The Bigger the Bubble

Harry Dent | November 25, 2019 | When I am speaking in Australia, New Zealand, and the U.K., all of whom have big real estate bubbles, I always ask: How do you think this is good for your country that it costs so much to live, and so much investment and attention goes to speculating in real estate instead of producing real goods and services? Now, I will admit that healthy real estate prices are a good thing; it says you are an attractive city or country to live in with a good standard of living, good schools, and low crime, etc. But nosebleed levels like eight to 10 and even 20 times everyday incomes to buy an everyday house? Then there are higher wages paid to employees by businesses to compensate for that higher standard of living and higher office, store, warehouse and plant costs. Isn’t that one of the reasons we are losing key industries to lower cost countries? And then there’s lower spending in other sectors, like eating out, entertainment, travel, and cars to compensate for higher housing costs... High real estate prices past a normal level of three to four times income in good cities only benefits the older people who already own real estate and who are going to work and produce less, and then die. It kills the standard of living for the new up-and-coming generation. It only encourages more focus on fixing up and flipping homes instead of investing in productive capacity to produce real goods and services and for export and global competitiveness. Productive investment would be reflected in money velocity, as I covered a few weeks back. And yes, if you look at the countries that have the most overvalued real estate nationally, this clearly seems to be the case. The U.S. and Canada have some highly very overvalued major cities and areas, but they are not as overvalued nationally (3.9 and 4.3 respectively) as countries like Hong Kong, China, Australia, the U.K and Switzerland. Note that the valuations here are median home prices vs. median household income. These ratios get more extreme at average levels that favor the more affluent that are the most overvalued. For example, Hong Kong is almost twice as high on average price to income, at 36 times income.

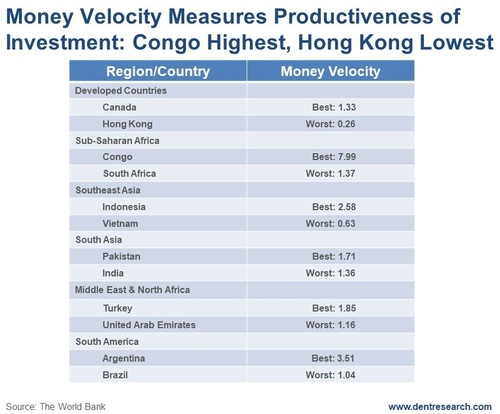

No surprise, Hong Kong has the lowest money velocity in the world at 0.26, with the very highest real estate valuations at 20.9 times income. This is the home of “closet condos.” China, with the same strategy of overbuilding and households overinvesting in real estate, is next at 0.50 velocity and valuations in their top two cities at 16.0 and 15.0 times. | Meanwhile, America Has Its Own Crisis Waiting in the Wings Harry Dent reveals shocking new details behind the next financial attack on America… how the rich may profit and how you could be the one paying for it. Some may call it a conspiracy theory, but the cold hard evidence is hard to ignore, and you need to learn how to protect yourself now. Get all the details here. | Then comes Australia with velocity at 0.88 vs. 1.12 in the U.S., despite dramatically better demographic trends and lower overall debt ratios. It’s top two cities, Sydney and Melbourne, are 11.7 and 9.2 times, respectively – the second most overvalued in the world after China. Then comes expensive Switzerland at an abysmal velocity of 0.53. I think that is partly due to extreme wealth and urbanization already and nowhere to expand. But its price to high incomes in its lead cities are 9.4 in Geneva and 8.4 in Zurich. Higher than London... Then finally comes the U.K. at 0.66 velocity and its leading city London at 8.3 times. That’s way below the U.S. at 1.12 and the euro countries at 1.01. Too much focus on real estate investing and flipping? The countries and cities with the highest real estate valuations will crash the most to be brought back down to reality. And that will be good medicine for their awful addiction -- and for future growth again… And, they wouldn’t have bubbled up so much, if they weren’t so special! But back to the original question: Do you want to make money on real estate gains for your oldest citizens, or increase your competitiveness as a nation for your future generations?

Harry Dent Trending Stories... As you know, I'm on the road in Australia at the moment, handling a few speaking engagements for my readers in fans Down Under. I always love coming here and recently have tried to do it about twice each year, and it never fails to impress or reinvigorate me. So thanks, Australia, for being lovely... If you think Social Security is a genuine, albeit compulsory, retirement program, then you haven't read the fine print. Most of us have to put money in over our working lives, and then get the privilege of applying for benefits when we reach age 62 or later (somehow, Congress saw fit to exempt federal employees,... A reader recommended I adapt an excerpt from April's Leading Edge that discusses the seven laws of cycles. These are guiding principles by which I abide at all times when performing research and forecasts. 1. All of history and progress is exponential not linear, as knowledge and learning build on itself as in compound returns... If you're looking for free drinks and new friends, loudly discuss your support for the Second Amendment. If you'd rather engage in colorful discourse and potentially continue the conversation outside, bring up your views of much-needed gun control and the possibility that the framers of the Constitution didn't mean for every house to have the... The tech stocks are likely to have either a final blow-off rally into early 2020, or a bigger correction followed by a final rally to new highs into mid-2020. So, what's the best way to play that? Everyone's been buying the FAANGs or leading tech stocks (Facebook, Amazon, Apple, Netflix, and Google), or simpler, just... |

No comments:

Post a Comment