Some Indicators That Don't Confirm Economic Resurgence

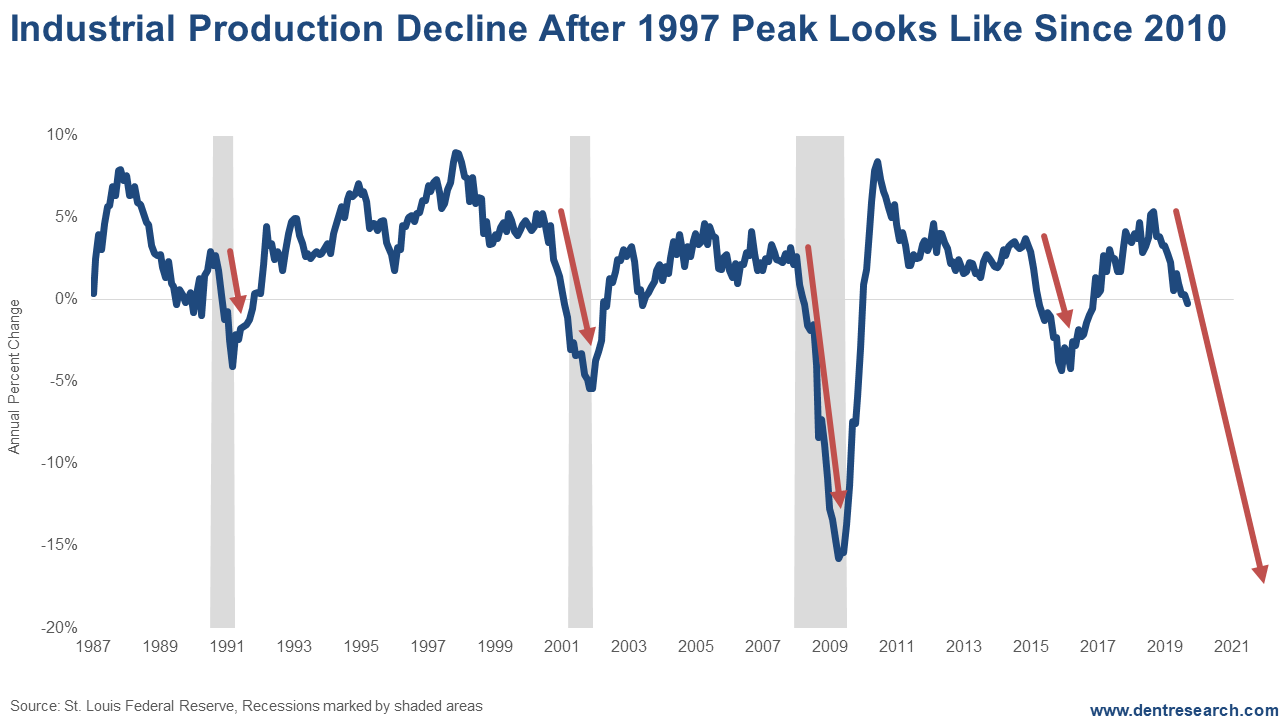

Harry Dent | November 04, 2019 | When David Stockman spoke at our IES conference in October, he had a whole slew of charts that showed that the main street economy had nothing to do with the Wall Street one – and that there were more signs of weakening growth than strengthening. He recently showed some updates and these were the two that most caught my eye. Both of these are from the more cyclical sectors that most often cause recessions. Look at the year-over-year change in Industrial Production.

[Click to Enlarge] This indicator just crossed zero again and would suggest a recession sometime next year. More interesting to me is the overall pattern. The first peak came in late 1997. It was followed by a modest fall into 1998 and then a tepid bounce into early 2000. Then came a more substantial decline into the mild recession of 2001 to -6%. And then a bigger, longer bounce back to positive, followed by the dramatic decline to -16% into the great recession into the latter part of 2009. The final bottom came almost 12 years after the peak. The next peak came very sharply with the dramatic first QE steroid shot into mid-2010 That was followed by a mild drop and more sideways bounce into 2014. Then there was a larger drop to -5% into early 2016 – a near recession, now that QE was countering any such thing. Then a bounce back positive again and now a potentially final drop that has already crossed zero. URGENT MESSAGE FROM ECONOMIST

