Forex System |

- Weekly Forex Forecast (15/11/21) EurUsd / XauUsd + FULL PROCESS! [HD]

- What’s the Best Credit Card Machine for Your Business?

- You Won’t Believe The POWER Of This Strategy (#1 Price Action Candlestick Trading System)

- What Is Cyber Extortion?

- The True Power Of Support & Resistance

- Which Android Credit Card Payment App Is Best for You?

- Forex mobile Strategy (The 1% MARSI Strategy) ��1minute forex scalping for milking money!

- Direct Deposit Guide for Small Businesses

- Live Trading Forex || Silver FX || Anish Singh Thakur || Booming Bulls

- 6 Ways to Increase Your Holiday Sales

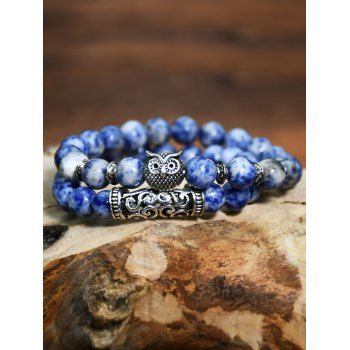

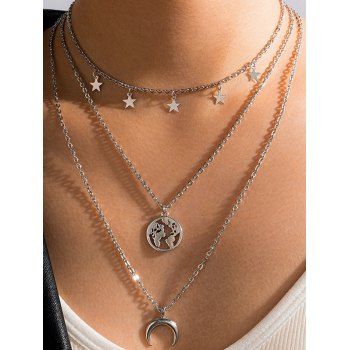

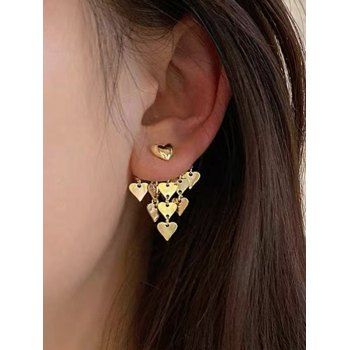

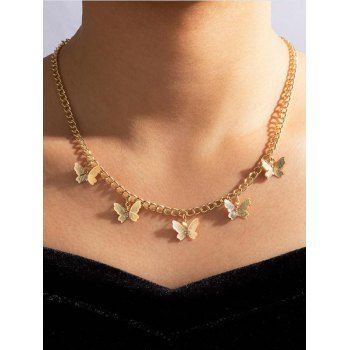

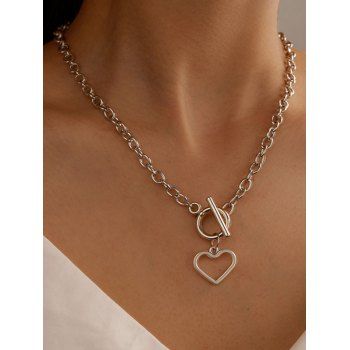

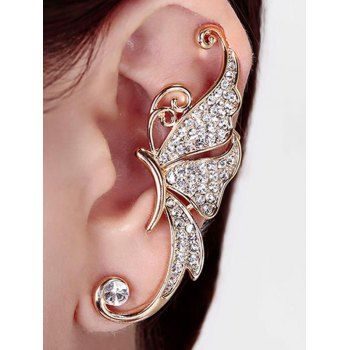

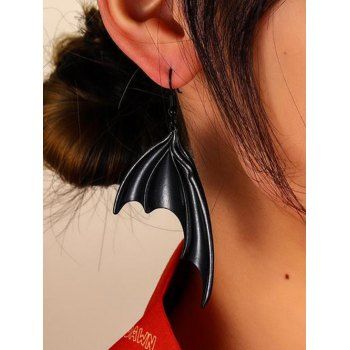

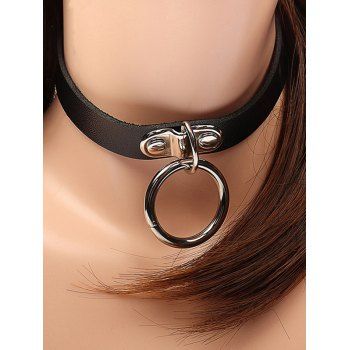

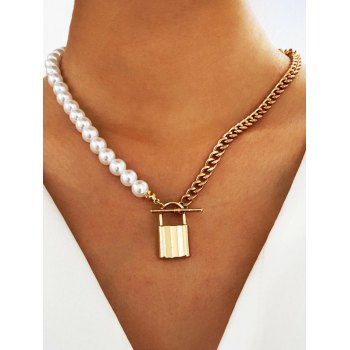

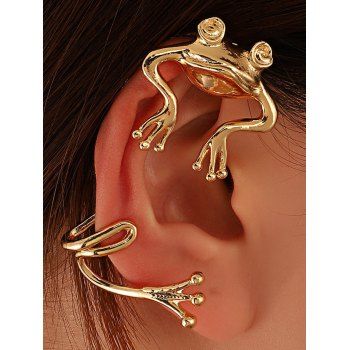

| Weekly Forex Forecast (15/11/21) EurUsd / XauUsd + FULL PROCESS! [HD] Posted: 15 Nov 2021 02:01 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Forex pairs & markets covered in this week's Weekly Forex Forecast & Forex Analysis: USD (DXY), EUR, GBP, CHF, JPY, CAD, AUD & NZD EurUsd, UsdJpy, GbpUsd, AudUSd, NzdUsd, Crude Oil (WTI), EurCad, CadJpy, AudJpy, GbpChf, EurChf, SPX (S&P 500), Russell 2000, Nasdaq, Dow Jones, Nifty, XauUsd (Gold Analysis), XagUsd (Silver Analysis), Btc/Usd ( Bitcoin Analysis) & more! The Forex analysis outlined in the Weekly Forex Forecast should be used together with professional Risk Management principles to create a complete Forex strategy. Any Forex trader who does not currently have a professional Risk Management process can get one for free in GMT’s Free Forex Trading Course here: http://bit.ly/34hCPJv #forex #forexforecast #weeklyforexforecast #forexanalysis #forextrading #forextradingforbeginners #howtotradeforex #commodities #technicalanalysis #swingtrading #priceaction #priceactiontrading #supportandresistance #forextradingcourse #forexcourse #freetradingcourse How to use the Weekly Forex Forecast The Forex analysis in the Weekly Forex Forecast can be used with any Forex trading strategy but should be used together with professional Risk Management principles to create a complete Forex strategy. Any Forex trader who does not currently have a professional Risk Management process can get one for free in GMT’s Free Trading Course here: http://bit.ly/34hCPJv The Price Action of each Forex market is combined with key support and resistance levels, in the direction of the prevailing trend, to create a framework where the odds are in the favour of each Forex trader. We cover why this is crucial to long term success in the Forex markets in detail in the Risk Management section of GMT’s Free Trading Course (http://bit.ly/34hCPJv) The Forex Forecast video presents the highest probability directional move for every market each week as well as a “work space” for each Forex pair by putting into place the key support and resistance levels. ———— Learn to trade with the Free Get Me Trading Course which teaches traders how to trade Forex, Stocks, Bonds and Commodities as well as how to trade Forex and Stock Market Fundamental Analysis, Technical Analysis and Risk Management Principles. Each section of GMT’s Free Trading Course can be found here: Forex, Bond & Commodity Market Fundamentals – http://bit.ly/2KxhEwc Stock Market Fundamentals – http://bit.ly/34hCPJv Technical Analysis (Swing Trading & Breakout Trading) – https://bit.ly/2KwKGM4 Risk Management – http://bit.ly/34hCPJv Take GMT’s Free Trading Course today, no sign up required at https://getmetrading.com ———— A complete Forex Strategy: The Weekly Forex Forecast and Technical Analysis video can be combined with GMT’s Free Trading Course to provide a complete Forex Strategy for every Forex trader to approach the Forex markets with each week. It uses the following process to put the odds onto the side of the each Forex trader ensuring long term, sustainable success in the Forex markets: Directional Bias By assessing the overall trend of each market a directional bias is created in each Forex