Forex System |

- XM Registration: How to Register in XM Forex Trading Philippines

- The Lending Landscape for Small Businesses in 2022

- A'dan Z'ye FOREX ( Başlangıç / Eğitim )

- DG – Assistant Manager – Treasury Operations

- How CPI Data Affects Currency Prices

- Quality Analyst

- Remove False signals from your Forex Trading

- VP Product Control

- No End Yet in Sight for EUR/USD Weakness

- Automation Quality Analyst

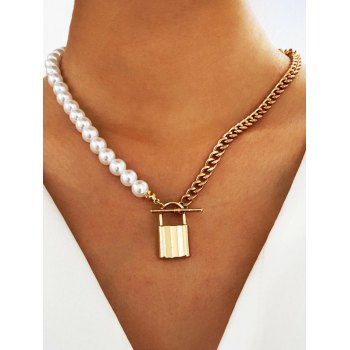

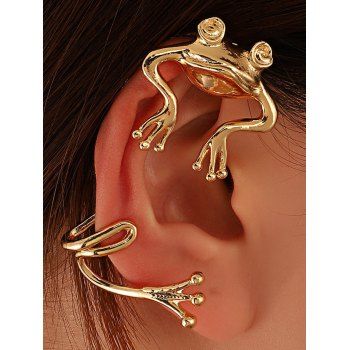

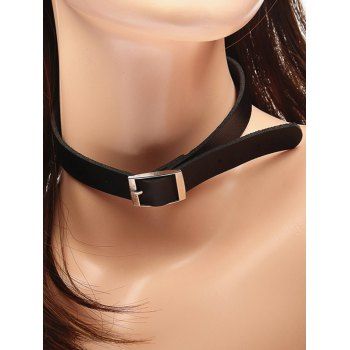

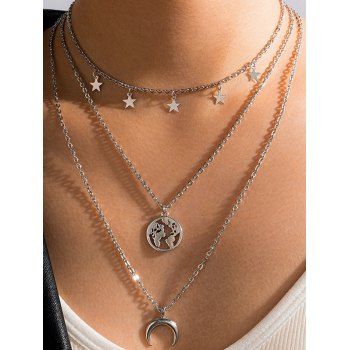

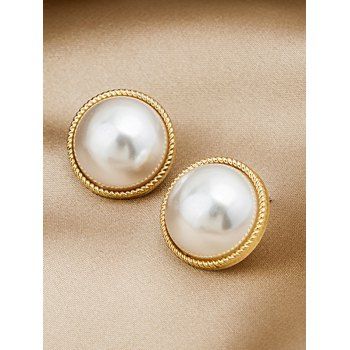

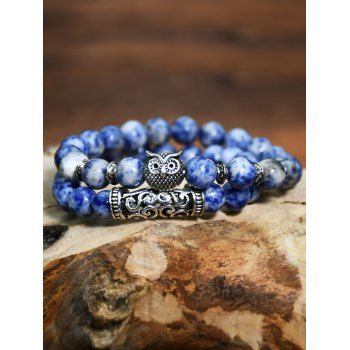

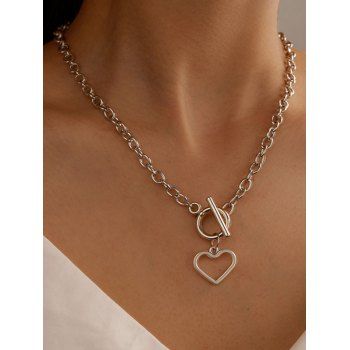

| XM Registration: How to Register in XM Forex Trading Philippines Posted: 17 Nov 2021 04:16 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ XM Registration: How to Register in XM Forex Trading Philippines [ Choose Leverage ] XM Registration Link: https://clicks.pipaffiliates.com/c?c=598262&l=en&p=1 Step by step tutorial guide on how to register in XM where you can trade in Forex. XM Registration is a platform that lets you trade in Forex. So, if you’re a newbie to trading, make sure you check out the tutorial video to learn more about how to register in XM. Keep in mind that the leverage you will use will depend on your experience and what kind of account you want to open. So you want to trade in Forex, but you don’t know how to get started? That’s a good question. It can be pretty overwhelming for newbies. And that’s where XM comes in. It’s a high-quality online Forex broker that offers a user-friendly interface and lots of educational materials. That’s why I decided to create this tutorial- a step by step tutorial guide on how to register in XM and how to trade in Forex. Frequently Asked Question about XM registration: ======================= TIMESTAMP ======================= Kung may iba ka pang mga tanong baka nasagot namin ito sa mga video dito sa Playlist: #xm OTHER VIDEOS YOU MIGHT ALSO LIKE: GoTrade Tutorial for Beginners – https://youtube.com/playlist?list=PLLchY5eWy4I7mDkT3SUChxYa2DZT1fB5o eToro Review Tutorials for Beginners (eToro Philippines) – https://youtube.com/playlist?list=PLLchY5eWy4I53QEOJNoxCtkbwxE5QpCZd Seedin Tutorial – https://youtube.com/playlist?list=PLLchY5eWy4I7DU0X1lzlKcyBDEPArsVVi ABOUT INVESTLIBRARY: DISCLAIMER:

Please always do your own due diligence when investing. Do not just blindly listen to anyone on YouTube or any social media platform. As we are not financial advisors, please consult one for your personal financial assessment and guidance. ALL ABOUT THIS VIDEO: source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| The Lending Landscape for Small Businesses in 2022 Posted: 17 Nov 2021 03:37 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Supply-chain delays, worker shortages and rising wages make it costlier for small business owners to capitalize on pent-up pandemic demand – especially heading into the holiday season. But that doesn’t mean they have to lose out on what is forecast to be a strong holiday season and beyond. Financing options abound, as banks and non-banks continue to open their coffers to the nation’s small businesses. For several months, loan approvals have been slowly rising across all lender types except credit unions. According to the Biz2Credit Small Business Lending Index, alternative lenders led the pack in October, approving 25.6% of borrowers. That’s up from 25.4% in September. Big banks approved 14.1% of loans, up from 14%. Meanwhile, small banks approved 19.7% of loan applications, a 0.2% increase. “Lending is coming back, more from alternative sources, but also smaller banks are increasing their lending again,” Rohit Arora, CEO of Biz2Credit, told business.com. In addition to a willingness to lend, many are relaxing their standards. “Since businesses got $1.3 billion in forgiven loans [during the pandemic], lenders can afford to be less stringent,” Arora said. Many businesses’ sales are up this year, he said, and their debt is a lot lower than in 2019, which also helps.

SBA sets non-pandemic loan volume recordIt’s not just small banks and alternative lenders increasing the pace of lending. The U.S. Small Business Administration, which proved to be a lifeline during the pandemic, is also setting lending records. Earlier this month, the SBA announced it backed $4.8 billion in small business funding in fiscal 2021 through more than 61,000 traditional loans. That doesn’t include the $1 trillion-plus in COVID-19 relief the SBA meted out since the pandemic began. Loan volume for its 504 loan program increased 41% this year. The SBA expects another busy year in 2022, with a lot of the volume driven by lenders looking to reduce their exposure. “Concerns over the pandemic in the economy are adding some risk,” said Alan Haut, district director for the SBA North Dakota Office. “Lenders, banks and credit unions typically don’t like a lot of risk. An SBA guarantee helps reduce that in an unsure environment.” Stigmas among business owners fadeLenders’ willingness to issue various types of small business loans is increasing at the same time the stigma associated with borrowing is disappearing. In a recent PayPal survey, 44% of small business owner respondents said they were now more willing to apply for a small business loan than prior to the pandemic, and 1 in 3 said they plan to seek funding in the next year. “The pandemic created a lot of stress, and small businesses needed to reinvent themselves,” said Bernardo Martinez, vice president of global merchant lending at PayPal. “They are embracing their new roles online and are really trying to invest in those areas. They need capital they may have not needed in the past.”

Of the business owners in PayPal’s survey, 1 in 5 said they need cash to boost their email and social media marketing, while another 20% want to scale up. During the holiday season, business borrowers are putting loans toward marketing and advertising, building their online presence, and selling in new marketplaces.

Where can small businesses get funding?It’s a good time to be a small business owner if you need funding. There are various options to secure capital. With interest rates hovering at pandemic lows, borrowing is also cheaper. Take banks for starters. The big ones aren’t lending, but the smaller ones are. “Community banks make up 43% of all business loans, more than 40% of agricultural loans, and more than a third of commercial real estate loans,” said Orvin Kimbrough, chairman and CEO of Midwest BankCentre. These local banks have relationships with their small business customers, which helps during the underwriting process. Still, getting approved for a bank loan can be arduous. It requires a lot of paperwork, which is why 16% of business owners in PayPal’s survey said they didn’t apply for a business loan. Small business owners have choices outside of bank loans, though. They can borrow against their current and future sales with working capital loans and merchant cash advances. These loans typically require much less paperwork, and funding can be quick.

Short-term loans and equipment financing are other popular options from banks and alternative lenders. Short-term loans – which are often used for cash flow, inventory, or promotions that yield direct results – have terms of no more than 18 months. The underwriting is less arduous and the funding is quick. Our review of Fora Financial found that it maxes out its terms at 15 months. Business lines of credit and microloans are other options for small business owners.

Money is flowing to small business owners again, but that doesn’t mean every loan is right for you. Before you select a loan, figure out why you need the money and for how long. If it’s to purchase more inventory ahead of the holidays, a working capital loan or merchant cash advance may be a good option. If you need to purchase expensive machinery, equipment financing is a better choice. “What is the use for the funds? Are you just patching up a hole, or is it in fact to fuel growth?” said Hal Shelton, SCORE mentor and angel investor. “There has to be a benefit. How much will you get, are you able to pay it back, and will you have something left over?”

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| A'dan Z'ye FOREX ( Başlangıç / Eğitim ) Posted: 17 Nov 2021 03:14 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ A’dan Z’ye FOREX ( Başlangıç ) Forex Nedir? Canlı Eğitim, trading / trader strategy #Forex #Dolar #Borsa Abone Olun ► https://goo.gl/QZJh1X Forex Grafik Eğitim Videolarım : https://goo.gl/ZPquu5 Tweets by PriceAction_TRForex Eğitim Kanalı Para Sihirbazı ( Grafiklerin Dili) video eğitim kanalı ‘nda 2018 yılında paylaşmaya başladığım borsa kripto ve çoğunlukla da forex piyasa analiz ‘lerini bulabilirsiniz. Amacım, forex nedir ikili opsiyon nedir, nasıl oynanır ya da internetten para kazanma gibi arayışlarda olan, yatırım yapmak ve para kazanmak amacında olan sizler için fiyat hareketleri mum çubuklar ve arz talep ekseninde elimden geldiği kadar öğrendiğim teknik analiz eğitimini sizlere ücretsiz olarak aktarmaktır. Konuyla alakalı başka yerde bulamayacağınız yeni sistem ve strateji paylaşımları yapıyorum. Forex ‘te indikatör ‘lerin faydasına inanmayan biri olarak destek direnç hacim momentum testere iğneler bobin engulflar korelasyon formasyon ‘lar vb. ile işlem yapmanın daha kazançlı olduğunu söyleyebilirim. Asıl önemli olan ise disiplinli bir şekilde para yönetimi ve risk kazanç oranını çok iyi belirlemektir. Yeni başlayan bir çok arkadaşın forex piyasasına ilk giren herkesin yaptığı hataları yapmamaları için bu kanal bir yol gösterici olacaktır. Zaman zaman borsa ‘da kayda değer hisse ‘lerinde analizini yaptığım bu kanalda Dolar tl (usdtry) eurusd altın brent wti usdjpy audusd gbpusd gbpjpy eurgbp eurjpy usdcad cadjpy dolar index vs. bir çok parite hakkında yükseliş ve düşüş fırsatlarının paylaşıldığı analizler yer almaktadır. İşin temel analiz kısmı olan Türkiye Cumhuriyeti Merkez Bankası (Tcmb) açıklamaları tarım dışı istihdam (tdi – nfp) işzilik oranları faiz artışı enflasyon federal açık piyasa komitesi tutanakları (fomc) vs. nin fiyatı tetikleyen bir etken değil bir sonuç olduğunu düşünen taraftayım. Ekonomik haberlerin ekonomik takvim ‘in doğuracağı sonuçları mum çubuklarda gizli olan sinyal ‘lerle önceden tahmin edebileceğimizi düşünüyorum. Faydalı olması temennisiyle. İyi Seyirler… source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| DG – Assistant Manager – Treasury Operations Posted: 17 Nov 2021 03:01 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: DG – Assistant Manager – Treasury Operations Company: Genpact Job description: and resolve payment related investigations, such as amendments, recalls and cancellations. Work with banks to resolve pending… as per request. Prepare, update and maintain the Standard Operating Procedures and project related documents. Work… Expected salary: Location: Bangalore, Karnataka Job date: Wed, 17 Nov 2021 06:21:06 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| How CPI Data Affects Currency Prices Posted: 17 Nov 2021 02:35 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ In this article, we'll explore CPI and forex trading, looking at what traders should know about the Consumer Price Index to make informed decisions. We'll cover what CPI is as a concept, the CPI release dates, how to interpret CPI, and what to consider when trading forex against CPI data. What is CPI and why does it matter to forex traders?The Consumer Price Index, better known by the acronym CPI, is an important economic indicator released on a regular basis by major economies to give a timely glimpse into current growth and inflation levels. Inflation tracked through CPI looks specifically at purchasing power and the rise of prices of goods and services in an economy, which can be used to influence a nation's monetary policy. CPI is calculated by averaging price changes for each item in a predetermined basket of consumer goods, including food, energy, and also services such as medical care. It is a useful indicator for forex traders due to its aforementioned effect on monetary policy and, in turn, interest rates, which have a direct impact on currency strength. The full utility of knowing how to interpret CPI as a forex trader will be explored below. Read more on how interest rates impact the forex market. CPI release datesCPI release dates usually occur every month, but in some countries, such as New Zealand and Australia, quarterly. Some nations also offer yearly results, such as Germany's index. The US Bureau of Labor Statistics has reported the CPI monthly since 1913. The following table shows a selection of major economies and information about their CPI releases.

Why forex traders should follow CPI dataUnderstanding CPI data is important to forex traders because it is a strong measure of inflation, which in turn has a significant influence on central bank monetary policy. So how does CPI affect the economy? Often, higher inflation will translate to higher benchmark interest rates being set by policymakers, to help dampen the economy and subdue the inflationary trend. In turn, the higher a country's interest rate, the more likely its currency will strengthen. Conversely, countries with lower interest rates often mean weaker currencies. The release and revision of CPI figures can produce swings in a currency's value against other currencies, meaning potentially favorable volatility from which skilled traders can benefit. Also, CPI data is often recognized as a useful gauge of the effectiveness of the economic policy of governments in response to the condition of their domestic economy, a factor that forex traders can consider when assessing the likelihood of currency movements. The CPI can also be used in conjunction with other indicators, such as the Producer Price Index, for forex traders to get a clearer picture of inflationary pressures. What to consider when trading forex against CPI dataWhen using CPI data to influence forex trading decisions, traders should consider the market expectations for inflation and what is likely to happen to the currency if these expectations are met, or if they are missed. Similar to any major release, it may be beneficial to avoid having an open position immediately before. Traders might consider waiting for several minutes after the release before looking for possible trades, since forex spreads could widen significantly right before and after the report. Below is a chart displaying the monthly inflation rates for the US. For the latest month, expectations are set at 1.6% inflation compared to last year's data. If CPI is released higher or lower than expectations this news event does have the ability to influence the market.

Chart to show US inflation levels in 2018/19. Source: TradingEconomics.com. US Bureau of Labor Statistics One way the effects of CPI data can be interpreted is by monitoring the US Dollar Index, a 2018/19 example chart for which is below. If CPI is released away from expectations, it is reasonable to believe this may be the catalyst to drive the Index to fresh highs, or to rebound from resistance. Since the Index is comprised of EUR/USD, USD/JPY, and GBP/USD, by watching the US Dollar we can get a full interpretation of the events outcome.

Chart to show movement in the US Dollar Index. Source: TradingView.com As can be observed in the example above, as inflation rose during the first half of 2018, the US Dollar Index went up accordingly. But with US inflation drifting lower in the following months and with a missed target of 2%, this pushed US interest rate hikes off the agenda. As a result, the dollar struggled and weakened against a basket of other currencies. Not every fundamental news release works out through price as expected. Once the CPI data has been released and analyzed, traders should then look to see if the market price is moving through or rebounding off any areas of technical importance. This will help traders understand the short-term strength of the move and/or the strength of technical support or resistance levels, and help them make more informed trading decisions. Read more on CPI, inflation and forexMake sure you bookmark our economic calendar to stay tuned in to the latest CPI data released by a range of countries, and stay abreast of all the DailyFX news and analysis updates. Also, reserve your place at our Central Bank Weekly webinar series to learn about news events, market reactions, and macro trends. For more information on inflation and its impact on forex decisions, take a look at our article Understanding Inflation for Currency Trading.

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Posted: 17 Nov 2021 02:30 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Quality Analyst Company: UBS Job description: different roles to acquiring fresh knowledge and skills – at UBS we know that great work is never done alone. We know that it… Minimum 5 years experience of testing complex systems and business flows should have full understanding of SDLC, QA and Defect… Expected salary: Location: Pune, Maharashtra Job date: Wed, 17 Nov 2021 06:40:45 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Remove False signals from your Forex Trading Posted: 17 Nov 2021 02:13 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Remove False Signal From Your Trading. False trading signals are the real reason for draining money from your forex account. So, If in any way you decrease the false signals you will increase your net profit dramatically. Today in this video I will teach you some ways to remove those false signals from your Forex trading. 3 Days Forex Analyzing Course: source Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Posted: 17 Nov 2021 01:59 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: VP Product Control Company: HSBC Job description: for all Global Markets (GM) asset classes including Forex, Forex Derivatives, Interest Rate Derivatives, Fixed income, Money Market… systems for EOD Valuation, stale price checks along with building controls around the data sources. Reporting of various… Expected salary: Location: Mumbai, Maharashtra Job date: Wed, 17 Nov 2021 05:38:39 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| No End Yet in Sight for EUR/USD Weakness Posted: 17 Nov 2021 01:33 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ EUR price, news and analysis:

