Forex System |

- First level Windows Supporter / Service Desk Specialist

- Rates Spark April Bounce | Investing.com

- EP5 – How to build a No Nonsense Forex trading bot from scratch – ATR (cTrader Tutorial)

- Senior Depositary Control Analyst M/F

- Software Engineer (Fintech/Career Advancement/High Bonus)

- Junior Translation Manager

- B2B Trading support engineer (HRCY-7747)

- Pricing Contractor

- Senior Depositary Control Analyst M/F

- Some Bond Market Charts: Corporate High-Yield Now Fully Valued

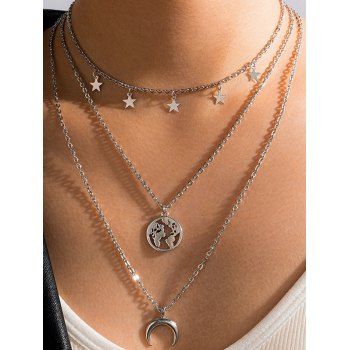

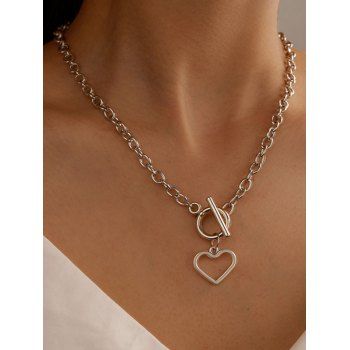

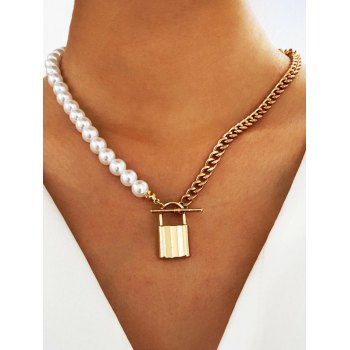

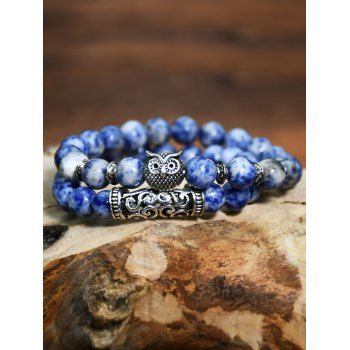

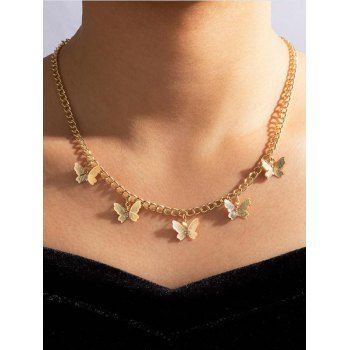

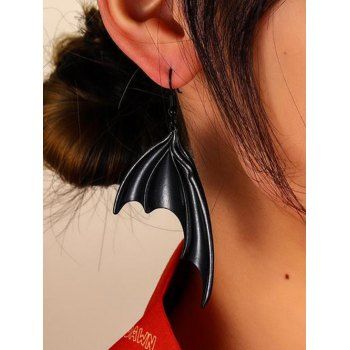

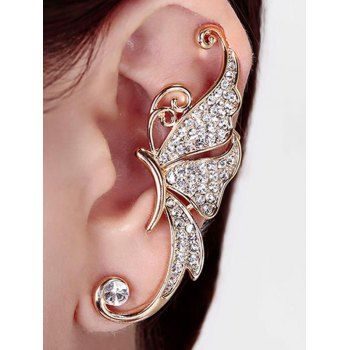

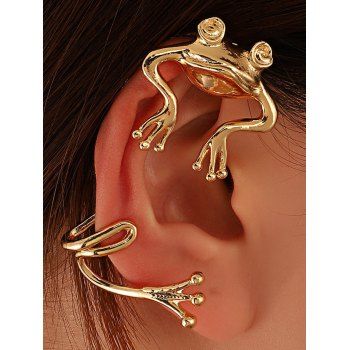

| First level Windows Supporter / Service Desk Specialist Posted: 05 Nov 2021 11:57 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: First level Windows Supporter / Service Desk Specialist Company: Interactive Brokers Job description: . You will assist business and development end-users over the phone, by email and through a centralized ticketing system to resolve… Provide technical assistance and support for reported issues related to computer systems, software, and hardware on a timely… Expected salary: Location: Dublin Job date: Sat, 06 Nov 2021 04:30:22 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Rates Spark April Bounce | Investing.com Posted: 05 Nov 2021 11:54 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ We look through potential reasons for the April bounce in fixed income. A stubborn Fed and gloomy Eurozone outlook provide the best, if unsatisfactory, explanations. Upcoming US inflation data and supply offer the most likely drivers for a return to the higher rates trend. The April bounce is more technical than fundamentalApril has proved a good month for fixed income so far, and rates markets have been no exception, be it or . We are tempted to dismiss the rebound in government bonds, and the drop in rates, as technical in nature. Still, since they run counter to our macro view, they warrant further investigation. This should also give us an indication of how rates markets might trade into next week. In short, we see no reason in data to question our economics team's bullish outlook on the US economy. If anything, job creation in March surprised to the upside and sentiment indicators confirmed the strength of the upcoming upswing. The same cannot be said in the Eurozone but we feel that survey-based data have at least eased the gloom caused by a third Covid-19 wave. Incidentally, the discrepancy in economic environments is the key reason why , to 190 basis point in 10-year swaps. The trend towards higher rates has stalled in April