WHO PREDICTED 2008 MARKET CRASH: HELL IN 2020: Why Revolt Is

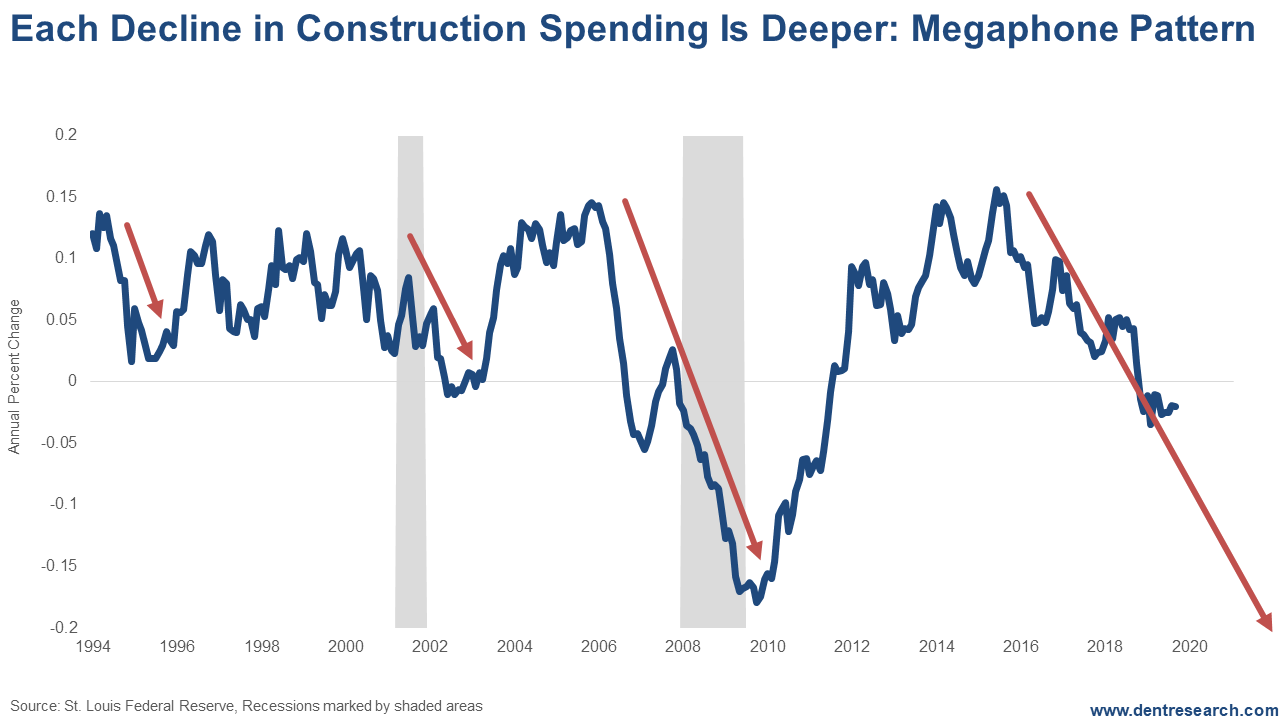

Coming And How To Prepare Now Click Here To Watch Now >> | I fully expect this decline to go much lower than the last one at -16% to 20-25%+. A 12-year lag on the 2010 peak would put this bottom into 2022. I expect late 2022+. The next indicator has more of a megaphone pattern with slightly higher highs and progressively lower lows – mimicking the pattern I have been seeing in the stock markets, longer and shorter term.

[Click to Enlarge] There was a modest dip in construction that didn’t go negative from 1994 into 1995. After a rebound into late 1999, the next dip came into mid-2002 and went to -1% in that mild recession. And then there was another slight new high into late 1995 (when I called for a housing bubble top) and then the dramatic plunge down to -18% from late 1995 into 2009. Since, we have seen another slightly higher growth peak in 2018 and a decline that has thus far fallen to -3%. A lower low this time would suggest a plunge to -25%+!!! So, the big question is: When do the ever-optimistic “markets on crack” get the picture?

Harry Dent |  Is “$7 Internet” Coming to Your State This Year? Is “$7 Internet” Coming to Your State This Year?

"America’s Most Hated” cable companies are mad as hell. A brand-new internet technology with the code name “Halo-Fi” is about to make its way off a Florida assembly line. It promises to be faster than cable yet, by my estimates, over 7 times cheaper, which could save you an easy $19,494. Plus, the startup with exclusive rights to distribute “Halo-Fi” could go from $1.2 billion to $251 billion in the blink of an eye, making investors ungodly rich. Everything shifts December 19th, so there’s no time to lose. Discover the full story here... | Trending Stories... Today's rant covers an unusual topic: China. No, not Chinese trade. We talk about that plenty. Rather, today I want to talk about a new angle on Chinese real estate. Chinese Real Estate The Chinese are strange real estate investors, largely because its communist government had not broadly allowed real estate ownership until recently in... It's been two days since my movers met my contractors. I don't mean a "Hey-nice-to-meet-you" kind of greeting; it was more of a "get-out-of-my-way-I'm-working-here." My planned extrication from my old digs into my partially-renovated new home didn't go like I thought it would. The exercise brought to mind the paraphrased wisdom of Von Moltke: "No... Somehow the stock market is expecting growth to re-accelerate after a disappointing 2.0% GDP growth in Q2. The only sign of such growth in the stock market is central banks lowering rates and expanding their balance sheets again. Q3 just came in at 1.9%, just below the 2.0% last quarter. And that covers over the... I never understood WeWork. The company either purchased or took long-term leases on commercial properties. It dressed them up with Millennial-friendly details like beer taps and cool art, and then re-leased the space in very small increments for a higher price. Leave out the cosmetics, and you've got a traditional commercial leasing company that tries... It's no secret to you that I am still more bearish on gold than bullish. And it's no secret to me that a lot of our subscribers still like gold and feel that it is still a safe haven and a good store of value long term. Despite having argued that gold was one of... |

No comments:

Post a Comment