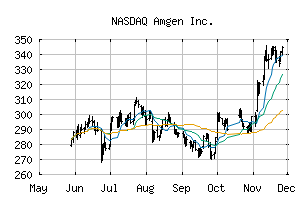

This week's pick is: AMGEN (NASDAQ:AMGN) The market averages tumbled on Monday with the Dow Jones falling over 1.5% and the NASDAQ dropping by more than 3%. The broad sell-off was triggered by lowered expectations for tech stocks - mainly Apple (AAPL), Amazon (AMZN), and Facebook (FB). With growth stocks in trouble with the added volatility, investors are looking for safety and getting ready for any kind of larger bear trend that could emerge. What makes a stock a good value buy can be deducted from its fundamentals. The price-to-earnings ratio relative to the average price-to-earnings ratio for the industry it operates in is one of the most important fundamentals. A lower P/E than the average means that the stock may be undervalued relative to its peers. Another consideration is how the P/E compares to the expected EPS growth rate. This ratio, known as the PEG ratio, compares the expected growth rate of earnings to the P/E of the stock. Anything more than 2 means that the stock may be undervalued, while numbers close to, or less than 1 mean the stock could be undervalued. But there's another consideration for investors - the ability to perform in volatile environments. For that, investors need to look at non-cyclical industries like consumer staples, utilities, biotech, and others. In a volatile market, these steady businesses will continue to perform. For one biotechnology company, bullish or bearish environments have no impact on its profits and could provide investors with a safe haven. A Best-In-Breed Biotechnology Company in Value Territory Amgen Inc. (AMGN) is a $124 billion biotechnology conglomerate with numerous patents and drugs on the market to treat everything from infections in cancer treatments to autoimmune disorders. Its best selling brands include: Neulasta/Neupogen, Enbrel, Epogen, Prolia, XGEVA, and more. The company beat 3rd quarter earnings of $3.69 per share versus the $3.45 per share that analysts had expected. Total revenues climbed 2% year-over-year to $5.9 billion while total product sales of all drugs increased 1% year-over-year. The company has plans for new product launches in the coming year with six of their most recent products showing double-digit sales growth for the most recent quarter. While the stock may be firmly in value territory, additional sales growth could give investors an additional boost going into 2019. Checking up on Amgen's Financial Health The stock trades at just 14 times earnings - far lower than the industry average of 32 times earnings indicating a stock that looks to be in value territory. With a long-term EPS growth rate of 14%, that gives it a PEG ratio of exactly 1 as well, solidifying Amgen's status as a value stock. AMGN - Free Technical Analysis Amgen also carries an attractive dividend yield of 2.70% giving investors downside protection and boosting annual returns along with it. The company has a strong buyback program as well - since 2011, its bought back $36 billion worth of shares giving investors more reason to consider Amgen as a defensive play. Based on Amgen's full-year EPS expectations, this stock should be fairly valued at around $215 per share - a gain of more than 10%. With the dividend included, the gain goes to up to 13% annually. For investors who are looking for a safe value stock that performs in any kind of market, Amgen is a must-have portfolio pick-up.

| | 191.2500 | 194.4800 | 190.7727 | 192.6400 | -0.1300 |

|

| | Year High | 210.19 | | Year Low | 163.31 | | 52wk High | 210.19 | | 52wk Low | 163.31 | | Previous Close | 192.77 | | Average Volume | 3,062,144 | | % Institutional | 80 | | Volatility | 29.44 | | Assets | 31,209M | | Liabilities | 8,103M |

|

|

This stock was hand-selected as this week's Stock of the Week by Daniel Cross, professional trader and financial writer. Please note that AMGN may not stay a favorite for this entire week. Markets change and so do the recommendations on what to do with AMGN. To get up-to-date buy and sell signals for AMGN and other analyzed stocks, take a 30-day trial to MarketClub today. |

No comments:

Post a Comment