Forex System |

- Australian Dollar Sinks on US Dollar Gains as CPI Fall Oout Continues. Where To From Here?

- Forex Trading Bonus

- Crude Oil Price Volatility Ahead of US-Iran Nuclear Deal Talks

- �� Weekly Forex Forecast – EURUSD, GBPUSD, USDJPY, AUDUSD, XAUUSD OIL (08/11/2021) Supply and Demand

- The Deviation Between Bond Spreads And Reality

- USDJPY Forecast For Nov – USDJPY technical analysis today for Nov – USDJPY – FOREX

- It’s ‘Unanticipated’ Inflation That’s The Real Bond Market Killer

- MACD Trading Strategy + Price Action – My FAVORITE Trading Strategy – Practice Examples ��

- High Yield Leads The Way

- LESSON 3 What are the advantages of Forex market 1080p

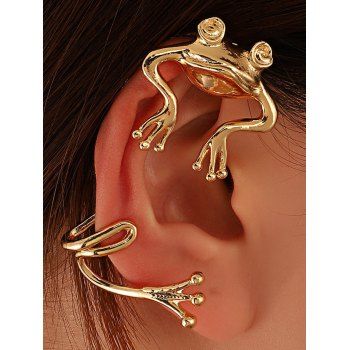

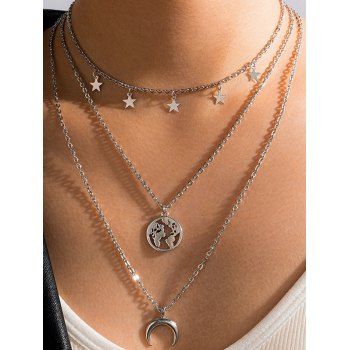

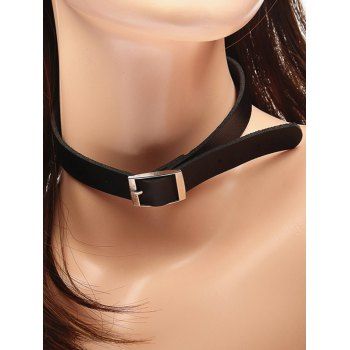

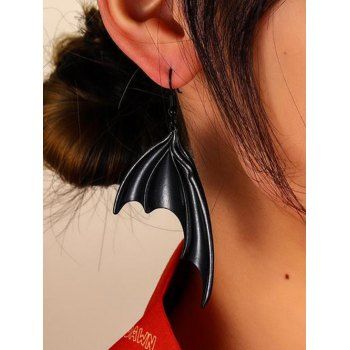

| Australian Dollar Sinks on US Dollar Gains as CPI Fall Oout Continues. Where To From Here? Posted: 12 Nov 2021 12:57 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Australian Dollar, AUD/USD, US Dollar, US Yields, Gold – Talking Points

The Australian Dollar has lost ground to the US Dollar with US yields continuing higher in the aftermath of an eye watering CPI on Wednesday. All across the US curve, rates went north in the US session but have since settled back a touch in Asian trade. 5-year Treasuries sold off the most as they have gone from 1.08% before CPI to a high of 1.27% today. Not surprisingly, the Move index, a measure of volatility in the Treasury market, is at its' highest level since the outbreak of the pandemic. Gold has also pushed higher again today with some pundits citing unchecked inflation as the catalyst. This would seem incongruent with the performance of the yellow metal and the inflation reads so far this year. In geo-political news, the US warned the European Union that Russia might be preparing to invade the Ukraine. It is being reported that the US has observed a build up of military at the border. If true, this would have implications for energy prices. However, crude oil is lower again today on the back of US Dollar strength. The Swiss Franc and Japanese Yen were the underperformers in Asia today while commodity currencies found some support after overnight weakness. The AUD/USD remains hostage to a strengthening US Dollar and yesterday's weak Australian jobs data compounded the rout. Asian equites were mostly positive with Japanese stock making some solid gains. Looking ahead, the University of Michigan sentiment index is due out and Federal Reserve Bank of New York President, John William will be talking. AUD/USD Technical AnalysisAUD/USD continues to move lower this week with the price breaking below short, medium and long-term simple moving averages (SMA). The 55-day and 100-day SMAs are currently near a pivot point at 0.73602 and this level may offer resistance. Above there, there previous highs of 0.73418 and 0.75560 could be resistance levels. On the downside, support night be provided at the intersection of an ascending trend line, currently at 0.7250. Support is also potentially at the prior lows of 0.71705 and 0.71062.

