Forex System |

- Crude Oil Prices Jump as US Holds Reserves and Ahead of US CPI. Where To from Here?

- RTFX-Area Sales Head

- THE BEST FOREX TRADING WORKSHOP!!

- RTFX-Area Sales Head

- Top Differences & How to Trade Them

- RTFX-Area Sales Head

- Content Editor

- APA ITU FOREX | PENGERTIAN FOREX BAGI PEMULA 2021

- Content Editor (6-month contract)

- Sentiment Indicators: Using IG Client Sentiment

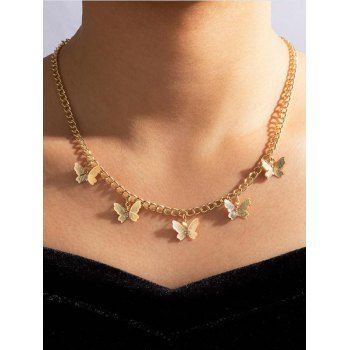

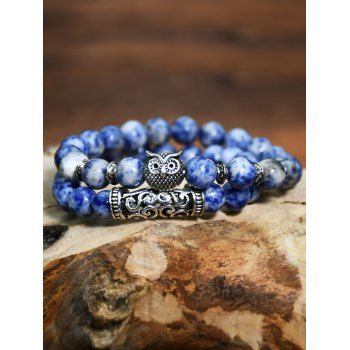

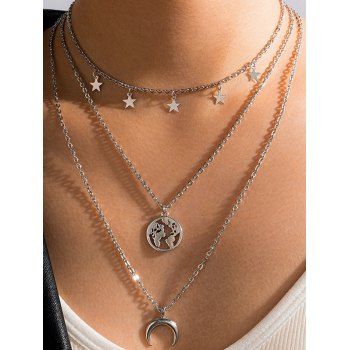

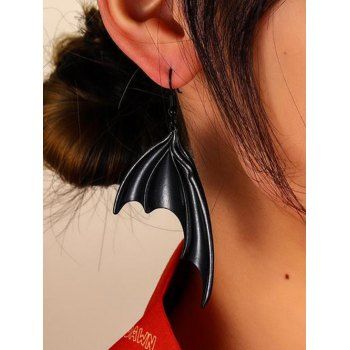

| Crude Oil Prices Jump as US Holds Reserves and Ahead of US CPI. Where To from Here? Posted: 10 Nov 2021 12:15 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Crude Oil, US Dollar, China, PPI, US CPI – Talking Points

Crude oil found firmer footing after the White House indicated that it would not be tapping the Strategic Petroleum Reserves (SPR). A forecast from the US governments own Energy Information Agency (EIA), has the global market being oversupplied next year and that prices were likely to fall as a result. The US Dollar and Treasury yields went lower in the US session, but both have made small gains in Asia. Gold is close to making a 5-month high. The Aussie and Kiwi Dollars were the underperforming currencies of the day as risk sold off. APAC equities went lower today. They were led by Chinese stocks that were weighed down by inflation data and property developer Fantasia returning to the boards after 6 weeks and trading more than 50% lower. It defaulted on debt last month. This weighed on the broader market and spread to the bond market. Chinese companies that borrow via high yield bonds are now facing funding costs near 24%. Chinese investment grade also sold off as their borrowing rates went higher. Year on year to the end of October, Chinese CPI was 1.5% and PPI was 13.5% against expectations of 1.4% and 12.3% respectively. A 26-year peak for PPI. Last night, US PPI came in on expectations at 0.6% for the month of October to give a year-on-year print of 8.6%. With PPI outstripping CPI, it hard to see CPI backing off in any hurry. Businesses can either reduce their profit margins, pass on the costs to consumers or do a combination of these. Looking ahead, forecasts for headline US CPI are 0.6% for October and 5.9% for the annual number, while core inflation expectations are 0.4% and 4.3% respectively. Crude Oil Technical AnalysisOil has resumed moving up in the last few sessions as it looks to test the 7-year high at 85.41. This level and another peak at 84.88 may offer resistance. The move up saw the price cross above the 10 and 21-day simple moving averages (SMA) These SMAs are also beginning to resume a positive gradient. This may indicate potential short-term bullish momentum could unfold. Below the market, the previous lows at 78.25 and 74.96 could provide support. Between these 2 levels is the 38.2% retracement of the move from 61.74 to 85.41 at 76.37 which is potential support. The Fibonacci retracement also aligns with the 55-day SMA.

