Forex System |

- How to Trade Forex News: An Introduction

- Chodzi o pieniądze TVP – Łowcy Frajerów FOREX

- GBP/AUD, GBP/CAD, GBP/NZD Rates Outlook

- Keistimewaan Online Forex Trading dan Ciri-Ciri Pasaran Forex | Belajar Forex Percuma Episode 02

- XAU/USD Eyes US Retail Sales for Direction

- Forex Supply And Demand Zones Strategy – In 5 Minutes

- Swiss Franc Technical Analysis: CHF/JPY, EUR/CHF, GBP/CHF

- How your Forex Broker can Scam you || ECN or Dealing Desk ? || Anish Singh Thakur || BooomingBulls

- FX Week Ahead – Top 5 Events: UK Jobs Report; US Retail Sales; Inflation Data from Canada, the Eurozone, and the UK

- FOREX, wat is het en hoe werkt FOREX TRADING? | Compareallbrokers.com

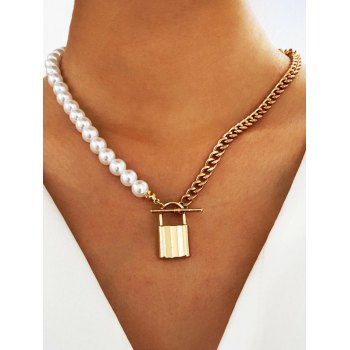

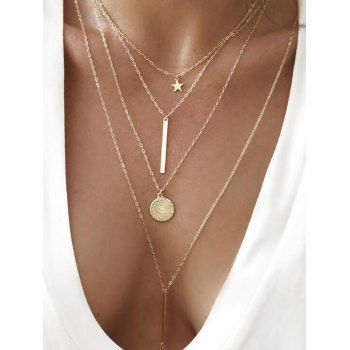

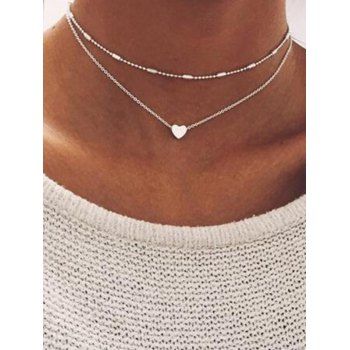

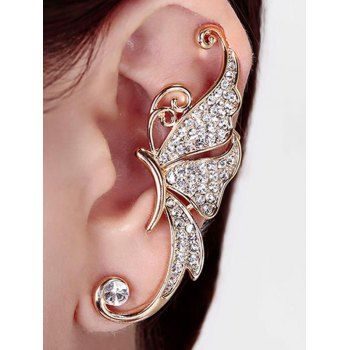

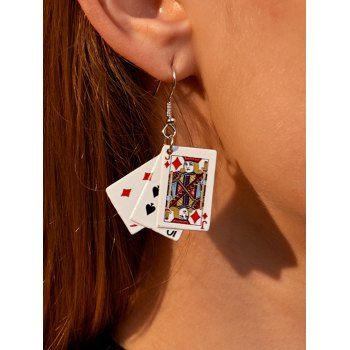

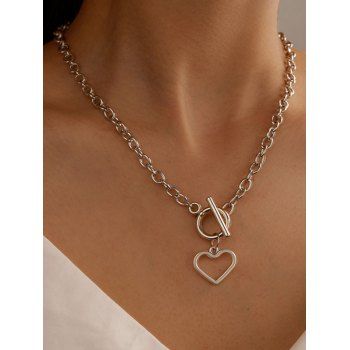

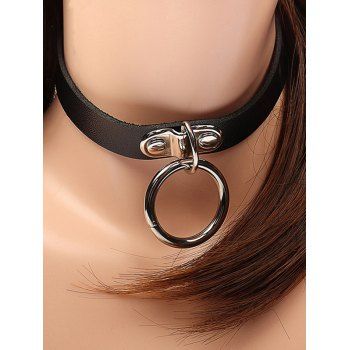

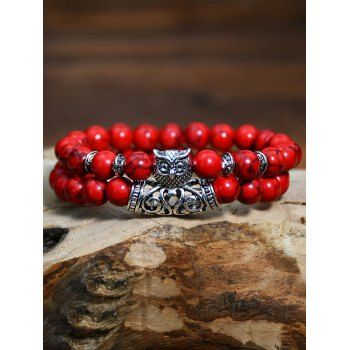

| How to Trade Forex News: An Introduction Posted: 15 Nov 2021 11:43 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------  Major economic data has the potential to drastically move the forex market. It is this very movement, or volatility, that most newer traders seek when learning how to trade forex news. This article covers the major news releases, when they occur, and presents the various ways traders can trade the news. Why Trade the News on Forex?Traders are drawn to forex news trading for different reasons but the biggest reason is volatility. Simply put, forex traders are drawn to news releases for their ability to move forex markets. 'News' refers to economic data releases such as GDP and inflation, and forex traders tend to monitor such releases considered to be of 'high importance'. The largest moves tend to follow a 'surprise' in the data – where the actual data contrasts what was expected by the market – the good news here is that you don't have to hold a PhD in Economics because our economic calendar already provides economist expectations. Furthermore, news releases are set at pre-determined dates and times allowing traders enough time to prepare a solid strategy. Traders that can effectively manage the risks of volatility, at the predetermined time of the news release, are well on their way to becoming consistent traders.

The Impact of Major News Releases on the Forex marketJust before a major news release, it is common to witness lower trading volumes, lower liquidity and higher spreads, often resulting in big jumps in price. This is because large liquidity providers, much like retail traders, do not know the outcome of news events prior to their release and look to offset some of this risk by widening spreads. While large price movements can make trading major news releases exciting, it can also be risky. Due to the lack of liquidity, traders could experience erratic pricing. Such erratic pricing has the potential to cause a huge spike in price that shoots through a stop loss in the blink of an eye, resulting in slippage. Additionally, the wider spread could place traders on margin call if there isn't enough free margin to accommodate this. These realities surrounding major news releases could result in a short trading career if not managed properly through prudent money management such as incorporating stop losses or guaranteed stop losses (where available). In general, major currency pairs will have lower spreads than the less traded emerging market currencies and minor currency pairs. Therefore, traders may look to trade the majors EUR/USD, USD/JPY, GBP/USD, AUD/USD and USD/CAD to mention a