The Best Immigrants

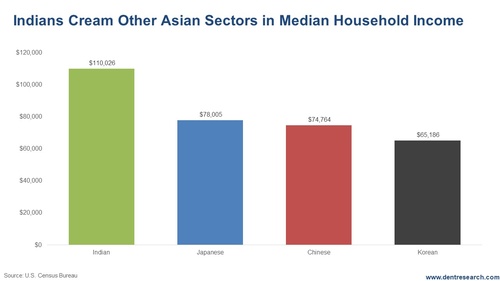

Harry Dent | November 13, 2019 | I love to ask people who they think are the highest earning ethnic or immigrant group. They almost always guess Japanese or Chinese… But those guesses are not even close. It’s the Indians. Look at this chart of median household income… the average numbers would be even more skewed.

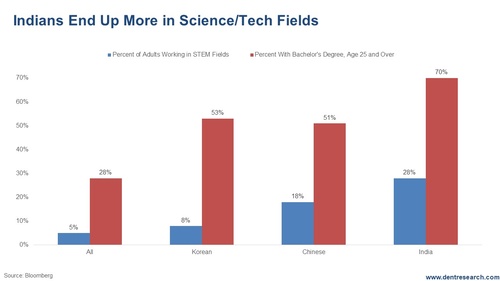

The median U.S. household income is $63,179. So, all of these Asian groups are higher. India’s is off the charts at $110,026. That is 74% higher than the U.S. average, 69% greater than the Koreans, 48% above the Chinese, and 41% more than the Japanese. I have always attributed this to the greater English influence in the India culture over many decades. More speak English, and more are familiar with English systems and the tradition of rule of law. I had three Indians in my Harvard Business School class – all highly analytical and great at finance. I also find they have an edge as entrepreneurs over even the Chinese. They also end up more in the technology, scientific, and technology fields that are the most valued: 28% vs. 18% for the Chinese, 8% Korean, and a mere 5% for the U.S..

70% have bachelor degrees or higher vs. 53% for Koreans, 51% for Chinese, and 28% for the U.S. average. I have heard no one anywhere in the world complain about Asian immigrants. Australia, where I most often travel to for speaking engagements outside of the U.S., is the largest relative beneficiary of Asian immigration. But Indians are the best, even though we get more of their top 1% to 10%, as we do with other Asian countries. We are not seeing their average citizens, so we overestimate their cultures. It’s always strange to me that when I say India will become the next China, most people just look at me like… “what are you smoking?” I covered that topic in depth in the October edition of my flagship newsletter, The Leading Edge.

Harry Dent P.S. I’m excited to pass along an opportunity for those of you looking to take advantage of this bull marketing, while it's still roaring... my colleague, Adam O'Dell is holding a live webinar on Tuesday, Nov. 19th, where he'll reveal his innovative timing strategy that has earned an average of 46% gains on every trade recommendation. You can sign up for free, here! Trending Stories... I peruse at least two newspapers, three blogs, and one financial news program before breakfast. Once I get the official workday underway, I dive deeper into research on the Fed, consumer spending, or whatever happens to be the topic du jour. Using my knowledge, I write mostly about economic trends and work to bring you... Wall Street continues to be convinced that the economy is edging back up again after a stall following the tax cut boost and near 3% GDP figures in 2018. I talked last Monday about how there were some key indicators like industrial production growth and construction spending that were not confirming such a resurgence… at... I've been harping on this megaphone pattern for quite a while now, but you've got to remember, there's a reason why these megaphones are so important for predictions: They tend to occur at the major tops before a fall. Think 1965, 1968, and again in 1972. Three tops to what's clearly now a megaphone. What... Last weekend McDonald's dismissed CEO Steve Easterbrook for having a consensual relationship with a subordinate. The relationship broke the rules, which Easterbrook admits. The company obviously fired him for cause. For his troubles, he walks out the door with $700,000 in severance, plus a potential $70 million in stock and options. It must be terrible... I have shown conclusively in my ebook on gold, How to Survive & Thrive During the Next Gold Bust , and past newsletter issues that gold correlates primarily with inflation rates – not just in the past century, but back to the 1700s! I have also shown that inflation correlates most with workforce growth. We will... |

No comments:

Post a Comment