Forex System |

- WE REVIEWED Easy Forex Pips – MAY 2021 – TrustedForexReviews

- Sales Officer CA

- How to Choose the Best POS System for Your Bar

- OPÇÕES BINÁRIAS E FOREX – EU TESTEI ! Será que dá pra REALMENTE GANHAR DINHEIRO com isso??

- A2R Senior Asset & Inventory, Cash & ICO Accountant-TOM_10332

- Technical Writer -MadCap Flare

- How to Choose POS Software for Your Business

- Que es Forex y como funciona mercado divisas desde cero principiantes

- Payment Gateway vs. Processor: What’s the Difference?

- Ichimoku Forex Analyse USDJPY

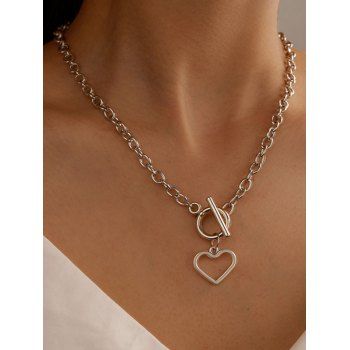

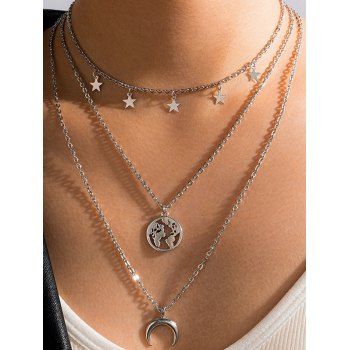

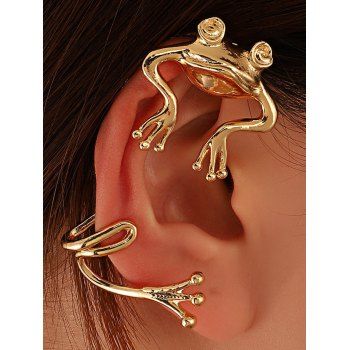

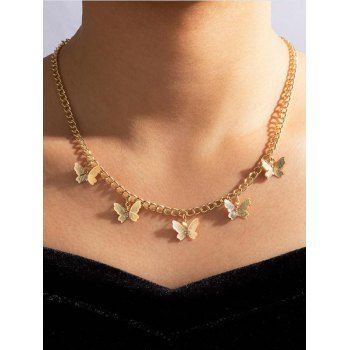

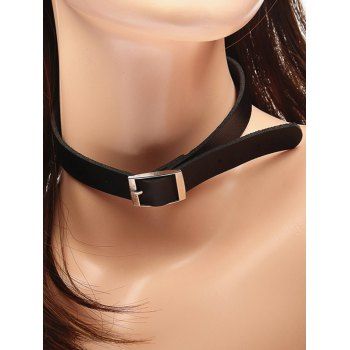

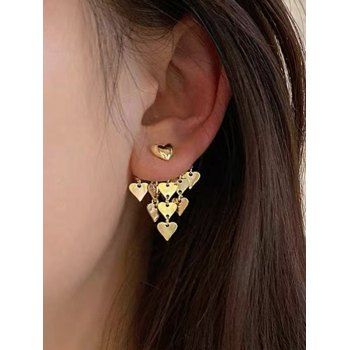

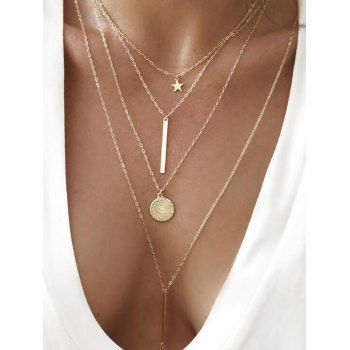

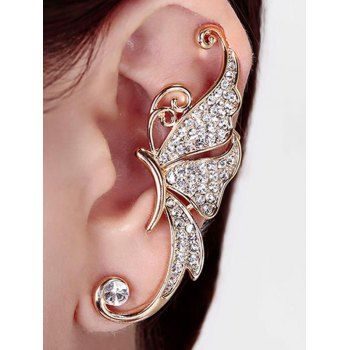

| WE REVIEWED Easy Forex Pips – MAY 2021 – TrustedForexReviews Posted: 31 Oct 2021 11:45 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ In this video, we talk about Easy Forex Pips signals. We also have a full review article about them, if you are interested you can check out from here. Recommended Brokers links:- Link: https://trustedforexreviews.com/product/easy-forex-pips-review Watch other provider reviews: Disclaimer: Trading involves the possibility of financial loss. Only trade with money that you are prepared to lose, you must recognize that for factors outside your control you may lose all of the money in your trading account. Many forex brokers also hold you liable for losses that exceed your trading capital. So you may stand to lose more money than is in your account. https://trustedforexreviews.com takes no responsibility for loss incurred as a result of our trading signals. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision to copy our trades on your own account. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. You must make your own financial decisions, we take no responsibility for money made or lost as a result of our signals or advice on forex related products on this website source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| Posted: 31 Oct 2021 11:39 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Sales Officer CA Company: Yes Bank Job description: added products such as Trade Forex, CMS, POS, Payment gateway solutions, doorstep banking, working capital / loan needs… & OPDT and family SA Works towards catchment mapping & scoping for the CA business with the help of BRPs along with BBL… Expected salary: Location: Ahmedabad, Gujarat Job date: Mon, 01 Nov 2021 06:39:14 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| How to Choose the Best POS System for Your Bar Posted: 31 Oct 2021 11:09 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ If you are operating a business, chances are good that you will need a point-of-sale (POS) system to complete consumer purchase transactions – and bars are no exception. The components of a POS system include hardware, software, and operational features. Not all POS systems are the same, and some will fit your business better than others. You may only need a simple system to complete business transactions, or you may require a full-service option that also monitors inventory, tracks employee tips, and integrates with other applications. Before choosing from the many great POS systems for restaurants and bars, evaluate your business’s needs and assess how each option fulfills those needs.