few. Traders need to be well prepared ahead of time – with a clear idea of what events they want to trade and when they occur. It's also important to have a solid trading plan in place. "Don't think about what the market's going to do; you have absolutely no control over that. Think about what you're going to do if it gets there. In particular, you should spend no time at all thinking about those rosy scenarios in which the market goes your way, since in those situations, there's nothing more for you to do. Focus instead on those things you want least to happen and on what your response will be." – William Eckhardt Which Major Forex News Releases to Trade?When learning how to trade news, traders must be aware of the major news events that affect the forex market, that can be monitored closely using an economic calendar. US economic data is so influential within global currency markets that it is generally seen as the most important news. It is important to note that not all news releases lead to increased volatility. Rather, there are a limited number of major news releases that have previously produced the greatest potential to move the market. The table below summarizes the major US economic releases alongside some of the most important non-US data releases from around the world. Major news releases (US and rest of world):

Key Tools & Resources to Trade Forex NewsDailyFX provides a one-stop-shop for all your forex related data and news releases:

Managing risk when trading news and eventsThe importance of prudent risk management cannot be overstated during volatile periods that follow a news release. The use of stops is highly recommended but in this case, traders may want to consider using guaranteed stops (where available) over normal stops. Guaranteed stops do come with a fee so be sure to check this with your broker; however, this fee can oftentimes end up being insignificant in relation to the amount of slippage that can occur in such volatile periods. Additionally, traders should also look to reduce their normal trade size. Volatile markets can be a trader's best friend but also have the potential to reduce account equity significantly if left unmanaged. Therefore, in addition to placing guaranteed stops, traders can look to reduce their trade sizes to manage the emotions of trading. 3 Approaches to forex news tradingThere are a number of approaches traders can adopt when developing a forex news trading strategy which depend on the timing of the trade relative to the news release. Many traders like to trade in the moment and make decisions as and when an announcement happens – using an economic calendar to plan ahead. Others prefer to enter the market in less volatile conditions ahead of a release or announcement. To summarize, forex news trading fits into one of the categories below: 1. Trading before the news release Trading forex news before the release is beneficial for traders looking to enter the market under less volatile conditions. In general, traders who are more risk averse gravitate towards this approach looking to capitalize on the quieter periods before the news release by trading ranges or simply trading with the trend. Discover strategies on how to trade before the news release. 2. Trading during a release These forex news trading strategies are not for the faint hearted as it involves entering a trade as the news breaks or in the moments that immediately follow. This is at a time when the market is at its most volatile which underscores the importance of having a clear strategy and well-defined risk management. Equip yourself with strategies to navigate the volatility associated with forex news trading at the release.

