Tech bubble 2.0 continues to quietly burst amidst the backdrop of a market near all-time highs. Besides struggling companies that went public this year in the ride share and plant-based meat alternative space, there's the failed attempt of companies like WeWork to even get to an IPO.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can Manage Subscriptions. |  |  |  | |

|  |  Good morning.. Tech bubble 2.0 continues to quietly burst amidst the backdrop of a market near all-time highs. Besides struggling companies that went public this year in the ride share and plant-based meat alternative space, there's the failed attempt of companies like WeWork to even get to an IPO. Good morning.. Tech bubble 2.0 continues to quietly burst amidst the backdrop of a market near all-time highs. Besides struggling companies that went public this year in the ride share and plant-based meat alternative space, there's the failed attempt of companies like WeWork to even get to an IPO.

Now, we're seeing some companies with a longer market history likewise start to quietly get taken out at steep discounts to a once high-flying valuation. Google announced it would buy Fitbit for a total value of approximately $2.1 billion. For a company that went public in 2015 and quickly soared from $20 to $50, the buyout price represents approximately $8 per share, or a 65 percent discount from the IPO price… assuming the deal goes through.

| |  | |

|

|

|

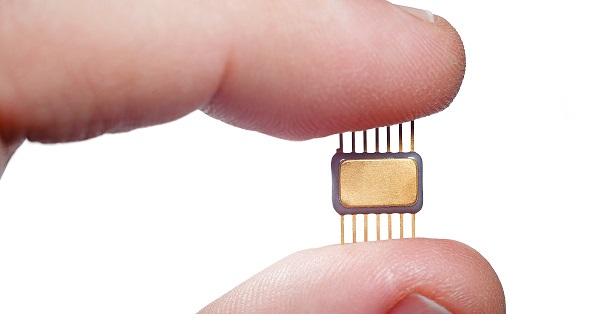

| This Bold New Tech Could Transform Business Forever Starting as Early as January 7 |  |

|

Famous Wall Street high-tech investment legend is warning Americans about a disruptive new technology that promises to upend everything from finance to your future ... from Google to General Electric ... from how we deliver cheese to how we record history.

At the center of this technological revolution is a powerful little-known company that — according to Paul's research — on January 7, could make an earth-rattling announcement that will send shockwaves through markets and transform business forever. To find out why this date is so important, click here.  | |

|

|  | | Q3 GDP growth was expected to hit 1.7 percent. What did it actually hit? Reply to this Email. | |  | |

|

|  |  |

| DOW 27,347.36 | +1.11% |  | |

| S&P 3,066.91 | +0.97% |  | |

| NASDAQ 8,386.40 | +1.13% |  | |

|

| *As of market close |

|

| • | Stocks rallied into the weekend, with the S&P 500 hitting all-time highs on strong jobs numbers. |  | | • | Oil rose 3.5 percent, to $56.06 per barrel. |  | | • | Gold rose 0.1 percent, to $1,515 per ounce. |  | | • | Cryptocurrencies generally traded flat, , with Bitcoin still around $9,220. | | |

|

|

|

| Three Different Ways to Own Gold in Your Portfolio |  |

|

|

Since the start of 2016, gold prices have been moving upwards. It hasn't always been obvious. The metal has been prone to some sideways trends that have lasted a long time, and the price of the yellow metal will often pull back after a sharp rally.

But with a long-term trend in place, and with more money moving into the space as a result, gold prices seem apt to continue heading higher. Here are three ways you can own gold:

» FULL STORY |

|

| |

|

|

| Insider Activity: Diebold Nixdorf (DBD) |  |

|

|

A number of insiders at Diebold Nixdorf (DBD) bought shares following earnings. The buys included multiple directors, a Senior Vice President of Services, and a 28,000 share buy from the President and CEO.

The CEO's buy came to nearly $195,000, and most directors picked up around $50,000 in shares. The SVP bought nearly $7,000 in shares. Insider data shows a number of insider buys this year, with only one sale.

» FULL STORY |

|

| |

|

|

| Unusual Options Activity: Hanesbrands Inc. (HBI) |  |

|

|

The April 2020 $17 put options on Hanesbrands (HBI) saw over 13,700 contracts trade, a 68-fold surge in volume. Oddly, with shares of the company already at $15.50, the option is already about $1.50 in-the-money, and should move dollar-for-dollar with shares lower from here.

At a price of $2.70, the put buyer really paid just $1.20 in premium, and shares would need to only slip to $14 for the put buyer to make money by April.

» FULL STORY |

|

| |

|

|  |  |

| TOP |  | | QRVO | 20.233% |  |  | | FTNT | 10.508% |  |  | | APA | 9.926% |  |  | | NWL | 8.593% |  |  | | SWKS | 7.951% |  |  | | BOTTOM |  | | ANET | 24.234% |  |  | | TTWO | 2.867% |  |  | | IDXX | 2.856% |  |  | | CL | 2.609% |  |  | | HSY | 2.587% |  |  | |

|  |  |

|

| The job market is resilient and brought a sigh of relief despite a quadruple whammy of labor shortages, the trade war, diminishing effects of the tax cut and slowing global economy. Manufacturing shed 36,000 jobs, but would have shown a slight increase without the GM strike. |

- Sung Won Sohn, professor of finance and economics at Loyola Marymount University and president of SS Economics, on the jobs report showing a strong economy despite some potentially fearful events.  |

|

|

| This Bold New Tech Could Transform Business Forever Starting as Early as January 7 |  |

|

Famous Wall Street high-tech investment legend is warning Americans about a disruptive new technology that promises to upend everything from finance to your future ... from Google to General Electric ... from how we deliver cheese to how we record history.

At the center of this technological revolution is a powerful little-known company that — according to Paul's research — on January 7, could make an earth-rattling announcement that will send shockwaves through markets and transform business forever. To find out why this date is so important, click here.  | |

|

No comments:

Post a Comment