pair which helps put the odds on our side for reasons covered extensively in the Risk Management section of GMT’s Free Trading Course. Support and Resistance By updating key support and resistance levels in each Forex market each week a “work space” is created allowing each Forex trader to assess potential set ups on a pullback to support and resistance levels or by filtering out trades which might be too close to upcoming support and resistance levels. It is an additional filter which increases the odds further in our favour. Entries In the Technical Analysis section of GMT’s Free Trading Course both Breakout and Swing Trading techniques are covered and both can be used to enter positions into the Forex markets for set ups as highlighted in the Forex Forecast. Stop Losses Stop Loss placement depends on the individual Forex trader with Stop Losses and Position Sizing being covered in great detail in the Risk Management section GMT’s Free Trading Course for any Forex trader who doesn’t yet know how to correctly implement these techniques (http://bit.ly/34hCPJv) ———— Thanks for watching and a big extra thank you to those who comment, like, share and subscribe to the channel! Have a great week and don’t forget to trade safely! Get Me Trading Team source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| What’s the Best Credit Card Machine for Your Business? Posted: 15 Nov 2021 01:29 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ If you do business with customers face-to-face and want to accept credit cards, you need to get a credit card machine. The credit card machine reads the information from the customer’s credit or debit card, encrypts the information and sends it along with the purchase amount to your credit card processor. The credit card processor then sends the information to the cardholder’s issuing bank, where the transaction is either approved or declined. If it is declined, this will be relayed back to your credit card machine so you can ask the customer for another form of payment. If it’s approved, the process of transferring the money from the customer’s account to your account is initiated. How to get a credit card machineYour credit card machine must be compatible with your credit card processor, and most businesses buy their credit card machines from their processor. There are various highly rated credit card processors. Part of why you might choose one over the other is the types of credit card machines they have available. Your credit card processor is likely to offer various kinds of credit card machines at different price points so that you can choose the best one for your business.

Types of credit card machinesThe best kind of credit card machine depends very much on the type of business you have and where you do business. Below are the different types of credit card processing machines, their functionality and what kinds of businesses they are best suited for. Wired credit card terminalsThese devices are connected to the internet via Ethernet or phone line, or to an internet-enabled point-of-sale (POS) system with a wire. They may or may not have a numeric pad that enables customers to enter their debit card’s personal identification number (PIN). They are usually 4 to 6 inches long and 4 inches wide. Some have the ability to print receipts, and others can connect to a stand-alone receipt printer. Having a credit card terminal with a PIN pad can benefit you because some credit card processing companies charge a lower transaction rate for debit card transactions with a PIN than for credit card or debit card transactions without a PIN. Best for:

Wireless/mobile credit card readersThere are two types of wireless credit card machines: Wi-Fi and Bluetooth. Wi-Fi readers connect to the internet through the business’s wireless router or gateway. Some Wi-Fi credit card readers have a wire to plug into an electrical outlet, while others have a rechargeable battery. Bluetooth credit card readers use this technology to connect to an internet-connected mobile phone or tablet, although a few of them are capable of offline transactions if the internet signal is too weak or not available. In this case, payments are processed later, once an internet connection is established.