— Written by Daniel McCarthy, Strategist for DailyFX.com To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Posted: 10 Nov 2021 12:01 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: RTFX-Area Sales Head Company: HDFC Bank Job description: for necessary course correction. C. Activation, Retention and Increasing Wallet Share To work towards retention of existing Trade… and Forex customers. Increasing wallet share, ‘stickiness’, by ensuring superior, time-bound, compliant ‘First Time Right… Expected salary: Location: Ludhiana, Punjab Job date: Wed, 10 Nov 2021 01:17:42 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| THE BEST FOREX TRADING WORKSHOP!! Posted: 09 Nov 2021 11:32 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------   Freedom By Forex Masterclass Freedom By Forex Masterclass   My most powerful [FREE] training for learning the proven and timeless systems to learning Forex Trading successfully.  Suitable For Beginners Suitable For Beginners➤➤➤ https://bit.ly/2CTMDz5

★☆★ CONNECT WITH HITHER ON SOCIAL MEDIA ★☆★ source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Posted: 09 Nov 2021 11:29 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: RTFX-Area Sales Head Company: HDFC Bank Job description: for necessary course correction. C. Activation, Retention and Increasing Wallet Share To work towards retention of existing Trade… and Forex customers. Increasing wallet share, ‘stickiness’, by ensuring superior, time-bound, compliant ‘First Time Right… Expected salary: Location: Panaji, Goa Job date: Wed, 10 Nov 2021 00:57:47 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Top Differences & How to Trade Them Posted: 09 Nov 2021 11:11 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Traders often compare forex vs stocks to determine which market is better to trade. Despite being interconnected, the forex and stock market are vastly different. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best.But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. Top 5 Differences between forex and stocksThe table below summarizes a few key differences between the forex market and the stock market:

Let's take a more in-depth look into how exactly the forex market compares with equities (stocks). 1) Volume One of the biggest differences between forex and stocks is the sheer size of the forex market. Forex is estimated to trade around $5 trillion a day, with most trading concentrated on a few major pairs like the EUR/USD, USD/JPY, GBP/USD and AUD/USD. The forex market volume dwarfs the dollar volume of all the world's stock markets combined, which average roughly $200 billion per day. Having such a large trading volume can bring many advantages to traders. High volume means traders can typically get their orders executed more easily and closer to the prices they want. While all markets are prone to gaps, having more liquidity at each pricing point better equips traders to enter and exit the market. 2) Liquidity A market that trades in high volume generally has high liquidity. Liquidity leads to tighter spreads and lower transaction costs. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Read more on the differences in liquidity between the forex and stock market. 3) 24 Hour Markets Forex is an over the counter market meaning that it is not transacted over a traditional exchange. Trading is facilitated through the interbank market. This means that trading can go on all around the world during different countries business hours and trading sessions. Therefore, the forex trader has access to trading virtually 24 hours a day, 5 days a week. Major stock indices on the other hand, trade at different times and are affected by different variables. Visit the Major Indices page to find out more about trading these markets-including information on trading hours.

4) Minimal or no commission Most forex brokers charge no commission, instead they make their margin on the spread – which is the difference between the buy price and the sell price. When trading equities (stocks) or a futures contract, or a major index like the S&P 500, often traders must pay the spread along with a commission to a broker. Forex spreads are quite transparent compared to costs of trading other contracts. Below you will see the spread of the EUR/USD highlighted inside of the executable dealing rates. The spread can be used to calculate the cost for your position size upfront prior to execution.

5) Narrow focus vs wide focus There are eight major currencies traders can focus on, while in the stock universe there are thousands. With only eight economies to focus on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair to trade. Eight currencies are easier to keep an eye on than thousands of stocks. The variables that effect the major currencies can be easily monitored using an economic calendar. Should you trade forex or stocks?Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks.

