Percent of Money-Losing IPOs as High as 2000 Tech Bubble Peak

Harry Dent | January 29, 2020 | John Thomas at The Mad Hedge Fund Trader used to speak at our Dent Advisors' Network sessions and currently speaks in Australia for my promoter there, Greg Owen at Goko. Thomas just put out a good newsletter article on the recent slew of IPOs and why he sees them mushrooming to a major peak this year, which could coincide with a tech bubble blow-off top – and that blow-off phase is already occurring from my view, starting in early October. But first, I saw a chart that was similarly ominous. 81% of the IPOs in 2018 were profitless – the highest since 2000 also at 81%. Such questionable IPOs always appear near speculative tops like this one.

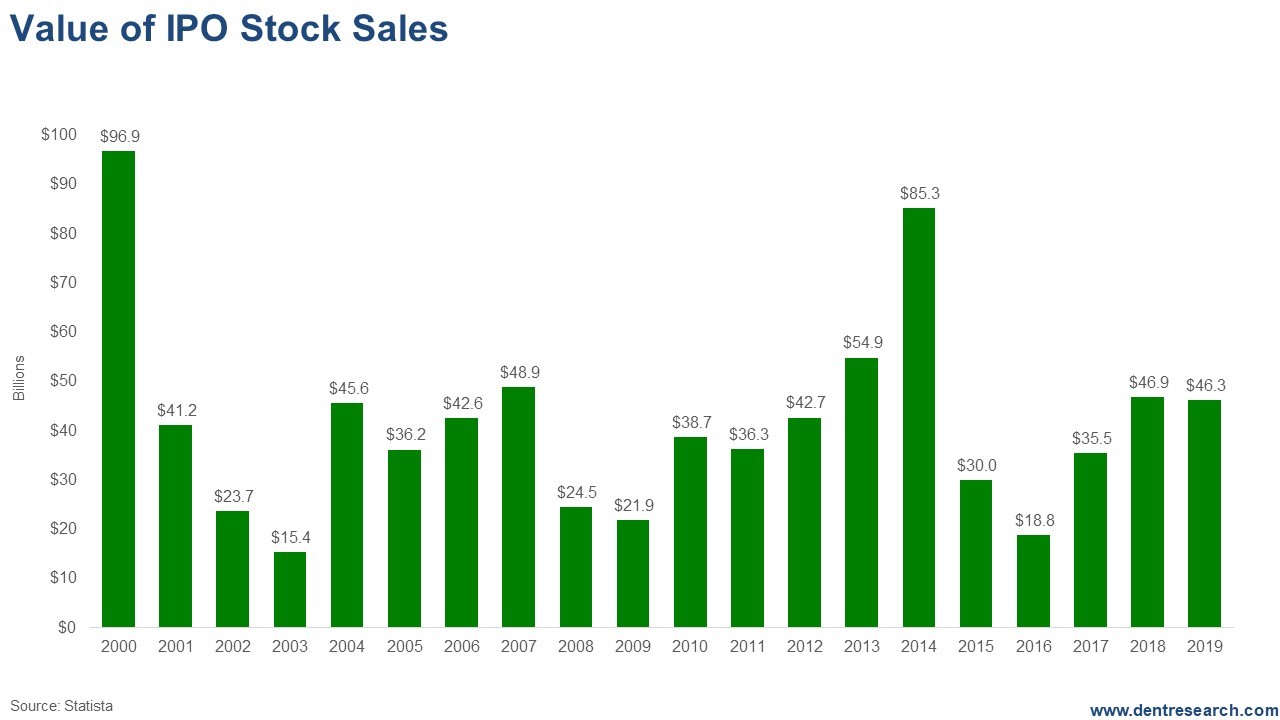

[Click to Enlarge] This is worrisome on its own. But Thomas brings a more impactful insight from his ear to the ground in Silicon Valley. He says there are about 220 companies valued collectively at around $700 billion that are looking to go public in 2020. Why? Most there see a recession after the election and want to get in while the sun shines on high valuations and speculative offerings – and yes, those without profits. I showed in a recent article that 97% of corporate CFOs expect a recession to start by the end of this year. His best estimate is that around $100 billion of stock could be actually sold from these companies with $700b billion+ collective valuations. That would be just a tad higher than the all-time peak, also back in 2000, of $96.9 billion. Former "Megabank" Trader Reveals Powerful Details… In an unprecedented new video, Michael Coolbaugh pulls back the curtain on one of Wall Street's biggest trading systems. This includes a unique way to detect market signals that are invisible, not only to the human eye… but to every other trading system on the planet Find out for yourself today! Thomas astutely states that the big problem is that such high amounts of money going towards primary speculative offerings sucks money from the secondary traded markets like the Nasdaq and the high-flying FAANG stocks.

[Click to Enlarge] $100 billion or so would be a bit more than double the value of IPOs sold in 2018 and 2019 – a classic sign of a blow-off top. Also, note that tech stocks peaked in March of 2000. So, most of those IPOs came after the peak and only contributed to the crash to follow – especially that first and typical 41% Nasdaq crash between late March and early June. So, if we see such an explosion of profitless IPOs – and most won't be big names like Facebook or Uber – then it's time to start looking for a tech bubble peak. I am currently expecting that to occur somewhere between late May and the election at the latest, just from the chart patterns vs. the 2000 bubble and blow-off phase.

Harry Dent Retire Rich with Trump's Help!  Donald Trump laid out his brilliant ideas about America's financial system in this book long before he was president.

He wrote it with the #1 best-selling author in personal finance, Robert Kiyosaki…

And it's designed to help everyday Americans retire wealthy!

If you only have a few thousand saved for retirement…

Or simply want to learn why Trump will win again in 2020…

This Week in Economy & Markets... |

No comments:

Post a Comment