Best for:

POS systems and smart terminalsThis type of system is the most complex and has the most functionality. It uses specialized POS software and displays products and services with their prices on a screen that the cashier can select from there. There may be the option to add services like warranties or shipping, capture the customer’s name and other information, and input coupons or other promotions and discounts. The best POS systems allow merchants to use the system for other parts of their business as well, such as managing inventory, scheduling employees, managing customer profiles or sending orders to kitchen staff for restaurants. They also give business owners the ability to generate reports by total sales, product, location and other criteria. The main difference between a POS system and a smart terminal is that a POS system is a fixed device that stays at the cashier location, while a smart terminal has the POS software loaded on a wirelessly connected (Wi-Fi or cellular) tablet that can be taken to different locations. Some POS systems have an integrated credit card reader, while others connect to an external reader. Smart terminals require an external reader, which is usually connected via Bluetooth. Best for:

Self-service kiosksSelf-service kiosks eliminate the need for a human cashier at each payment location. They are freestanding devices that have an integrated POS system and credit card reader, as well as the ability for customers to scan product barcodes with an integrated scanner and/or a handheld scanner. More and more retailers are using these, replacing some or all of their human-run cashier stations. With more of these kiosks, retailers can optimize space and shorten checkout lines. Best for:

Payment typesBefore deciding on a specific credit card machine, you first need to know exactly which types of payments you want to accept. As a business owner, one of your main goals is to generate as much sales revenue as possible. One way to do this is to make it convenient and easy for customers to pay you by accepting multiple payment types. Most credit card machines can accept credit cards and debit cards, but there are differences in their physical and processing capabilities. Physical capabilities

Processing capabilitiesWhile most credit card processors enable merchants to accept the major credit cards (Visa, Mastercard, Discover and American Express), some also allow you to accept other forms of payment. Their credit card readers also process these alternative payment types. Digital walletsThese are digital, contactless payments that utilize the NFC technology along with the customer’s mobile smartphone. The customer opens and logs into a payment app and holds the phone over the tap area on the credit card reader to complete payment. The app sources payment from a credit or debit card that the customer has previously added to the app. All payment information is encrypted in a different way for every transaction, making it very secure.

P2P“P2P” stands for “peer-to-peer” and describes payment methods that were initially designed to easily allow users to send money digitally to their friends or family. P2P works very similarly to digital wallets with a mobile phone app. The main difference is that while some users link the app to some funding source like a credit card or bank account, they can also link it to a separate account that can hold its own funds. Within the past few years, these P2P providers have branched out into merchant services, allowing businesses to use them as a form of payment. The two most popular merchant-enabled P2P systems are PayPal and Venmo. The advantage of accepting digital wallets and P2P payments is that it gives your business access to customers you might otherwise have been unable to sell to. Both of these payment forms are popular with millennials and Gen Z consumers, and P2P is also used by some of the 14 million American adults who do not have any kind of bank account or credit card. Credit card machine recommendationsBest wired credit card terminal: Dejavoo Z8 Tri CommThe Dejavoo Z8 Tri Comm terminal can connect via Ethernet or Wi-Fi. It has a color LCD screen and a privacy-screened PIN pad for debit transactions. It accepts swiped, tapped and inserted cards; Apple Pay; Samsung Pay; Google Pay; Visa payWave; and Mastercard PayPass NFC payments. It also has a built-in receipt printer in a compact device. This card reader is compatible with multiple credit card processors, including Fattmerchant, and costs $99 to $299. Fattmerchant charges just a monthly fee rather than a transaction rate, with small business plans starting at $99 per month for up to $500,000 in annual processing. Learn more in our full review of Fattmerchant. Best wireless mobile reader: PayPal ZettleThe PayPal Zettle mobile reader is compact and attractive. It comes in black or white and includes a PIN pad. It takes chip, magnetic stripe and NFC cards, as well as Apple Pay, Samsung Pay, PayPal and Google Pay. It also comes with Zettle’s POS software for free. The battery lasts eight hours, or about 100 transactions, between charges. The first Zettle mobile card reader is $29 when you sign up for Zettle payment processing, and additional units are $79 each. You can use this reader only with PayPal Zettle, which has a competitive transaction rate of 2.29% + $0.09. Learn more in our full review of PayPal. Best POS system with integrated payments: Square RegisterSquare Register is an integrated POS system with two digital screens: a product selection screen facing the cashier and a payment screen facing the customer. It is sleek and attractive, and takes credit and debit cards by swiping, dipping and tapping, as well as NFC payments with Apple Pay, Google Pay and Samsung Pay. The customer-facing screen provides a digital PIN pad. Compatible accessories, such as a cash drawer, receipt printer and handheld scanner, are sold separately. The Square Register costs $799, including the POS software, which is the most comprehensive retail and restaurant industry-specific POS systems on the market. The Square Register is compatible only with Square payment processing, which costs 2.6% + $0.10, with no monthly fee for the basic plan. Learn more in our review of Square. Best self-service kiosk: Ingenico Self/2000The Ingenico Self/2000 is a payment terminal that integrates with a self-service kiosk or vending machine and can be used inside or outside. It accepts NFC and chip cards, Apple Pay and Google Pay. The device has an LCD color touchscreen and a camera for scanning QR codes. It can integrate with an external speaker for sound alerts and voice prompts, and has Bluetooth and 4G connectivity. Contact the manufacturer for custom pricing.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| You Won’t Believe The POWER Of This Strategy (#1 Price Action Candlestick Trading System) Posted: 15 Nov 2021 12:57 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Discover probably the best day trading & scalping strategy for trading Forex, crypto and stock market. In this video you will discover: • How to make money trading stocks and Forex market using a simple candlestick combination and price action • how to combine the pin bar candlestick pattern with the inside bar formation to find the best price action signals (how to buy and sell using pin bar and inside bar combination) • How to trade price action for day trading and scalping stocks and currencies (on different trading platforms: Tradingview, Thinkorswim, Webull, Metatrader 4 etc) • How to correctly trade this price action strategy, with low risk and high reward • Several pin bar – inside bar trading strategies to increase your trading account