If you are new to trading forex download our free forex for beginners guide. We also provide free equities forecasts to support stock market trading. Forex vs other markets FAQsHow can I transition from forex trading to stock trading? To move from forex to stock trading you will need to understand the fundamental differences between forex and stocks. When you boil it down, forex movements are caused by interest rates and their anticipated movements. Stocks are dependent on revenue, balance sheet projections and the economies they operate in amongst other things. Find out more on how to transition from forex to stock trading. Are there any differences between forex and commodities trading? Forex and commodities differ in terms of regulation, leverage, and exchange limits. Forex markets are a lot less regulated than commodities markets whilst commodities markets are highly regulated. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility (leverage can amplify losses and gains). Also, like stocks, commodities trade on exchanges. Commodity exchanges set roofs and floors for the price fluctuations of commodities and when these limits are hit trading may be halted for a certain time depending on the product traded. The forex and stock market do not have limits that can prevent trading from happening. Keep up to date with current currency, commodity and indices pricing on our top rates page. Also, see our expert trading forecasts on equities, major currencies the USD and EUR, or read our guide on the Traits of Successful traders for insight into the top mistake traders make.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Posted: 09 Nov 2021 10:59 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: RTFX-Area Sales Head Company: HDFC Bank Job description: for necessary course correction. C. Activation, Retention and Increasing Wallet Share To work towards retention of existing Trade… and Forex customers. Increasing wallet share, ‘stickiness’, by ensuring superior, time-bound, compliant ‘First Time Right… Expected salary: Location: Kochi, Kerala Job date: Wed, 10 Nov 2021 00:41:25 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Posted: 09 Nov 2021 10:46 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Content Editor Company: OANDA Job description: a trading platform that helped pioneer the development of online-based trading around the world, enabling forex and CFD… with an option to work from our London office one day per week. What you will do: Content Management Adding new content… Expected salary: Location: London Job date: Wed, 10 Nov 2021 00:04:21 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| APA ITU FOREX | PENGERTIAN FOREX BAGI PEMULA 2021 Posted: 09 Nov 2021 10:28 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ asalamualaikum.. pada vidio ini saya sahabat dapur mencoba sesuatu yang berbeda Dari biasanya.apa sih beda nya.. di vidio ini saya akan coba membagikan pengenalan dasar trading forex, apa itu forex , apa itu forex trading , forex trading indonesia , apa itu trading forex , apa itu futures , cara kaya dari forex. semoga perkenalan forex ini bisa membantu semuanya yang ingin memulai berbisnis di dunia trading forex  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Content Editor (6-month contract) Posted: 09 Nov 2021 10:15 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Content Editor (6-month contract) Company: OANDA Job description: a trading platform that helped pioneer the development of online-based trading around the world, enabling forex and CFD… with an option to work from our London office one day per week. What you will do: Content Management Adding new content… Expected salary: Location: London Job date: Wed, 10 Nov 2021 01:45:01 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||||||||||

| Sentiment Indicators: Using IG Client Sentiment Posted: 09 Nov 2021 10:08 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Sentiment Indicators: Using IG Client SentimentThe IG Client Sentiment (IGCS) is unique, proprietary and potentially helpful to traders. The article will outline the following illustrative points: What is IG Client Sentiment (IGCS)?IG Client Sentiment (IGCS) is a tool that traders can use in conjunction with a broader technical and/or fundamental strategy. IGCS incorporates retail trader positioning (long and short) to formulate a sentiment bias. This is represented in percentage form (see image below) which aids traders in identifying market imbalances which could lead to possible opportunities. IGCS on EUR/USD: Sentiment IndicatorsSentiment indicators are few and far between. The two most well-known are open interest in options, which largely applies to stocks, and the Commitment of Traders Report (CoT). What sets IGCS apart is the large sample size of retail traders which deliver more usable data in terms of indicator readings, multiple market data sets (FX, equities commodities) and timely updates for these markets which are refreshed several times daily. IGCS as a Leading IndicatorThe use of IGCS as a technical indicator can allow traders to confirm or refute signals produced by their wider trading strategy. Both fundamental and other technical techniques are used to gauge trends, ranges, potential reversals etc. so incorporating IGCS provides another layer of data to help verify a hypothesis. IGCS can be considered as a leading indicator as it uses past and current data to project possible future price movements however, as IGCS (retail) covers only one component of the market equation, traders should not rely solely on the IGCS tool for trading decisions. Simply put, retail traders contribute only a certain percentage of market input so naturally other factors will have influence on the respective market. For example, the EUR/USD chart below shows the projectible nature that can occur with IGCS. The highlighted are on the chart exhibits an increase in net short positions from retail traders which coincided with a rise in price action (EUR appreciation) on the price chart itself. IGCS EUR/USD: IGCS as a Technical Indicator: SummaryWe have shown how sentiment/IGCS can be a unique, proprietary and potentially helpful addition to a trader's approach. In subsequent IGCS articles in this market sentiment sub-module, we will go through the implementation and flexibility of this tool in varying trading circumstances. Looking to trade in a simulated environment to better learn strategies, tactics and approach? Click here to request a free demo with IG group.

Source link Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

JOIN MY FORTUNE FAMILY GROUP ON FACEBOOK

JOIN MY FORTUNE FAMILY GROUP ON FACEBOOK

No comments:

Post a Comment