The economy continues to deliver a lot of mixed signals—a trend we expect to continue well into 2020. But for at least one signal, things are looking up.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can Manage Subscriptions. |  |  |  | |

|  |  Good morning, and Happy Thanksgiving! For the 34th year in a row, the American Farm Bureau Foundation conducted a survey to estimate the cost of a Thanksgiving dinner for 10 people. This year, the price rose to $48.91 from $48.90 last year. Good morning, and Happy Thanksgiving! For the 34th year in a row, the American Farm Bureau Foundation conducted a survey to estimate the cost of a Thanksgiving dinner for 10 people. This year, the price rose to $48.91 from $48.90 last year.

That's less than $5 per person, and this year showed a mere penny increase… and that increase follows three years of decline since 2018. The numbers just go to show how low food costs are in the United States, and how little the price has changed in recent years. In a year with a lot of uncertainties, it's something to be thankful for.

| | |  | | | You can also find the hottest, most up-to-date trading information by visiting our Instagram. We share everything we know here, including hot stock tips, trending investment news, and even full-length videos that cover critical investment strategies. Our most recent post just went live right here. |

| |  |

|  |  |

| DOW 28,164.00 | +0.15% |  | |

| S&P 3,153.63 | +0.422% |  | |

| NASDAQ 8,705.17 | +0.66% |  | |

|

| *As of market close |

|

| • | Stocks rallied into Thanksgiving Day, with more highs being set in light trading. |  | | • | Oil declined 0.5 percent, to $58.11 per barrel. |  | | • | Gold dropped 0.4 percent, to $1,461 per ounce. |  | | • | Cryptocurrencies had a great day, with bitcoin rallying 4.8 percent to $7,550. | | |

|

|

|

| Two Tech Companies Likely to Run to New All-Time Highs |  |

|

|

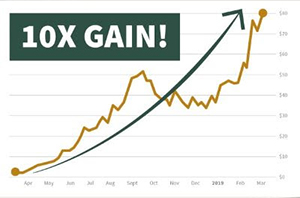

Typically, technology companies help lead the market to new highs. That's because these firms are capable of rapid, disruptive growth.

While that's been true generally, in the past two years technology companies have been lagging while value-oriented companies have taken a turn as market leaders.

Nothing lasts forever, however, and buying some tech companies still well off of their most recent highs of past years will likely give investors great returns in the next rotation.

» FULL STORY |

|

| |

|

|

| Insider Trading Reports: Genesis Energy (GEL) | |

|

|

Kenneth Jastrow, a director at Genesis Energy LP (GEL), recently bought 50,000 shares. At a cost of $948,000, the buy brings his holdings up to 150,000 shares.

Insider buying data shows only buys from insiders in the past two years, including another 50,000 share buy from Jastrow back in May.

Overall, insiders own over 12 percent of the company, a strong sign that their interests are aligned with long-term shareholders.

» FULL STORY |

|

| |

|

|

| Unusual Options Activity: Royal Caribbean Cruises (RCL) |  |

|

|

Put options expiring on December 6th with a $117 strike on Royal Caribbean Cruises (RCL) saw an 89-fold surge in volume recently, going from 131 open contracts to over 11,675 contracts trade.

The option, expiring in nine days, will likely expire worthless unless shares drop from their current price just under $120, about a 4 percent move in-the-money.

At a cost of just $1.00, or $100 per contract, however, it's an inexpensive bet on a drop.

» FULL STORY |

|

| |

|

|  |  |

| TOP |  | | HP | 6.558% |  |  | | UA | 6.193% |  |  | | UAA | 6.17% |  |  | | ADSK | 5.492% |  |  | | WDC | 3.49% |  |  | | BOTTOM |  | | DE | 4.297% |  |  | | PVH | 2.599% |  |  | | CME | 2.375% |  |  | | DLTR | 2.341% |  |  | | IRM | 1.902% |  |  | |

|  |  |

|

| Everybody looks at the stock market and sees share prices going through the roof right now, but few of the CEOs I talk to feel good about that. There is an increased worry about their ability to deliver results amid prolonged periods of uncertainty next year. |

- John Richert, head of J.P. Morgan Chase regional investment banking, on the disconnect between the market rally this year and the slowing global economy.  |

|

No comments:

Post a Comment