Elliott wave analysis of EUR/JPY for November 20, 2018

Elliott wave analysis of EUR/JPY for November 20, 2018

2018-11-20

EUR/JPY has traded within a very narrow band the last 24 hours. Nothing has changed and we continue to look for more downside pressure in wave C towards 123.66 to complete wave (E) and the long-term triangle consolidation.

A break above 129.35 will be of concern, but it will take a break above 130.13 to invalidate the C-wave target and indicate that wave (E) already has completed and a new impulsive rally is building.

R3: 130.13

R2: 129.40

R1: 129.06

Pivot: 128.90

S1: 128.40

S2: 128.00

S3: 127.74

Trading recommendation:

We sold EUR at 128.75 with our stop placed at 129.75.

Elliott wave analysis of EUR/NZD for November 20, 2018

2018-11-20

With the break above 1.6706 it was confirmed that wave iii/ had completed and wave iv/ towards at least 1.6914 is developing. The former resistance at 1.6706 now acts as support and will ideally protect the downside for the expected continuation higher to 1.6914.

Only an unexpected break below support at 1.6561 will invalidate the expected rally towards at least 1.6914.

R3: 1.6836

R2: 1.6793

R1: 1.6731

Pivot: 1.6706

S1: 1.6660

S2: 1.6570

S2: 1.6561

Trading recommendation:

We are long EUR from 1.6706 and we have placed our stop at 1.6555. Upon a break above 1.6768 we will move our stop higher to break-even.

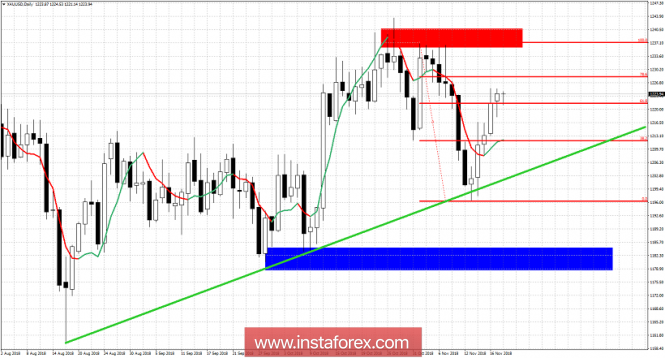

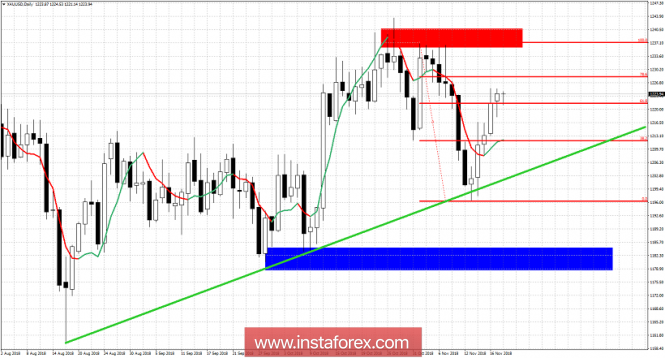

Technical analysis for Gold for November 20, 2018

2018-11-20

Gold price is trading around $1,224 remaining in a bullish short-term trend. Price is now above the 61.8% Fibonacci retracement but the upward momentum has weakened according to the 4hour RSI. I expect Gold to pull back or start a new downward move from current levels.

2018-11-20

EUR/JPY has traded within a very narrow band the last 24 hours. Nothing has changed and we continue to look for more downside pressure in wave C towards 123.66 to complete wave (E) and the long-term triangle consolidation.

A break above 129.35 will be of concern, but it will take a break above 130.13 to invalidate the C-wave target and indicate that wave (E) already has completed and a new impulsive rally is building.

R3: 130.13

R2: 129.40

R1: 129.06

Pivot: 128.90

S1: 128.40

S2: 128.00

S3: 127.74

Trading recommendation:

We sold EUR at 128.75 with our stop placed at 129.75.

Elliott wave analysis of EUR/NZD for November 20, 2018

2018-11-20

With the break above 1.6706 it was confirmed that wave iii/ had completed and wave iv/ towards at least 1.6914 is developing. The former resistance at 1.6706 now acts as support and will ideally protect the downside for the expected continuation higher to 1.6914.

Only an unexpected break below support at 1.6561 will invalidate the expected rally towards at least 1.6914.

R3: 1.6836

R2: 1.6793

R1: 1.6731

Pivot: 1.6706

S1: 1.6660

S2: 1.6570

S2: 1.6561

Trading recommendation:

We are long EUR from 1.6706 and we have placed our stop at 1.6555. Upon a break above 1.6768 we will move our stop higher to break-even.

Technical analysis for Gold for November 20, 2018

2018-11-20

Gold price is trading around $1,224 remaining in a bullish short-term trend. Price is now above the 61.8% Fibonacci retracement but the upward momentum has weakened according to the 4hour RSI. I expect Gold to pull back or start a new downward move from current levels.

Red rectangle - major resistance

Blue rectangle - major support

Green trend line - short-term trend support

Gold price is making higher highs and higher lows in small time frames. However in the Daily chart we remain below the key resistance of $1,243.50. Gold price shows bearish divergence RSI signs in the 4 hour chart and if short-term support at $1,218 is broken, I will assume that the entire bounce is over and we should at least challenge the green trend line at $1,210-$1,205 area. Gold price has important support at $1,196 that if broken, we will see prices move towards the blue rectangle area at least. If the red rectangle resistance is broken Gold could rally 20$ higher. I continue to consider this bounce as a selling opportunity with stops at the highs of October and remain bearish as long as we trade below that area.

