Gold, Repos, Iran, and Puerto Rico

Harry Dent | January 10, 2020 | It's been a busy week around the world, and particularly here at home in Puerto Rico, where we were without power for a bit after the string of earthquakes on the southern coast on Wednesday. Luckily, we have since recovered and are stabilizing pretty quickly. That was no Hurricane Maria, I'll say that much. And in Iran, where geopolitical tensions are simmering at a near-boil after the United States' assassination last week of Qassem Soleimani. As you know, Iranian forces responded this week, firing missiles at a U.S. base in Iraq. The fact that they failed to hit any soldiers is a good thing, obviously, and it looks to have been intentional. My thinking here is that Iran blinked first in this standoff as I recently advised they should, given the instant win of having Iraq vote to kick the U.S. out. Nevertheless, the fluctuations we were expecting in the markets as a result of the Iranian conflict haven't come to fruition quite yet. We're still in this holding pattern, where two scenarios are possible, but the near-term blow-off top looking more likely after Iran's tepid response. What we do know is that markets haven't been given any specific reason to go down now, so it's likely they'll continue to climb a bit through the first few months of 2020 and that could form a top by March. Remember, this is a different type of global conflict, one raised over geopolitical tensions, not the pursuit of a commodity, so we should expect to see markets and entities like precious metals move differently than usual. That goes for gold and silver, especially — neither of the two has changed course much in response to this week's news. They're still moving in those bullish trends, but silver is not advancing faster than gold, as it usually does. I have more on all of this, as well as a breakdown of the mess we're in on repurchasing agreements, in this week's Friday Rant.

Harry Dent

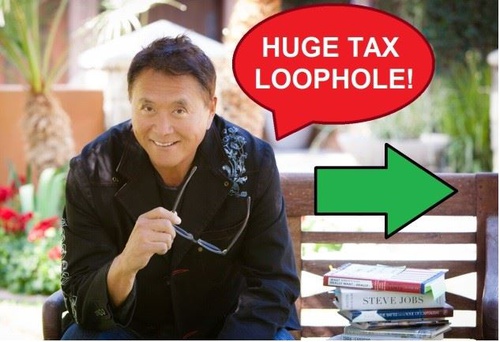

Robert Kiyosaki: "Don't file your taxes just yet!"  This obscure tax "paycheck loophole" could boost your bottom line by up to $13,300 or more, depending on your situation. This obscure tax "paycheck loophole" could boost your bottom line by up to $13,300 or more, depending on your situation. This Week in Economy & Markets...  It's been a busy week around the world, and particularly here at home in Puerto Rico, where we were without power for a bit after the string of earthquakes on the southern coast on Wednesday. Luckily, we have since recovered and are stabilizing pretty quickly. That was no Hurricane Maria, I'll say that much. And... It's been a busy week around the world, and particularly here at home in Puerto Rico, where we were without power for a bit after the string of earthquakes on the southern coast on Wednesday. Luckily, we have since recovered and are stabilizing pretty quickly. That was no Hurricane Maria, I'll say that much. And...

The holidays are over and we're finally getting our home back in order. We had 16 people in the house for Christmas dinner, including our three children and our son-in-law. The youngest was our 21-year-old daughter, so it was a home full of adults. Our kids stayed with us for several days, which filled the... The holidays are over and we're finally getting our home back in order. We had 16 people in the house for Christmas dinner, including our three children and our son-in-law. The youngest was our 21-year-old daughter, so it was a home full of adults. Our kids stayed with us for several days, which filled the...

I was looking at some cycle work from J. M. Hurst, and there were related articles on how sunspot cycles affect very short-term movements in stocks – not just the 8-14, or near 10-year average cycles in booms and busts. I will be looking more into that. I was recently looking at the longer-term cycles,... I was looking at some cycle work from J. M. Hurst, and there were related articles on how sunspot cycles affect very short-term movements in stocks – not just the 8-14, or near 10-year average cycles in booms and busts. I will be looking more into that. I was recently looking at the longer-term cycles,...

As Americans, we profess to love our privacy. Gone are the days of our youth when backyard football games stretched across several properties. Now everyone has a six-foot privacy fence and a host of webcams that ping us every time a feral cat crosses the front lawn. And yet, we carry smartphones. That nifty electronic... As Americans, we profess to love our privacy. Gone are the days of our youth when backyard football games stretched across several properties. Now everyone has a six-foot privacy fence and a host of webcams that ping us every time a feral cat crosses the front lawn. And yet, we carry smartphones. That nifty electronic...

|

No comments:

Post a Comment