Source: Refinitiv, ING More credible central banks? Perhaps the ECBGiven the above, we find it difficult to explain why the market would all of a sudden believe the Federal Reserve’s forward guidance. To be sure, the March FOMC minutes were very much on message, but we detect a growing disconnect between their projected rates path and the strength of the recovery. Perhaps the key here is that the Fed can be wrong longer than investors can remain solvent, so extending Fed hike pricing this early before data will prove them right or wrong might seem a bit of a stretch. For what it's worth, we don’t think that Fed Fund rates two-year forwards above 30bp look stretched when one takes into account the term premia necessary to reflect exceptionally wide confidence bands this far ahead. In Europe, it is also tempting to attribute some of the fixed income strength to a greater degree of ECB credibility. After all, its decision to ramp up purchases for three months combined with the Covid-19 gloom could account for EUR rates' failure to follow their USD peers higher, but the latest did not suggest a firm conviction that the central bank needs to suppress rates at all costs. As far as we can tell, technical factors might also be at play here, as elevated government bond redemptions in April should bring higher ECB reinvestments, on top of the faster net purchases announced in March. Today's events and market view: the April bounce to the testWe find none of the above explanations satisfactory on their own, although the central bank credibility argument holds most water in our view. Going forward, the fixed income rebound will be put to the test fairly quickly. First up, the US is expected to jump to 3.8% in February (release is today), and to 2.5% in March (release next Tuesday). Both are headline figures, and both year-on-year are likely to be heavily distorted by last year's slump, both the month-on-month prints look similarly strong if consensus is anything to go by. USD rates markets will also have to contend with long-dated US Treasury supply next week. If the recent bounce has been on the back of strong buying flow, then these should pose no particular challenge. Still, the rebound has been strongest in the belly of the curve, so we are unsure how much support this could lend to the long end. We find it prudent to stick to our bearish USD rates view into next week, but it could affect the long-end more due to supply. Central bank speakers today include ECB VP Luis de Guindos and Dallas Fed president Robert Kaplan. Fed President Jerome Powell repeated his dovish mantra yesterday, judging that the spike in inflation mentioned above will be temporary and that much progress remains necessary on the job market. Original Post

Source link Click to rate this post! [Total: 0 Average: 0] |

| EP5 – How to build a No Nonsense Forex trading bot from scratch – ATR (cTrader Tutorial) Posted: 05 Nov 2021 11:30 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Learn how to build the No Nonsense Forex trading bot in this cTrader tutorial series. This is the first coding video of the series where you will learn how to load the ATR Indicator onto the trading bot. Get access to the code from every episode: https://www.buymeacoffee.com/nnfxbot Risk Warning source Click to rate this post! [Total: 0 Average: 0] |

