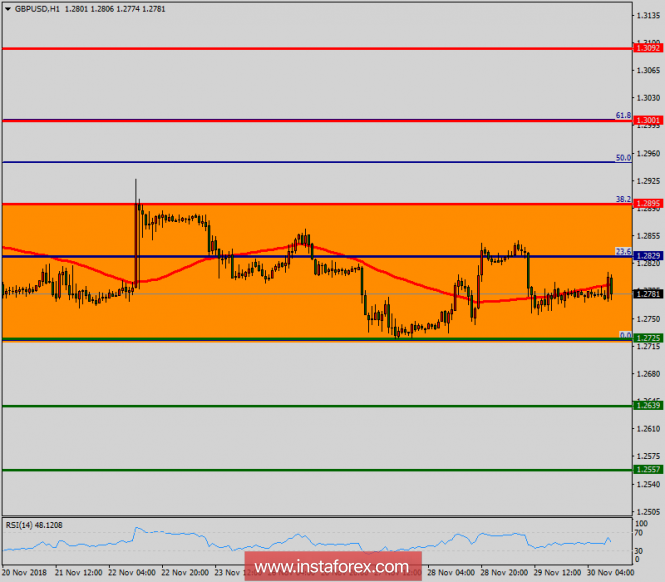

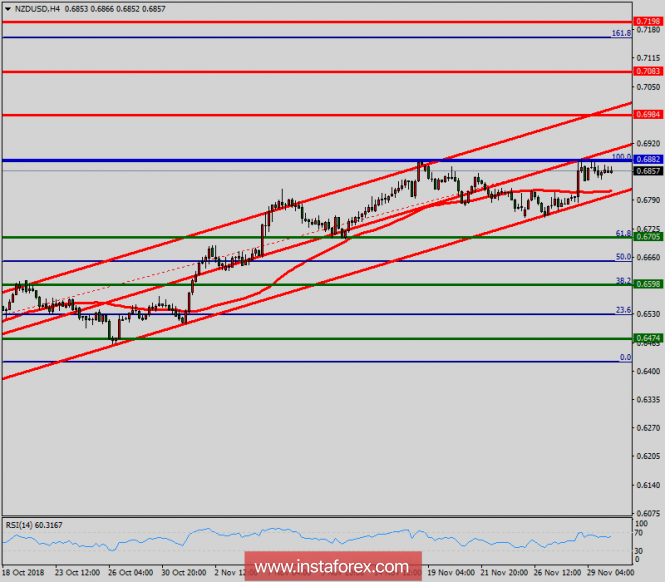

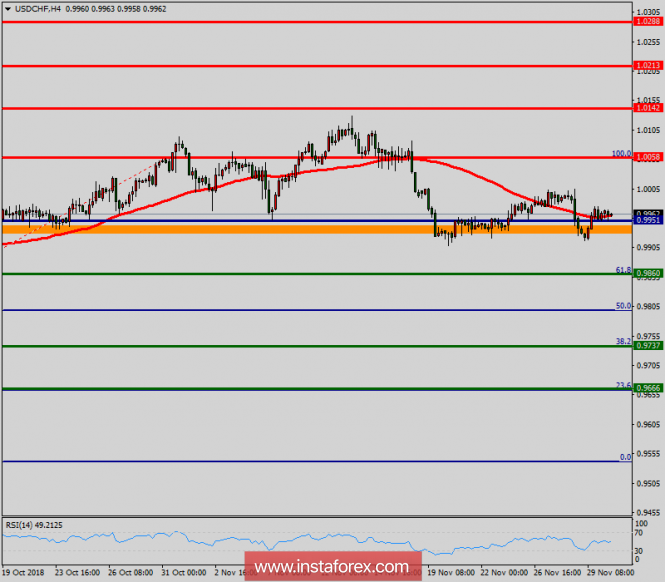

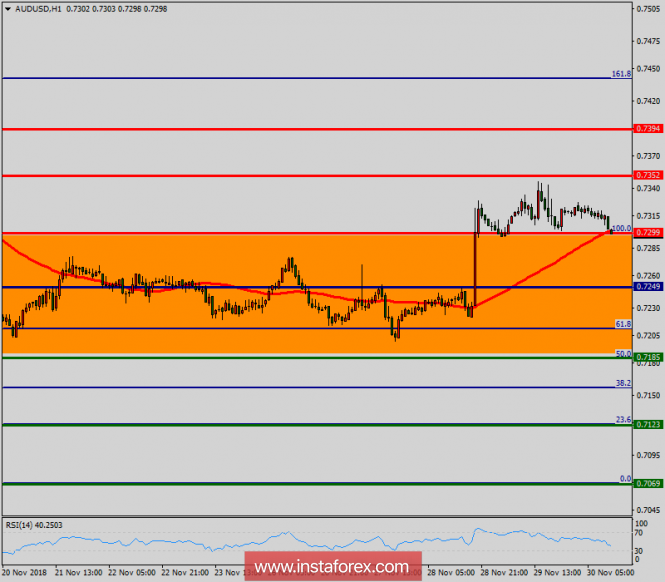

| Technical analysis of GBP/USD for November 30, 2018 2018-11-30  Overview: The GBP/USD pair fell from the level of 1.2890 towards 1.2780. Now, the price is set at 1.2850. On the H1 chart, the resistance is seen at the levels of 1.2890 and 1.3001. Volatility is very high for that the GBP/USD pair is still expected to be moving between 1.2829 and 1.2725 in coming hours. In the short term, we expect the GBP/USD pair to continue to trade in a bullish trend from the new support level of 1.2725 to form a bullish channel. Also, it should be noted that major resistance is seen at 1.2829, while immediate resistance is found at 1.2829. According to the previous events, the pair is likely to move from 1.2725 towards 1.2829 and 1.2890 as targets. In the H4 time frame: However, if the pair fails to pass through the level of 1.2890, the market will indicate a bearish opportunity below the level of 1.2890. So, the market will decline further to 1.2725 in order to return to the daily support. Moreover, a breakout of that target will move the pair further downwards to 1.2640. Technical analysis of NZD/USD for November 30, 2018 2018-11-30  Overview: The NZD/USD pair broke resistance which turned to strong support at the level of 0.6705 this week. The level of 0.6705 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today. The Relative Strength Index (RSI) is considered overbought because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 0.6800 with the first target at the level of 0.6882. From this point, the pair is likely to begin an ascending movement to the point of 0.6882 and further to the level of 0.6984. The level of 0.6984 will act as strong resistance. On the other hand, if a breakout happens at the support level of 0.6705, then this scenario may become invalidated. Technical analysis of USD/CHF for November 30, 2018 2018-11-30  Overview: The USD/CHF pair didn't make any significant movements yesterday. There are no changes in our technical outlook. The bias remains bullish in the nearest term testing 1.0142 or heigher. The USD/CHF pair continue to trade upwards from the level of 0.9951 on the H4 chart. Today, the first support level is currently seen at 0.9951, the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 0.9951, which coincides with the daily pivot point. This support has been rejected three times confirming the veracity of an uptrend. According to the previous events, we expect the USD/CHF pair to trade between 0.9951 and 1.0058. So, the support stands at 0.9951, while daily resistance is found at 1.0058. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.0058. In other words, buy orders are recommended above the spot of 1.0058/0.9951with the first target at the level of 1.0142; and continue towards 1.0216. However, if the USD/CHF pair fails to break through the resistance level of 1.0058 today, the market will decline further to 0.9860. Technical analysis of AUD/USD for November 30, 2018 2018-11-30  Overview: The AUD/USD pair continue to trade upwards from the level of 0.7242. The pair rose from the level of 0.7242 to a top around 0.7299 but it rebounded to set around the spot of 0.7242. Today, the first resistance level is seen at 0.7299 followed by 0.7352, while daily support 1 is seen at 0.7185 (50% Fibonacci retracement). According to the previous events, the AUD/USD pair is still moving between the levels of 0.7250 and 0.7352; so we expect a range of 102 pips. Furthermore, if the trend is able to break out through the first resistance level at 0.7299, we should see the pair climbing towards the double top (0.7299) to test it. Therefore, buy above the level of 0.7299 with the first target at 0.7352 in order to test the daily resistance 1 and further to 0.7394. Also, it might be noted that the level of 0.7394 is a good place to take profit because it will form a double top. On the other hand, in case a reversal takes place and the AUD/USD pair breaks through the support level of 0.7185, a further decline to 0.7069 can occur which would indicate a bearish market. AUD/USD analysis for November 30, 2018 2018-11-30

Recently, the AUD/USD pair has been trading sideways at the price of 0.7300. Anyway, according to the H1 time – frame, I have found confirmed intraday head and shoulders pattern (bearish), which is a sign that sellers are in control. I also found a hidden bearish divergence on the MACD oscillator, which is another sign of weakness. My advice is to watch for selling opportunities. The downward target is set at the price of 0.7252. Intraday technical levels and trading recommendations for EUR/USD for November 30, 2018 2018-11-30

On the weekly chart, the EUR/USD pair is demonstrating a highly possible Head and Shoulders reversal pattern, where the right shoulder is currently in progress. On the Daily chart, the pair has been moving sideways with slight bearish tendency. Recent bearish movement is maintained within the depicted daily movement channel. On November 13, the EUR/USD demonstrated recent bullish recovery around 1.1220-1.1250 where the lower limit of the channel, as well as the depicted demand zone came to meet the pair. Quick bullish advancement was demonstrated towards 1.1420. It should be noted that prominent supply zone, as well as the previous wave high are located around 1.1420-1.1520. Bullish fixation above 1.1420 was needed to enhance further bullish movement towards 1.1520. However, the market demonstrated significant bearish rejection (shooting-star weekly candlestick). The EUR/USD pair remains under bearish pressure below 1.1420. The nearest demand level to meet the pair is located around 1.1270 (upper limit of the demand zone) and 1.1170 (the lower limit of the depicted channel). Thus, the pair remains trapped between 1.1420 and 1.1270 until a breakout occurs in either directions. A quick bearish decline was expected towards 1.1270 and probably the price zone of 1.1170-1.1150 would be visited soon if early bearish breakout below 1.1270 is achieved on lower time frames. Intraday technical levels and trading recommendations for GBP/USD for November 30, 2018 2018-11-30

On September 21, the GBP/USD failed to demonstrate sufficient bullish momentum above 1.3296. Since then, the short-term outlook turned to become bearish under the depicted daily downtrend. On the H4 chart, the GBP/USD pair looked oversold around the price levels of 1.2700 where profitable BUY entries were suggested. A Quick bullish movement was demonstrated towards the price level of 1.3170-1.3200 where another descending high around the depicted downtrend was established. This initiated the current bearish pullback towards the depicted consolidation-zone of (1.2750-1.2880) where the current sideway movement within the depicted H4 channel was initiated. Recently, the GBP/USD pair failed to establish a successful bullish breakout above the price level of 1.2880 (the upper limit of the current consolidation range). Moreover, bearish persistence below 1.2790 (79.8% Fibonacci level) allowed a quick bearish decline to occur towards the price zone around 1.2750-1.2730. The current scenario may pursue a bearish flag continuation pattern provided that bearish persistence below 1.2730 is maintained on a daily basis. Projected target for the bearish flag continuation pattern is initially located around 1.2600.

Author's today's articles: Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Mohamed Samy  Born November 18, 1966, in Egypt. In 1990 graduated from the Faculty Of Engineering, Alexandria University. In 2000 started to follow financial markets. Took a higher diploma in investing and finance in 2008 and also CMT in 2009. Started at the Financial World as an analyst, then worked as a technical analysis consultant at Misr Financial Investments Co. Since 2005 has been working on the Stock Exchange. Has been familiar with Forex since December 2005. Being a member of the Egyptian Society of Technical Analysis, attends seminars and conferences dedicated to financial markets. Is a member of the American Market Technicians Association. Interests: football, reading, volleyball, swimming, movies Born November 18, 1966, in Egypt. In 1990 graduated from the Faculty Of Engineering, Alexandria University. In 2000 started to follow financial markets. Took a higher diploma in investing and finance in 2008 and also CMT in 2009. Started at the Financial World as an analyst, then worked as a technical analysis consultant at Misr Financial Investments Co. Since 2005 has been working on the Stock Exchange. Has been familiar with Forex since December 2005. Being a member of the Egyptian Society of Technical Analysis, attends seminars and conferences dedicated to financial markets. Is a member of the American Market Technicians Association. Interests: football, reading, volleyball, swimming, movies

Subscription's options management

Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

Alexandros Yfantis, Arief Makmur, Dean Leo, Oscar Ton, Michael Becker, Mohamed Samy, Mourad El Keddani, Petar Jacimovic, Rocky Yaman, Sebastian Seliga, Torben Melsted

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

No comments:

Post a Comment