Forex System |

- ★ Curso Forex COMPLETO Gratis en Español El MEJOR Curso de FOREX TRADING

- Crude Oil Reignites for Bulls As OPEC+ News Sinks In. Can WTI Make a New High?

- SAP FSCM Treasury & Risk Management Application Designer

- International Relationship Manager – Business Banking

- Cómo ganar más pips en Forex | Winpips

- Gold Price Outlook Turns to Fed Chair Jerome Powell as XAU/USD Breaks Resistance

- Beginner Trading System | Custom Indicators | Forex Factory

- AUD/USD Rises Despite Wall Street Selloff as Chinese Flooding Lifts Coal Prices

- The Most Powerful MT4 Indicator Buy Sell Signals – Combine with Advanced Supertrend + MACD

- How CPI Data Affects Currency Prices

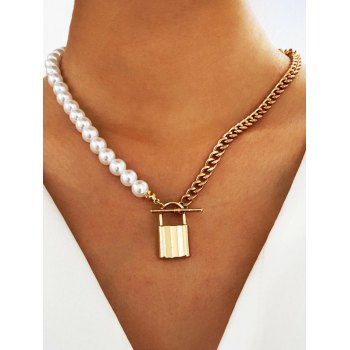

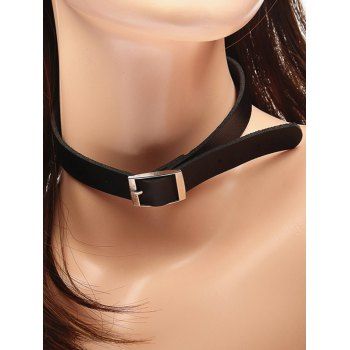

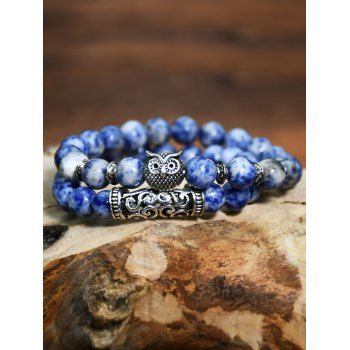

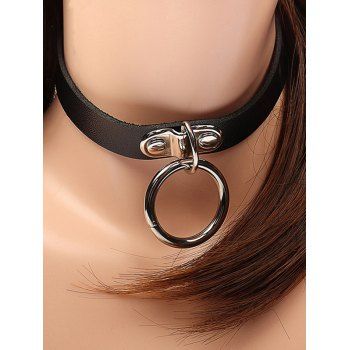

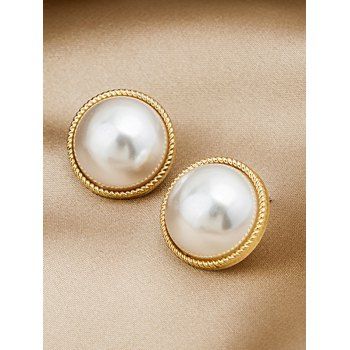

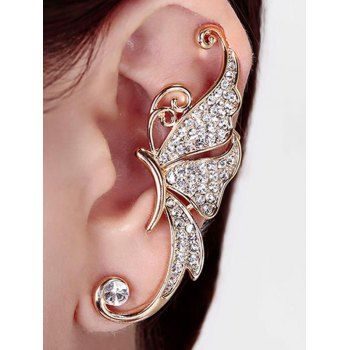

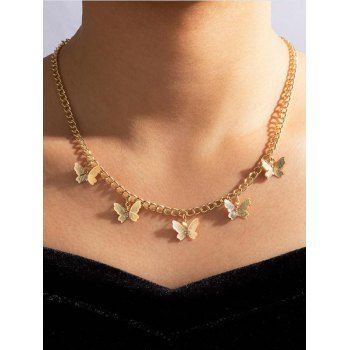

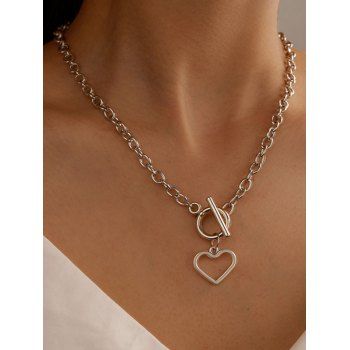

| ★ Curso Forex COMPLETO Gratis en Español El MEJOR Curso de FOREX TRADING Posted: 08 Nov 2021 12:03 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ SUSCRÍBETE: http://goo.gl/JFCEuh A continuación explicaremos cuales son los términos mas utilizados en el mercado Forex y cual es la forma correcta de analizarlos y de evaluarlos respecto de la operativa. SÍGUEME EN: http://www.experium.es manual de forex, curso de forex, como invertir en forex, que es forex, vocabulario forex, trading forex, forex online, que es forex, forex tutorial, forex blog, curso gratis, como funciona forex, inversion en forex, curso de inversiones, invertir en divisas, invertir en bolsa, como invertir, saber invertir, empezar a invertir, aprenda a invertir, forex markets, forex tutorial, manual forex, manual gratuito de forex, curso forex, curso de forex gratis, forex curso, curso completo forex, trading forex, forex inversiones, manual de inversion, curso de inversion, invertir en forex, source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Crude Oil Reignites for Bulls As OPEC+ News Sinks In. Can WTI Make a New High? Posted: 07 Nov 2021 11:41 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Crude Oil, China, Coal, Baltic Dry Index – Talking Points