Chris Ligan, vice president of acquisitions at credit card processing company Auric, listed a few must-haves that every business, bar or otherwise, should look for in a POS system. “When purchasing a point-of-sale system, make sure to pick a system that is flexible [and] has a good support service … with a strong call center,” Ligan told business.com. “Most importantly, find a system that does not hold you hostage by forcing you to use their merchant services, as the hardware you have should be open source.” Editor’s note: Looking for the right POS system for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Bar POS hardwareFor a bar POS system, you will need to either purchase or lease your hardware components, though industry experts recommend avoiding leasing, as contracts are lengthy and noncancelable. A countertop POS station usually includes a tablet and stand, receipt printer, and cash drawer. You will also need a credit card terminal or card reader. Depending on your needs and budget, you may want to incorporate other peripherals for a seamless POS station, including barcode scanners, scales and liquor control devices. Bars with kitchens and cocktail servers will need additional hardware. For example, if you serve food at your bar, you will need a kitchen printer or a kitchen display system (KDS). “If you have cocktail servers, you will need a cocktail station or, even better, a mobile POS device to take orders at the table, but it is really a matter of personal preference or theme of the bar,” said Ligan. Since bars are typically fast-paced environments that have occasional spills, smaller accessories like waterproof tablet cases can be a good investment to keep your equipment in good working condition. POS hardware like kiosks, digital menu boards and coin dispensers is available, but these are typically not necessary items for a bar POS system. Bar POS softwareMost POS software is a software as a service (SaaS) and either web-based or app-based, although you also have the choice of a local server-based option. Ligan said the best POS software for your business will depend on your bar size and load. Based on its affordability and ease of use, cloud-based POS software has become very popular in the business community. This type of software can be easily installed on your POS terminal or tablet and has a wide range of capabilities – a notable one being the ability for you to store and view your sales data online. The type of integrations you deploy with this software will depend on the plan you choose from your service provider. Although cloud-based software is easy to deploy and maintain for most bars, Ligan said it can be slow and prone to crash if you have an unstable internet connection.

