There are plenty of ways to measure global growth or contraction. One sign of the latter has been spotted with China, whose official (and possibly overstated) GDP growth numbers are likely to slow to under 6 percent this year.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

|  |  Good morning. There are plenty of ways to measure global growth or contraction. One sign of the latter has been spotted with China, whose official (and possibly overstated) GDP growth numbers are likely to slow to under 6 percent this year. Good morning. There are plenty of ways to measure global growth or contraction. One sign of the latter has been spotted with China, whose official (and possibly overstated) GDP growth numbers are likely to slow to under 6 percent this year.

For the first time in decades, China is now a net seller of foreign assets. Year-to-date, they've sold $40 billion in foreign holdings, but only bought $35 billion. The net decline is small, but getting rid of overpriced assets and buying fewer ones is also a way to deleverage and raise cash. Fewer foreign buys from China could lower bids on U.S. and other assets as well. It's just one more sign that the economy is quietly slowing behind the noise of activity.

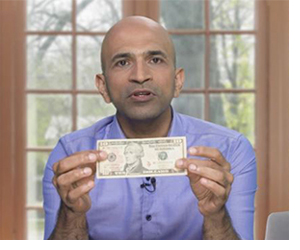

| |  | |  |  |  |  | The Stock of the Century — Buy This Stock RIGHT NOW! |  |  | What if you could buy one tiny stock today for $10 — at the center of a growing tech industry — that experts believe will explode a massive 77,400%?

Wall Street legend Paul Mampilly recently identified this as the stock of the century.

Buying up a handful of shares of this small company now could change your life and even make you millions. Click here now. | |  |

|  |  |  | DOW 26,949.99 | +0.06% |  | |  | S&P 2,991.78 | -0.01% |  | |  | NASDAQ 8,112.46 | -0.06% |  | |  | | *As of market close |  | | • | Stocks traded flat on Monday, as Eurozone data continued to point to a slowing global economy. |  | | • | Oil prices rose slightly, to $58.46 per barrel. |  | | • | Gold rose another 1.1 percent, to $1,531 per ounce. |  | | • | Cryptocurrencies declined on average, with Bitcoin dropping under $10,000 again. | | |  |

|  | | Credit Suisse Gives Micron a $90 Price Target |  |  |  | An analyst at Credit Suisse upgraded shares of Micron (MU). Although the company is going through a down cycle for its semiconductors, the company is expected to report its first profitable cyclical bottom when it reports earnings later in the week.

The expectation is for the company to report between $4.6 and $4.8 billion in revenue, above average analyst consensus. The combination of profit and improving supply and demand for the company's products are likely to lead to multiple expansion.

» FULL STORY |  | | |  |

|  | Morgan Stanley Sees Double Digit Growth at Microsoft |  |  |  | With growth in the cloud architecture space, Microsoft (MSFT) can show investors "durable double-digit growth" according to a recent comment from Morgan Stanley. Improving profit margins for the company's commercial cloud product, known as Azure, make the software giant big relative to better-known names in the cloud space.

Morgan Stanley has an Outperform rating on the stock, and has given shares a $155 price target, an 11.5 percent increase over the current price of shares near $139.

» FULL STORY |  | | |  |

|  | Insider Activity: Roadrunner Transportation Systems (RRTS) |  |  |  | Investment fund Elliott International bought 6,529 shares of Roadrunner Transportation Systems (RRTS), shelling out over $64,000 to make the trade. A mere 0.3 percent increase in holdings, Elliott now owns over 23,227,100 shares, a stake worth more than 10 percent of the company.

Elliott has been an active buyer of shares throughout the year, at prices as much as 25 percent higher than where shares currently trade. There has been only one insider sale this year, from a different fund.

» FULL STORY |  | | |  |

|  |  | | Unusual Options Activity: Amazon (AMZN) |  |  | The November 15th $1,770 call options on Amazon (AMZN) saw over 2,042 contracts trade against a prior open interest of 147, a 14-fold surge in volume. With each option contract representing 100 shares, each option essentially controls $177,000 worth of shares.

With Amazon shares around $1,775, the options are $5 in the money. Trading around $80, or $8,000 per contract, shares would need to top $1,850 for the trade to close in-the-money in the next 52 days.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | ULTA | 3.742% |  |  | | AAP | 3.552% |  |  | | CTL | 3.195% |  |  | | EQIX | 2.694% |  |  | | KMX | 2.682% |  | | BOTTOM |  | | INCY | 4.396% |  |  | | TTWO | 3.699% |  |  | | ABMD | 3.502% |  |  | | CAG | 3.053% |  |  | | MCK | 2.65% |  |  | |  |

|  |  |  | | Rates are once again at another all-time low, yet interestingly enough, most homeowners are not taking advantage of the opportunity to inexpensively tap into their home's equity. My observation has been that the driving force behind this decision-making is based on residual fear from the last real estate crash. This event has since shifted the perspective of many homeowners to now view home equity as a nest egg rather than a bank account. |  | - Matt Weaver, VP of Sales at Cross Country Mortgage, on how real estate perceptions have shifted, and homes are more likely to be treated as a savings account rather than an ATM.  |  |

|  | The Stock of the Century — Buy This Stock RIGHT NOW! |  |  |  What if you could buy one tiny stock today for $10 — at the center of a growing tech industry — that experts believe will explode a massive 77,400%? What if you could buy one tiny stock today for $10 — at the center of a growing tech industry — that experts believe will explode a massive 77,400%?

Wall Street legend Paul Mampilly recently identified this as the stock of the century.

Buying up a handful of shares of this small company now could change your life and even make you millions. Click here now.

| |  |

|

No comments:

Post a Comment