Can You Stomach Pot Stocks?

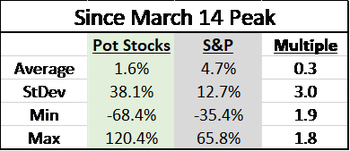

Adam O'Dell | July 24, 2019 | The cannabis industry as a whole holds a ton of promise, which Rodney alluded to yesterday when he discussed Tuesday's Senate Banking Committee hearing. But since many companies won't live up to their hopes and dreams, I think investors are best-served taking a technical approach to buying pot stocks. In mid-May, I shared my "technical take" on Aurora, Cronos, and Tilray, three of the industry's biggest players. At the time, they were all on my "avoid" list. They didn't (and still don't) meet the stringent criteria of my trend and momentum system… so I'm avoiding them for now. Since sharing that analysis, shares of Cronos (Nasdaq: CRON) are down about 2%, while Tilray (Nasdaq: TLRY) has lost 10.6%, and Aurora has shed more than 18%! Of course, I'm not taking credit for forecasting the price declines of those specific stocks. The reality is that the broader cannabis space had been suffering through a pullback. The industry's most liquid ETF — the ETFMG Alternative Harvest ETF (NYSE: MJ)— is down around 10% since mid-May. In fact, a string of bad news and PR has caused some hesitation among the industry's investors of late. Regardless, I'm incredibly bullish on the cannabis space as a whole. So much so that I believe that, using the Cannabis Profit Code I've created, you could bank up to 25 1,000% winners in the next five years! Cannabis stocks are more volatile than your "average stock," so I strongly advocate following a proven strategy in this space. Let me show you what I mean… One Wild Ride As I said, cannabis stocks are volatile. You expect that from the smallest and most speculative pot stocks. But even the big industry-leading ones are far more volatile than what you'll find in the S&P 500. There are currently about 250 to 300 publicly traded stocks that we can call "pot stocks." Of those, there are only 25 stocks that have an average daily trading volume equal to $10 million or greater. In comparison, there are only three stocks in the S&P 500 that trade less than $10 million a day — most S&P 500 stocks trade far more. So today, let's look at the volatility of the biggest pot stocks… during two time periods. Cannabis stocks reached a mid-year peak on March 14 and then pulled. Here are some summary statistics since then:

As you can see, the average "big-and-liquid" pot stock has gained a measly1.6% since mid-March, whereas the S&P 500 is up 4.7%. And that's reflective of the cannabis industry's recent pullback. More importantly though, the standard deviation of those 25 pot stocks has been three-times greater than S&P 500 stocks! And you can see these extremes more closely by considering the minimum and maximum returns. One pot stock is down 68%, whereas the worst S&P 500 stock is down a milder 35%… one pot stock is up 120%, whereas the best S&P stock is up just 66%. All told, these statistics clearly point to pot stocks being far more volatile than S&P 500 stocks. And remember, these are the biggest, most heavily traded pot stocks out there! But how do these numbers look year-to-date? READ MORE » Most Will FAIL at Cannabis Investing  While others try to guess which cannabis products will become popular or which state will legalize next, you could be using Adam O'Dell's scientific and systematic strategy for riding cannabis stocks to potentially huge gains. An exhaustive 15-year backtest shows that he could pinpoint as many as FIVE 1,000% winners a year and 25 in the next 5! In just one hour, you can learn about Adam's strategy for winning at cannabis investing. Go here to watch the presentation now. While others try to guess which cannabis products will become popular or which state will legalize next, you could be using Adam O'Dell's scientific and systematic strategy for riding cannabis stocks to potentially huge gains. An exhaustive 15-year backtest shows that he could pinpoint as many as FIVE 1,000% winners a year and 25 in the next 5! In just one hour, you can learn about Adam's strategy for winning at cannabis investing. Go here to watch the presentation now.

| This Week in Economy & Markets... It's another hot week on the Texas Gulf Coast. For yet another day, when I went on my morning run at 4:45 am, the temperature was 84 degrees. And with humidity, it was a heat index of 96. This Was The Coolest Time Of Day It's about now that we start longing for the cooler... The biggest breakthrough in my research came in 1988. That was when I came up with my Generational Spending Wave. With it, I could predict the economy almost five decades out. And I did so by lagging the birth index for the predictable peak spending of the average household. I Needed To Make Some Tweaks... Pot. Pot. Everywhere. It's new, it's exciting. It's an emerging high growth industry that has investors clambering over themselves to invest in the big one now so they can hold the stock for 10 years and then walk away millionaires. I've got bad news for them. And some good news. Bad News First… They're going... It's only been a half-decade since 2014, but it really seems like a lifetime ago. I still had a kid in high school, I wasn't quite yet 50, and marijuana was still illegal… for the most part. Marijuana sales for medical use had been legal in several states since the mid-1990s. However, 2014 was the... Most financial advisors have a simple religion: Invest for the long term, diversify, buy and hold, and don't try to time the markets… The truth is, that works most of the time. It would have worked very well from 1942 to 1968, and again from 1982 to early 2000. Those were the best of the... I'm tempted to glance at Amazon today. I don't need anything, but that's not the point. Surely there's a new gadget or doohickey that will make my life immediately better, even if I don't know that it exists. Once I see it, I'll have to have it – chances are that Amazon is offering it... |

No comments:

Post a Comment