What's Driving Gold?

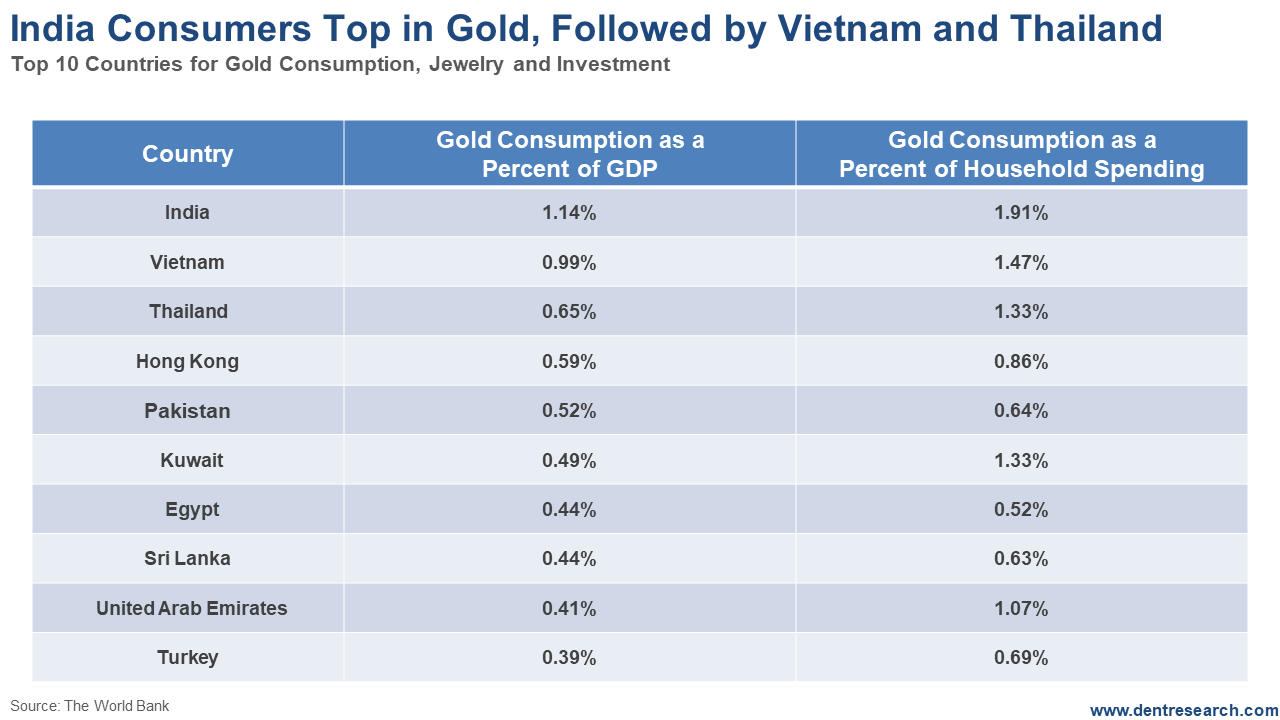

Harry Dent | November 06, 2019 | I have shown conclusively in my ebook on gold, How to Survive & Thrive During the Next Gold Bust, and past newsletter issues that gold correlates primarily with inflation rates – not just in the past century, but back to the 1700s! I have also shown that inflation correlates most with workforce growth. We will not see inflation rates like anything in the 1970s again, or at least not for many decades as births and workforce growth are slowing everywhere. It was a global baby boom that caused inflation rates to go the highest outside of war times in modern history into 1980. The U.S. saw as high as 16%. I have also claimed that commodities and gold could see the greatest boom yet into the next 30-Year Commodity Cycle into 2038-40. But how does that happen for gold if inflation rates will be lower in the future, even in emerging countries that have better demographic trends? Consumer demand… That's how! Virtually all of the demographic growth will come in the emerging world after this boom – and most of that in the developed world in the last 30 years came from the U.S. and its large immigration patterns into 2001. Emerging countries spend disproportionately more on commodities – more like 60% of income in India today and 40% in China. This is why I see a strong commodity boom and bubble in the next cycle despite lower inflation rates (yet, still higher than in the current deflationary period). | Man Who Predicted Trump's 2016 Election Victory Makes Shocking New Prediction For 2020... He predicted 2008's Great Recession... The devastating crash of oil prices in 2015... And Trump 2016 campaign victory... Now he's making another shocking prediction... one that could bring America to its knees by early 2020... Click here to see it now >> | I have also projected in the October Leading Edge that India, not China, will be the largest country in GDP in the world by 2065, and even more dominant by 2100 when Asia will rule more completely on a 165-year East-West cycle. Just guess which consumers spend the most on gold – for jewelry and investment? India! And by a lot. Here's the top 10 countries in consumer purchases of gold as a percentage of GDP and household spending. This table ranks by the highest percentage of GDP.

[Click to Enlarge] China has the largest overall spending on gold due to being the largest emerging country in GDP by far and the second largest overall. But China at 0.30% does not even make the top 10 list on gold spending here as a percentage of GDP, although Hong Kong does at 0.59%. India is a whopping 1.14% and 1.91% of household income. I've always said that Indians wear gold in places we can't even imagine. Vietnam and Thailand come next at 0.99% and 0.65%. Southeast Asia is my second region for stellar growth in the next global boom. Just for reference: The global average is 0.16% of GDP and 0.29% of household income. Note that all of the top 10 here are in Asia or the Middle East. The U.S. is a mere 0.03% of GDP, and Germany, second only to Switzerland in Europe, comes in at only 0.11%. Developed western countries do spend much less relatively on gold and commodities. Conclusion: The next global boom will be dominated by emerging countries, especially Asia and India. China and India together are already 53% of global consumer gold demand… Imagine what happens when India grows nearly as fast as China did in the last boom and spends three to four times as much on gold with Southeast Asia and much of the Middle East chiming in at high rates. Gold production only grows historically at about 2% a year. The demand from emerging countries led by India will be much higher than that!

Harry Dent |  Don't take CBD until you do this 1 thing Don't take CBD until you do this 1 thing

I hate to be a buzzkill…but despite all the media hype touting its "miraculous" qualities, you should NEVER take CBD until you do this 1 thing. | Trending Stories... I grew up on the Gulf Coast, beginning in Florida, then over to Texas, then part way back to Louisiana. We weren't testing beaches, we were following boats. My stepfather joined our family when I was quite young, essentially becoming my parent. He took a job on a shrimp boat in the Florida panhandle and... When David Stockman spoke at our IES conference in October, he had a whole slew of charts that showed that the main street economy had nothing to do with the Wall Street one – and that there were more signs of weakening growth than strengthening. He recently showed some updates and these were the two... Today's rant covers an unusual topic: China. No, not Chinese trade. We talk about that plenty. Rather, today I want to talk about a new angle on Chinese real estate. Chinese Real Estate The Chinese are strange real estate investors, largely because its communist government had not broadly allowed real estate ownership until recently in... It's been two days since my movers met my contractors. I don't mean a "Hey-nice-to-meet-you" kind of greeting; it was more of a "get-out-of-my-way-I'm-working-here." My planned extrication from my old digs into my partially-renovated new home didn't go like I thought it would. The exercise brought to mind the paraphrased wisdom of Von Moltke: "No... Somehow the stock market is expecting growth to re-accelerate after a disappointing 2.0% GDP growth in Q2. The only sign of such growth in the stock market is central banks lowering rates and expanding their balance sheets again. Q3 just came in at 1.9%, just below the 2.0% last quarter. And that covers over the... |

No comments:

Post a Comment