Recession Warnings Abound? Meh!

Harry Dent | March 27, 2019 | In the last week, there have been a slew of articles warning that we’re on the verge of a recession. The most prominent is talk about the yield curve – the 10-year versus the three-month Treasurys – finally inverting. That has led every recession since 1955, and only gave one false signal in the 1960s. I agree. This is something to worry about. But, this signal typically appears about a year before any recession hits. That means stocks could run up another six to nine months before they react. That’s all we need for my Dark Window blow-off rally scenario. Then there was what was called “The Vicious Trifecta”: - German 10-year bonds went back into negative yields adjusted for inflation when European manufacturing data came in weak. This follows other slowing indicators, including Italy falling into a recession in the last two quarters of 2018.

- U.S. manufacturing data also came in at the lowest rate in two years and 10-year Treasurys have fallen to 2.36% since, near negative yields just above the inflation rate.

- Fund managers pulled capital out of equities to the tune of $20.7 billion in the week ending March 21.

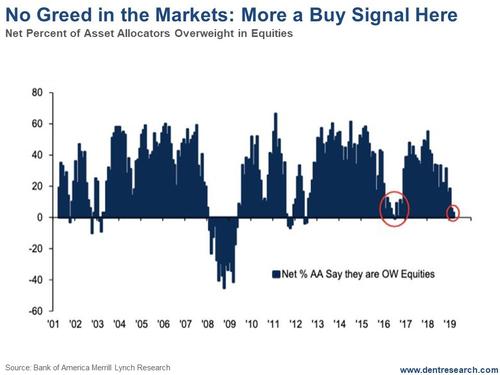

So much for those tax cuts creating sustainable 3% to 4% growth, which we warned was impossible. Gary Shilling, known for his deflationary leanings, issued a warning because we can’t seem to break above the Fed’s 2% inflation target, even though unemployment has fallen from 10% in 2009 to a recent low of 3.5% (it’s currently at 3.8%). That’s a sign of deflation and recession. Then both Morgan Stanley and RBC Markets warned that the correction into late December looked like ones that have preceded previous recessions and larger corrections. Well, that’s where I most disagree. It might be true for normal stock crashes and corrections. But this is the peak of the largest and most global bubble of our lifetimes. My research and analysis prove without a shadow of a doubt that stock bubbles go out with a bang, not a whimper. And like I said recently, the late September/early October top in the markets was a whimper. That was the first sign to me. The second was that you only know a major bubble has finally topped when you see a first violent correction, with losses ranging from 30% to 50% in the first two or three months (the average loss is 42% in 2.6 months). Halfway into the last correction in mid-November, I could tell we weren’t on that trajectory and declared this just another correction, not a top and the start of a major crash yet. In light of this, here’s a chart I just came across that argues we’re nearing a final buying opportunity into this Dark Window blow-off top scenario I’ve forecast…

The percentage of asset allocations that claim they’re over-weighted to equities is near zero. Outside of being at the bottom of the major stock crash/recession in late 2008/early 2009, where the reading was -40% to -45%, near zero is where you want to buy! If we were near a top and major turning point down, we should have seen investors pouring into equities, not being this conservative. In short, all the pieces fit perfectly into my favored Dark Window scenario, in which we could see a final blow-off rally that takes the Dow to 33,000-plus and the Nasdaq to 10,000 by early 2020. After that, it’s tickets. Yes, things are slowing. Yes, there is reason to worry. But not yet. I share with Boom & Bust Elite subscribers the lines in the sand I’m watching. If any of those lines are crossed, we can start worrying earlier. If not, don’t miss the opportunities in front of you.  Harry Follow me on Twitter @HARRYDENTJR View Article on Economy & Markets » | Harry Dent, Founder, Dent Research From decades of research and hands-on business experience, Harry has perfected an easy-to-understand view of the economic future. READ MORE » | |

Trending Stories... I live 200 feet from open water, facing Clear Lake, Texas. It's not a lake, it's a bay off of Galveston Bay, and it's definitely not clear. But other than that, the description is perfect. My downstairs area is 9.2 feet above sea level and consists of garage space and a storage area. The first... People don't understand gold. They don't understand the U.S. dollar either. Mostly, it's the same people. Gold bugs thought we were debasing the dollar by printing our way out of the 2008/9 financial crisis. Ha! Actually, the dollar has been rising since the start of that recession. The dollar, not gold, is actually the safe... Every six weeks the Federal Open Market Committee (FOMC) meets to decide whether a change in policy is needed to coax our economy in the right direction. They wrapped up their latest meeting on Wednesday. When Fed Chair Jerome Powell delivered his policy statement, stocks bounced and Treasury yields fell sharply. (Keep in mind the... The admissions scandal is starting to fade; I saw only three articles on it in the past couple of days. Now, according to The New York Times, universities are starting to consider if they should de-enroll (not expel) students who matriculated through fraud, whether the students were aware of it or not. As the paper... The cold makes people happy (and more productive… in every way… ahem). The warmth makes people unhappy (and less productive). And, as Rodney and readers have been debating a lot lately, temperatures across the globe are changing. Frankly, I was surprised at the hot button this topic proved to be! But, just like productivity, and... |

No comments:

Post a Comment