Locally hosted POS software is the legacy way of operating a POS system. With this option, your data is stored on site, which can cause problems for managers who need to access their data sets away from the bar. This option is more costly and typically only beneficial for extremely large establishments. If you are operating a small or midsize bar, cloud-based POS software is likely the best option for your business. Choosing the best bar POS systemWhen choosing the best POS system for your bar, it is important to factor in the POS features you need and your available budget. You don't want to be stuck with one that has all these bells and whistles you'll never use or worse can't grow with your business. To ensure you're making a sound decision take the following things into consideration:

Best bar POS SystemsWhen choosing a POS system for your bar, there are a number of choices to consider. UpserveUpserve POS, formerly Breadcrumb, is our current choice as the best POS system for bars. Our review of Upserve found that it can accommodate large, multilocation bars, as well as smaller taverns and restaurants. focused on small restaurants but can also accommodate large, multilocation bars. Key features

Upserve pricing

Lightspeed RestaurantOur comprehensive review of Lightspeed found that it has POS software designed specifically for bar and restaurant owners. It has a smorgasbord of services aimed at helping the hospitality industry run its businesses. Its mobile app is a bonus, enabling you to stay on top of your business from anywhere. Key features

Lightspeed pricing

TouchBistroWhen reviewing TouchBistro it was easy to see why it is a leader in the restaurant POS market. It offers customers an affordable, easy-to-use system that has a lot of built-in features bar owners will appreciate. Key features

TouchBistro pricing

ToastOur review of Toast shows that it has a lot of features geared specifically toward establishments in the hospitality industry. One such tool is Toast Now, which lets you accept online ordering without the need to purchase more hardware. Key features

Toast pricing

CloverClover is a one-to-shop for bar and restaurants owners thanks to its POS and credit card processing services. When reviewing Clover we found that it has a vast network of resellers, making its hardware affordable. Couple that with robust POS software and you can see why it's a top option for bars. Key features

Clover pricing

Features needed in a bar POS systemThe size and speed of your bar will play a role in what features your POS system should have. However, there are a few standard features that can be beneficial for every bar:

Ligan said bar owners should also look for these capabilities when choosing a POS system:

Determining bar POS system costWhen determining how much a bar POS system will cost your business, you must first decide if you are going to lease or purchase your hardware. Many small businesses benefit from buying their POS hardware outright since POS leases can be tied to credit card processing and have lengthy contracts. Merchants should choose POS equipment that is “unlocked” so they can use it with another vendor if they decide to switch providers. Although the cost per hardware device varies by provider, tablet-based systems are currently the most popular option and typically much less expensive than bulky legacy systems. Tablet-based systems are also beneficial for small bars that have a limited budget to start with but want to add peripheral pieces as their needs and capabilities grow. Small bars typically benefit from cloud-based POS software offered on a month-to-month basis. Many companies offer discounts for merchants that pay annually in advance (usually 10% for one year or 20% for two years). Before taking advantage of these long-term discounts, you should be confident that you like the software enough and will still be in business for that length of time because there are usually no refunds. In this case, you can close your account and switch software; you just won’t get your money back. Ligan said to look for POS systems that are open-source on merchant processing, which means they are compatible with almost any processor. This gives you the flexibility to change processors, if needed, and can ultimately save you money. “When [a POS system] isn’t open-source, it’s basically like buying a car and then having to buy gas from the person who sold you that car,” said Ligan. “The gas prices are forever set by whatever the seller of the car decides that month.”

Benefits of POS systems for your barThere’s a lot of reasons POS systems are so popular with bar and restaurant owners. They can streamline many of the processes, freeing up time to keep customers happy and business growing. From controlling inventory to speeding up ordering, here are some of the top benefits of using a POS system in your bar.