Trade with confidence with our RECOMMENDED online stock trading TOOLS, best online Forex trading platforms and Metatrader platforms, stock trading simulators, stock screeners, penny stock screeners, stock trading picks, investment portfolio tools (and discover our online stock trading sites and stock firms recommendations)

Check out our Playlists | Learn to trade Fx – Online Fx Trading | How To Trade Stocks And Shares | Stock Trading Techniques | Trading For Dummies |Trend Trading Forex | MT4 trading systems

Best Forex & Stock Trading Platform Software We Use: https://www.tradingview.com/

RISK DISCLAIMER: Please be advised that I am not telling anyone how to spend or invest their money. Take all of my videos as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this channel. This content is for educational purposes only, and is not tax, legal, financial or professional advice. Any action you take on the information in this video is strictly at your own risk. We therefore recommend that you contact a personal financial advisor before carrying out specific transactions and investments. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. TheSecretMindset.com and all individuals affiliated with this channel assume no responsibilities for your trading and investment results. AFFILIATE DISCLOSURE: Please note that some of the links above are affiliate links, and at no additional cost to you, we will earn a commission if you decide to make a purchase after clicking through the link. We only promote those products or services that we have investigated and truly feel deliver value to you. source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| Posted: 15 Nov 2021 12:28 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Cyber extortion is when hackers gain access to your computer system, hijack your data or website, and demand a ransom.  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| The True Power Of Support & Resistance Posted: 15 Nov 2021 11:55 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ What is Support and Resistance? How should you identify the different levels? Navin goes from the basics to the most advanced techniques on how you should be using S&R in your trading.  Bonus: Improve your trading with the Mastering Price Action 2.0, get your FREE Trial: https://www.urbanforex.com/freetrial Bonus: Improve your trading with the Mastering Price Action 2.0, get your FREE Trial: https://www.urbanforex.com/freetrial 00:00 Introduction Useful Links

source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| Which Android Credit Card Payment App Is Best for You? Posted: 15 Nov 2021 11:27 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Credit card payment applications have made accepting payments on mobile devices commonplace, especially for businesses at trade shows, conventions, festivals and more. Of course, trusting a third-party company with your customers’ credit card information and a significant chunk of your revenue is a major decision. How to choose a credit card payment app for AndroidResearching the many mobile credit card processors out there can be a monumental task. Not only are there many vendors, each has its own credit card readers, terms, conditions, fees and rates. Sifting through all this information can be a challenge for the busy entrepreneur. Luckily, with the proper criteria in mind, the research phase of your buying journey becomes easier. Here’s a look at the critical aspects of mobile credit card processing to keep in mind when you’re examining the market.

With these factors in mind, you’re ready to test out the Android credit card payment apps on the market. If you’re still not sure where to start, business.com has already reviewed hundreds of credit card processors. Here are some of the best credit card readers for Android that we encountered.

Editor’s note: Looking for the right credit card processor for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. What is the best credit card reader for Android?Determining which credit card reader is the best for Android depends on your specific needs and priorities. We’ve reviewed a wide range of services to determine the best mobile credit card processing companies and best credit card processors, many of which also offer mobile credit card readers. See all of our best picks for both types of processors by clicking the links above, but the snapshots below will get you started in finding the best credit card reader for Android. PayPal Zettle for AndroidPayPal Zettle is a popular application for small businesses. It offers competitive rates, and there are no monthly account maintenance fees or monthly minimums. When you sign up for PayPal’s merchant processing services, you can purchase a card reader for $29, plus $79 for each additional reader. PayPal’s rates and fees range from 2.29% to 3.49%, plus 9 cents per credit card transaction. QR code transactions range from 2.4% plus 5 cents per transaction for purchases $10 and below to 1.9% plus 10 cents per transaction for purchases above $10.01. Learn more in our full PayPal review. Square Reader for AndroidSquare offers a low rate with no fees, no contracts and a free credit card swiper for every account. Square charges the same rates for all types of cards, so you don’t have to worry about whether your customers primarily use debit, credit, rewards or corporate cards. When you sign up with Square, you receive free point-of-sale software in the form of the company’s payment application, Square Point of Sale. You can purchase additional hardware options, including a Square Contactless and Chip Reader for contactless payments and EMV chips. Square’s rates range from 2.5% to 2.6%, plus 10 cents on card-present transactions. For card-not-present transactions, rates range from 2.9% plus 30 cents per transaction to 3.5% plus 15 cents per transaction. Learn more in our full review of Square. SumUp for AndroidSumUp provides services on a pay-as-you-go basis and allows you to close your account at any time with no cancellation fees. There are no setup fees or additional hidden fees, either. When you sign up for SumUp, you can purchase a $19 credit card reader that accepts magstripe, chip, and contactless credit and debit cards. SumUp also allows you to accept payments from mobile wallets like Google Pay. Shipping on the EMV/NFC card reader is free. SumUp’s rates are straightforward, starting at 2.65% for transactions made in person using the card reader. Payments accepted through the virtual terminal cost 2.95% plus 15 cents per transaction. There are no maintenance fees, statement fees, PCI compliance fees or payment gateway fees. There is a $10 chargeback fee that is only incurred when a customer disputes a charge. For a full breakdown, see our full review of SumUp. QuickBooks PaymentsIf you’re a QuickBooks user, QuickBooks Payments is useful for syncing your payment data with your accounting software, saving you the work of double entry. The company charges flat processing rates and has a pay-as-you-go plan for small businesses. There is no long-term contract required for the use of its services. QuickBooks Payments includes free access to its GoPayment mobile application on Android phones and tablets. The app includes the core point-of-sale features as well as invoice-generation options and recurring payments. When you sign up for service, you receive a free QuickBooks Chip and Magstripe Card Reader. Additional readers cost $19 each, making them some of the most cost-effective EMV readers in our review. The QuickBooks Payments pay-as-you-go plan ranges from 2.4% to 3.4% plus 25 cents per transaction. For businesses that process more than $7,500 per month, the company offers a monthly fee plan with lower rates for $20 per month. Rates range from 1.6% to 3.2% plus 25 cents per transaction. Learn more in our full review of QuickBooks Payments. Shopify PaymentsShopify Payments is the processor we recommend for online businesses that need to make in-person sales using an Android phone or tablet. It offers month-to-month terms and simple flat rates. Shopify Payments is the in-house credit card processing service offered by the e-commerce platform Shopify. There are no long-term contracts, but you must pay a monthly subscription fee for the e-commerce software to use its mobile payment processing app. When you sign up for Shopify Payments, you receive access to the company’s point-of-sale app, which allows you to accept all major credit and debit cards. Processing hardware, such as a chip and swipe reader, is available at an additional cost. Shopify Payments charges flat rates from 2.4% to 2.9% plus 30 cents per transaction, depending on the plan you sign up for and whether a card is present during the transaction. There are five plans ranging from $29 per month to $299 per month, as well as a custom plan for high-volume merchants. The company offers discounts for long-term commitments. For a full breakdown, see our Shopify Payments review. Comparison of Android mobile credit card readers