— Written by Daniel McCarthy, Strategist for DailyFX.com To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] |

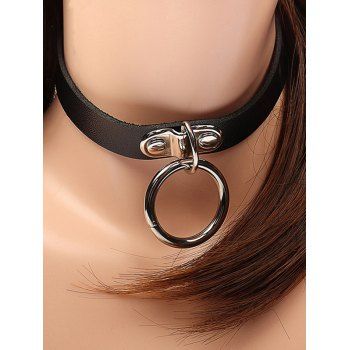

| Posted: 12 Nov 2021 12:21 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Forex Trading Bonus  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] |

| Crude Oil Price Volatility Ahead of US-Iran Nuclear Deal Talks Posted: 11 Nov 2021 11:55 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ CRUDE OIL PRICES, INFLATION, IRAN-US RELATIONS, IRAN NUCLEAR DEAL – TALKING POINTS

Alchemy or Affectation? Iran Nuclear TalksCrude oil prices are vulnerable to geopolitically-induced volatility at the end of November when Iranian, US and European officials are set to meet in Vienna to discuss reviving an agreement on de-nuclearization. After an initial accord was negotiated and implemented in 2015 under the leadership of US President Barack Obama, the subsequent administration of President Donald Trump shredded it and reimposed sanctions. Since then, Iran has been enriching uranium beyond the stipulated limits. In an attempt to reconcile, officials met in June this year and held six rounds of indirect talks on the nuclear deal. While the discussions did not yield an agreement, policymakers did identify key concessions that both Iran and the US would want out of a revived accord. A hardliner emerged victorious in Iran's presidential election around the same time, however. The newly-elected President Ebrahim Raisi expressed a willingness to approach the nuclear deal again, but his disposition meant steeper concessions for his counterparts. Since then, rhetoric out of Tehran has included not only calling for the US to lift all sanctions, but also publicly acknowledge "its fault in ditching the pact". Foreign Ministry spokesman Saeed Khatibzadeh also said in a virtual conference that: “The US should show that it has the capability and will to provide guarantees that it will not abandon the deal again if the talks to revive the deal succeed". Western allies did not receive the message well, with one diplomat saying the new demands meant Iran was not "serious". Given the rigidity on both sides, the old question of "what happens when an unstoppable force meets an immovable object?"is revived. For markets, this means more of the same, unless a clear-cut breakthrough or a conclusive breakdown trigger a bout of volatility. Both sides have leverage and stand to gain something from a deal. Who will yield first? Chest Puffed, Economy in TattersUS sanctions on Iran have crippled the economy and crushed the exports of petroleum-based products – especially crude oil – which are the lifeblood of the local economy. In 2020 alone, in addition to the sanctions, Iran's crude oil production fell to an almost 40-year low as a result of the COVID-19 pandemic. But even before that, the picture was bleak. As the EIA points out, after Trump pulled out of the deal and reimposed sanctions on Iran's oil exports, "crude oil production held steady at around 2.6 million b/d during the first few months of 2019, when the [US] granted sanction waivers for some of Iran's key oil-importing countries. However, after these waivers expired in May 2019, output fell to about 2.1 million b/d".

Source: Bloomberg With Iranian inflation close to 40 percent on-year and the unemployment rate just shy of the 10 percent, it appears that the US carries enormous economic leverage heading into the talks. Lifting sanctions could significantly mitigate domestic woes, giving Washington a lot of bargaining power in the talks. Nevertheless, Tehran is not coming to the negotiating table empty-handed. Biden Needs a Foreign Policy WinUS President Biden's popularity has been sliding, with an average of polls compiled by FiveThirtyEight showing a narrow majority of 51.6 percent of Americans disapprove of his policies and actions. Just 42.5 percent of poll respondents approve of Mr Biden's The much-maligned US withdrawal from Afghanistan dampened Mr Biden's popularity significantly, with "just 27 percent [rating] Biden’s handling of the situation as “excellent” or “good,” while 29 percent rated it “only fair” and 42 percent rated it “poor", according to NBC News.