Additional reporting by Donna Fuscaldo. Some source interviews were conducted for previous versions of this article.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| OPÇÕES BINÁRIAS E FOREX – EU TESTEI ! Será que dá pra REALMENTE GANHAR DINHEIRO com isso?? Posted: 31 Oct 2021 10:44 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Será que vale REALMENTE a pena investir em OPÇÕES BINÁRIAS? E em FOREX? POLÊMICA! Qual a DIFERENÇA entre eles? Será que é tudo pirâmide financeira? Hoje você vai aprender um pouco desses TREM AÍ, e também dos RISCOS envolvidos nesses mercados. E no final, vamos fazer um investimento NA PRÁTICA, saindo do ZERO, pra você ver como funciona. Será que eu ganhei ou perdi dinheiro? No mundo das opções binárias, os ativos podem ser: ações de empresas… Commodities como ouro, prata e petróleo… Podem ser os índices, como NASDAQ, S&P 500… E também podem ser os PARES ou PARIDADE de moedas, também conhecido como FOREX. Segura aí que já que a gente vai falar de FOREX também. Então, juntando as coisas, uma OPÇÃO BINÁRIA é um instrumento financeiro, um TIPO de investimento, onde a gente tem APENAS dois resultados possíveis: CARA ou COROA, ou VAI ou RACHA. Explicando de um outro jeito, investir em OPÇÕES BINÁRIAS, é o mesmo que apostar na TENDÊNCIA de ALTA, ou de QUEDA, de um ativo. E você vê que o trem é meio esquisito mesmo, quando eu misturo, numa mesma frase, as palavras INVESTIMENTO e APOSTA. Além do ativo, nas OPÇÕES BINÁRIAS a gente também "aposta" no VALOR que o ativo pode atingir, dentro de um período de TEMPO determinado. Normalmente esse tempo é muito curto, tipo 15 ou 30 segundos. Mas também podem chegar a 30 ou 60 minutos. De qualquer modo, já deu pra gente ver que as OPÇÕES BINÁRIAS são investimentos de CURTÍSSIMO prazo. E também que tá um cheirinho de especulação no ar… Tipo assim, um DAY TRADE EXÓTICO. Bóra pra um exemplo teórico. Imagina que você apostou R$ 1.000 na QUEDA da cotação do EURO em relação ao DÓLAR. Essa cotação Euro/Dólar custava U$ 1,13, e a DURAÇÃO da operação era de 60 segundos. Isso mesmo. Trade ligeiro de 1 minutinho. Nessa operação, a regra dizia que em caso de GANHO, você levaria 75% de lucro. Nada mal. Investiria R$ 1.000 e sairia da operação com R$ 1.750. Mas a regra também dizia que se você PERDESSE, sairia com apenas R$ 10 de consolo. Os outros R$ 990 teriam ido pro ralo. Sabendo disso, você vai lá e aperta o botão. Nos primeiros 30 segundos, a cotação chega a U$ 1,10. ÓTIMO, porque você tinha apostado da QUEDA mesmo. Só que faltando 10 segundos pro tempo acabar, a cotação voltou para U$ 1,13. E quando bateu os 60 segundos, a cotação estava em U$ 1,14. Então, a operação terminou com a cotação mais ALTA que no início. E o que vale é esse preço no final da operação. Nesse caso, meu amigo… Lamento informar: você acabou de ficar 990 PILAS mais pobre, sacou? Simples assim. Alguns DINHEIRUDOS me pediram pra gente falar sobre a IQ OPTION, vamos usar a plataforma deles pra gente fazer nossa operação. Vamos ver sobre a parada do FOREX. Não foi à toa que eu usei um PAR DE MOEDAS como ativo do nosso exemplo da OPÇÃO BINÁRIA. No exemplo da OPÇÃO BINÁRIA, eu usei o par EURO/DÓLAR, que aliás é o MAIS negociado no FOREX mundial, com uns 30% de todos os trades. Mas tem outros pares de moedas que também são MUITO negociados: O mercado de FOREX é mais parecido com a bolsa de valores, porque você pode montar uma operação LONGA, e carregar ela pela quantidade de tempo que você quiser (desde que você tenha SALDO na sua conta, pra cobrir as VARIAÇÕES no preço). E dá pra você sair da sua operação na hora que você quiser, pra realizar seu LUCRO, ou pra diminuir o PREJÚ. Falando de outro modo, dá pra usar os conceitos de STOP GAIN e STOP LOSS da bolsa. Quando a gente compara o FOREX com as OPÇÕES BINÁRIAS, a gente pode dizer que as opções binárias são DERIVADAS do Forex, e com um prazo CURTÍSSIMO de operação. E tem regras FIXAS, onde você já sabe desde o início, quanto você pode GANHAR e PERDER. Bem, espero que você tenha gostado do vídeo. E FICA ESPERTO com as OPÇÕES BINÁRIAS, e outros tipos de investimento similares, que são "vendidos" por aí como a FÓRMULA do DINHEIRO FÁCIL. Além disso ser uma BAITA mentira, esse tipo de investimento é VICIANTE, e pode se transformar numa JOGATINA. E você, o que achou desse negócio de opções binárias e forex? Conta nos comentários pra gente! ————————-