Crude oil continued higher today as the reality of OPEC+ not adding to production output seems to be sinking in. The market also questioned if the US Strategic Petroleum Reserve would be tapped or not. The WTI oil contract traded as high as US$ 82.47 in the Asian session. Despite record highs for US stocks on Friday, APAC equities were mixed with Australian and Japanese stocks a bit soft while Hong Kong were slightly up. The kiwi was the best performing currency today. In China, the communist party meets this week where it is believed that President Xi Jinping is likely to get an extension of his term as leader of the party. The implementation of his 'shared prosperity' policy has seen many sectors of the economy come under regulatory scrutiny. This has created a degree of uncertainty for some companies. Over the weekend, China reported a larger than expected October trade surplus, coming in at US$ 84.54 billion, well ahead of forecasts of around US$ 65 billion. Exports ramped by 27.1% for the year to the end of October while imports increased by only 20.6%. Today, the National Development and Reform Commission (NDRC) reported that coal output has hit its' highest level in several years. State Grid Corp. of China stated that power supply is back to normal. The utility supplies 88% of China's power. It's possible that supply chain congestion might be easing as indicated by shipping costs. The Baltic Dry Index that measures the cost of shipping in the 3 largest categories of cargo ships, is roughly half of where it was at the peak in early October. However, it is still above levels not seen since 2010. Today we have US PPI figures due out and then on Wednesday, US and China inflation will be released. Crude Oil Technical AnalysisWTI crude oil moved below an ascending trend line last week. On the run down it also went below the 10 and 21-day simple moving averages (SMA). It is now challenging to move back above these 2 SMAs. It has remained above the longer term SMAs as represented in the chart by the 100-day SMA. This could suggest that shorter term momentum is directionless while underlying longer term bullish momentum is potentially still intact. The recent high of 84.88 and 85.41 may offer resistance. On the downside, the previous lows of 78.25 and 74.96 and a pivot point at 73.14 are possible support levels.