Source: FiveThirtyEight Compounded with the seemingly sour reception of the 2021 United Nations Climate Change Conference, Mr. Biden appears to be in desperate need of a win. A breakthrough on the nuclear deal therefore carries much more weight in the broader context. Not only was it a cornerstone of Mr. Biden's foreign policy pitch on the campaign, but its revival would reinstate a key achievement of the Obama administration, in which Mr. Biden served as Vice President. In this regard, Iran has some leverage in the upcoming talks, though Tehran should probably be prudent and not overplay its hand. Looking ahead, the apparent stalemate in market price action over the past month may have traders looking to the conference for the off-chance possibility that progress toward reconciliation is made. Crude oil prices might be in for a rough ride in that scenario. Crude Oil Price OutlookCommodity strategists appear to be betting on a delay in Iranian oil returning to the market, and are therefore not expecting any major breakthroughs this month. Consequently, if there is then an agreement – in principle or in writing – that brings the timeline of lifting sanctions forward, then selling pressure may build and volatility ensue. Expectations seem to be heavily tilted against the likelihood of a breakthrough. If progress is achieved nevertheless, the adjustment to new geopolitical circumstances will probably manifest in larger-than-usual price swings. The path of least resistance would likely favor the downside in such a scenario. That remains a distant prospect however, with Iran and the US unlikely to agree to any major concessions (at least not publicly, until there is a politically-profitable way of announcing progress). That will then leave crude oil to be swayed by macro-fundamental factors, like progress toward economic reopening following the COVID-19 pandemic and economic data shaping expectations for growth and monetary policy. Still, traders would be prudent to monitor news-flow for any changes in official rhetoric that could signal a change in US-Iran relations and therefore a potential shift in expectations at the end of this month. Purely economic models are notoriously vulnerable to asymmetric risks like a political breakthrough. They can and do work… until they don't. Follow Dimitri on Twitter @ZabelinDimitri for more geopolitical and market insights!

Source link Click to rate this post! [Total: 0 Average: 0] |

| �� Weekly Forex Forecast – EURUSD, GBPUSD, USDJPY, AUDUSD, XAUUSD OIL (08/11/2021) Supply and Demand Posted: 11 Nov 2021 11:19 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Weekly forex forecast for November 8 – November 12, using COT reports and supply and demand zones. In this forex forecast I have identified all of the important supply and demand zones created by large institutions that you should also be watching for this upcoming trading week! You can use this weekly forex forecast to trade confirmation entries, or simply use the supply and demand zones I show in the forecast, to help you with your own trading strategy! We will analyze the DXY, EURUSD, AUDUSD, USDJPY, GBPUSD, USDCAD, USDCHF, Gold(XAUUSD), & Oil *FOREX FORECAST TIMESTAMPS* If You Want My Chart Analysis Every Single Day, Join the Team!: Join my free discord group! If you want custom chart analysis, join the Tier 2 Patreon/YouTube membership! New to Supply And Demand Trading? Start HERE Follow me on Instagram: DISCLAIMER: #weeklyforexforecast source Click to rate this post! [Total: 0 Average: 0] |

| The Deviation Between Bond Spreads And Reality Posted: 11 Nov 2021 10:54 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------

We recently wrote that line in The Markets Are Sending Confounding Messages. The article discusses a "metaphorical fog", induced by central banks. The fog envelops all market signals and, in the process, take away all means of orientation. Investors, unaware of the fog, are pushing the pedal to the metal with little concern. This article examines the corporate bond fog. In particular, we show how corporate yields are priced for perfection while the economy languishes in what some describe as depression. Quantifying Warped PerceptionsThere are many ways to quantify risk. For this article, we use the Economic Policy Uncertainty Index (EPUI). EPUI is computed by Economic Policy Uncertainty. The index is comprehensive, as it uses three distinct underlying components to measure the degree of economic uncertainty. Per the organization, their methodology is as follows:

A high index level denotes more uncertainty, and conversely, a lower level reflects more confidence. The index and its history can be found and downloaded on the St. Louis Federal Reserve's web site. Corporate Bond SpreadsThe opening quote was from a section of the mentioned article where we discuss the gross mismeasurement of corporate bond risk. Specifically, corporate bond yields versus U.S. Treasuries are at minimal levels, reflecting a high degree of certainty and strength in the economy and financial conditions of corporations. The fact of the matter is that over 90% of the world's economies are in a recession. Second-quarter real GDP fell by an annualized rate of 32.9%. The last such decline was during the Great Depression. While recovery may take hold, there is no guarantee it will last. Recovery has been fully supported by grossly unsustainable fiscal and monetary actions. There are serious questions as to whether these operations can continue. Needless to say, confidence in the ability of corporations to thrive is misplaced today. Historically, economic certainty and corporate spreads tend to follow the same path. Today, they are moving in the opposite direction. To quantify this irrational deviation, we compare the EPUI and BBB-corporate/Treasury yield spreads. The first graph below compares EPUI to BBB spreads. The higher EPUI, the more uncertainty. Similarly, the higher BBB spreads, the more investor insecurity is priced into bonds. The second graph divides BBB-rated spreads by the EPUI to provide a comparative ratio. Traditionally, in environments like today, the ratio rises. Conversely, in times of a healthy economy with solid investor confidence, the ratio is low. The current level of economic uncertainty in EPUI dwarfs prior extremes. BBB spreads are near historic lows. As a result, the ratio of the two rests at the lowest level in 20 years. This reading is untenable. If the Fed were not rigorously manipulating yields, we would expect the ratio to be at the upper end of the graph. Yields should easily be into the double digits.  BBB Spreads And Economic Policy Uncertainity Index ConfirmationAnother powerful way to measure the separation of reality and yield spreads is to equate GDP growth with corporate spreads. During economic slowing or a recession, corporate spreads should widen. When revenues decline, earnings are more dubious, and the ability to service debt therefore, is more difficult. Investors in such environments historically demand more protection in the form of higher yields. The scatter plot below shows quarterly instances of GDP and BBB-rated corporate spreads dating back to 1997. As shown, the relationship is statistically relevant with an R-squared of .6105. To the human eye, the data also follows a well-correlated path. As GDP declines (y-axis) corporate spreads increase (x-axis) and vice versa. The two orange dots represent the exceptions to the rule, March 31 and June 30, 2020.  BBB Spreads To GDP Growth To estimate where yield spreads should be, we can draw a horizontal line to the right from the orange dots to their intersection with the dotted line. The point of juncture is off the charts, literally. While Q2 was an anomaly, it is not an anomaly to assume a growth rate for 2020 of minus 10%. Based on the data above, at such a level, BBB spreads should be 11.65%. A second way to assess meaning to the graph is to draw a line vertically from the orange dots to the dotted line. By doing this, you arrive at the historical economic growth rate associated with the spreads. This optimistic approach says current spreads are commensurate with GDP growth of 3-5%. Economic Caution AheadIn times like these it is near impossible to be certain in your economic outlook. More concerning than the current situation, we believe investors are overestimating what economic growth will look like in the next expansion. In The Decade Long Path Ahead to Economic Recovery – Part 1 Debt, we showed the graph below. The clear takeaway is that the economic growth rate of each successive expansion was less than the one before it.  Real GDP And Prior Expansion Growth Trends Given the massive Federal debt supporting the economy, this trend will undoubtedly continue in the future. Our analysis leads us to conclude the real future economic growth rate will be just above 1%. As such, we state in the article: "Based on this analysis, the economy will not regain pre-COVID economic levels this decade." Real Measures of Corporate CreditWe present more evidence below to help further highlight the gross mispricing of bond spreads.  Tweet  From Mike Larson at Weiss Ratings:

Lastly, the following quote from a recent New York Federal Reserve white paper- Implications of the COVID-19 Disruption for Corporate Leverage

No one knows with certainty what the future holds. We do, however, know what the present holds. The graphs and commentary shown above do not depict an environment in which investors should accept a bare minimum return for taking risk. SummaryThe yield on BBB-rated bonds is now in many cases below the yields of Treasury Bills from 2019. Just think about the irrationality of that one fact. Corporate bond investors no longer have a voice. The Fed now dictates market levels through direct manipulation and suggestions for future action. Investors must accept yields that bear no resemblance to reality or receive a negative real return on their money. The Fed is encouraging investors to pick up their speed despite extremely hazardous conditions. While many appear to trust the Fed, the Fed cannot eliminate risk. We leave you with a quote from David Rosenberg– "The Fed is distorting risk markets on a scale never before seen. They are making a mockery of capitalism and bailing out bad actors. The system is broken."

Source link Click to rate this post! [Total: 0 Average: 0] |

| USDJPY Forecast For Nov – USDJPY technical analysis today for Nov – USDJPY – FOREX Posted: 11 Nov 2021 10:16 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ USDJPY Forecast For Nov – USDJPY technical analysis today for Nov – USDJPY – FOREX ~~SUBSCRIBE~~ USDJPY analysis today source Click to rate this post! [Total: 0 Average: 0] |

| It’s ‘Unanticipated’ Inflation That’s The Real Bond Market Killer Posted: 11 Nov 2021 09:52 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ When studying Bond Management, and Money and Banking and the like in business school and the CFA program, the one thing that always stuck out to me in terms of academic discussions of inflation and growth is that it's "unanticipated" or "unexpected" inflation that is the true bond market killer. As a kid in the 1970's, starting high school in 1974 I remember the formation of OPEC and the Arab Oil Embargo well, and how waking up one day and finding all the US petroleum assets suddenly nationalized, and the cost of a gallon of gas rising from $0.25–$0.30 to $3 per barrel and what that did to inflation and the bond markets in the 1970s. That was unanticipated or unexpected inflation. Today, with the constant chattering of inflationistas, and the non-stop worrying over all things commodity-inflated, it's hard to make the case that any of this inflation will be "unexpected." Think about it: in May or June of '21, do you think a or that is above or below expectations will cause a bigger bond market reaction ? The could trade up to 2% in the next few months or quarters and that alone wouldn't be too alarming and—in my opinion—wouldn't be anything that the US equity market couldn't adjust to over time. The fact of the matter is the whole US bond market(s), including Treasuries, mortgages, corporate high-grade and high-yield, asset-backed, and CMBS, there is very little "real” (i.e. after-inflation) return available today. Clients are in BlackRock's Strategic Income (), JP Morgan's Income Fund (JGIAX), and some high-yield ETFs as well as a growing allocation to municipal bonds, even in tax-deferred accounts like IRAs and SEPs. The looming tax hikes as well as the bailout package will bring in credit support to munis and then demand for tax-exempt income if the Dems try and pass what they said they wanted to pass in the Presidential campaign. Since I graduated from college in 1982, the one consistent theme that has been prevalent from the Fed, from the money markets, from the financial media, is that "we need to worry about inflation" and the great irony has been that in the last 25–30 years, we really haven't needed to worry about inflation at all. The heightened anxiety over inflation seems to have removed all "unanticipated or unexpected" aspects to it entirely.

Source link Click to rate this post! [Total: 0 Average: 0] |

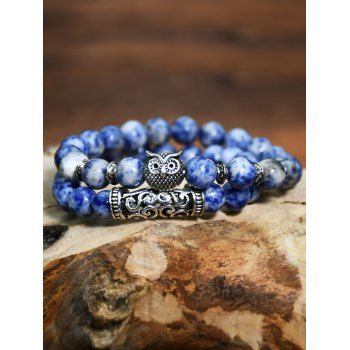

| MACD Trading Strategy + Price Action – My FAVORITE Trading Strategy – Practice Examples �� Posted: 11 Nov 2021 09:13 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ MACD Trading Strategy + Price Action – My FAVORITE Trading Strategy – Practice Examples In today’s video, We go through a simple MACD trading strategy …  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] |