►Vem conhecer os bastidores no Instagram: http://instagram.com/dinheirocomvoce source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| A2R Senior Asset & Inventory, Cash & ICO Accountant-TOM_10332 Posted: 31 Oct 2021 10:42 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: A2R Senior Asset & Inventory, Cash & ICO Accountant-TOM_10332 Company: Sanofi Job description: to use your excellent baggage and ability to deal with people? Is innovation part of the way you work? Do you have passion… and drive accounting, process and systems changes operationally and facilitate A2R service delivery Ensure all automatic… Expected salary: Location: São Paulo – SP Job date: Mon, 01 Nov 2021 01:03:31 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| Technical Writer -MadCap Flare Posted: 31 Oct 2021 10:33 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Technical Writer -MadCap Flare Company: Interactive Brokers Job description: and content migration plan as needed. Define our voice and tone as part of the larger product design and marketing system… experience, and 3 years’ experience in financial services, information services or software industry. Exceptional written… Expected salary: Location: Greenwich, CT Job date: Wed, 16 Jun 2021 03:39:34 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| How to Choose POS Software for Your Business Posted: 31 Oct 2021 10:07 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ If you operate a business that sells goods or services, chances are you will need some form of point-of-sale (POS) system to ring up sales and accept customer payments. As technology evolves, so has the functionality of POS systems. In addition to payment processing, there are hundreds of POS software features available. Your business should choose a top POS software solution that has features tailored to your specific industry and size. Learn which POS system software features are available to make an educated choice for your business. What is a POS system?A POS system is a combination of software and hardware that allows businesses to complete purchasing transactions. Businesses can often tailor POS systems to their specific business needs. There are various types of POS software (cloud-based, on-premises, hybrid) and hardware options (stationary POS terminals, mobile POS systems, cash drawers, barcode scanners, receipt printers, card readers, customer-facing display systems, self-serve kiosks, kitchen display systems, digital menu boards, etc.). Editor’s note: Looking for a POS system for your business? Fill out the below questionnaire to have our vendor partners contact you with free information.

What are the benefits of POS software?The most beneficial POS software depends on the industry you’re in, the size of your business, your budget and the features you need. Some POS software companies tier the features in each plan, so when you consider a plan, pay special attention to the benefits it includes. Here’s how five of the major feature categories of POS software can greatly impact your business:

How does a POS system work?A POS system works through the combination of hardware and software. When a customer chooses something to purchase, you use the POS system to ring up their sale. The POS system tallies up the cost, including tax. You then use the POS system to physically accept payment from the customer. If they use a debit or credit card, you can use the POS hardware (a card reader or credit card terminal) to swipe, dip, or tap their card and process the payment. Most POS systems give you the option to print and/or email the customer a receipt. In addition to ringing up sales, POS systems can often store a variety of data, such as customer information, employees’ hours, and inventory levels. This data can be compiled into actionable insights via POS reports. Many POS systems can also integrate with other business platforms. What’s the difference between POS software and hardware?When you get a POS system, you will need both POS software and POS hardware. The main difference between these two items is that the POS hardware is the set of physical components you need to operate, whereas the POS software is the digital technology program you use to access information. POS softwareThere are three main POS software options: cloud-based, on-premises and hybrid software.

POS hardwarePoint-of-sale hardware can be purchased or leased. However, you may be better served buying your equipment, because POS leases are notoriously unfavorable to merchants. POS hardware typically includes these components:

Depending on your needs and budget, you can incorporate additional pieces of hardware, such as these:

How to choose a POS systemThere is no one-size-fits-all when it comes to POS systems. Some companies offer software and hardware, while others only offer software. Some have in-house payment processing, whereas others can integrate with third-party payment processors. To determine the best POS software for your business, you need to consider several things. 1. Determine your budget.As with any business purchase, you need to determine how much you can spend on your POS system. Look at industry averages on what you should expect to spend and go from there. You may want to look for a scalable POS system, meaning you can start out with affordable, basic features and then add on advanced features and peripherals as your business (and budget) grows. Your total budget should include the cost of the software, hardware and payment processing. 2. Decide which features you need.A POS system can do more than just ring up sales. It can store a plethora of data, integrate with other platforms, and streamline processes like employee, customer and inventory management. Some systems even include features like online ordering, delivery options, customer loyalty programs and gift cards. However, you may not need all the bells and whistles just yet. Identify which features you need, which ones would be nice to have, and which ones you don’t need at all.