3. Trading after the news release Trading post-release involves entering the trade after the market has had some time to digest the news. Often the market, through price action, provides clues on its future direction – presenting traders with great opportunity. Learn how to trade the news when the market is in transition with our article on trading after the news release.

Top 3 things to remember when trading news releases

Trading the News FAQsHow will high importance news releases affect my existing trade? This will depend mainly on the currency pair and the actual data/figures released. The data will impact the currency that is directly involved i.e. a change in the interest rate by the European Central Bank (ECB) will affect any Euro crosses that you hold. However, currencies trade in pairs so it's important to be mindful of the strength/weakness of the accompanying currency. Data that comes out contrary to estimations, tend to make the biggest impact in the market and these can affect your open trades the most (good or bad). Looking at this from a swing trader point of view, you may want to consider how close the market is to your stop or limit prior to the news release. If the market is close to either of those levels it may be best to close out the trade, there and then. When the market is close to the target, it is better to not risk a lot to gain a little and when the current price is close to your stop, you may want to cut your losses before they potentially increase as a result of slippage.

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Chodzi o pieniądze TVP – Łowcy Frajerów FOREX Posted: 15 Nov 2021 11:21 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Uwaga TVP ujawnia jak działają „Łowcy Frajerów" – zorganizowane grupy przestępcze – okradające Polaków na inwestycjach typu FOREX. Program dotyczy takich podmiotów jak: Alpha Finex, Markets.com, Keystock.com, CFD1000, Vortex Assets, FX Imperium. Redaktorzy Jacek Łęcki i Mateusz Ratajczak opowiadają o kulisach dziennikarskiego śledztwa. Adwokat Patryk Przeździecki i Andrzej Tomczyk komentują na żywo w studio działania prokuratury i KNF, ostrzegają jak nie paść ofiarą oszustów i jak sprawdzić wiarygodność brokera. Po emisji programu został aresztowany EYAL P., obywatel Izraela, szef Łowców Frajerów z Alpha Finex, któremu postawiono zarzuty oszustwa i wyłudzenia na wiele milionów złotych. http://tvn24bis.pl/z-kraju,74/eyal-p-aresztowany-mial-oszukac-sto-klientow-firmy-alpha-finex,712438.html  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| GBP/AUD, GBP/CAD, GBP/NZD Rates Outlook Posted: 15 Nov 2021 10:40 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ British Pound Outlook:

Sterling Has a Shot at RedemptionSurging inflation pressures and a Bank of England that proved to disappoint at its November policy meeting weighed heavily on the trio of Sterling commodity currencies crosses through the first two weeks of this month. However, the upcoming slate of UK economic data may soon help spark a turn higher for each of GBP/AUD, GBP/CAD, and GBP/NZD rates. The UK economy has seemingly overcome recent upticks in COVID-19 infections as the economy has been opened full-tilt, and the outcome for the UK labor market has been a positive one according to consensus forecasts. And if UK inflation rates jump considerably like their American counterparts, speculation around the first BOE rate hike should be revived, which should help the British Pound recover from its early-month woes. GBP/AUD RATE TECHNICAL ANALYSIS: DAILY CHART (November 2020 to November 2021) (CHART 1)After losing their 2021 uptrend at the end of October, GBP/AUD rates have been rejected twice at reclaiming the multi-month trendline, treating former support as resistance. But price action through November has established a series of lower highs and higher lows, suggesting that consolidation is taking root. Momentum is slowly turning more bullish for GBP/AUD rates, but the pair hasn't 'turned the corner' just yet. GBP/AUD rates are still below their daily 5-, 8-, 13-, and 21-EMA envelope, which remains in bearish sequential order. However, daily MACD has turned higher and has been rising for six consecutive sessions, while daily Slow Stochastics have advanced through their median line. The pair's rebound today at the 23.6% Fibonacci retracement of the 2020 high/2021 low range at 1.8213, in the form of a hammer candlestick, hints that another attempt higher may soon arrive. A move above 1.8437 would clear out the November highs, as well as retake the uptrend from the January 2021 and May 2021 swing lows. GBP/CAD RATE TECHNICAL ANALYSIS: DAILY CHART (November 2020 to November 2021) (CHART 2)Last month it was noted that "GBP/CAD rates may be in the early stages of a more meaningful breakdown. The pair has recently exit the symmetrical triangle in place since November 2020, after having exited the longer-term symmetrical triangle measured against the descending trendline from the March 2018 and March 2020 highs and the ascending trendline from the August 2019 and December 2020 lows." GBP/CAD rates hit a fresh yearly low soon after, and even carved out a fresh low just last week. Among the GBP-crosses discussed in this report, GBP/CAD rates have the clearest discernible bearish bias. The steep descending parallel channel in place since mid-September remains in place, while the shooting star candlestick on the daily timeframe suggests that momentum remains to the downside after failing to climb into the daily EMA envelope – which remains in bearish sequential order. Another swing lower appears possible in the near-term; only a close above the May low at 1.6858 would invalidate the bearish perspective. GBP/NZD RATE TECHNICAL ANALYSIS: DAILY CHART (November 2020 to November 2021) (CHART 3)In the prior update, it was noted that "GBP/NZD rates have been in a symmetrical triangle since last August, but another test of trendline support from the December 2020 and September 2021 lows may soon arrive…the seeds are planted for a more considerable pullback through the end of October." Having realized their bearish potential, GBP/NZD rates may be working on carving out a low now through the middle of November. GBP/NZD rates have already started to climb higher into their daily EMA envelope, which is on the verge of losing its bullish sequential nature. Daily MACD has begun its turn higher (albeit still below its signal line), while daily Slow Stochastics have risen through their median line. A break above last week's high at 1.9103 would offer a strong hint that a near-term bottom has been found. — Written by Christopher Vecchio, CFA, Senior Strategist

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Keistimewaan Online Forex Trading dan Ciri-Ciri Pasaran Forex | Belajar Forex Percuma Episode 02 Posted: 15 Nov 2021 10:19 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ DAFTAR AKAUN UNTUK TRADE FOREX, GOLD, WTI OIL, SAHAM, INDEKS dan CRYPTO DAN DAPATKAN FREE $5 MODAL TRADE : https://moshed.com/free5usd Join Telegram Rasmi saya untuk tak terlepas update, tips, info dan nasihat tentang trading dalam pasaran kewangan : https://t.me/moshedmohamad Siri pembelajaran percuma ini menggunakan Buku Panduan Lengkap Mula Trade Forex sebagai Buku Teks. Jadi sesiapa belum dapatkan boleh dapatkan di link ini : https://intraday.my/mulatradeforex/ Tak paksa pun, nak beli, serius nak belajar beli lah. Taknak pun takpe, terpulang kepada anda. Dalam Buku tersebut sudah tentu anda lebih senang nak rujuk bila saya buat video-video pembelajaran. Saya cuba sehabis baik untuk SHARE ilmu agar bermanfaat untuk anda. JANGAN LUPA SUBSCRIBE YOUTUBE CHANNEL MOSHED! Nak Mula Belajar Forex? INTRADAY – Website Pasaran Kewangan No 1 Malaysia Website Rujukan Forex No 1 : https://intraday.my/ DAFTAR AKAUN UNTUK TRADE FOREX, GOLD, WTI OIL, SAHAM, INDEKS dan CRYPTO DAN DAPATKAN FREE $5 MODAL TRADE : https://moshed.com/free5usd FOLLOW SAYA: #BelajarForex #INTRADAY #Moshed source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| XAU/USD Eyes US Retail Sales for Direction Posted: 15 Nov 2021 09:39 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Gold, XAU/USD, US Retail Sales, Treasury Yields – Talking Points

