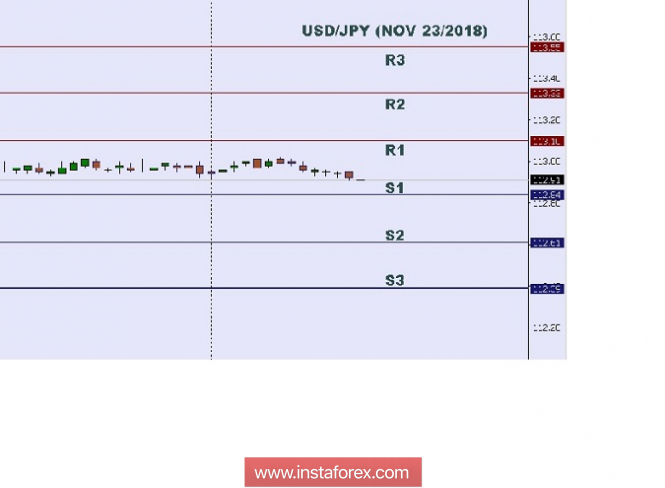

| Technical analysis: Intraday level for USD/JPY for November 23, 2018 2018-11-23

In Asia, Japan will release the Flash Manufacturing PMI and the US will publish some economic data such as Flash Services PMI, and Flash Manufacturing PMI. So there is a probability that the USD/JPY pair will move with a low to a medium volatility during this day. TODAY'S TECHNICAL LEVEL: Resistance. 3: 113.55. Resistance. 2: 113.33. Resistance. 1: 113.10. Support. 1: 112.84. Support. 2: 112.61. Support. 3: 112.39. Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors.The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Technical analysis: Intraday Level For EUR/USD for November 23, 2018 2018-11-23

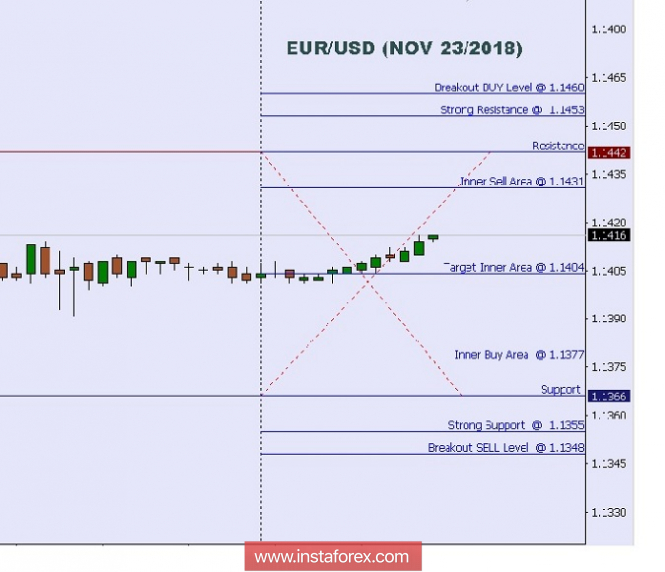

When the European market opens, some economic data will be released such as Belgian NBB Business Climate, Flash Services PMI, Flash Manufacturing PMI, German Flash Services PMI, German Flash Manufacturing PMI, French Flash Services PMI, French Flash Manufacturing PMI, and German Final GDP q/q. The US will also publish the economic data such as Flash Services PMI, and Flash Manufacturing PMI, so amid the reports, EUR/USD will move in a low to a medium volatility during this day. TODAY'S TECHNICAL LEVEL: Breakout BUY Level: 1.1460. Strong Resistance:1.1453. Original Resistance: 1.1442. Inner Sell Area: 1.1431. Target Inner Area: 1.1404. Inner Buy Area: 1.1377. Original Support: 1.1366. Strong Support: 1.1355. Breakout SELL Level: 1.1348. Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. GBP/JPY Approaching Resistance, Prepare For A Reversal 2018-11-23 GBP/JPY is approaching its resistance at 146.11(100% & 61.8% Fibonacci extension, 38.2% Fibonacci retracement, horizontal pullback resistance) where it is expected to reverse down to its support at 144.85 (61.8% Fibonacci retracement, horizontal pullback support). Stochastic (55, 5, 3) is approaching its resistance at 97% where a corresponding reversal is expected. GBP/JPY is approaching its resistance where we expect to see a reversal. Sell below 146.11. Stop loss 146.88. Take profit at 144.85.

Technical analysis for Gold for November 23, 2018 2018-11-23 Gold price remains below the important long-term resistance of $1,240-43.50. On a daily basis, price is making higher highs and higher lows for the last 3 months. If we see higher highs in November then we could expect much more upside in Gold prices. If the recent lows are broken, Gold will most probably push to new lows over the coming months.