3. Consider your industry.The industry your business operates could be another factor, as some vendors offer industry-specific POS systems. Depending on your industry, this could help narrow down your choices significantly. For example, if you own a food service business, look for a POS system geared toward restaurants. Considering your industry and employees will help you pick a POS system that is easy for your staff to use. 4. Research and choose a specific POS system.Once you are armed with information on the type of POS you want, research your options. Narrow the list down to your top picks, and call each of these companies to inquire about terms and features. Ask any questions you may have so you can make an educated decision. How much does a POS system cost?The total cost of your POS system is the combination of hardware (which could be anywhere from $20 to $1,000), software ($25 to $250 per month), and payment processing (roughly 1.3% to 3.5% per card transaction). The exact cost will depend on what type of hardware you need, what payment processor you use, how many registers and locations you have, and what software features you want. You get what you pay for, so advanced systems tend to cost more. Who offers the best POS Software?There are several great POS systems on the market, but the best one for your business depends on your industry, budget, and the features and tools you need. What is the best POS software based on industry?Each industry has its own software requirements. For example, a large restaurant may need POS software that focuses on ingredient-level inventory management, menu and order management, and employee scheduling and tip management. A retail store may need software that focuses on inventory management with size and color matrices, customer relationship management features to track interactions and purchase histories, and a loyalty program. Best POS software for retailIf you’re looking for POS software for your retail business, you have several factors to consider. You will likely need a system with extensive retail-centric POS features like inventory management for unique items and pricing, customer management for purchase histories and loyalty programs, reporting tools for sales data and performance, and third-party integrations. Here are some great options for retail POS:

Best POS software for restaurantsOperating a restaurant requires POS features designed with the food service industry in mind. The ability to manage food inventory, add nightly specials, send order tickets to the kitchen, monitor employee sales, and tip out are just a few of the features to look for in POS software for restaurants. Here are some great restaurant POS options:

Best POS software for salonsWhen you’re choosing the best POS software for your salon, keep a few key elements in mind. Your salon POS software will likely need inventory management to track nail and hair care products, integration with an online booking system to set up client appointments, and accounting software integration to monitor and track employee sales and tips. Epos Now is a flexible POS system with a long list of versatile features. It is easy to use, with an average training time of just 15 minutes, so your stylists can acclimate to it in no time. You can also add on customer loyalty campaign features. It offers affordable rates and month-to-month terms. Read our full review of Epos Now to learn more. What are some POS software options for PCs?Whether you are looking for a retail or restaurant POS option for your business, several POS systems are available for your device. Some POS software is both browser- and app-based and works with various devices, like iPads and iPhones, Android phones and tablets, and PC or Mac computers. Others are limited in their connections or may only work with dedicated, proprietary POS terminals. If you are looking for POS software for a specific platform, make sure you read the terms or speak with a representative about the hardware and operating system requirements. What is open-source point-of-sale software?There are multiple variations of POS software when it comes to compatibility, with open-source software offering the most flexibility. For example, if a POS software program is listed as open-source on merchant processing, that means you can use it with the credit card processor of your choice. Some POS system providers offer in-house processing; these companies might charge an extra fee (sometimes per transaction) if you choose to work with a third-party processor. Some POS systems are compatible with a handful of processors, giving you a small pool to choose from. Open-source (or processor-agnostic) POS systems are the best option, because you can switch processors if the rates go up, the service is lousy, or you find a better deal elsewhere without changing your POS system as well. This flexibility is especially beneficial for small business owners, because switching POS systems is more expensive and time-intensive than switching payment processors.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| Que es Forex y como funciona mercado divisas desde cero principiantes Posted: 31 Oct 2021 09:41 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ ¿ Que es Forex y como funciona mercado divisas desde cero principiantes ? en este tutorial doy una explicación de Forex desde 0 para principiantes.  Curso Gratuito Invertir en bolsa americana desde 0: https://bit.ly/3ms21W0 Curso Gratuito Invertir en bolsa americana desde 0: https://bit.ly/3ms21W0 Curso Gratuito Trading desde 0 : https://bit.ly/3lm9PZX Curso Gratuito Trading desde 0 : https://bit.ly/3lm9PZX Hablemos en Instagram : https://www.instagram.com/sergioerincon Hablemos en Instagram : https://www.instagram.com/sergioerincon►Mi cuenta auditada de Trading http://bit.ly/31OM1kP  Quieres aprender Gratis y simple Trading. Suscríbete y activa notificaciones Quieres aprender Gratis y simple Trading. Suscríbete y activa notificaciones . . Que es como funciona mercado forex desde cero source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| Payment Gateway vs. Processor: What’s the Difference? Posted: 31 Oct 2021 09:05 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ If you’re in the market for a top credit card processing solution, you might have come across the terms “payment gateway” and “payment processor.” While these are two key, related elements of credit card processing, they are not the same. If you’re unsure of the distinction, you’re not alone. However, to make an educated purchasing decision about your small business’s ability to accept credit card payments, you need to understand the nuances. This guide will introduce you to payment gateways and myths about payment processors, explaining how the two work together. If you plan to accept credit card payments online, you’ll likely need both a payment gateway and a payment processor, so understanding each is critical to making the right choice for your small business. Key parties involved in a credit card transactionWhen a customer pays you with a credit card, a lot goes on behind the scenes among multiple parties. To understand how you need to set up your credit card processing, you should know who is involved.