Gold's recent upside appears to be stalling out after prices cleared a key level of resistance during last week's big +2.64% gain. XAU is currently trading near the highest levels since early June despite rising Treasury yields and a stronger US Dollar – two things which typically work against the non-interest-bearing asset. Still, given gold's recent move amid inflation hitting multi-decade highs via the CPI index, it’s clear investors' appetite for the yellow metal is heating up. Historically, gold is viewed as a store of value and an asset that withstands periods of economic stagnation. Gold also has an inflation-hedging appeal – although there is a debate over that claim's veracity. However, higher inflation has bolstered Federal Reserve rate hike bets. That has thrown doubt on the equity market's ability to keep pacing higher should monetary policy tighten too quickly. Gold traditionally performs well during times of higher volatility, as investors favor the asset to smooth out volatility within their portfolios. Following this line of logic lays out a rather bullish path for gold. That said, upcoming economic data out of the United States in the form of retail sales may provide the next directional driver for gold prices. The preliminary print for October retail sales is expected to cross the wires at 1.5%, according to a Bloomberg survey. That would be up from 0.6% in September. A stronger-than-expected figure would likely further shift Fed rate hike bets to the left. Federal Funds futures are pricing in a nearly 50% chance for a 25 basis point Fed rate hike at the June 2022 FOMC meeting, up from 45.5% just a week ago per the CME's FedWatch Tool. Gold's ability to weather higher rate hike bets, along with a stronger Greenback and higher rates, is an encouraging sign. It could even signal a shifting market dynamic on a broader scale – perhaps one that could bode well for the yellow metal. Gold Technical ForecastXAU/USD sliced above a critical level of resistance that has capped gold's upside going back to July. The break higher brought further strength, with the 1900 psychological level now in focus. A pullback would see the rising 9-day Exponential Moving Average (EMA) offer possible support, with the aforementioned resistance level below that. Gold Price Chart

Chart created with TradingView — Written by Thomas Westwater, Analyst for DailyFX.com To contact Thomas, use the comments section below or @FxWestwateron Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Forex Supply And Demand Zones Strategy – In 5 Minutes Posted: 15 Nov 2021 09:17 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Forex Supply And Demand Zones Strategy – In 5 Minutes The strategy producing the referenced performance may have made or lost money before or after the referenced trade(s) was/were executed, and the referenced trade(s) may not necessarily be representative of the average subscriber's experience or performance utilizing the strategy. No representation is being made that you will achieve the same or similar results as the referenced results. The performance referenced in any testimonial may not be representative of all reasonably comparable accounts, and although Blue Edge believes the information contained in the testimonial is accurate and reliable, Blue Edge has not independently verified the accuracy. If you’re looking for a forex supply and demand zones indicator, curious about how to draw forex supply and demand zones, or wanting to know how to trade forex supply and demand zones, then this video is EXACTLY what you’re looking for! Also covered in this video: – How to identify forex supply and demand zones

Other Helpful Videos For You:

Disclaimer: Trading FX and futures is not appropriate for everyone. Trading and investing involve substantial risk of loss. You should trade or invest only using risk capital – money you can afford to lose. No representation is being made that utilizing the referenced strategy or trading robot will ensure profitable trading or freedom from risk of loss. Some or all of the referenced trades may not be actual trades and instead could be hypothetical trades or simulated trades. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, such as the costs of commissions or other fees. Because the trades underlying these examples may not have been actually executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Simulated trading results in general are also designed with the benefit of hindsight, which may not be relevant to actual trading. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of the financial risk of actual trading. The strategy producing the referenced performance may have made or lost money before or after the referenced trade(s) was/were executed, and the referenced trade(s) may not necessarily be representative of the average subscriber's experience or performance utilizing the strategy. No representation is being made that you will achieve the same or similar results as the referenced results. The performance referenced in any testimonial may not be representative of all reasonably comparable accounts, and although Blue Edge believes the information contained in the testimonial is accurate and reliable, Blue Edge has not independently verified the accuracy. source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Swiss Franc Technical Analysis: CHF/JPY, EUR/CHF, GBP/CHF Posted: 15 Nov 2021 08:36 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Swiss Franc, CHF, CHF/JPY, EUR/CHF, GBP/CHF – Talking Points

