Tax Cuts: Thanks For Nothing – Trump and Corporate America!

Harry Dent | October 15, 2019 | David Stockman, Dr. Lacy Hunt and I agreed on a lot of things last week at the seventh annual Irrational Economic Summit in D.C. One of the key points that I have been harping on over the last year is simple: The recent tax cuts were destined to go into financial engineering to leverage earnings per share, not into new productive capacity that would create future jobs and earnings… Why else do you think that Lacy Hunt's acid test for productive investment – money velocity – keeps sinking despite the so-called recovery? Couldn't be clearer than this chart from Stockman's presentation.

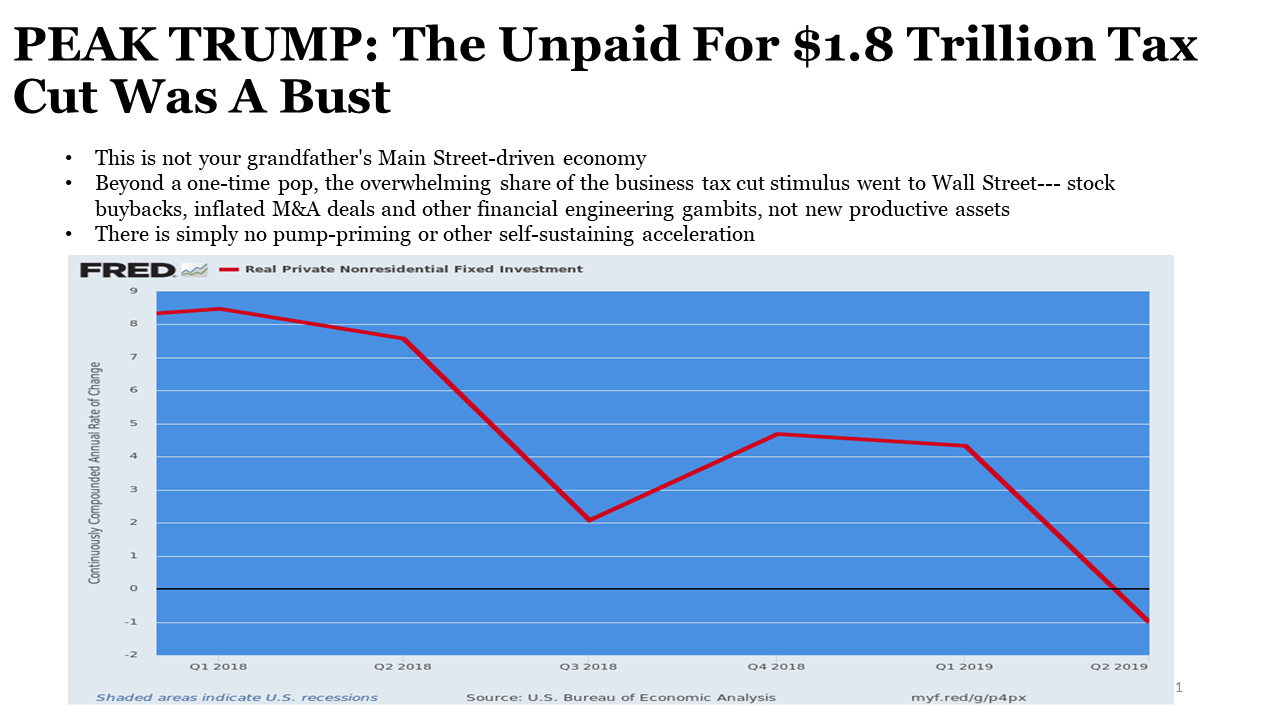

[Click to Enlarge] When the tax cuts hit in the first quarter of 2018, real capital investment was at 8.5% growth. It not only went down, it plummeted to negative 1% one year later in Q1 2019… They could have at least faked a little investment for a year to make Trump look good! Stockman, Hunt, and I all warned about this before it happened. Companies do not need extra capacity. They already over-invested in the bubble boom that peaked in 2007. This recovery has been the weakest on record. In fact, from the top in 2007, the cumulative growth in GDP 11 years later has been a mere 19%, less than the horrific 1929-40 Great Depression at 20% – and we still have the worst ahead of us when this totally artificial bubble finally bursts. And it went right where we all said it would go – the same place it already had been going, just faster with such a boost for no logical economic reason.