What is a payment gateway?A payment gateway facilitates online credit card payments and other transactions where the credit card is not physically present. It is the technology that creates a secure connection between your business’s website or browser and the credit card processing company. Payment gateways usually have an interface when you can manually enter credit card information for phone sales; this is called a virtual terminal. How payment gateways work

Generally, you can set up a payment gateway in partnership with your chosen credit card processing company. When you set up a payment gateway through your merchant account provider, complications like compatibility issues are less likely. This is often the most cost-effective route for setting up a payment gateway. Usually, when you work through your merchant account provider, you can avoid payment gateway setup fees. Some credit card processors have their own payment gateways, while others work with third-party payment gateways on behalf of their client businesses. One of the most popular third-party payment gateway providers is Authorize.Net. You should always check the terms and conditions before setting up a payment gateway so you know exactly how much it will cost you upfront, as well as on a monthly and sometimes even per-transaction basis.

What is a payment processor?If you want to accept credit card and debit card payments from your customer online, over the phone, or at the point of sale, it is necessary to partner with a payment processor. A payment processor is the company that handles the credit card and debit card transactions for a business. If the payment gateway moves encrypted data around, then the payment processor could be said to move the funds from one account to another. Payment processors can be categorized into front-end and back-end processors. Front-end processors maintain connections to card networks and settlement services and manage merchant accounts on behalf of their clients. They contract with back-end processors who handle the actual movement of money behind the scenes. Back-end processors primarily settle the transactions, moving money from the issuing bank (the customer’s account) to the merchant bank, which ultimately transmits funds to the business’s bank account when the transaction is finalized. Payment processors’ pricing structures and fees vary by the amount and value of the transactions you process and the model you choose. Generally, payment processors charge a percentage of each transaction, often adding a small per-transaction fee and a few other fees, such as a monthly statement fee, a monthly minimum fee and an annual PCI compliance fee. Difference between payment gateway vs. payment processor

Editor’s note: Looking for the right credit card processor for your business? Fill out the below questionnaire below to have our vendor partners contact you about your needs. Do I need both a payment gateway and a payment processor?You might need both a payment processor and a payment gateway in order to accept credit card and debit card payments online. However, you can typically forgo the use of a payment gateway if you only intend to accept credit and debit card payments at a point-of-sale (POS) terminal. Virtual terminals accessed through your computer, though, require a payment gateway even if you only accept payment at the point of sale. Is PayPal a payment gateway or a payment processor?PayPal is what is known as a payment aggregator, and it has its own payment gateway, Payflow. You can learn more in our PayPal review. Payment aggregators do not require your business to set up a merchant account, unlike traditional payment processors. Instead, aggregators group your transactions with those of other merchants, essentially making you a submerchant on the aggregator’s own merchant account. Payment aggregators generally have a quick and easy application process and allow for much faster processing times than conventional payment processors. Fees tend to be more straightforward, and aggregators are often cheaper overall, depending on the amount and value of your transactions. Unfortunately, payment aggregators are warier of risks and may place holds on your account if they detect suspicious activity or the increased possibility of chargebacks. Unlike payment processors, aggregators generally offer fixed rates, so even as your transaction volume increases, the price you pay does not increase. Payment processors, on the other hand, typically offer more favorable rates to businesses with high transaction volumes or high-value transactions. What is the difference between a merchant account and a payment gateway?A merchant account is essentially an arrangement with the bank to create a space for pending transactions where the funds go before they are credited to your business’s bank account. It is distinct from a payment gateway in that it doesn’t transmit encrypted data, but rather the funds related to the transaction. The payment will temporarily be held in the merchant account as the transaction is finalized, at which point the funds will pass through the merchant account and into your business’s bank account. To set up your merchant account, a payment processing company will assign you a merchant ID number. This number is tied to the merchant account, which holds your funds until the settlement of a transaction. A merchant account is necessary to accept credit and debit card payments from your customers, unless you are operating as a submerchant with a payment facilitator, like Square or Stripe. To learn more, you can read our full review of Square and our Stripe review. So, while a merchant account is distinct from a payment gateway, it is often essential to accept both online and POS credit and debit card payments.