CHF/JPY Technical AnalysisAfter making a swift break higher to fresh yearly highs in the first few sessions of the month, CHF/JPY has since fallen onto the backfoot. A swift decline for the pair from overbought conditions has seen seven losing sessions out of the last eight. As mentioned, the pair's robust melt higher saw the relative strength index (RSI) approach 80, indicating severely overbought conditions were present. The move lower over the last couple of weeks has been constrained by overhead trendline resistance, which has guided price lower. Price may continue to guide lower to the previous yearly high of 122.771, a level which may act as a key pivot point. With sellers firmly in control of this cross, traders may look for a test of the 50-day moving average should the previous yearly high fail as support. CHF/JPY Daily ChartChart created with TradingView EUR/CHF Technical AnalysisEUR/CHF finds itself on the backfoot as well, with price failing to hold the 0.236 Fibonacci level at 1.064 as support. Despite gyrating price action to begin November, the trend lower has continued as the pair looks to test the upper bound of a key pivot zone from the 2020 lows. Price immediately reversed from these levels during two separate tests in March and May of last year. Should that replicate in the coming weeks, traders may eye a retest of the aforementioned 0.236 Fib level. A break lower through this key zone would see the cross trade to lows not seen since 2015. EUR/CHF Daily ChartChart created with TradingView GBP/CHF Technical AnalysisGBP/CHF appears to have carved out a bottom above 1.2300 following a break lower from a bear flag. Confirmation of the bear flag saw the cross break the lower bound of a descending channel it had been carving out since early May. Sentiment was already bearish, as a Death Cross had formed in early October. With 1.2300 propping up price in the near-term, the cross may find resistance in the form of previous support, being the lower bound of the multi-month descending channel. A break back into the channel could see price retest 1.2500, but a failed breakout may bring 1.2300 back into play. GBP/CHF Daily ChartChart created with TradingView Resources for Forex TradersWhether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex. — Written by Brendan Fagan, Intern To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| How your Forex Broker can Scam you || ECN or Dealing Desk ? || Anish Singh Thakur || BooomingBulls Posted: 15 Nov 2021 08:14 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ OPEN YOUR DEMAT ACCOUNT IN ZERODHA: https://bit.ly/3gyhIWN OPEN YOUR DEMAT ACCOUNT IN UPSTOX: BOOKS I RECOMMEND: Learn types of Brokers in Forex Markets Website: www.boomingbulls.com Enquiry / Suggestions: info@boomingbulls.com Follow us on Instagram: https://www.instagram.com/boomingbulls/ —————————————– For more content from Anish Sir, Connect to Anish Singh Thakur: —————————————– About: In general, trading is considered a business not suitable for everyone, but this is just a hoax which we clear by letting you learn about the strategies that can provide a good profit. source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Posted: 15 Nov 2021 07:36 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ FX Week Ahead Overview:

For the full week ahead, please visit the DailyFX Economic Calendar. 11/16 TUESDAY | 07:00 GMT | GBP Employment Change (AUG) & Unemployment Rate (SEP)The UK economy has seemingly overcome recent upticks in COVID-19 infections as the economy has been opened full-tilt, and the outcome for the UK labor market has been a positive one. According to a Bloomberg News survey, the UK economy gained+185K jobs in the three months through August 2021, and the unemployment rate fell from 4.5% to 4.1% in September. The upcoming UK jobs report, which covers various aspects of the labor market in June, July, August, and September, points to an improving outlook that may help resuscitate BOE rate hike odds. 11/16 TUESDAY | 13:30 GMT | USD Retail Sales (OCT)Consumption is the most important part of the US economy, generating around 70% of the headline GDP figure. The best monthly insight we have into consumption trends in the US might arguably be the 'retail sales advance' report. In the wake of the October US inflation report (CPI) that showed the highest price pressures since 1990, traders are wondering if US consumers began to close their wallets, finding certain goods and services too expensive. Nevertheless, according to a Bloomberg News survey, headline US retail sales are expected to have grown by +1.1% in October after posting a modest +0.7% gain in September (m/m). The Atlanta Fed GDPNow 4Q'21 growth tracker, currently at +8.2% annualized, will be updated after the US retail sales data are released. 11/17 WEDNESDAY | 07:00 GMT | GBP Inflation Rate (OCT)Bank of England Chief Economist Huw Pill started the week by noting that "if we don't act there is a danger that inflation achieves some self-sustaining momentum that we will have to resist down the road.But equally I think that if we act prematurely there is a danger that we derail some of the recovery which is still in some respects quite fragile." With this context, particularly after the November BOE meeting, the upcoming UK inflation report will carry additional weight. According to a Bloomberg News survey, the October UK inflation rate (CPI) is due in at +3.9% from +3.1% (y/y), while the core inflation rate is due in at +3.1% from +3.2% (y/y). If UK inflation rates jump considerably like their American counterparts, speculation around the first BOE rate hike should be revived, which should help the British Pound recover from its early-month woes. 11/17 WEDNESDAY | 10:00 GMT | EUR Inflation Rate (OCT)The final October Euroarea inflation rate (CPI) report is the top item of interest for the Euro this week, although ECB President Christine Lagarde may have taken some wind out of the report's sails. ECB President Lagarde noted that the ECB still sees"inflation moderating in the next year, but it will take longer to decline than originally expected,"a suggestion that any upside price pressures won't be met by a response by the central bank. According to Bloomberg News, the headline Euroarea inflation reading is due in at +4.1% from +3.4% (y/y), while the core reading is due in at +2.1% from +1.9% (y/y). 11/17 WEDNESDAY | 13:30 GMT | CAD Inflation Rate (OCT)According to a Bloomberg News survey, the October Canada inflation rate (CPI) is forecasted to show an increase of +4.7% from +4.4% (y/y), while the core reading is due in at +3.9% from +3.7% (y/y). As has been the case in recent months, while these figures remain lofty, they are not due to show the same type of acceleration that their American counterparts did just last week. But more upside price pressures could spur a faster rate hike cycle by the BOC, which has already surprised markets in recent weeks by abruptly ending their QE program; rising BOC rate hike odds would be supportive of the Canadian Dollar near-term. — Written by Christopher Vecchio, CFA, Senior Strategist

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| FOREX, wat is het en hoe werkt FOREX TRADING? | Compareallbrokers.com Posted: 15 Nov 2021 07:13 PM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Forex trading is het handelen in verschillende valuta, daarom ook wel valutahandel genoemd. Lijkt dit je interessant maar weet je niet hoe het werkt? of vraag je jezelf af; wat is forex? in deze video leggen we je de basisprincipes van de forex handel uit. Alle informatie die je nodig hebt voor een beeld bij het begrip ‘forex’ is te vinden in deze video.

Beleggen doe je via een broker. Beleggen in forex begint dan ook met het kiezen van een geschikte broker. Bij https://compareallbrokers.com/nl/ vergelijk je alle forex brokers en kies je de broker die het best bij je past. Mocht je graag nog meer informatie over forex trading of andere beleggingsvormen tot je nemen voordat je een account bij een broker opent, bekijk dan zeker onze kennisbank en blogs voor alle beleggingsinformatie voor een goed ingelezen beleggingsstart! Deze video is enkel bedoeld voor educatie doeleinden. Het doel van deze video is het bijbrengen van basiskennis rondom het begrip ‘forex’. Deze video bestaat dan ook niet uit professioneel beleggingsadvies. source Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

7 Day FREE Trial of Indicator: https://blueedgefx.com/free-trial/blue-edge-financial-free-trial/?el=youtube

7 Day FREE Trial of Indicator: https://blueedgefx.com/free-trial/blue-edge-financial-free-trial/?el=youtube  Download the FREE Edge Trading Secrets Book here: https://blueedgefinancial.com/free-book-new/?el=youtube

Download the FREE Edge Trading Secrets Book here: https://blueedgefinancial.com/free-book-new/?el=youtube Subscribe to our YouTube channel: https://www.youtube.com/blueedgefinancial

Subscribe to our YouTube channel: https://www.youtube.com/blueedgefinancial

No comments:

Post a Comment