— Written by Daniel McCarthy, Strategist for DailyFX.com To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| SAP FSCM Treasury & Risk Management Application Designer Posted: 07 Nov 2021 11:38 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: SAP FSCM Treasury & Risk Management Application Designer Company: Accenture Job description: ability to build, manage and foster a team-oriented environment -Desire to work in an information systems environment -Excellent… to meet business process and application requirements. Management Level : 9 Work Experience : 6-8 years Work location… Expected salary: Location: Bangalore, Karnataka Job date: Sun, 07 Nov 2021 23:21:19 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| International Relationship Manager – Business Banking Posted: 07 Nov 2021 11:07 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: International Relationship Manager – Business Banking Company: HSBC Job description: or professional's interaction with HSBC. Work in partnership with colleagues across the HSBC network to deliver exceptional standards… information, including KYC requirements in Group systems Resolve any/all identified issues promptly, and escalate concerns… Expected salary: Location: Mumbai, Maharashtra Job date: Mon, 08 Nov 2021 07:05:12 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Cómo ganar más pips en Forex | Winpips Posted: 07 Nov 2021 11:02 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ En este video, veremos cómo ganar más pips en forex con algunos consejos. Explicaremos qué tipo de pares de divisas son los más adecuados para una mayor volatilidad, cuánto tiempo debes dejar tus operaciones abiertas según el time frame (temporalidad), cuántos pares es conveniente que operes a la vez, cuáles son los ratios riesgo beneficio óptimos y cuál es la mejor actitud para cada vez hacer mejores trades y maximizar nuestras ganancias. Bienvenidos a Winpips, el canal donde te ayudamos a mejorar tu trading. Suscríbete gratis al canal: Síguenos en redes Sociales: Más información en: Hasta pronto! source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Gold Price Outlook Turns to Fed Chair Jerome Powell as XAU/USD Breaks Resistance Posted: 07 Nov 2021 10:37 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Gold, XAU/USD, NFPs, Treasury Yields, Fedspeak, Technical Analysis – Talking Points:

Gold prices traded quietly as the new trading week began with the Asia-Pacific session. Treasury yields trimmed losses from Friday. The yellow metal closed at its highest since early September last week following fairly supportive fundamental developments. That would be the combined disappointment that hawks were looking for from the Reserve Bank of Australia, Bank of England and Federal Reserve. The key takeaway between the three of them was their stance on inflation being transitory, cooling 2022 rate hike expectations. The 10-year Treasury yield closed at its lowest since late September. This is something that the anti-fiat XAU/USD likely took well advantage of. But, persistent strength in the US Dollar likely capped its upside potential. Over the remaining 24 hours, gold prices will eye Fedspeak, including Chair Jerome Powell and Vice Chair Richard Clarida. This follows last Friday's stellar non-farm payrolls report, which struggled to bring forward hawkish Fed monetary policy expectations in the wake of patient commentary around interest rates. Reiterating similar language may continue keeping yields at bay, supporting XAU/USD. Check out the DailyFX Economic Calendar for more key events! Gold Technical AnalysisOn the 4-hour chart, gold prices broke above the 1813 – 1808 resistance zone, exposing the 1825 – 1834 zone above. The latter is made up of peaks from July. A bullish Golden Cross between the 20- and 50-period SMAs may form, opening the door to an upward technical bias. These lines may also come into play as key support in the event of a near-term decline. XAU/USD 4-Hour Chart

Chart Created Using TradingView Gold Sentiment Analysis – BullishAccording to IG Client Sentiment (IGCS), roughly 66% of retail traders are net-long gold. Downside exposure has increased by 10.30% and 48.34% over a daily and weekly basis respectively. We typically take a contrarian view to crowd sentiment. Since most traders are net-long, this suggests prices may fall. But, recent shifts in positioning are resulting in a bullish-contrarian trading bias.

*IGCS chart used from November 8th report –— Written by Daniel Dubrovsky, Strategist for DailyFX.com To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Beginner Trading System | Custom Indicators | Forex Factory Posted: 07 Nov 2021 10:01 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ I test the Daylight Trading Strategy by LauraT that has become a trending thread on Forex Factory. This system is a simple mechanical method that is great for beginner traders and those looking for a non-discretionary trading system.

