What Does Wall Street See that These Charts Don't?

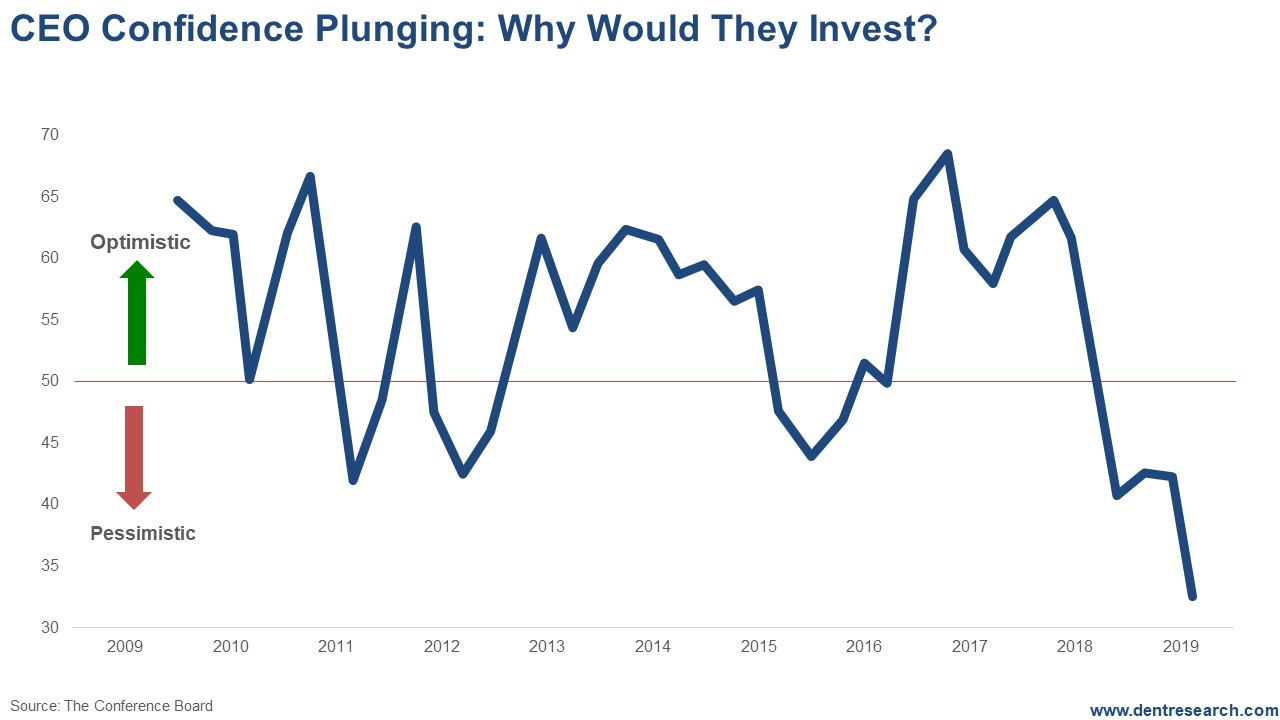

Harry Dent | November 11, 2019 | Wall Street continues to be convinced that the economy is edging back up again after a stall following the tax cut boost and near 3% GDP figures in 2018. I talked last Monday about how there were some key indicators like industrial production growth and construction spending that were not confirming such a resurgence... at least not yet. And such falling trends tend to be a leading indicator of falling profits. This chart is more disturbing, as it comes from those very CEOs that got the direct benefits from the tax cuts at the beginning of 2018. Their confidence in the economy is not just slowing, it is plunging!

[Click to Enlarge] They clearly and haven’t been making significant investments in new capacity as they don’t need it. The publicly-traded ones are buying their own stocks to goose earnings per share instead. But are they seeing signs of declining demand from their customers? Are they worried about Trump getting impeached and ending the corporate tax and deregulation gravy train? All, legitimate concerns which could accelerate the pending financial crisis. Wall Street is clearly not reacting much to that threat yet. | Harry's Latest Market Update: Harry Dent shares details on his latest forecast for the market and new dangers just ahead for America: "This is no longer a question of 'if' but simply a question of 'when.'" Read more here! | The next chart also clearly shows that earnings per share are cratering as well. Part of that is to be expected as the surge from the tax cuts does not continue forward. But the actual 4% decline in the third quarter should be alarming.

[Click to Enlarge] This combination of indicators simply does not bode well for the stock market, yet it keeps edging up. How long can the markets continue to be divorced from Main Street and the real world? So, what does Wall Street see that these charts don’t? Good question… I say it simply sees “more crack” from lower rates and more QE. How much longer can that last?

Harry Dent Trending Stories... Wall Street continues to be convinced that the economy is edging back up again after a stall following the tax cut boost and near 3% GDP figures in 2018. I talked last Monday about how there were some key indicators like industrial production growth and construction spending that were not confirming such a resurgence… at... I've been harping on this megaphone pattern for quite a while now, but you've got to remember, there's a reason why these megaphones are so important for predictions: They tend to occur at the major tops before a fall. Think 1965, 1968, and again in 1972. Three tops to what's clearly now a megaphone. What... Last weekend McDonald's dismissed CEO Steve Easterbrook for having a consensual relationship with a subordinate. The relationship broke the rules, which Easterbrook admits. The company obviously fired him for cause. For his troubles, he walks out the door with $700,000 in severance, plus a potential $70 million in stock and options. It must be terrible... I have shown conclusively in my ebook on gold, How to Survive & Thrive During the Next Gold Bust , and past newsletter issues that gold correlates primarily with inflation rates – not just in the past century, but back to the 1700s! I have also shown that inflation correlates most with workforce growth. We will... I grew up on the Gulf Coast, beginning in Florida, then over to Texas, then part way back to Louisiana. We weren't testing beaches, we were following boats. My stepfather joined our family when I was quite young, essentially becoming my parent. He took a job on a shrimp boat in the Florida panhandle and... |

No comments:

Post a Comment