| Senior Depositary Control Analyst M/F Posted: 05 Nov 2021 11:27 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Senior Depositary Control Analyst M/F Company: CACEIS Job description: , and Asia, CACEIS offers a broad range of services covering execution, clearing, forex, securities lending, custody, depositary…, team player, focused attitude towards work and an ability to consistently meet deadlines Technical skills… Expected salary: Location: Dublin Job date: Sat, 06 Nov 2021 04:30:49 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Software Engineer (Fintech/Career Advancement/High Bonus) Posted: 05 Nov 2021 11:19 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Software Engineer (Fintech/Career Advancement/High Bonus) Company: Align Recruitment Pte. Ltd. Job description: Software Engineer (Fintech/Career Advancement/High Bonus) We are hiring Senior Software Engineer (Frontend/Backend…) to join a FinTech company that provides a crypto derivatives exchange allowing more Software Engineer (Fintech/Career Advancement/High… Expected salary: $60000 – 120000 per year Location: Singapore Job date: Fri, 05 Nov 2021 23:28:33 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Posted: 05 Nov 2021 11:11 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Junior Translation Manager Company: Libertex Group Job description: its proprietary mobile and online trading platforms, Libertex offers trading in Forex, crypto, stocks, CFDs, futures, funds… "Best Trading Platform 2020" by World Finance Magazine and "Best FX Broker Europe 2020" by Forex Report… Expected salary: Location: Rio de Janeiro – RJ Job date: Fri, 05 Nov 2021 23:27:44 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| B2B Trading support engineer (HRCY-7747) Posted: 05 Nov 2021 11:05 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: B2B Trading support engineer (HRCY-7747) Company: Exness Job description: Comprehensive knowledge of spot forex, CFDs & OTC products Good understanding in DevOps procedures Deep understanding of B2B… for knowledge, technologies and sophisticated systems Acting as a team player Result-oriented individual… Expected salary: Location: London Job date: Wed, 27 Oct 2021 07:26:30 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Posted: 05 Nov 2021 11:03 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Pricing Contractor Company: Interstate Batteries Job description: , e.g., processing price lists in current ERP system and updating customer facing part and price workbooks Maintain the… lead market data within Lead Index Report & Canadian Forex Rates 20% – Pricing Administrative support for Revenue… Expected salary: Location: Dallas, TX Job date: Sat, 06 Nov 2021 00:15:39 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Senior Depositary Control Analyst M/F Posted: 05 Nov 2021 10:56 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Senior Depositary Control Analyst M/F Company: Crédit Agricole Job description: , and Asia, CACEIS offers a broad range of services covering execution, clearing, forex, securities lending, custody, depositary…, team player, focused attitude towards work and an ability to consistently meet deadlines Technical skills… Expected salary: Location: Dublin Job date: Sat, 06 Nov 2021 05:25:05 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| Some Bond Market Charts: Corporate High-Yield Now Fully Valued Posted: 05 Nov 2021 10:52 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Click on and expand the above iShares 20+ Year Treasury Bond ETF (NASDAQ:) chart and you'll see the ETF holding weekly support. If readers would then look at the bottom third of the chart, you'll see the ETF hasn't been this "oversold" since September '18 and early 2017. There has been a lot of chatter on Twitter about interest rates and the fact that the 1.75% high water mark for the (post the 55 bp low yield in early August, '20 around the Jackson Hole conference) hasn't been exceeded despite the blow-out March on April 2nd or Good Friday (the stock market was closed but the Treasury market was not closed that day) and subsequent strong or "above-expectations" economic data. Have interest rates—particularly Treasury rates—peaked? My old Money & Banking and Bond Management professor used to say the best interest rate forecasting tool was "i + 1 = i" or the best forecaster of tomorrow's interest rate (i + 1) is the interest rate today (i). Some TLT has been added for clients simply because in the past I've liked to add to stocks or ETFs testing 200-week chart support, but also being long the TLT is a good hedge against equity market weakness. I'm not an "inflationista" but that doesn't mean they are wrong. The and "comps don't begin to get tougher until June–July '21, meaning that the fixed weight inflation data doesn't begin to see tougher "compares" until July–August '21, so some of the inflation data could get stronger over the next few months. Also this discussion omits consideration of the which is the inflation indicator to which the Fed has historically paid