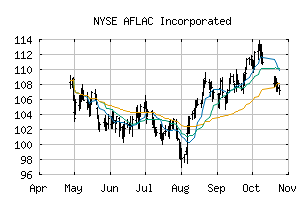

This week's pick is: AFLAC (NYSE:AFL) The market's performance leading into the Thanksgiving holiday gave investors pause and reignited doubts about the strength of the US economy. The S&P 500 fell by 3.5%, and the tech-heavy NASDAQ registered a loss of more than 4%. In the past two months, the broader averages have dropped by about 10% - a solid sign of a correction. But as with any market, not all sectors experience bullish or bearish outlooks at the same time. In a volatile market that's undergoing a rising rate environment, one sector, in particular, stands out - financials. This segment of the economy, which includes industries like banks and insurance companies, typically outperforms when interest rates rise. Because they are required by law to keep large cash holdings, they are limited as to how they can invest it - investment grade bonds, treasuries, and other conservative assets. That means as rates go higher, so too does the rate of investment returns. For one insurance company, a rising rate environment and uncertain economic outlook is a recipe for bigger profits. A Best-In-Breed Company with Staying Power Aflac Incorporated (AFL) is a $34 billion accident and health insurance company that most consumers are familiar with through its colorful duck mascot. The company's primary business is supplemental insurance with its best-known policy being payroll deduction coverage which provides insureds with income during periods of illness or disability. The company reported an earnings beat for the third quarter of $1.03 per share compared to the $0.99 per share that analysts had expected. Revenues came in 1% higher as well at $5.58 billion while net investments income, helped out by the rising interest rates, climbed 3.3% for the quarter. The company hasn't had an easy year with a fraud investigation causing share values to plummet. But the claim turned out to be nothing more than a rumor and the stock has slowly begun to reclaim lost ground registering a slight 1.30% gain year-to-date. It has more stable earnings than most life insurance companies while sales of benefits products have grown both in the US as well as Japan. One defensive aspect of Aflac is the fact that the company does most of its business in Japan - not the US. That means it's geographically diverse and won't be as affected by domestic economic downturns or corrections. In August, the stock was upgraded by Sandler O'Neill from "hold" to "buy" as well giving investors a clue that Wall Street may be catching on to Aflac's building defensive value stock story. The Fundamental Case Aflac's stock trades in line with the industry average at 11 times earnings but comes with a PEG ratio of less than 2 suggesting that the stock may be currently undervalued. The stock is also less volatile than the broader averages with a beta of 0.90 with 1.0 being the benchmark for the S&P 500. That means that Aflac's stock shouldn't be subjected to as much volatility as other stocks. AFL - Free Technical Analysis As with most insurance stocks, Aflac comes with a dividend as well which currently yields 2.35%. That should help protect against downside movements and gives investors income during volatile markets. Based on Aflac's full-year EPS estimates, this stock should be fairly valued at around $48 per share - a gain of about 11% with the annual dividend reinvested. As the markets continue to show signs of weakness, Aflac should provide investors with a safe haven and reliable profits going forward " especially if 2019 turns out to be the year of the bear.

| | 44.430 | 44.750 | 44.175 | 44.325 | -0.285 |

|

| | Year High | 48.187 | | Year Low | 41.41 | | 52wk High | 48.187 | | 52wk Low | 41.41 | | Previous Close | 44.61 | | Average Volume | 3,328,202 | | % Institutional | 63.3 | | Volatility | 20.63 | | Assets | M | | Liabilities | M |

|

|

This stock was hand-selected as this week's Stock of the Week by Daniel Cross, professional trader and financial writer. Please note that AFL may not stay a favorite for this entire week. Markets change and so do the recommendations on what to do with AFL. To get up-to-date buy and sell signals for AFL and other analyzed stocks, take a 30-day trial to MarketClub today. |

No comments:

Post a Comment