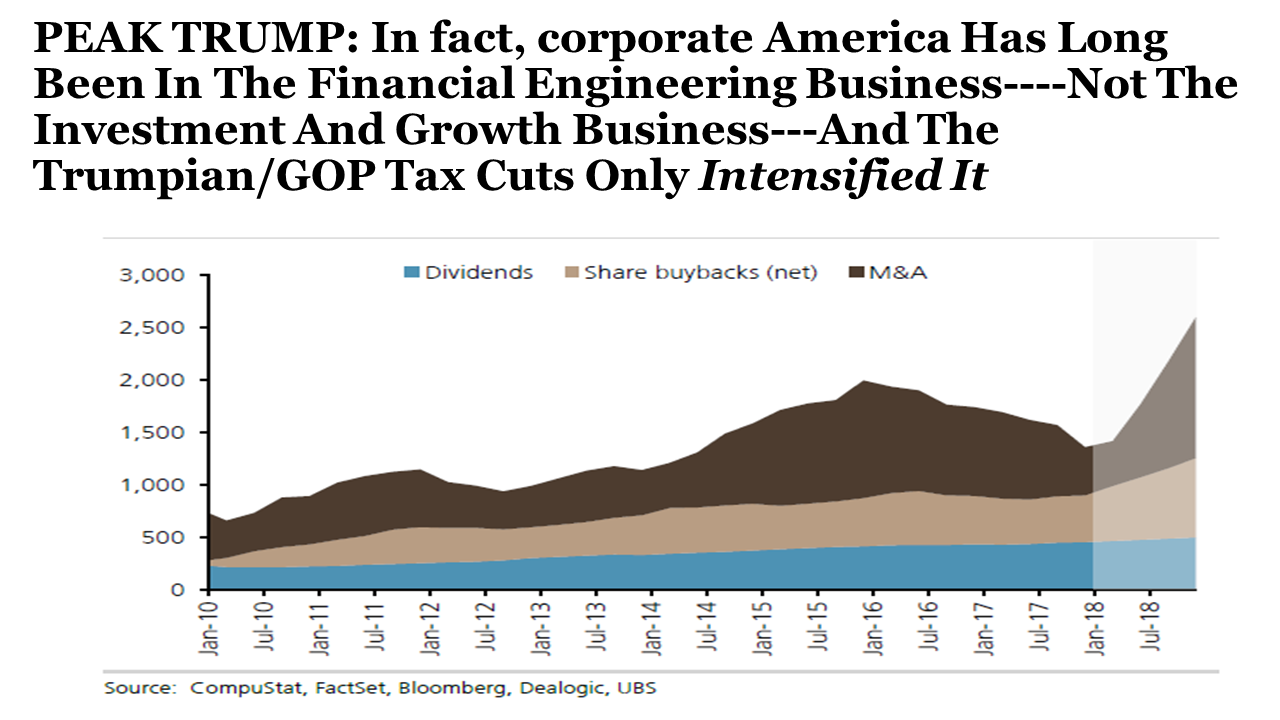

[Click to Enlarge] Dividends just kept drifting up as usual. But stock buybacks accelerated more dramatically since the beginning of 2018, and so did mergers and acquisitions – re-arranging the assets. Why would anyone do anything else as zero interest rate policies and endless money printing gives incentives to do so easily and cheaply. Building plants and stores and warehouses is hard work. Buying back your own stock is just pushing a button… And this is supposed to turn out okay?

Harry Dent Trending Stories... The two fighters were nice enough to each other. They exchanged pleasantries, took their places on the stage, and then began to trade their blows. This took place at our Irrational Economic Summit over the weekend when David Stockman and Lacy Hunt squared off and went at it. The topic was the Fed – or... The 7th Annual Irrational Economic Summit has officially come to an end. This by far was the best, most contrarian event yet. With over 260 attendees filling the conference rooms each day and another 250+ livestream viewers, savvy investors got direct access to strategies and insights from the brightest Wall Street analysts and economists in... Yesterday kicked off Day 1 of the 2019 Irrational Economic Summit, and was by far one of the best days since this event started in 2012. Mark Yusko If you have even a dime of your money in the market, the research-backed insights from Morgan Creek Capital Management's CEO Mark Yusko, alone, could get you... As you know, this week myself and the Dent Research team are at the National Harbor outside Washington DC for the 7th annual Irrational Economic Summit. Festivities kicked off Thursday, and it was simply a great day – and Friday and Saturday should be just as wonderful. (You can get fully caught up, and even... The 2019 Irrational Economic Summit is already off to a big start. The Irrational Economic Summit opened with a full house of 260 attendees. Boom & Bust co-editor Rodney Johnson drove home the importance of pinpointing the right information, at the right time, to take the right action on your money. "We don't just give... |

No comments:

Post a Comment