Trader's Landing is a trading system review and education channel. By testing indicator based trading strategies we are able to learn and understand a system's performance by using a repeatable and clearly defined trading criteria that has a predictable performance through a series of many setups. These trading systems can be ported over to many instruments such as Forex (FX), Cryptocurrency (Crypto), Options, Stocks, or anything that has a chart and a significant amount of volume and market participants. If you are looking for trading systems to test out on your own here is a playlist of systems that I like: https://bit.ly/SystemsILike

See a trading system you would like tested on this channel? Be sure to let me know, including links where you found it, and any other pertinent information. In many ways you are the eyes and ears of this channel. Link to thread by LauraT on Forex Factory https://www.forexfactory.com/thread/1086170-daylight-trading-strategy Chapters: System Specifics Indicators Long Entry Short Entry R:R Where to place stop-loss Indicators tested on this channel so far: Captions Available in: Arabic, Chinese, English, German, Hindi, Italian, Japanese, Korean, Norwegian, Portuguese, Punjabi, Russian, Spanish. #BeginnerTrading #TradingSystem #ForexFactory Disclaimer source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| AUD/USD Rises Despite Wall Street Selloff as Chinese Flooding Lifts Coal Prices Posted: 07 Nov 2021 09:34 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Australian Dollar, AUD/USD, China, Coal, Crude Oil, BOK – Talking Points

Tuesday's Asia-Pacific Forecast The Australian Dollar remains on a solid footing after gaining overnight despite a weak performance in US stocks on Wall Street. The Dow Jones Industrial Average (DJIA) closed 0.76% lower on Monday. Rising energy costs are fueling concerns that inflation may be stickier than most economists and central bankers have predicted. Those higher costs could very well eat into consumer spending in other parts of the economy. A downbeat GDP report from Goldman Sachs also weighed on sentiment. The US bank cut its growth target to 5.6% for 2021. AUD/USD rose as coal prices surged in Asia. Beijing ordered energy producers to increase production last week, which relieved some upward pressure on prices. However, flooding across China is halting mining operations. That sent coal futures in China to record highs on Monday, which lifted the Australian Dollar. Australia is a major coal exporter, and China has reportedly allowed small amounts to clear customs despite a ban on coal imports from the southern neighbor. Oil prices also rose overnight, further spurring inflationary concerns as crude oil hit its highest level since October 2014. The demand for energy products is rising as economies come back online following Covid restrictions put in place versus the highly contagious Delta strain. New South Wales, Australia's most populated state, loosened restrictions on Monday. Vaccination rates in Australia have seen significant progress in recent months, allowing the reopening. Elsewhere, New Zealand reported a 0.9% rise in electronic card spending for September on a month-over-month basis. Later today, Japan will report bank lending and producer prices data for September. The Bank of Korea (BOK) is set to keep its benchmark interest rate on hold at 0.75%. Traders will also have a close eye on the United Kingdom's July employment report in the European session. AUD/USD Technical Forecast AUD/USD put in a solid move higher overnight, breaching above the 50-day Simple Moving Average (SMA). Upward momentum eased prior to hitting the psychologically important 0.74 handle, but bulls appear to be in control for the time being. If prices head lower, the 50-day SMA will come back into focus as potential support. AUD/USD 8-Hour Chart