Does Google Pay accept credit cards?No. Cashless payment applications or mobile wallets, like Google Pay, are consumer apps. They work with consumer credit cards to allow your customers to make payments from their mobile phones. They are not intended to be used by merchants to accept payments.

How mobile credit card processors are changing portable paymentsIn the past, businesses that traveled were limited to accepting credit card payments over the phone or accepting cash or checks, which carried certain risks and logistical challenges. Today, mobile credit card processors have solved that problem. Whether your business is mobile as a matter of operations or you’re visiting a trade show or convention, a mobile credit card processor allows you to conduct business anywhere. Keep in mind the criteria above and compare the details of each service to one another to make the best decisions about your business’s mobile payment collections. Jennifer Dublino contributed to the writing and research in this article.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| Forex mobile Strategy (The 1% MARSI Strategy) ��1minute forex scalping for milking money! Posted: 15 Nov 2021 10:53 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ This is a perfect Forex mobile strategy to scalp any forex pairs and other indices. Only 1 minute timeframe applicable to perform this, you can try on 5 or 15 min. Zoom level 2 applied. The 1% MARSI strategy setup: take 9, 20, 50, 200 EMA on first window take volume indicator on second window and add 20 EMA applied to first indicator data. take RSI 500 period, on third window and add here add 9, 50, & 200 smoothed Moving average applied to close. this combination of Moving average on RSI will let you take entry and exit from trade. Entry Rules: sell: Yellow heading up from 10-20 zone and after crossing blue it touches the 20. Buy: yellow heading down from 90-80 zone and after crossing blue it touches the 80 hold the trade if you see green also cross blue and heading towards 50 touching one zone to another (20 to 80) of yellow will be the exit. Trusted Broker: Receive $10,000 in virtual funds and learn how to trade with a market leader https://www.exness.asia/a/1622xls8sx?platform=mobile&pid=mobile_share Best of Luck… watch my $500 challenge series video (part-2) https://youtu.be/8kIZtsSiHMQ source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| Direct Deposit Guide for Small Businesses Posted: 15 Nov 2021 10:26 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------

We’ve come a long way since paper paychecks. Thanks to direct deposit, your employees no longer need to head straight to the bank on paydays. While direct deposit is safer, cheaper, greener and an often more efficient way of paying employees, it’s not without the occasional problem. Because of how important it is to pay your employees accurately and on time, small business owners must understand how direct deposit works and whether it’s right for their businesses. What is direct deposit?Direct deposit is the electronic form of a paycheck. It’s an electronic transfer of funds from an employer’s business bank account to an employee’s account at a bank or credit union. It’s also known as an automated clearing house transaction. This process requires the employee’s bank account number, routing number, type of account, bank name and address, and the names of the account holders listed on the account. Direct deposit isn’t used solely for paying wages. “It is also used for tax refunds, retirement benefits, expense reimbursements, investment distributions, and insurance claim payments,” said Heather McElrath, senior director of communications at the National Automated Clearing House Association (Nacha). What is Nacha?When it comes to payroll services it’s best to get familiar with Nacha, which is also known as the Electronic Payments Association. This nonprofit manages the Automated Clearing House Network, which processes and moves trillions of dollars every year. The ACH moved 23 billion payments, valued at $51 trillion, in 2018. These transactions included direct deposit, Social Security, government benefits, electronic bill payments and person-to-person and business-to-business payments. The ACH network creates the grid for all American financial institutions to safely transfer money from one bank account to another. Nacha is not a government agency, but it works directly with the Federal Reserve, state banking authorities and the Treasury Department. Nacha has its own rules and code of ethics that ensure business is conducted fairly and with as little risk as possible. Direct deposit services for small businessOnce upon a time, 28 million checks were written daily, according to a study in James McKenney’s Waves of Change: Business Evolution Through Information Technology. Today, nearly 93% of American workers are paid using direct deposit, which includes both small and large businesses, according to a 2018 American Payroll Association survey. Like many technological advancements, direct deposit has pushed out its paper predecessor. “Whether you are a 10-person operation or smaller, or a business of more than 100 employees, you can gain from direct deposit’s advantages,” said McElrath. Using direct deposit gives you more control over your finances and provides you with up-to-date electronic records of your payments. This electronic record helps clear up any confusion about your payroll deposit and provides a point of reference. Pros of direct depositDirect deposit has a lot to offer in terms of speed and efficiency, proving to be a win-win for both you and your employees. Here are some of the benefits of using direct deposit. It saves your business money.Direct deposit, like most online innovations, has a lot to offer. It helps businesses save a lot of money by eliminating manual check preparation. Since there is no need for postage and mailing supplies, it saves business owners about $3 per paper check. Direct deposit can also be used to pay Social Security benefits. In 2013, the Social Security Administration mandated beneficiaries collect their payments electronically. Child support payments and tax refunds can also be sent using this method. To receive your tax refund this way, inform your tax preparer. If you want to save some of your tax refund, you can disburse funds into several different accounts – you only need to provide your bank account information. It saves your business time.Saving money is always a bonus, but saving time is also a welcome win. With direct deposit, you no longer spend time printing and mailing paper paychecks, and you no longer need to wait for all of your employees to cash their checks. It also saves employees time since they no longer need to wait in line at the bank to cash or deposit their paychecks. It’s more secure than paper.Direct deposit has a big security advantage over paper checks, which can be lost, stolen or counterfeited. Direct deposit is perceived as more secure by 83% of employees, according to the Nacha survey. In a recent Association of Finance’s Payments Fraud and Control Survey, researchers found that checks were the most vulnerable to fraud. It supports employees’ financial health.Direct deposit allows you to help your employees automatically direct part of their paycheck into their savings accounts. “With split deposit, employees can direct a fixed amount or percentage of their pay into a savings or investment account to help build savings,” said McElrath. “As the single biggest influence on employees’ use of direct deposit, businesses can play a key role in supporting employee financial health.” Most financial institutions offer free checking when employees use direct deposit, which saves on banking fees, said Kristin Walle, senior vice president of Global Payments and Compliance at Automatic Data Processing, Inc. It’s good for the environment.Our environment is precious, and when we say direct deposit is greener, we mean it. A 10-person small business that pays employees twice a month uses 10.7 pounds of greenhouse gases each year – that’s the equivalent of driving almost 40 miles in your car. If the same small business switched to direct deposit instead of printing paper checks, it would save 3.7 pounds of paper, 35.7 gallons of waste water from being drained into natural bodies of water, 1.4 gallons of gas, and 4.3 pounds of solid waste, according to the Wagepoint. Can you imagine the impact on the environment if big corporations like Amazon or Microsoft used only paper checks?

