2018-11-20

Overview:

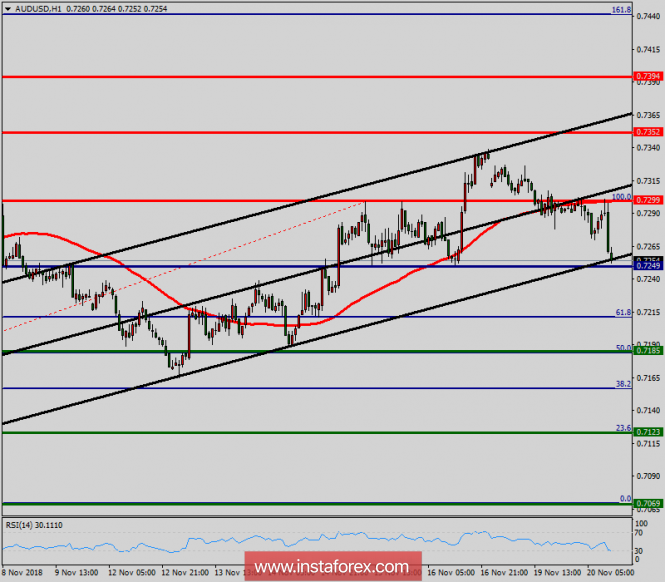

Pivot point: 0.7299.

The AUD/USD pair continues to trade upwards from the level of 0.7185. This week, the pair rose from the level of 0.7185 to a top around 0.7299 but it rebounded to set around the spot of 0.7242. Today, the first resistance level is seen at 0.7299 followed by 0.7352, while daily support 1 is seen at 0.7185 (50% Fibonacci retracement). According to the previous events, the AUD/USD pair is still moving between the levels of 0.7250 and 0.7352; so we expect a range of 102 pips. Furthermore, if the trend is able to break out through the first resistance level at 0.7299, we should see the pair climbing towards the double top (0.7299) to test it. Therefore, buy above the level of 0.7299 with the first target at 0.7352 in order to test the daily resistance 1 and further to 0.7394. Also, it might be noted that the level of 0.7394 is a good place to take profit because it will form a double top. On the other hand, in case a reversal takes place and the AUD/USD pair breaks through the support level of 0.7185, a further decline to 0.7069 can occur which would indicate a bearish market.

Technical analysis of EUR/USD for November 20, 2018

2018-11-20

Overview:

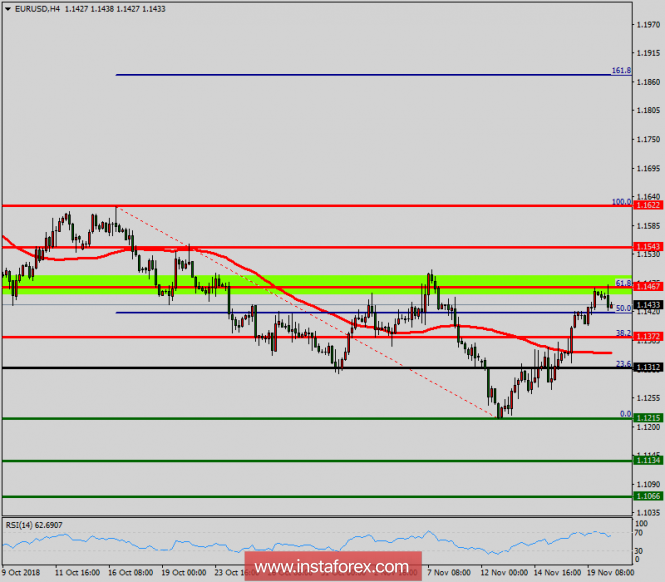

The EUR/USD pair fell from the level of 1.1467 to the bottom around 1.1215. But the pair rebounded from the bottom of 1.1215 to close at 1.1347. Probably; historic will repeats itself again. Today, the first support level is seen at 1.1215, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.1312, which coincides with the 23.6% Fibonacci retracement level. This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.1215 , the market will decline further to 1.1134 in order to test the weekly support 2. In the H4 time frame, the pair will probably go down because the downtrend is still strong. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.1215 with the first target at 1.1170 and further to 1.1134. At the same time, the breakdown of 1.1312 will allow the pair to go further up to the levels of 1.1467 in order to retest the major resistance.

AUD/USD analysis for November 20, 2018

2018-11-20

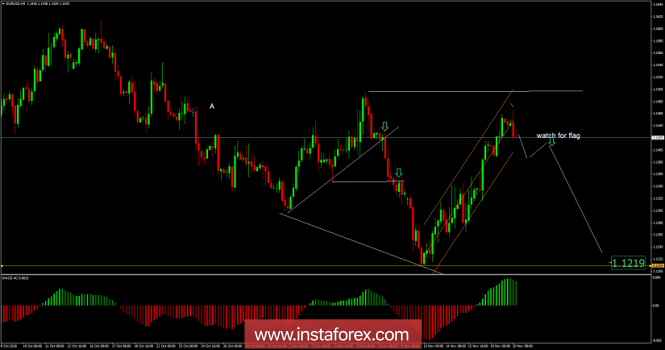

Recently, the AUD/USD pair has been trading sideways at the price of 0.7258. According to the H4 time – frame, I have found a fake breakout of the resistance at the price of 0.7300, which is a sign of weakness. I also found the breakout of the support trendline in the background and hidden bearish divergence on the MACD oscillator, which is another sign of weakness. Watch for selling opportunities with the target at the price of 0.7167.

EUR/USD analysis for November 20, 2018

2018-11-20

Recently, the EUR/USD pair has been trading upwards. The price tested the level of 1.1471. Anyway, according to the H4 time – frame, I found the potential reversal zone around the level of 1.1465. I found the up-thrust (reversal bar) and price failed to test the resistance at 1.1500, which is a sign of weakness. The upward channel is active and my advice is to watch for a breakout of the upward channel to confirm a further downward movement. The downward target is set at the price of 1.1220,

No comments:

Post a Comment