Housing Bubbles and Bursts

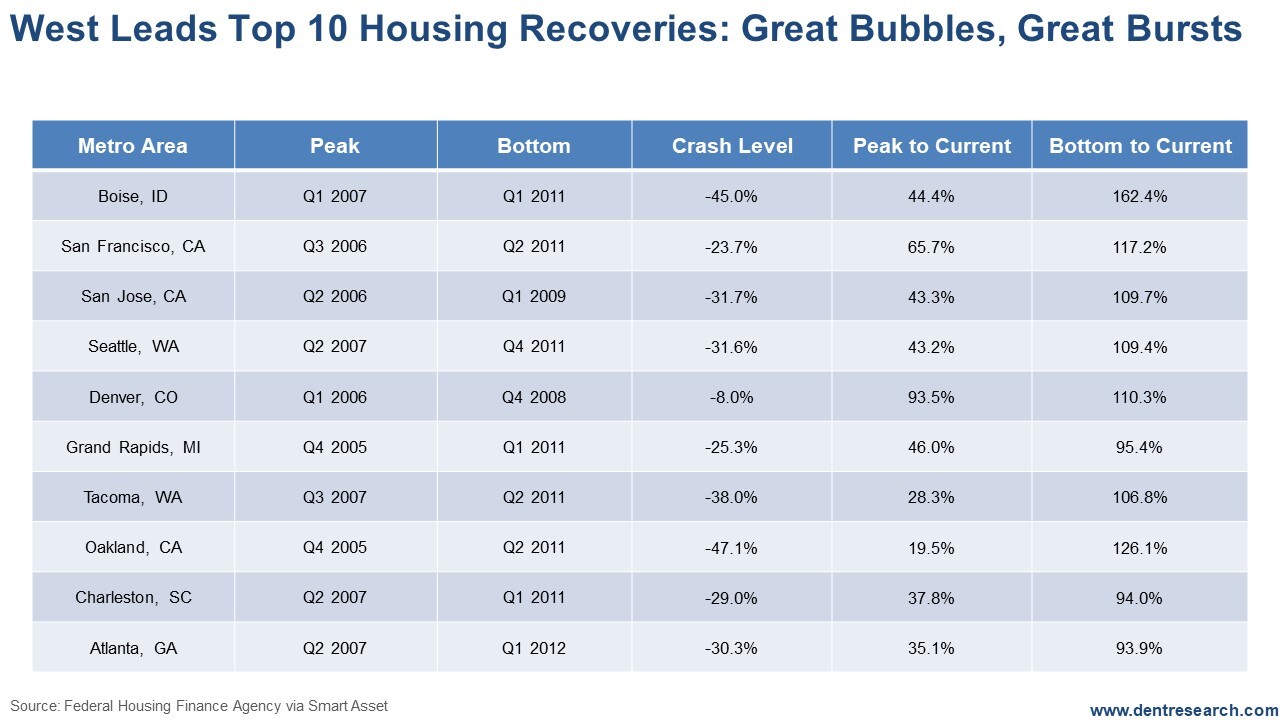

Harry Dent | January 27, 2020 | The biggest bubble blindness doesn't come in stocks. People know that stocks can bubble and burst. The 1929-32 crash was most infamous, but we've seen two just in the last two decades: 2000-2002 for tech stocks and 2008-09 more broadly. The next will be the worst by far. But real estate has only seen one bubble burst of significance for well over a century: 2006-12 at 34% on average. Even 1925-33 was only a 26% crash, with a strong rebound to follow. But the demographics for real estate have changed for a long time, as a larger generation is followed by a smaller one in ultimate magnitude for the first time ever. Most cities have recovered to slight new highs in this second bubble, driven by cheap, endlessly printed money just like stocks and bonds. But many are now much higher, from San Francisco to Denver. I was in the Miami bubble when South Beach beachfront condos were going for $800-$1,000 per square foot. Now, it's $2,000! Manhattan is double or more the 2006-07 top. Here are the top 10 metros that have appreciated the most from their bottoms, typically between 2011 and 2012. I would not have guessed that Boise would be the hottest right off the bat, at a 162.4% rise since 2011. But it is a hot town with good weather (for the upper Rockies) and good jobs in the tech industry. The other really hot cities have been mostly on the west coast: Oakland at 126.1%, San Francisco at 117.2%, Seattle at 109.4%, San Jose at 109.7%, and Tacoma at 106.8%.

[Click to Enlarge] For decades, migration has moved from north to south and east to west. The difference is that the western states have less developable land – often, mountainous or desert. So, there's more demand pressure vs. supply. No One Outside of Wall Street Has Ever Seen This… After years working at some of Wall Street's biggest megabanks, Michael Coolbaugh is revealing the details of one of his most powerful trading systems directly with everyday investors. You don't want to miss all of what he's sharing today in his latest, unprecedented presentation. Click here to watch! Dallas is a great example of a city with endless flat land. The joke there is that "you can watch your dog run away all day." So, despite lots of growth, prices stay more reasonable. Dallas only went down 14% in the first crash and has appreciated more this time. But it is still more reasonably priced. Denver is another new exception. It only went down 9% last time but has become a very popular place to live since. It has appreciated 110.3% this time and now does have much more downside. It's the second biggest boom city in the Rockies. The general rule of bubbles is, the greater the bubble, the greater the burst. So, these cities and more, like Manhattan and the beaches and downtown area of Miami, will burst bigger this time. Nine out of 10 of the worst recoveries came not in the Midwest, but in the Northeast. Both regions are losing jobs and often have negative migration. But the Northeast came in more overvalued. They will tend to have much less dramatic crashes, as will the Southwest and much of the Southeast.

[Click to Enlarge] Look up your city. How much did it decline in the last bubble burst? How much has it boomed in this final bubble? The minimum downside for most will be the last lows, typically between 2011 and 2012. They could go as low as early 2000 prices at the worst. How much do you love your real estate? All we can do is point you to the downside risk… But the worst news: You can't expect a big rebound next time, as boomers dying will outweigh Millennials buying in general until around 2040. Yes, falling net demand for decades.

Harry Dent This Week in Economy & Markets... |

No comments:

Post a Comment