Stock Buybacks:

The Worst Financial Mistake Ever Made?

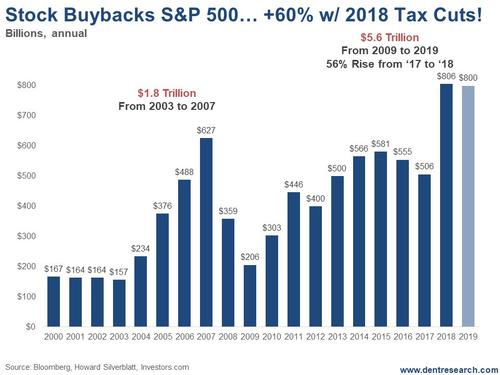

Harry Dent | April 02, 2019 | A lot’s driving this bubble we’ve been in since 2009, but good fundamental trends and things like demographics and technology are not among them. The biggest inflator has been the $13 trillion worth of quantitative easing (QE) courtesy of central banks. Thanks to their significant gift to all but retail investors like you and me, speculation has become the norm. With higher cash flow and cheaper borrowing rates – all in a slow growth economy – companies quickly learned that the best way to increase their earnings per share (EPS) was to shrink the number of shares available. Just look at this…

In 2018, Trump added the massive tax cuts to the stimulus plan. That created even more direct cash flow to corporations, who responded with record stock buy backs of $806 billion last year, which was a 56% increase over 2017. JP Morgan expects we’ll see about as many buybacks this year. The 2019 number is an estimate. Regardless, it’s insanity. Since 2009, corporations have done more than 90% of net buying in the stock market. As The New York Times accurately describes it, “This stock market rally has everything except [individual] investors.” Institutional buyers – aka the smarter money – have been net sellers. Individual investors – you and me – have been neutral, while foreign buyers have been only slightly involved in stock purchases. Rather, the dizzying gains the U.S. stock market has enjoyed are a result of $5.6 trillion worth of stock buybacks over the last decade! READ MORE » Trending Stories... Biotech in 1990, internet companies in 1999, vacation homes in 2005, cryptocurrencies in 2017. Now the fast money is chasing ridesharing pioneer Lyft, as well as other unicorns (private, money-losing companies valued at $1 billion or more). The Fear of Missing Out (FOMO) can certainly make us look foolish. My mother warned me about things like... The last time this "window" opened in the market some large caps rose like penny stocks... Giving you the chance to make up to ten times your money on some of America's best companies. It's open again, and some household name stocks are expected to soar... An article caught my eye earlier this week: 102-year old John "Sonny" Franzese, a former Colombo crime family member, incarcerated for 50 years for refusing to rat on his friends, is finally speaking out. This, on the heels of the Francesco "Frank" Cali murder on March 14 – the first killing of a New York... Last weekend wasn't exactly sunny on the Texas coast, but it was the closest we've gotten in two months. Early on Saturday, I started work in the yard. 96 bags of mulch later, I took a much-needed rest and made my way through the day's news. It was all Mueller, which is unfortunate because there are... In the last week, there have been a slew of articles warning that we're on the verge of a recession. The most prominent is talk about the yield curve – the 10-year versus the three-month Treasurys – finally inverting. That has led every recession since 1955, and only gave one false signal in the 1960s.... I live 200 feet from open water, facing Clear Lake, Texas. It's not a lake, it's a bay off of Galveston Bay, and it's definitely not clear. But other than that, the description is perfect. My downstairs area is 9.2 feet above sea level and consists of garage space and a storage area. The first... |

No comments:

Post a Comment