-cheatsheet Moving Averages Strategy Guide – https://go.forexsignals.com/moving-averages-strategy

Moving Averages Strategy Guide – https://go.forexsignals.com/moving-averages-strategy ATR Indicator Strategy Cheat Sheet – https://go.forexsignals.com/atr-indicator-cheatsheet

ATR Indicator Strategy Cheat Sheet – https://go.forexsignals.com/atr-indicator-cheatsheet Top 10 Candlestick Patterns Cheat Sheet – https://go.forexsignals.com/3j5p1-cheat-sheet-pdf

Top 10 Candlestick Patterns Cheat Sheet – https://go.forexsignals.com/3j5p1-cheat-sheet-pdf Download Our App – https://go.forexsignals.com/ri0g-download-app

Download Our App – https://go.forexsignals.com/ri0g-download-app Lot Size Calculator – https://go.forexsignals.com/h8zg-lot-size-calculator

Lot Size Calculator – https://go.forexsignals.com/h8zg-lot-size-calculator Profit Calculator – https://go.forexsignals.com/tk3kw-profit-calculator

Profit Calculator – https://go.forexsignals.com/tk3kw-profit-calculator Currency Heat Map – https://go.forexsignals.com/7okv9-currency-heat-map

Currency Heat Map – https://go.forexsignals.com/7okv9-currency-heat-map Economic Calendar – https://go.forexsignals.com/si6u-economic-calendar

Economic Calendar – https://go.forexsignals.com/si6u-economic-calendar Community Trade Ideas – https://go.forexsignals.com/j49g-trade-ideas

Community Trade Ideas – https://go.forexsignals.com/j49g-trade-ideas Instagram – https://instagram.com/forexsignalscom

Instagram – https://instagram.com/forexsignalscom Facebook – https://www.facebook.com/forexsignalscom

Facebook – https://www.facebook.com/forexsignalscom Facebook Group – https://www.facebook.com/groups/forexsignalscom

Facebook Group – https://www.facebook.com/groups/forexsignalscom

Telegram – https://t.me/forexsignalscom

Telegram – https://t.me/forexsignalscom Twitter – https://twitter.com/ForexSignalsFTW

Twitter – https://twitter.com/ForexSignalsFTW

Trustpilot – https://www.trustpilot.com/review/forexsignals.com

Trustpilot – https://www.trustpilot.com/review/forexsignals.com Forex Peace Army – https://www.forexpeacearmy.com/forex-reviews/9043/forexsignals.com

Forex Peace Army – https://www.forexpeacearmy.com/forex-reviews/9043/forexsignals.com Customer Stories – https://go.forexsignals.com/gri11-customer-stories

Customer Stories – https://go.forexsignals.com/gri11-customer-stories

COMO VAI FUNCIONAR?

COMO VAI FUNCIONAR?  Você vai investir a partir de 97 reais parcelado em 12x ou R$997 à vista. Colocando na ponta do lápis é só 2,70 por dia, preço de um pastel com suco

Você vai investir a partir de 97 reais parcelado em 12x ou R$997 à vista. Colocando na ponta do lápis é só 2,70 por dia, preço de um pastel com suco

para mudar a sua realidade financeira e a vida da sua família!

para mudar a sua realidade financeira e a vida da sua família!  FALTA POUCO PARA MUDAR A SUA VIDA FINANCEIRA!!!

FALTA POUCO PARA MUDAR A SUA VIDA FINANCEIRA!!!

No comments:

Post a Comment