Chart created with TradingView — Written by Thomas Westwater, Analyst for DailyFX.com To contact Thomas, use the comments section below or @FxWestwateron Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| The Most Powerful MT4 Indicator Buy Sell Signals – Combine with Advanced Supertrend + MACD Posted: 07 Nov 2021 09:00 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Trade with World Top Broker And Enjoy Exclusive Benefits. 1. Xm – https://clicks.pipaffiliates.com/c?c=594203&l=en&p=1 Now open Forex account with this link and actively trading on the same account to get on my Future Copy Trading program or Money Management and other more benefit #macd #supertrend #POWEROFTRADING #mt4indicator Indicator Download Link:- on my telegram channel ( https://t.me/POWEROFTRADINGrv ) How to Install Indicator In MT4 ( Step by Step ) – https://youtu.be/ztcYw9Q_LTg In this video, we look at the top technical indicators successful spread betters create their trading strategies from. We look at what the indicators mean and how they should be applied to the markets. We look at real-world examples as to how the signals and indications can lead to profitable trades. Discover the best Binary and Forex indicator for your trading strategy so you can improve your winning rate and profit I Hope This Indicator Brings Success For You. Business Contact Email : poweroftrading7@gmail.com Twitter : https://twitter.com/PowerOfTrading2?s=09 Indicator Download Link:- on my telegram channel ( https://t.me/POWEROFTRADINGrv ) Subscribe Our Channel To Received Binary And Forex Profitable Indicators And Strategy (FULL FREE ) ***** Watch Our Popular Video ***** FOREX: Top Best Technical Indicator for Profitable Trading ( FREE INDICATOR ) – HINDI – https://youtu.be/KwyXOz2Z6Bk Thanks For Watching Video ……. Forex,Trading,Daytrading,Forex Trading,FX Trading,Swing Trading,Forex Market,Market,Indicator Trading,Forex Indicator,Price Action,FX Trader,Trading Tips,How To Trade,How To Trade Forex,Forex Trading For Beginners,Strategies,trend lines,trend line,trendline,trendlines,trading strategy,trading strategies,price action,swing trading,day trading,forex,stocks,wysetrade,price action trading,Forex Trading Lessons,Forex lessons,trading lessons,Forex trading tips,trading tips,stock market lessons,stock market tips,best forex tips,best forex trading,the secret trading techniques,Trading,Investing,Entrepreneur,Equities,Forex,FX,Stock Investing,Day Trading,Swing Trading,Trading Strategies,Price Action Trading,The Secret Trading Shares,forex,forexsignals,trading,room,forex trading,forex trader,scalping forex,scalping trading,scalpingforex scalping,forex scalping strategy,forex scalping live,forex scalping 1 minute,forex scalping 5 minute,forex scalping indicators,scalping forex,scalping trading,best forex scalping strategy,what is scalping in forex,what is scalping trading,what is scalping in day trading,what is scalping in options trading,what is scalping trading forex,best 5 minute forex strategy,forex 500 to 30000,forex 500 dollars,forex 5 minute scalping strategy,forex trading,candlestick patterns,candlestick pattern,candlestick chart,candlestick patterns for beginners,candlestick #poweroftrading #forexdaytrading #forexindicator #buysellsignal #Forex_strategy_for_beginners #forex_scalping_strategy #trend_forex_indicator #best_scalping_strategy #forextrading #forexindicator #Forex #forex_Strategy #non_repaint_indicator #IQoption #Signal #Earning_Money #poweroftrading #forex #factoryforex source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| How CPI Data Affects Currency Prices Posted: 07 Nov 2021 08:31 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ In this article, we'll explore CPI and forex trading, looking at what traders should know about the Consumer Price Index to make informed decisions. We'll cover what CPI is as a concept, the CPI release dates, how to interpret CPI, and what to consider when trading forex against CPI data. What is CPI and why does it matter to forex traders?The Consumer Price Index, better known by the acronym CPI, is an important economic indicator released on a regular basis by major economies to give a timely glimpse into current growth and inflation levels. Inflation tracked through CPI looks specifically at purchasing power and the rise of prices of goods and services in an economy, which can be used to influence a nation's monetary policy. CPI is calculated by averaging price changes for each item in a predetermined basket of consumer goods, including food, energy, and also services such as medical care. It is a useful indicator for forex traders due to its aforementioned effect on monetary policy and, in turn, interest rates, which have a direct impact on currency strength. The full utility of knowing how to interpret CPI as a forex trader will be explored below. Read more on how interest rates impact the forex market. CPI release datesCPI release dates usually occur every month, but in some countries, such as New Zealand and Australia, quarterly. Some nations also offer yearly results, such as Germany's index. The US Bureau of Labor Statistics has reported the CPI monthly since 1913. The following table shows a selection of major economies and information about their CPI releases.