EUR/USD weakness to persistThe tumble in EUR/USD that has taken it from a high of 1.2266 on May 25 to only just above 1.13 now shows no sign of ending anytime soon. Indeed, the price has now broken below the support line connecting the lower lows of a downward-sloping channel in place since that May date and this means it could drop much further, perhaps to the lows around 1.1170 reached in June last year. As always, a near-term bounce cannot be ruled out but a sustained rally looks very unlikely even though the 14-day relative strength index, or RSI, that can seen at the bottom of the chart below is now under the 30 level that suggests the pair has been oversold. EUR/USD Price Chart, Daily Timeframe (May 24 – November 17, 2021)Source: IG (You can click on it for a larger image) ECB pushes back against rate risesFrom a fundamental perspective, the key problem for Euro bulls is that ECB President Christine Lagarde is still arguing that tightening monetary policy now to rein in Eurozone inflation would throttle the Eurozone's economic recovery – and that economists and the markets are still too hawkish. Even after the Covid-19 pandemic ends "It will still be important that monetary policy – including the appropriate calibration of asset purchases – supports the recovery throughout the Euro area and the sustainable return of inflation to our target of 2%," she said earlier this week. This contrasts with market speculation that the Federal Reserve will accelerate the tapering of US monetary measures to boost economic growth as US inflation remains stubbornly high, and that the Bank of England will raise UK interest rates on December 16, also to counter strong inflationary pressures. Sentiment data bearishTurning to the positioning of retail traders, IG client sentiment data also argue for a still weaker Euro. The numbers show 71.59% of EUR/USD traders are net-long, with the ratio of traders long to short at 2.52 to 1. The number of traders net-long is 3.32% lower than yesterday but 23.26% higher than last week, while the number of traders net-short is 10.31% lower than yesterday and 32.38% lower than last week. Here at DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias. Like to know more about EUR/USD and why to trade it? Check out this article here — Written by Martin Essex, Analyst Feel free to contact me on Twitter @MartinSEssex

Source link Click to rate this post! [Total: 0 Average: 0] | |||||||||||||||||||||||||||||||||

| Posted: 17 Nov 2021 01:27 AM PST Halloween Sale! Buy 1 get 10% off, Buy 2 get 15% Shop Now https://www.dresslily.com/promotion/Halloween-pre.html Hot deals ,ALL $12.99 Hot deals ,ALL $9.99 Hot deals ,ALL $6.99 ------------------------------------ Job title: Automation Quality Analyst Company: UBS Job description: different roles to acquiring fresh knowledge and skills – at UBS we know that great work is never done alone. We know that it… Minimum 5 years experience of testing complex systems and business flows should have full understanding of SDLC, QA and Defect… Expected salary: Location: Pune, Maharashtra Job date: Wed, 17 Nov 2021 01:01:58 GMT Apply for the job now!  UP TO 70% OFF UP TO 70% OFF BUY 1 GET 1 FREE UP TO 70% OFF DressLily 9th Anniv Mega sale! Up to 25% off with code: DL9TH from 10th Aug to 18th Aug Click to rate this post! [Total: 0 Average: 0] |

| You are subscribed to email updates from Forex System. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

WE INVEST.

WE INVEST.

Did you know? When we set out to

Did you know? When we set out to  Tip: It may be too late to stock up on inventory for the holidays, given the supply-chain chaos, but small business owners should already be preparing for 2022. Valentine’s Day and Easter are just around the corner.

Tip: It may be too late to stock up on inventory for the holidays, given the supply-chain chaos, but small business owners should already be preparing for 2022. Valentine’s Day and Easter are just around the corner. FYI: In our

FYI: In our  Bottom line: Small business owners have a lot of options for funding. If you have time for the longer process, a bank loan is a good choice. If you need fast funding, consider working capital loans and

Bottom line: Small business owners have a lot of options for funding. If you have time for the longer process, a bank loan is a good choice. If you need fast funding, consider working capital loans and

No comments:

Post a Comment