Cons of direct depositThere are some drawbacks of using direct deposit that you’ll want to consider, both for employers and employees. It’s time-sensitive.Direct deposit is a very time-sensitive process, and depending on an employer’s workload, deadlines could be overlooked. If you don’t collect all of your employees’ time and attendance sheets and process payroll by a certain day and time, the money won’t be transferred into your employees’ accounts on time. Late checks lead to disgruntled employees, and if you want to speed up the process, it will cost you extra. There are potential security risks.Because you need your employees’ bank routing and account information to set up direct deposit, you need to have strong security measures in place to protect this sensitive information. Changing banks means starting over.Changing banks can also prove to be an inconvenience, because it means changing direct deposit information, so all of your employees will need to submit new authorization forms. There’s no “stop payment” option.Although it’s convenient to use direct deposit to make payments, you can’t put a stop on the payment like you can with a paper check – which might be an issue if you make a mistake when calculating employee hours. You could incur overdraft fees.If you don’t have enough money in your account when funds for payroll are withdrawn, it puts you in the negative – you’ll incur overdraft fees, which can be both inconvenient and expensive. How much does it cost to set up direct deposit for my employees?Direct deposit may seem to be all about saving time and money, but you can be hit with service fees that range from $50 to $149. Banks may also charge employers each time money is transferred from their account to an employee’s. Individual deposit fees can range from $1.50 to $1.90 per transfer. To find out exactly how much it costs to set up and maintain direct deposit, contact your financial institution or payroll provider. The financial institution or payment processor pays a fee to use the ACH network, but Nacha does not track fees that a business may incur, McElrath said. “Generally, [the] cost to use direct deposit are low,” McElrath said. “Most companies would save money using direct deposit compared to other payment methods, and any startup costs would be recouped in savings and increased productivity.”

What time do payroll direct deposits post?Direct deposit fund posting is governed by Nacha’s rules, which all financial institutions abide by, said Walle. “As a result, the funds are available by 9 a.m. local time at the receiving depository institution on the settlement day,” she said. “Many financial institutions ‘memo-post’ incoming transactions so employees may see a ‘pending’ transaction prior to funds being available.” Most American employees who use direct deposit are paid at the opening of business, on the Friday of payday. If your business doesn’t have set paydays, you can use direct deposit to pay employees promptly using same-day ACH. The payment would post by 5 p.m. on the day the payments are made, McElrath said. Can you pay contractors using direct deposit?Businesses can pay independent contractors using direct deposit the same way they pay traditional employees – contractors need to fill out the direct deposit form. “While there may be differences in the specifics of how a contractor is administered in a payroll system, the money-movement mechanics are the same,” Walle said. The difference is that contracted workers are not required to fill out a W-2 during their payroll process like traditional employees. Instead, they fill out W-9 forms, and you provide a 1099 form if you pay them $600 or more per year. How to set up direct depositA small business owner can set up direct deposit in four basic steps. Ultimately, the process will run through a payroll provider or bank, which brings us to the first step. 1. Choose a direct deposit payroll provider.You will need to set up a payroll service. When shopping around, pay close attention to the services offered, the fees and several other components of direct deposit management. You can always start by inquiring with your existing bank. They likely manage direct deposit, and their terms and fees can give you a baseline when you compare your options. 2. Collect information from your employees.Once you have a direct deposit provider, you will need information from your employees in order to process the payments. Each provider will provide you with their own direct deposit forms, but some information will prove universal. Make sure that every employee has the ability to safely and reliably provide the following information:

