WeWork, the shared workspace company, has a private valuation of around $47 billion, based on the investments it has received from private holders. However, the company is looking to start its initial public offering (IPO) process, with a valuation of $20-$30 billion.

|  |  Good morning. WeWork, the shared workspace company, has a private valuation of around $47 billion, based on the investments it has received from private holders. However, the company is looking to start its initial public offering (IPO) process, with a valuation of $20-$30 billion. Good morning. WeWork, the shared workspace company, has a private valuation of around $47 billion, based on the investments it has received from private holders. However, the company is looking to start its initial public offering (IPO) process, with a valuation of $20-$30 billion.

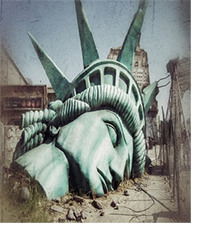

While a good IPO tends to lead to a rally in shares, the company is basically telling its early stage investors that they overpaid. With the company's high-cash burn business model, most serious analysts see the company as a sign of today's monetary excess, not a corporate success. It's another sign of caution in today's heated markets—and the importance of buying at the right price.

| |  | | | Do you want to improve your investment returns while taking less risk? Our FREE Dividend Investing Mini-Course will show you how to create an amazing new stream of passive income with dividend stocks. Learn how to find good dividend stocks to invest in, offering a great yield as well as capital gains potential. Sign up today! | | |  | |  |  |  |  | Analyst: "All hell is about to break loose" |  |  |  What you do in the next few days could determine your financial destiny for the rest of your life. What you do in the next few days could determine your financial destiny for the rest of your life.

The same forces that have triggered every financial boom and bust in our lifetimes are forming a powerful supercycle that will rip through the world economy. Don't disregard this warning.

Take a moment now to get the details on the terrifying new stock market ahead and learn why we're in for a 60-month long rollercoaster ride through hell. | |  |

|  |  |  | DOW 26,727.40 | +1.41% |  | |  | S&P 2,975.95 | +1.30% |  | |  | NASDAQ 8,116.83 | +1.75% |  | |  | | *As of market close |  | | • | Stocks had one of their best days of the year on Thursday, on favorable comments about trade. |  | | • | Oil prices fell a nickel, declining a tenth of a percent. |  | | • | Gold dropped like the rock that it is, down 2.2 percent, the metal's largest dollar decline in three years. |  | | • | Cryptocurrencies traded flat,, with Bitcoin trading around $10,600. | | |  |

|  | | Spruce Point Warns on Church & Dwight |  |  |  | A research note released by Spruce Point warns that Church & Dwight (CHD) may see 35-50 percent downside in the coming months.

That's based on the deteriorating retail environment for CHD products, recent leveraged acquisitions made at a premium leading to rising debt, and the company's aggressive financial accounting practices. The research note includes the growth of the company's goodwill on its balance sheet, an accounting item that has gotten companies like Kraft Heinz into trouble this year.

» FULL STORY |  | | |  |

|  | Oil Inventories Drop Further Than Expected |  |  |  | EIA petroleum estimates for the week indicated a 4.8 million barrel drop in crude oil inventories. This was nearly double the estimate for a 2.5 million barrel drop.

Gasoline dropped 2.4 million barrels, about 1 million barrels more than expected, and more than last week's decline of 2.1 million barrels. Distillates, which were expected to increase, also dropped 2.5 million barrels. Overall, the data shows robust demand for oil at current prices in the mid-$50 range.

» FULL STORY |  | | |  |

|  | Insider Activity: Coty Inc (COTY) |  |  |  | Multiple insiders are making a buy at cosmetic company Coty (COTY). On September 4th, director Robert Singer bought 35,000 shares, a $325,000 purchase that increased his stake in the firm by nearly 15 percent.

And director Peter Harf bought just over 1,050,000 shares, shelling out $9.98 million to do so, increasing his stake by 10 percent. Data for the past three years indicate that insiders have been buyers in that time, with their volume spiking this year.

» FULL STORY |  | | |  |

|  |  | | Unusual Options Activity: Advanced Micro Devices (AMD) |  |  | The October 4th $26 put options on Advanced Micro Devices (AMD) saw over 10,400 contracts trading—a 41-fold increase over the prior open interest of 250 contracts. With 28 days left to go and with shares around $32, the bet is that shares will decline nearly 19 percent.

At just $0.15 for the option, or $15 for the full contract, the trade may simply be a hedge following the strong rally this week on the announcement of new trade talks.

» FULL STORY |  | | |  |

|  | • | The Fed is lining up for another quarter point interest rate cut, reports the Wall Street Journal. |  |  |  | • | Insiders in China report that this next round of trade talks could lead to a breakthrough. |  |  |  | • | Hedge fund Autonomy Capital lost $1 billion on investments tied to Argentina. |  |  |  | • | Millennials are drinking more because they're having more kids, says spirits industry CEO. |  |  |  | • | Ford recalls 500,000 vehicles. |  |  |  | • | And UPS unveils 250-mile range hybrid trucks that can automatically switch modes. |  |  |  | • | In tech, Apple states that they're watching cryptocurrency, although they have no specific plans to launch a token like Facebook and other tech names. |  |  |  | • | Facebook launches its own dating app, sending shares of Match Group down. |  |  |  | • | In startups, tech privacy platform BigID receives a $50 million, Series C investment. |  |  |  | • | In earnings, Slack shares drop following their first post-IPO earnings report, citing slowing revenue growth. | |  |  |

|  |  | | TOP |  | | TPR | 8.356% |  |  | | IPGP | 7.763% |  |  | | CPRI | 6.954% |  |  | | MOS | 6.718% |  |  | | CPRT | 6.542% |  | | BOTTOM |  | | NEM | 4.096% |  |  | | CXO | 3.577% |  |  | | CHD | 3.355% |  |  | | MSI | 2.99% |  |  | | BLL | 2.563% |  |  | |  |

|  |  |  | | Right now, the market isn't only following fundamentals. It's very perceptive to the ongoing trade war…You can't discard the possibility that China and the U.S. will continue to raise the levies again. |  | - Paola Rodriguez-Masiu, Rystad Energy analyst on this week's oil data and shift higher as trade war fears have eased.  |  |

|

No comments:

Post a Comment