The economy continues to deliver a lot of mixed signals—a trend we expect to continue well into 2020. But for at least one signal, things are looking up.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can Manage Subscriptions. |  |  |  | |

|  |  Good morning. The economy continues to deliver a lot of mixed signals—a trend we expect to continue well into 2020. But for at least one signal, things are looking up. Good morning. The economy continues to deliver a lot of mixed signals—a trend we expect to continue well into 2020. But for at least one signal, things are looking up.

That signal? Home price growth. The trend, which had been on a decline since February 2018, showed an uptick in September. Higher home prices are a boon to homeowners, and a sign that the push for lower interest rates may be having a wealth effect on Main Street as well as Wall Street. If consumers feel wealthier, they'll spend more, and the economy will grow—a true self-fulfilling prophecy.

|

| |  |

|

| Will YOU Be the Next Microcap Millionaire?

(By clicking this link you will be registered — FREE — for the first-ever, the Microcap Millionaire Summit on December 3.)

|  |

|

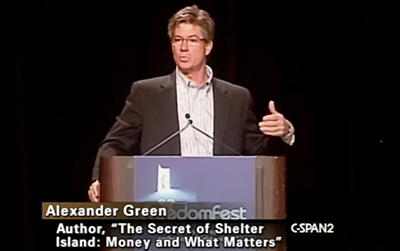

Meet Alex Green... Alex is an investment strategist and a GENIUS. He's known for picking really big winners... like the time one of his top microcaps took an incredible 1,795% gain in just ONE YEAR!

Enough to turn every $10,000 into $189,500 in just 12 months! This strategy is ignored by Wall Street... but YOU can still do it.

Click here now to find out - FOR FREE - Alex's next big microcap recommendation.

(By clicking this link you will be registered — FREE — for the first-ever, the Microcap Millionaire Summit on December 3.)

| |

|

|  |  |

| DOW 28,121.68 | +0.20% |  | |

| S&P 3,140.52 | +0.22% |  | |

| NASDAQ 8,647.93 | +0.18% |  | |

|

| *As of market close |

|

| • | Stocks rose yesterday, with trade expectations driving shares higher. |  | | • | Oil rose 0.6 percent, to $58.36 per barrel. |  | | • | Gold rallied 0.4 percent, to $1,462 per ounce. |  | | • | Cryptocurrencies generally rose, with bitcoin rallying 0.9 percent to $7,217. | | |

|

|

|

| Two Companies Offering a Great Returns Through Year's End |  |

|

|

With the stock market hitting all-time highs and with many retail names looking optimistic going into the year's end, the best values in the market going forward will be in companies with lower prospects.

By focusing on companies with lower expectations, investors get better valuations going in, and if it's a dividend-paying company, they get a higher starting yield.

Best of all, when these out-of-favor names move in favor with the market, investors will get a nice boost in capital gains.

» FULL STORY |

|

| |

|

|

| Insider Trading Reports: U.S. Concrete Inc. (USCR) | |

|

|

Kurt Cellar, director at US Concrete (USCR), picked up an additional 23,057 shares of the firm recently. That increased his stake by over 38 percent.

More importantly, the buy comes to $980,000—a sign of high conviction on shares.

Insider buying data shows this as the first buy from an insider in 2019, following a series of sales at prices anywhere from 8 to 22 percent higher than the current share price. Insiders own about 5 percent of the company.

» FULL STORY |

|

| |

|

|

| Unusual Options Activity: The Mosaic Company (MOS) |  |

|

|

The January 2020 $19 call options on The Mosaic Company (MOS) saw a 43-fold rise in volume in trading, with over 11,600 contracts trading hands against a prior open interest of 269.

With 51 days to go, and with shares trading just below $19, the option trades almost at-the-money, and could move higher penny-for-penny if shares do as well.

With the trade at $0.93, the shares will need to rise close to $20 for a profit by expiration.

» FULL STORY |

|

| |

|

|  |  |

| TOP |  | | BBY | 9.859% |  |  | | UA | 5.105% |  |  | | CMG | 3.729% |  |  | | UAA | 3.629% |  |  | | ABMD | 3.567% |  |  | | BOTTOM |  | | DLTR | 15.242% |  |  | | HPE | 8.481% |  |  | | XEC | 5.424% |  |  | | HP | 4.885% |  |  | | MCK | 4.874% |  |  | |

|  |  |

|

| After a long period of decelerating price increases, it's notable that in September both the national and 20-city composite indices rose at a higher rate than in August, while the 10-city index's September rise matched its August performance. It is, of course, too soon to say whether this month marks an end to the deceleration or is merely a pause in the longer-term trend. |

- Craig J. Lazzara, managing director and global head of Index Investment Strategy at S&P Dow Jones Indices, on the turnaround in housing price changes.  |

|

|

| Alex Green's $1.4 Million Mistake

(By clicking this link you will be registered — FREE — for the first-ever, the Microcap Millionaire Summit on December 3.)

|  |

|

It was the most frustrating day of my career...

I found two blockbuster microcaps that my publisher said were too small to recommend...

So my full readership missed out on a $1.4 million payday.

Today, I'm correcting this mistake... revealing my full system... and detailing THREE NEW MICROCAPS at a FREE-to-attend online event.

(By clicking this link you will be registered — FREE — for the first-ever, the Microcap Millionaire Summit on December 3.)

(By clicking this link you will be registered — FREE — for the first-ever, the Microcap Millionaire Summit on December 3.)

| |

|

No comments:

Post a Comment