Editor’s note: Need a payroll service for your business? Fill out the below questionnaire to have our vendor partners contact you with free information. 3. Add employees to the payroll system.Before you were using direct deposit, you still had a payroll system. The new method will require a system update. You will be running your payroll through the new provider, and that will require an exchange of information. It may take a little time to set up, but once you have everyone in the new system, it should prove easier to manage. Automation features can help you stay ahead of payroll and have everything processed quickly, easily, and consistently. For many small businesses, the transition to direct deposit does not happen all at once. Some employees may opt out for any number of reasons. You may find yourself using a hybrid payroll system – at least for a while. The good news is that the automation available with direct deposit can make a hybrid system ultimately easier to use than having to write out checks for every single employee. 4. Select your deposit schedule.Once your provider has all of the necessary information and reviews your orders, they will handle the actual process of depositing the checks. In order for them to do this, you will need to pick a deposit schedule. There are a few things to consider when selecting the schedule. The first is your own financial schedule. Funds need to be liquid and available for transfer in your business account before paychecks can be distributed. Make sure you pick a payment schedule that works with your expected cash flow. The second consideration is payment time. Employees depend on those checks, and they need to be received in a timely fashion. When the ACH distributes funds to employees’ banks, the process is not instantaneous, despite being digital. On average, it takes two business days for money to go from your business account to your employees’ accounts. Depending on the banks involved, downtime will be expanded in the case of holidays.

Source link Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| Live Trading Forex || Silver FX || Anish Singh Thakur || Booming Bulls Posted: 15 Nov 2021 09:53 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ For people in INDIA Exness: For Mobile – https://www.exness.asia/a/senizhs8qo?… For PC – https://one.exness.link/a/senizhs8qo For people in UAE —————————————– BOOKS I RECOMMEND: OPEN YOUR DEMAT ACCOUNT IN ZERODHA: OPEN YOUR DEMAT ACCOUNT IN UPSTOX: —————————————– Website: https://www.boomingbulls.com Enquiry / Suggestions: info@boomingbulls.com Follow us on Instagram: https://www.instagram.com/boomingbulls/ —————————————– For more content from Anish Sir, Connect to Anish Singh Thakur: —————————————– About: In general, trading is considered a business not suitable for everyone, but this is just a hoax which we clear by letting you learn about the strategies that can provide a good profit. source Click to rate this post! [Total: 0 Average: 0] | ||||||||||||||||||||||||

| 6 Ways to Increase Your Holiday Sales Posted: 15 Nov 2021 09:25 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ In any normal year, the holiday season is a profitable one for many businesses. According to Statista, shoppers spent over $750 billion during the 2020 holiday season. This year is expected to be even more lucrative. While supply chain issues have spurred many consumers to start their holiday shopping early this year, the holiday shopping season officially kicks off on Black Friday. Business owners who don’t take the time to prepare for holiday shoppers may find themselves at a disadvantage during the final quarter of the year. Here are several ways you can step up your marketing campaign this season for more leads, engagement and sales. How to prepare for Black FridayIndustry analysts estimate that this shopping season will be even bigger for both in-person retail stores and e-commerce operations. However, that doesn’t mean the impact of the COVID-19 pandemic won’t still be felt during this year’s Black Friday shopping experience. One of the reasons this holiday season will look different is the global semiconductor shortage. This shortage in microchips was caused by a delay in the supply chain at the start of the pandemic. Since then, many industries have had difficulty meeting customer demand for their electronic products – from cars to gaming systems to computers to electronic toothbrushes. Be prepared to inform consumers that you may be out of stock of some products due to this issue. There’s also been a shortage of workers for retail and restaurant jobs. This means that you should be hyper-focused on your staffing for the busiest times, ensuring that your most reliable workers are available. Make sure you have a well-trained and responsible staff for the holidays.

6 ways to increase holiday season sales1. Offer special discounts to your customers.Customer loyalty is the key to success, especially during the era of COVID-19. This season, consider offering special discounts, rewards or gifts to your most loyal customers. Making these offers exclusive to your best customers makes them feel appreciated and encourages them to browse your entire catalog. Additionally, you can use a special discount as a way to introduce, or reintroduce, your customers to a new line of products you want to move off your shelves. Remember, retaining customers is often more profitable than finding new ones, as customer acquisition becomes tricker each year. During the coronavirus pandemic, consumers are less willing to risk their hard-earned cash on something they don’t know, so start with those who already use and love your brand. 2. Optimize for mobile devices.As of October 2021, according to research by GSMA Intelligence, there are 5.29 billion mobile phone users worldwide. In other words, over half of the world’s population owns a cell phone, and many of those people shop online during the holiday season. The key to creating an effective mobile design for your users this year is simplicity. When someone lands on your website, they should know within seconds who you are, how you can help and why they should care. If necessary, you should also quickly explain how your business is maintaining safety measures during COVID-19. Mobile design goes far beyond the initial appearance of your business; it also includes how your site functions. For example, mobile users are notorious for abandoning their shopping carts if they have to fill out multiple pages to complete their orders. One way to optimize for mobile is to create a simplified checkout page that allows users to make a purchase with minimal effort.

