Rent to Live…

Buy to Rent

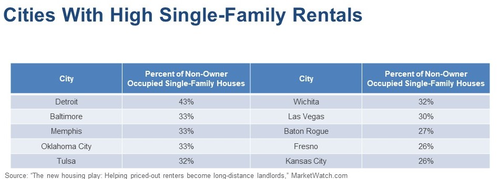

Harry Dent | February 07, 2019 | Did you read Andrea Riquier's two articles on Market Watch last year about real estate strategies? Definitely worth it! The first was "The new housing play: helping priced-out renters become long-distance landlords." It was a strategy aimed at people living in unaffordable areas like San Francisco, Los Angeles, Miami, or New York. Rent in those areas to avoid the high purchase costs and a major bubble burst (when it inevitably comes). Then use your freed-up borrowing power to buy a house in an affordable area where renting for income is more lucrative, and far less risky. We're talking places with high percentages of single-family rentals, like Detroit, Las Vegas, or Kansas City and a few more listed below.

Except for Baltimore, these cities aren't on the expensive coasts. Rather, they're more towards the center of the country. They have more struggling middle- or lower-income families who can't afford to buy, even in these less over-valued areas. And besides Detroit – to a degree – none of these are bubble cities that are likely to crash and crucify you. In her second article called "Pick your poison," Riquier showed that there are two ways to make money in real estate. Look at this chart that rates areas by quality of life. READ MORE »

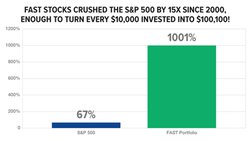

This subset of "FAST stocks" has

crushed the S&P 15-1 since 2000!  Want to know what they are?

And how to access the latest FAST stock opportunities hidden inside the stock market right now?

Just go here to get the full story.

More From Economy & Markets | Harry Dent | January 30, 2019 When I share with people my Spending Wave chart, I must now do so in TWO stages. The first with the market correlation to the 46-year lag for peak spending before the idiotic, insidious, irresponsible QE phenomenon took flight, and the second one after. Look what these "experts" did… READ MORE » | | Harry Dent | January 28, 2019 Ken Griffin, the Texas billionaire worth around $10 billion, just bought two combined penthouse apartments at 220 South Central Park for a whopping $238 million. And he recently bought a house in London for $122 million. So, in the last year, he's ponied up $360 million for property. Is this a case of more money than sense? READ MORE » | |

No comments:

Post a Comment