| Elliott wave analysis of EUR/JPY for November 22, 2018 2018-11-22

EUR/JPY remains locked in undecided territory between support at 127.90 and resistance at 129.22, we need a break out of this territory to get the next big move up or down. We remain biased towards the downside for a break below support at 127.90 for a continuation lower towards the long-term target at 123.66 to complete the long-term triangle consolidation and set the stage for the impulsive rally. If, however resistance at 129.22 is broken that will be a warning that wave (E) already has completed and the new impulsive rally already is under way. R3: 130.13 R2: 129.40 R1: 129.06 Pivot: 128.90 S1: 128.40 S2: 128.00 S3: 127.74 Trading recommendation: We are short EUR from 128.75 and we will move our stop+revers lower to 129.50. Elliott wave analysis of EUR/NZD for November 22, 2018 2018-11-22

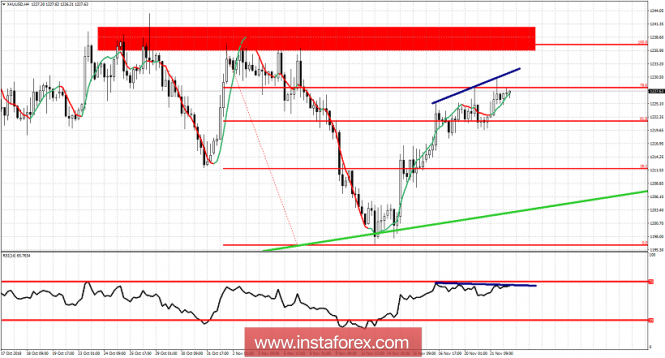

We continue to look for wave iv/ moving closer to resistance at 1.6914 and more likely closer to resistance at 1.7023. A break above minor resistance at 1.6767 will confirm the next push higher towards at least 1.6914. Support is now seen at 1.6642 and important support at 1.6560. A break below the later will invalidate our call for a corrective rally towards 1.6914 and above. R3: 1.6879 R2: 1.6836 R1: 1.6832 Pivot: 1.6767 S1: 1.6731 S2: 1.6706 S3: 1.6642 Trading recommendation: We are long EUR from 1.6706 with our stop placed at 1.6555. Upon a break above resistance at 1.6767, we will raise our stop to break-even. Technical analysis for Gold for November 22, 2018 2018-11-22 Gold price continues to trade near its recent highs and below major resistance at $1,243.50. Short-term trend remains bullish but I prefer to be neutral or bearish at current or higher levels as long as we trade below $1,243.50. There are some warning signs for bulls that should not be ignored.

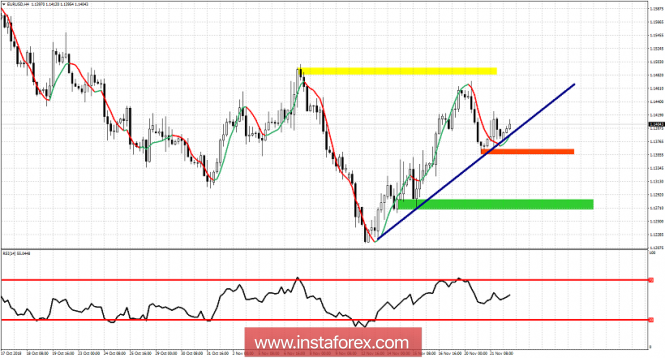

Red rectangle -major resistance area Blue lines - bearish divergence Green line -major support trend line Gold price has resistance at $1,232 but the major trend change level is at $1,243.50. The October highs. Support is at $1,219.70 and if broken I will be expecting a new strong downward move that will push price towards the green upward sloping trend line support. In the short-term the chances of a new higher high towards $1,232 are high. But be aware of the bearish RSI divergence. If we see a new high and the divergence persists, I will prefer the short side of the market with stops placed at $1,243.50. Otherwise, any sign of weakness with price breaking below $1,220 would make me bearish again with stops at recent highs. Technical analysis for EUR/USD for November 22, 2018 2018-11-22 EUR/USD pulled back towards 1.1375 but did not break below recent lows at 1.1358 nor below the upward sloping trend line support. Short-term trend remains bullish and we could see a new higher high towards 1.15 as long as we trade above 1.1350.

Yellow rectangle - major resistance Orange rectangle -important short-term support Green rectangle - major support Blue line - trend line support EUR/USD is trading upwards making higher highs and higher lows. Price so far has respected the blue trend line support.As long as we trade above 1.1350 trend will remain bullish in the short-term. Longer-term trend is still bearish. There are no bearish divergence signs and this implies that making a higher high towards 1.15 is very possible. I prefer to stay neutral and wait for more signs of weakness before turning bearish again in the short-term.

Author's today's articles: Torben Melsted  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Alexandros Yfantis  Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

Alexandros Yfantis, Arief Makmur, Dean Leo, Harsh Japee, Michael Becker, Mohamed Samy, Mourad El Keddani, Petar Jacimovic, Rocky Yaman, Sebastian Seliga, Torben Melsted

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

No comments:

Post a Comment