| Posted: 11 Nov 2021 08:50 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ This is a look at two ETFs: the granddaddy of them all, SPDR® S&P 500 (NYSE:) (the ) and the high-yield corporate fund symbol iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:). In normal markets, they pretty much mimic the behavior of the other. As you can see, for many years, they are joined at the hip.  HYG/SPY Chart Recently, however, a divergence has taken place which is well worth noting. The high yield corporate bonds have weakened. having peaked way back on February 8th while the SPY hit its own lifetime high a full five weeks later.  HYG/SPY Chart Take a closer look. The HYG (black line) has been making a series of lower highs while the SPY has steadfastly been marching higher and higher.  HYG/SPY Chart Historically, the HYG provides a heads-up about a shift in the direction of equities. I suspect this will be yet another instance of such a phenomenon. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data. Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source link Click to rate this post! [Total: 0 Average: 0] |

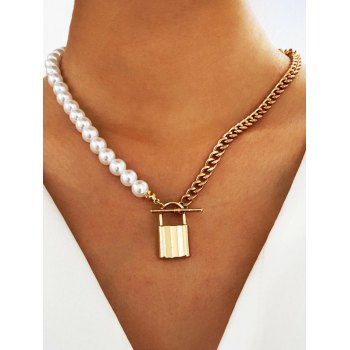

| LESSON 3 What are the advantages of Forex market 1080p Posted: 11 Nov 2021 08:11 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Với phương châm ” Cho đi là hạnh phúc” mong muốn chúng tôi là chia sẻ những kiến thức bổ ích Với phương châm ” Cho đi là hạnh phúc” mong muốn chúng tôi là chia sẻ những kiến thức bổ ích Đây là video trong chuỗi video hướng dẫn bạn #đầutưtàichính 1 cách đúng nghĩa về thị trường này. Đây là video trong chuỗi video hướng dẫn bạn #đầutưtàichính 1 cách đúng nghĩa về thị trường này.Giúp bạn trở thành #trader thực thụ , người Pro thật sự có thể kiếm triệu đô. Chứ không phải là hình thức cờ bạc BO, hay cá cược đỏ đen trên các sàn lừa đảo không uy tín ngoài kia ———————————————————————-  Phần lớn thị trường hiện nay là các #môhìnhkinhdoanhđacấpbiếntướng #sânsànlừađảo , dụ dỗ người tham gia để làm cháy tài khoản, thiêu rụi tài sản của mọi người Phần lớn thị trường hiện nay là các #môhìnhkinhdoanhđacấpbiếntướng #sânsànlừađảo , dụ dỗ người tham gia để làm cháy tài khoản, thiêu rụi tài sản của mọi người LỜI KHUYÊN khi tham gia thị trường thì hãy tham gia vào sàn uy tín như Exness… . Tôi sẽ để link bên dưới & phần bình luận Link đăng ký tài khoản chuẩn. Các bạn hãy đăng ký theo link chuẩn, để tránh xa các Broker #lừađảo hiện nay trên thị trường. LỜI KHUYÊN khi tham gia thị trường thì hãy tham gia vào sàn uy tín như Exness… . Tôi sẽ để link bên dưới & phần bình luận Link đăng ký tài khoản chuẩn. Các bạn hãy đăng ký theo link chuẩn, để tránh xa các Broker #lừađảo hiện nay trên thị trường. https://one.exness.link/boarding/sign-up/a/v2goda02?lng=vi https://one.exness.link/boarding/sign-up/a/v2goda02?lng=vi_________________________________________ ĐĂNG KÝ KÊNH NHƯ 1 LỜI ỦNG HỘ NHỮNG ĐỀU BỔ ÍCH  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

︎ https://www.youtube.com/channel/UCxxtaJqvUM4FIGtBqbBthYQ/join

︎ https://www.youtube.com/channel/UCxxtaJqvUM4FIGtBqbBthYQ/join

No comments:

Post a Comment