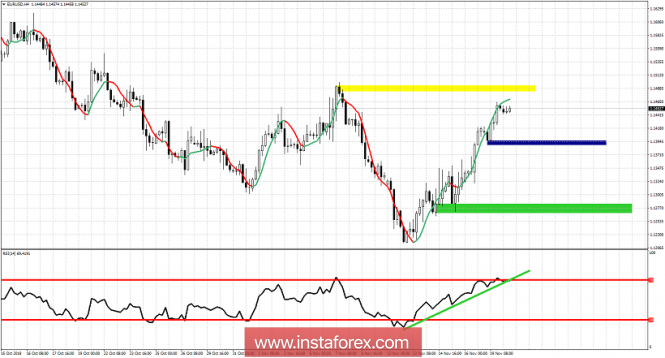

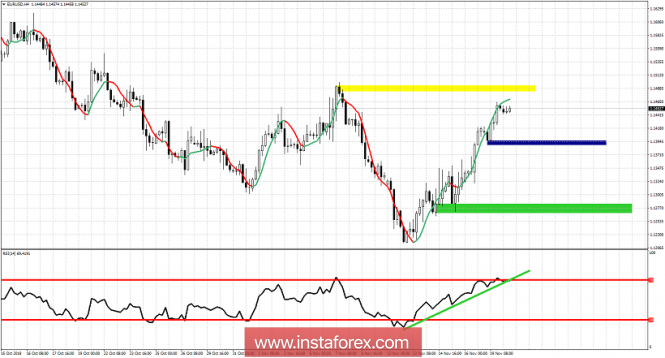

Technical analysis for EUR/USD for November 20, 2018

2018-11-20

EUR/USD is in a bullish short-term trend since bottoming around 1.1215. Our first target of 1.13 was reached and our next target of 1.1450-1.15 is also accomplished. There are no bearish divergence signs in short time frames but bulls should be very cautious from now on.

Blue rectangle - major support

Green trend line - short-term trend support

Gold price is making higher highs and higher lows in small time frames. However in the Daily chart we remain below the key resistance of $1,243.50. Gold price shows bearish divergence RSI signs in the 4 hour chart and if short-term support at $1,218 is broken, I will assume that the entire bounce is over and we should at least challenge the green trend line at $1,210-$1,205 area. Gold price has important support at $1,196 that if broken, we will see prices move towards the blue rectangle area at least. If the red rectangle resistance is broken Gold could rally 20$ higher. I continue to consider this bounce as a selling opportunity with stops at the highs of October and remain bearish as long as we trade below that area.

Technical analysis for EUR/USD for November 20, 2018

2018-11-20

EUR/USD is in a bullish short-term trend since bottoming around 1.1215. Our first target of 1.13 was reached and our next target of 1.1450-1.15 is also accomplished. There are no bearish divergence signs in short time frames but bulls should be very cautious from now on.

Yellow rectangle - resistance

Blue rectangle - short-term support

Green rectangle - trend support

Green line - trend line support

EUR/USD is approaching its last high. This is resistance area. Support is at 1.14-1.1390. If broken we would have the first weakness sign. If this happens we would most probably have a break of the green RSI trend line. We are very close to breaking it. Price of the RSI is marginally holding above it. So bulls need to be very careful as the RSI is reaching overbought levels. A break below the green rectangle area will confirm that we are in a new downward leg towards 1.1050. Breaking above 1.15 area would be a bullish sign but price should not be chased by bulls at current levels.

GBP/JPY Testing Support, Prepare For A Bounce

2018-11-20

GBP/JPY is approaching its support at 144.30 (100% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where price is expected to bounce up to its resistance at 145.93 (38.2% Fibonacci retracement, horizontal pullback resistance).

Stochastic (89, 5, 3) is testing its support at 2.7% where a corresponding bounce is expected.

GBP/JPY is testing its support where we expect to see a bounce.

Buy above 144.30. Stop loss at 143.18. Take profit at 145.93.

Blue rectangle - short-term support

Green rectangle - trend support

Green line - trend line support

EUR/USD is approaching its last high. This is resistance area. Support is at 1.14-1.1390. If broken we would have the first weakness sign. If this happens we would most probably have a break of the green RSI trend line. We are very close to breaking it. Price of the RSI is marginally holding above it. So bulls need to be very careful as the RSI is reaching overbought levels. A break below the green rectangle area will confirm that we are in a new downward leg towards 1.1050. Breaking above 1.15 area would be a bullish sign but price should not be chased by bulls at current levels.

GBP/JPY Testing Support, Prepare For A Bounce

2018-11-20

GBP/JPY is approaching its support at 144.30 (100% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where price is expected to bounce up to its resistance at 145.93 (38.2% Fibonacci retracement, horizontal pullback resistance).

Stochastic (89, 5, 3) is testing its support at 2.7% where a corresponding bounce is expected.

GBP/JPY is testing its support where we expect to see a bounce.

Buy above 144.30. Stop loss at 143.18. Take profit at 145.93.

No comments:

Post a Comment