3. Plan your content in advance.One of the biggest problems business owners face during the holiday season is not having enough content ready. If you’re falling behind this year, don’t worry. You can still create all of your email newsletters, promotions and blog content in the first few weeks of the holiday season. But the sooner your content is ready, the better. Consumers now expect businesses to deliver content themed around each of the significant shopping days, including Black Friday and Cyber Monday, as well as the entire month of December leading up to Christmas. The advantage of planning your content is you’ll have more time to build rapport and engage with your audience through your email and social media marketing campaigns. It’s not easy to build trust and close a sale in just a few days, but by providing meaningful insight and content early, you’re setting the stage for more sales this holiday season. Create a staggered schedule where you send out emails, upload new blog posts and regularly update your business’s social media pages. 4. Host an online contest.Online contests are one of the best ways to grow your business all year long, but they’re particularly useful during the holiday months. We know that a majority of the population has at least one social media account. Additionally, we understand that people are more likely to interact with a new brand if no financial risk is involved. In other words, someone that followed your brand on social media but never made a purchase from your online store is more likely to become a paying customer after participating in your contest. Contest prizes can vary depending on your marketing goals. For instance, you can allow your followers to enter your giveaway by sharing your page with friends, liking one of your posts or subscribing to your email marketing list. Business owners who want to grow their email list should offer a prize that is relevant to their target audience. Someone with a gardening e-commerce storefront may offer their latest tool set as a potential prize in exchange for subscribing. If your goal is to get more social media followers through shares and likes, use a prize that is both simple and useful, like a $25 Amazon gift card.

5. Segment your email marketing lead list.Email marketing has the best return on investment (ROI) of any form of online marketing. HubSpot reports that the average ROI for email marketing is $36 for every dollar spent. You’ll want to prepare for the holidays by segmenting your leads based on analytics, their behavior on your website, and the interests they expressed when they signed up for your emails. Let’s say you are creating content for your e-commerce website that sells pet supplies. Your goal is to segment your lead list into different categories based on types of pets. If a dog owner visited your website and subscribed to your email content, you should put them on a lead list that centers on dog-themed content, such as “8 Holiday Foods That Are Not Safe for Your Dog.” The goal is to deliver content that the subscriber finds relatable. Personalization has a considerable impact on consumer behavior and can result in additional sales. If someone sees you sent them just the content they asked for, they are far more likely to visit your website in the future. Segmenting your lead list is one of the best ways to improve your sales and click-through rate this holiday season. According to Mailchimp, segmented email lists tend to see a 100% increase in clicks over non-segmented lists. 6. Review your data analytics.Finally, if you need to make quick decisions about your holiday marketing campaign this year, review your data analytics from last year’s holiday season. Even though COVID-19 has changed the way many people shop, the data you have from previous sales cycles can still be informative and give you creative ideas. Social media, email and website metrics can help you identify your strengths and weaknesses by reviewing feedback, sales and product shortages. Did you run out of a product last year and lose out on sales? If that item is still popular, or you plan to put it on sale, consider stocking up now so you don’t run out during Black Friday when spending typically hits an all-time high. What did the customer feedback forms say this time last year? Overcoming your weaknesses is just as important as playing on your strengths. If most of your feedback forms complain that the checkout process is too long, you can use this information to plan for a simplified buying process this season. The great thing about data analytics is that you can compare and contrast information for years to come. After tracking all of your data over several winter seasons, you will be able to make informed decisions about your business, future products and marketing material. New Year’s Day will be here before we know it. There’s no better time than now to start getting ready for the massive influx of new customers that will be ready to spend this holiday season. Winter sales are expected to rise this year, so business owners who plan to reach their target audience need to act now to increase their profits. The sooner you start developing your marketing strategy, the better. Start using these tips today to grow your audience, personalize experiences and ultimately close sales. Now that vaccines are widely available, consumers feel more comfortable leaving the house to shop than they did last year. According to research by ICSC and Placer.ai, foot traffic has returned to pre-pandemic levels for grocery stores and is near pre-pandemic levels for malls. While some shoppers have been visiting stores less frequently, their visits now have more intention behind them; therefore, they are spending more money. Brick-and-mortar stores should prepare for the increase in foot traffic by operating their store as they did before the pandemic, while following any required safety measures. Encourage your patrons to comply with any mask mandates and stay 6 feet away from each other, and place hand-sanitizing stations at all of your entrances and exits. An opportunity to end the year strongThe COVID-19 pandemic impacted millions of entrepreneurs nationwide, forcing almost all to change how their business operates and some to close for good. While the holiday season is always critical to businesses, the 2021 holiday season is an opportunity to end an otherwise tense and challenging year on a high note. By taking advantage of the holiday rush – offering discounts, expanding e-commerce presences and investing in holiday marketing – your business can maximize its sales before the end of the year and enter 2022 with some momentum. It might be just the thing to help overcome the economic challenges associated with the COVID-19 pandemic. Sean Peek contributed to the writing and reporting in this article.

Source link Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Did you know? Your credit machine must be compatible with your credit card processor, and most businesses buy their machines from their processor.

Did you know? Your credit machine must be compatible with your credit card processor, and most businesses buy their machines from their processor. FYI: Bluetooth mobile card readers can be used anywhere, enabling merchants to

FYI: Bluetooth mobile card readers can be used anywhere, enabling merchants to

Ready for some TRADING and INVESTING action?

Ready for some TRADING and INVESTING action?  https://thesecretmindset.com/academy/

https://thesecretmindset.com/academy/

Urban Forex Website: https://www.urbanforex.com

Urban Forex Website: https://www.urbanforex.com Receive Urban Forex updates and Trading Tips: https://www.urbanforex.com/webinar-notifications

Receive Urban Forex updates and Trading Tips: https://www.urbanforex.com/webinar-notifications Improve your trading NOW

Improve your trading NOW  Urban Forex Mobile Apps: https://www.urbanforex.com/app-store

Urban Forex Mobile Apps: https://www.urbanforex.com/app-store Navin is using the software TradingView to look at his charts, get your access to the same charts here : https://www.urbanforex.com/tradingview

Navin is using the software TradingView to look at his charts, get your access to the same charts here : https://www.urbanforex.com/tradingview

Tip: Become familiar with the various

Tip: Become familiar with the various

Bottom line: Direct deposit saves time, money, paper, and is better for the environment.

Bottom line: Direct deposit saves time, money, paper, and is better for the environment.

No comments:

Post a Comment