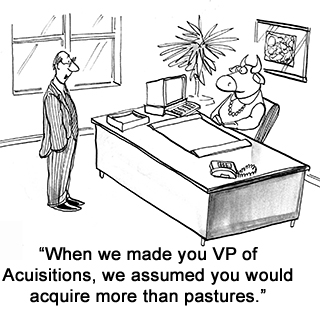

Shares of WeWork have had a tough couple of days, as the market has recognized that the "tech" company was really buying up long-term office leases with the hope of making more money renting them out in the short-term.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

|  |  Good morning. Shares of WeWork have had a tough couple of days, as the market has recognized that the "tech" company was really buying up long-term office leases with the hope of making more money renting them out in the short-term. Good morning. Shares of WeWork have had a tough couple of days, as the market has recognized that the "tech" company was really buying up long-term office leases with the hope of making more money renting them out in the short-term.

The company's founder and CEO has been ousted. The private jet is up for sale. And the company's bonds are dropping as they were dependent on an IPO that looks increasingly unlikely, at least at a reasonable price. It may only be ¬¬a matter of time before WeWork is renamed WeTried.

| |  | |  |  |

|  | | Do you think the Fed will cut interest rates another quarter point before the end of the year? Tell us why. | |  | |  |

|  |  |  | DOW 26,823.78 | -0.25% |  | |  | S&P 2,961.97 | -0.53% |  | |  | NASDAQ 7,939.63 | -1.13% |  | |  | | *As of market close |  | | • | Stocks dropped again, on speculation that the U.S. would limit portfolio flows into China. |  | | • | Oil prices declined about 1 percent, around $55.80 per barrel. |  | | • | Gold dropped 0.8 percent, to $1,511 per ounce. |  | | • | Cryptocurrencies slightly dropped as a whole, with Bitcoin trading around $8,000 even. | | |  |

|  | | Guggenheim Partners Upgrades Western Union |  |  |  | Guggenheim Partners raised their rating on Western Union (WU) from neutral to buy, and set a price target of the company at $27. That is about a 20 percent increase from where shares recently trade.

The upgrade comes after Western Union has partnered with Amazon to launch Amazon PayCode, allowing for shoppers to pay for online purchases at any of Western Union's 15,000 locations, which is rolling out in the next few weeks ahead of the holiday season.

» FULL STORY |  | | |  |

|  | Micron Upgraded After Earnings Report |  |  |  | Although shares of Micron (MU) dropped nearly 11 percent following its most recent earnings report, many analysts were quick to point out the long-term potential in shares.

Investment firm Needham reiterated its buy rating on shares following earnings, and raised the price target on shares from $50 to $60. At current prices, that implies a 33 percent upside for Micron shares in the coming months.

Investment firm Needham reiterated its buy rating on shares following earnings, and raised the price target on shares from $50 to $60. At current prices, that implies a 33 percent upside for Micron shares in the coming months.

» FULL STORY |  | | |  |

|  | Insider Activity: USA Technologies (USAT) |  |  |  | Hudson Executive Capital LP continues to buy massive blocks of shares at USA Technologies (USAT). Following a recent buy, the company picked up another 1.8 million shares on September 26th, increasing their stake by 21 percent. The fund paid $8.2 million for the block of shares, and now owns over 10.1 million shares of the company.

With a float of only 37 million shares, Hudson now owns over 27 percent of shares outstanding.

» FULL STORY |  | | |  |

|  |  | | Unusual Options Activity: CenturyLink (CTL) |  |  | The October 18th $13.50 call options on CenturyLink (CTL) saw nearly 4,000 contracts trade, against a prior open interest of 360, an 11-fold surge in volume. With shares at $12.75, the option will trade in-the-money if shares rise 5.8 percent in the next 18 days.

Given how shares have traded as high as $22 in the past year, the option stands a reasonable chance of heading higher in the next few weeks.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | WFC | 3.765% |  |  | | EMR | 3.443% |  |  | | ULTA | 3.424% |  |  | | ETFC | 3.024% |  |  | | WU | 2.718% |  | | BOTTOM |  | | MU | 11.091% |  |  | | LRCX | 5.251% |  |  | | AMAT | 5.216% |  |  | | BSX | 4.817% |  |  | | BK | 4.504% |  |  | |  |

|  |  |  | | Trade policies have had the greatest negative impact on consumers, with a near record one-third of all consumers negatively mentioning trade policies in September when asked to explain in their own words the factors underlying their economic expectations. |  | - Richard Curtin, Surveys of Consumers' chief economist, on rising consumer fear as the trade war continues.  |  |

|

No comments:

Post a Comment