Why forex traders should follow CPI dataUnderstanding CPI data is important to forex traders because it is a strong measure of inflation, which in turn has a significant influence on central bank monetary policy. So how does CPI affect the economy? Often, higher inflation will translate to higher benchmark interest rates being set by policymakers, to help dampen the economy and subdue the inflationary trend. In turn, the higher a country's interest rate, the more likely its currency will strengthen. Conversely, countries with lower interest rates often mean weaker currencies. The release and revision of CPI figures can produce swings in a currency's value against other currencies, meaning potentially favorable volatility from which skilled traders can benefit. Also, CPI data is often recognized as a useful gauge of the effectiveness of the economic policy of governments in response to the condition of their domestic economy, a factor that forex traders can consider when assessing the likelihood of currency movements. The CPI can also be used in conjunction with other indicators, such as the Producer Price Index, for forex traders to get a clearer picture of inflationary pressures. What to consider when trading forex against CPI dataWhen using CPI data to influence forex trading decisions, traders should consider the market expectations for inflation and what is likely to happen to the currency if these expectations are met, or if they are missed. Similar to any major release, it may be beneficial to avoid having an open position immediately before. Traders might consider waiting for several minutes after the release before looking for possible trades, since forex spreads could widen significantly right before and after the report. Below is a chart displaying the monthly inflation rates for the US. For the latest month, expectations are set at 1.6% inflation compared to last year's data. If CPI is released higher or lower than expectations this news event does have the ability to influence the market.

Chart to show US inflation levels in 2018/19. Source: TradingEconomics.com. US Bureau of Labor Statistics One way the effects of CPI data can be interpreted is by monitoring the US Dollar Index, a 2018/19 example chart for which is below. If CPI is released away from expectations, it is reasonable to believe this may be the catalyst to drive the Index to fresh highs, or to rebound from resistance. Since the Index is comprised of EUR/USD, USD/JPY, and GBP/USD, by watching the US Dollar we can get a full interpretation of the events outcome.

Chart to show movement in the US Dollar Index. Source: TradingView.com As can be observed in the example above, as inflation rose during the first half of 2018, the US Dollar Index went up accordingly. But with US inflation drifting lower in the following months and with a missed target of 2%, this pushed US interest rate hikes off the agenda. As a result, the dollar struggled and weakened against a basket of other currencies. Not every fundamental news release works out through price as expected. Once the CPI data has been released and analyzed, traders should then look to see if the market price is moving through or rebounding off any areas of technical importance. This will help traders understand the short-term strength of the move and/or the strength of technical support or resistance levels, and help them make more informed trading decisions. Read more on CPI, inflation and forexMake sure you bookmark our economic calendar to stay tuned in to the latest CPI data released by a range of countries, and stay abreast of all the DailyFX news and analysis updates. Also, reserve your place at our Central Bank Weekly webinar series to learn about news events, market reactions, and macro trends. For more information on inflation and its impact on forex decisions, take a look at our article Understanding Inflation for Currency Trading.

Source link Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

SUBSCRIBE NOW for more content like this: https://bit.ly/SubTL

SUBSCRIBE NOW for more content like this: https://bit.ly/SubTL Link to my Testing Performance Spreadsheet: https://bit.ly/TLResults

Link to my Testing Performance Spreadsheet: https://bit.ly/TLResults Link to my backtesting spreadsheet: https://bit.ly/TLTestSheet

Link to my backtesting spreadsheet: https://bit.ly/TLTestSheet Link to the backtesting spreadsheet tutorial: https://bit.ly/BTTutoiral

Link to the backtesting spreadsheet tutorial: https://bit.ly/BTTutoiral

No comments:

Post a Comment