How should I choose a payment processor and payment gateway provider?Selecting the right payment processor and setting up a payment gateway can seem complicated at first. There are many payment processors out there, all with their own pricing models and fee schedules. Navigating the sea of available services can be tough, especially for an entrepreneur concerned with the day-to-day operations of their business. [Check out our Clover review, National Processing review and ProMerchant review.] To help you choose the right payment processor for your small business, business.com has established a guide to accepting credit card payments. We have also closely reviewed some of the leading payment processors on the market to come up with a list of our best picks. To find out more about payment processors and how to choose the right one for your business so you can start accepting credit and debit card payments, both online and on location, check out these links: The right credit card processor can make a big difference in your small business’s revenue and your customers’ satisfaction. However, it’s important to investigate the market thoroughly to ensure you receive the best deal for your business. Whether that means accepting payments at the point of sale only or setting up a payment gateway for online transactions depends largely on the type of business you run and the volume and value of your typical transactions. Understanding the difference between payment processors, payment gateways and merchant accounts is the first step in making your customers’ buying journey less complicated. Adam Uzialko contributed to the writing and research in this article.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||

| Posted: 31 Oct 2021 08:39 PM PDT Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Analyse Ichimoku de la paire du Forex USDJPY Plans de trading intraday et Swing Peut on encore envisager du potentiel haussier sur cette paire ? Abonnez-vous à ma chaîne YouTube Ichimoku pour recevoir une notification à chaque nouvelle vidéo publiée https://www.youtube.com/c/cypressatpatrick Retrouvez mon site web entièrement dédié à l’ichimoku et aux chandeliers japonais ici : https://www.ichimoku-kinko-hyo.info/  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Day Finance Ltd: https://www.youtube.com/watch?v=LSLo5b4oJQY

Day Finance Ltd: https://www.youtube.com/watch?v=LSLo5b4oJQY

Did you know? When it comes to shopping for POS systems options abound. Vendors cater to different industries so make sure to go with one that has experience working with bar and restaurant owners.

Did you know? When it comes to shopping for POS systems options abound. Vendors cater to different industries so make sure to go with one that has experience working with bar and restaurant owners. Tip: Before purchasing a cloud-hosted software option, speak with your internet provider to ensure a fast and stable connection.

Tip: Before purchasing a cloud-hosted software option, speak with your internet provider to ensure a fast and stable connection. FYI: When shopping for a POS system think about what features are important and which ones you can live without. The fewer the bells and whistles the less expensive it will be.

FYI: When shopping for a POS system think about what features are important and which ones you can live without. The fewer the bells and whistles the less expensive it will be.

Ainda não é inscrito? Vem também com a gente! http://bit.ly/dinheiro_com_vc

Ainda não é inscrito? Vem também com a gente! http://bit.ly/dinheiro_com_vc Vem pra nossa Lista VIP no Telegram! http://bit.ly/telegram-dcv

Vem pra nossa Lista VIP no Telegram! http://bit.ly/telegram-dcv  Seja MEMBRO do nosso Canal! Vídeos extras, conteúdo exclusivo! http://bit.ly/membro-dcv

Seja MEMBRO do nosso Canal! Vídeos extras, conteúdo exclusivo! http://bit.ly/membro-dcv

Bottom line: The five major benefits of POS software are reporting, third-party integrations, employee management, inventory monitoring and customer management.

Bottom line: The five major benefits of POS software are reporting, third-party integrations, employee management, inventory monitoring and customer management.

No comments:

Post a Comment