attention. Watch the Treasury market, the TLT, the 10-year Treasury yield (TNX) and the 1.75% level and the Treasury yield contract (TYX). (For chart watchers, the TNX and the TYX are the CBOE 10-year and 30-year Treasury yield contracts. ) Corporate High Yield (iShares HYG):  The iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:) chart continues to trade above its 200-week moving average which is always a positive sign. The Fed's liquidity programs put in place in late March–early April '20 for credit market issues, to a great extent went unused for most of 2020 as just the mere public statements of Jay Powell and other Fed officials about providing enough liquidity to the capital and credit markets (i.e. moral suasion) did their job. The Bond Buyer ran an article last May '20 listing all the various credit market and support lines the Fed provided after COVID-19 started and again, later in the year Rick Rieder of BlackRock noted that much of that available capacity wasn't needed. Short-term Corporate High-Yield (iShares SHYG):  Here is the 0–5 year version of the HYG, the iShares 0-5 Year High Yield Corporate Bond ETF (NYSE:), which is less interest-rate sensitive and more geared to or sensitive to the "money-market" influence the Fed exercises (i.e. monetary policy) so the SHYG should be an early-warning indicator of Fed monetary policy more so than the HYG. As the chart indicates, $46 is a key level for the high-yield ETF. A trade above that $46 level on good volume is probably telling investors that the Fed's talk about "not even thinking about thinking of raising the Fed funds rate" is more reality than fiction. Looking at the Morningstar data, the effective duration on HYG is 3.73 years while the same metric is 1.93 years for SHYG, but the SEC yield on the HYG is 3.56% while the same SEC yield on the SHYG is 3.32%, with the point being you get half the effective duration on SHYG than HYG, at almost the exact same yield. A quick note for readers: Morningstar is noting that as of early May, 2021, they will NOT be updating the SHYG statistics or following the ETF any longer. It looks like the Morningstar coverage on HYG will be maintained. Since iShares is BlackRock, check the iShares website for relevant ETF information. Summary / conclusion: The problem with corporate high-yield debt is that it tends to be correlated with US equity market direction, which makes perfect sense, given that the US equity market —when the secondary market for equity issuance is open and healthy—can be used to raise capital and payoff or refinance high-yield debt, with the point being that during an equity market correction, the high-yield ETF's and funds are correcting with the stock market. During the Feb– March '20 selloff, the HYG corrected (looking at the second chart (HYG), about 23% peak-to-trough), while the SHYG corrected about 17%. With the overbought nature of the in terms of sentiment (although S&P 500 market breadth remains very healthy), clients are beginning to see some of their high-yield exposure reduced, and some TLT was added as well as some municipal high-yield (the two Nuveen open-ended high-yield mutual funds are used for clients). Being overweight corporate high-yield in clients accounts was not really a great intellectual stretch in 2020 given the massive Fed liquidity and the fiscal stimulus, but relative and absolute credit spreads are nearing 2007 levels (absolute yields are through 2007 levels I believe) so while retaining equity longs and sector and individual position weights, why push the envelope or the risk parameters by doing the same on the bond or credit side of portfolios. The total return on the S&P 500 as of 4/16/21 is 11.92%, and the "average, annual" return is 47.92%. Considering the 2-year S&P 500 total return from 1/1/2019 to 12/31/20 was a cumulative 55%, think about the return rate the S&P 500 has been appreciating at for 28 months. A normal corporate high-yield allocation in client accounts if you look across model portfolios is roughly 10%–15%. The clients that can handle that risk have been closer to 20% (or more) for most of 2020, but that overweight is now being reduced. With most macroeconomic and forecasting models expecting 6% GDP growth in 2021 (and some even higher) than that, there is a LOT of good news baked into corporate credit spreads. Although I dislike the term, you could call owning corporate high yield as an asset-class a "no-brainer' the last year given all the Fed liquidity, but clients are now seeing their taxable high-yield weight being reduced. Remember take any online or blog content with skepticism. Make your own investment decisions based on your own financial risk profile and your own emotional temperament for volatility and risk. Just because some asset class or security doesn't look like "risk" today, doesn't mean it won't tomorrow. The shocking aspect to late 2008, is that even "money market" accounts—the Reserve Fund—looked like "risk" back then.

Source link Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment