Managing Money Velocity

Harry Dent | November 27, 2019 | Dr. Lacy Hunt was the first economist to explain why money velocity is important: It measures whether a country is investing its money productively to create continued growth. When it's above average and growing, that’s a sign of productive investment that pays good returns and creates more such investment. Falling is a sign of increased speculation. Falling and below average means the deleveraging of unproductive and counter-productive stages. Like my demographic spending tools and urbanization vs. GDP per capita gains, I have now expanded this to all major countries in the world. This adds the acid test of whether investment is productive, and is especially important in emerging countries that are making the biggest investments in new infrastructures to urbanize. It can also help spot where corruption and bureaucracy are a hindrance. Here’s a quick summary of the best and worst velocity readings in the major regions of the world:

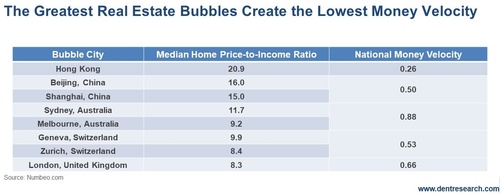

I’ll start here with the western developed countries including Japan. Canada is actually the best at 1.33 with the U.S. second at 1.12 – both in North America, not Europe. The worst is Hong Kong at 0.26 (China on steroids!), with Japan a close second worst at 0.40. China is also very low at 0.50 because of constant overinvestment in infrastructure. The highest velocity is in the youngest, least urban and fastest growing regions starting with Sub-Saharan Africa. Here, the poorest – the Congo – is highest at 7.99. Sounds great, but a very risky and volatile country at this point for investment. The lowest is the richest and most urban country, South Africa, at 1.37. | This Real Estate Bubble is Just the Tip of the Iceberg Get all the details on Harry Dent’s latest research and why he believes this upcoming collapse will not only be worse than the infamous 2008 financial crisis, but why it could have a “greater impact on the American people and their money than any bubble we’ve ever seen.” Find out how you can start preparing now! | Southeast Asia is next and a much more affluent and attractive investment environment. Here, Indonesia is the highest at 2.58, and surprisingly Vietnam – which used to be much higher – is the lowest at 0.63. A sign of corruption seeping in? My favorite region ahead for demographics and urbanization is South Asia, dominated by India. Velocity is similar in the key countries here, with Pakistan the highest at 1.71 and India actually lowest at 1.36. Still some corruption and bureaucracy there. The most turbulent, but likely less so in the coming boom, according to my Geopolitical Cycle – the Middle East/North Africa – has Turkey as the strongest (1.85), although its political shift is more than worrisome. The weakest is U.A.E. at 1.16 due to constant overbuilding in real estate, like Hong Kong and China. And finally, closer to home is Latin America from Mexico and the Caribbean to Chile. Here, surprisingly with its near-term debt, currency, and default problems, Argentina is the highest at a whopping 3.51. The largest country, Brazil, is the worst at 1.04. Argentina also has the latest peak in its Spending Wave in 2065 vs. Brazil the earliest in 2035. Argentina could be a good place to invest after the crash ahead. This is a much more complex topic when you put all of our proven indicators together, but South Asia and Southeast Asia still look best, all things considered for the next global boom… after the global crash and reset. Boom & Bust Elite subscribers will see more of this in a few weeks: I look at this indicator around the world in more depth in the upcoming December 2019 issue of The Leading Edge.

Harry Dent Trending Stories... It's that time of year. My wife has been baking up a storm as we get ready for a number of holiday events, including the big family gathering later this week. Black Friday commercials are everywhere as retailers try to pull holiday spending forward as far as possible. Forget Halloween, in a few short years... When I am speaking in Australia, New Zealand, and the U.K., all of whom have big real estate bubbles, I always ask: How do you think this is good for your country that it costs so much to live, and so much investment and attention goes to speculating in real estate instead of producing real... As you know, I'm on the road in Australia at the moment, handling a few speaking engagements for my readers in fans Down Under. I always love coming here and recently have tried to do it about twice each year, and it never fails to impress or reinvigorate me. So thanks, Australia, for being lovely... If you think Social Security is a genuine, albeit compulsory, retirement program, then you haven't read the fine print. Most of us have to put money in over our working lives, and then get the privilege of applying for benefits when we reach age 62 or later (somehow, Congress saw fit to exempt federal employees,... A reader recommended I adapt an excerpt from April's Leading Edge that discusses the seven laws of cycles. These are guiding principles by which I abide at all times when performing research and forecasts. 1. All of history and progress is exponential not linear, as knowledge and learning build on itself as in compound returns... |

No comments:

Post a Comment