Green line - major trend line support Red rectangle - long-term resistance Gold price has so far peaked at the 38% Fibonacci retracement level and where we also find important previous lows which are now confirmed resistance. Gold bulls need to break above $1,240 major resistance and the road to $1,270-$1,300 will be open. On the contrary, bears need to break below the green trend line support and specially below $1,180. If this happens, we should expect Gold prices to move below $1,100 over the coming months. Technical analysis for EUR/USD for November 23, 2018 2018-11-23 EUR/USD continues to trade above critical short-term support. The potential for a move towards 1.15 is still there. As long as we trade above 1.1380-1.1360, it is highly likely. Longer-term trend remains bearish targeting 1.10-1.08.

Yellow rectangle - resistance Green rectangle - major support Red rectangle- short-term support Blue line - trend line support EUR/USD is trading right along the blue trend line support. Breaking below it will be a bearish sign. However in order for bears to regain control of the short-term trend they will need to break below 1.1360 and the red rectangle area. Breaking below the green rectangle area will confirm the short-term bearish trend towards 1.10. So far we have not seen any bearish divergence sign. If the yellow rectangular area is tested, we might see one. Until then I remain neutral for the short-term. Elliott wave analysis of EUR/JPY for November 23, 2018 2018-11-23

Another range-trading day. Likely due to the US Thanksgiving holiday and today only being half a work day. So we do not expect much action to be seen before the start of next week. We continue to favor the bearish outcome and a break below support at 127.94 for a decline towards 123.66 to complete wave (E) and a long-term low being in place for the next impulsive rally. Resistance is now seen at 129.05 and more importantly at 129.23. Only a break above the later, will invalidate our bearish view and call for a rally towards 130.13 on the way higher to 133.00. R3: 130.13 R2: 129.40 R1: 129.06 Pivot: 128.90 S1: 128.40 S2: 128.00 S3: 127.74 Trading recommendation: We are short EUR from 128.75 with our stop+revers placed at 129.50. Elliott wave analysis of EUR/NZD for November 23, 2018 2018-11-23

We are still looking for a clear break above minor resistance at 1.6767 for a continuation of the ongoing correction towards at least 1.6914 and likely even closer to resistance at 1.7023. Only an unexpected break below support at 1.6683 and more importantly a break below support at 1.6560 will indicate that wave iv/ completed prematurely and wave v lower to 1.6250 already is unfolding. R3: 1.6879 R2: 1.6836 R1: 1.6832 Pivot: 1.6767 S1: 1.6731 S2: 1.6706 S3: 1.6642 Trading recommendation: We are long EUR from 1.6706 with our stop placed at 1.6555. We will raise our stop to break-even upon a break above 1.6767.

Author's today's articles: Arief Makmur  Born May, 15th/1970 at Jakarta; Graduate from Trisakti University in 1998 at Major Corporate & Bussiness Law. Starting in Finance World in 1998 at Jakarta Stock Exchange & Familliar with Forex Market since December 2003. Born May, 15th/1970 at Jakarta; Graduate from Trisakti University in 1998 at Major Corporate & Bussiness Law. Starting in Finance World in 1998 at Jakarta Stock Exchange & Familliar with Forex Market since December 2003. Dean Leo  Dean Leo lives in Singapore and graduated from the prestigious Nanyang Technological University. He worked previously at Standard Chartered in the risk management team and went on to build his own proprietary trading systems. He now works at the top investment research house providing technical analysis to the largest banks and hedge funds in different countries. Dean's approach utilizes 3 components to provide detailed and easy to understand analysis: graphical elements, mathematical indicators, Elliott structure. All 3 of these components are in line to create a holistic analysis on each currency pair. Dean Leo lives in Singapore and graduated from the prestigious Nanyang Technological University. He worked previously at Standard Chartered in the risk management team and went on to build his own proprietary trading systems. He now works at the top investment research house providing technical analysis to the largest banks and hedge funds in different countries. Dean's approach utilizes 3 components to provide detailed and easy to understand analysis: graphical elements, mathematical indicators, Elliott structure. All 3 of these components are in line to create a holistic analysis on each currency pair. Alexandros Yfantis  Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo Torben Melsted  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

Alexandros Yfantis, Arief Makmur, Dean Leo, Harsh Japee, Michael Becker, Mohamed Samy, Mourad El Keddani, Petar Jacimovic, Rocky Yaman, Sebastian Seliga, Torben Melsted

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

No comments:

Post a Comment