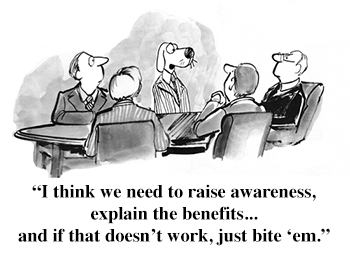

Most investors have to passively accept a management's policies. One group with sufficient clout to get changes, mutual funds, are following in the footsteps of passive investors, according to the Investment Company Institute.

|  |  Good morning. Most investors have to passively accept a management's policies. One group with sufficient clout to get changes, mutual funds, are following in the footsteps of passive investors, according to the Investment Company Institute. In 2009, funds voted for management 90 percent of the time. By 2017, proxy votes revealed that increased to 94 percent. On shareholder proposals, some of which are supported by management, mutual funds vote a mere 35 percent of the time. Good morning. Most investors have to passively accept a management's policies. One group with sufficient clout to get changes, mutual funds, are following in the footsteps of passive investors, according to the Investment Company Institute. In 2009, funds voted for management 90 percent of the time. By 2017, proxy votes revealed that increased to 94 percent. On shareholder proposals, some of which are supported by management, mutual funds vote a mere 35 percent of the time.

Don't like how a company is being run? Either don't buy shares at all— a challenge in the age of passive investing— or buy enough shares to get board seats. | |  | |  |  |

|  |  |  | DOW 27,166.18 | -0.20% |  | |  | S&P 3,010.12 | -0.36% |  | |  | NASDAQ 8,293.33 | -0.44% |  | |  | | *As of market close |  | | • | Stocks traded flat on Monday, as earnings season continued to unfold and the Fed expected to move on interest rates later in the week. | | | | • | Oil rose about 1 percentt, and precious metals moved higher nearly one percent. | | |  |

|  | | Consumer Confidence Hits Highest Level Since 2000 |  |  |  | Consumers saw increased confidence in the economy in July, making up for a drop in June. The confidence index hit 135.7, just below the highest level set in 2000.

After dropping below 100 in June to 97.6, a sign of a modest decline, consumer confidence expectations bounced back to 112.2, indicating economic strength. And in a sign of job strength, those claiming that jobs are "hard to get" declined to 12.8 percent from 15.8 percent.

» FULL STORY |  | | |  |

|  | Trump Administration Prepares Canadian Drug Import Deal |  |  |  | The Trump administration is working on a proposal that would allow the United States to import drugs from Canada. The news was broken by Health and Human Services Secretary Alex Azar.

The goal of the plan is to allow American citizens to pay a lower overall cost of drugs, and get the benefits of deals that pharmaceutical companies are making with foreign countries.

» FULL STORY |  | | |  |

|  | Insider Activity: Central Pacific Financial Corp (CPF) |  |  |  | On Monday July 29th, Paul Yonamine, Chairman and CEO of Central Pacific Financial Corp (CPF) bought over 8.600 shares of the company, paying just over $255,000 to do so. He was joined by President Catherine Ngo, who bought 8,550 shares, paying just over $253,500.

These buys follow off of some buys by directors back in mid-June.

» FULL STORY |  | | |  |

|  |  | | Unusual Options Activity: Bed Bath & Beyond, Inc (BBBY) |  |  | On Tuesday, an unusual number of the September 2019 $8 puts on Bed Bath & Beyond Inc. (BBBY) traded. Over 10,100 contracts traded against a prior open interest of 443, a 23-fold surge in volume.

With shares currently trading around $9.30, the $8 strike price is a bet that shares will drop at least 14 percent in the next 51 days before expiration.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | NOV | 11.315% |  |  | | MLM | 9.978% |  |  | | WAB | 9.452% |  |  | | INCY | 6.442% |  |  | | XEC | 6.309% |  |  | | BOTTOM |  | | IT | 19.018% |  |  | | UA | 13.694% |  |  | | UAA | 12.245% |  |  | | HCA | 9.141% |  |  | | DISH | 8.699% |  |  | |  | PFE

|  |  |  | | An end to QE means an end to constantly rising asset prices. Once asset prices start to fall, as is the case with the top half of the real estate market in the US, credit will return as an issue. But can we actually deflate the various asset bubbles including global equities without causing an equally global liquidity crisis? | - Analyst Chris Whalen on why central bankers are so keen to keep interest rates low… and engage in asset purchases  |  |

|  | Former Forklift Operator Turned Millionaire Shares the Secrets to His Success |  |  | | |  | | He started out making $8,000 a year. Now he's a millionaire many times over — thanks in part to this innovative trading strategy. He developed a formula for "flipping stocks" that leverages the power of real estate — and combines it with the speed and power of the US stock market. The secret has made him millions... and now he's "opening the vault" and teaching ordinary folks the very techniques and strategies that he has used to build his fortune. Learn the details here. |  | |

No comments:

Post a Comment