The Cycle Variation

That Points to a 2023 Bottom

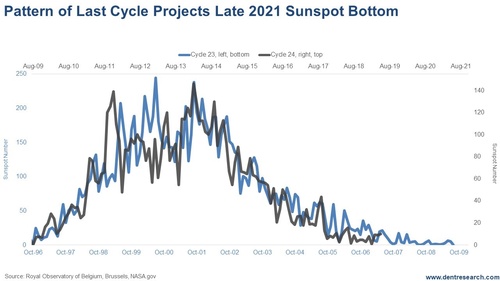

Harry Dent | August 05, 2019 | When I last met years ago with Richard Mogey, past director of The Foundation for the Study of Cycles, the topic of sunspot cycles came up… Mogey was the first person who totally got it. He had been following these cycles for a long time and understood their impact on the business cycle and agriculture. While we chatted, he said something interesting. He and his wife had determined that what caused the substantial variances in that approximate 10-year cycle was the gravitational pull of the larger planets on the sun. We're talking from Jupiter on out. Gravity is of course a CORE principle in physics. | While tens of millions of investors, business owners, and self-employed professionals will be losing their nest eggs, going out of business, and struggling financially for years to come… Those who possess one of the limited copies of this highly sought-after financial research will be able to GROW their retirement funds, EXPAND their businesses, and PROSPER like never before… For complete details, CLICK HERE. | When doing my normal overview of scientists' forecasts for when this current sunspot cycle is most likely to bottom, I found that the consensus was for December 2019 to early 2020. But there was one group that was forecasting late 2020, citing the "gravitational" factor… That's when I remembered that conversation with Richard… and I started favoring the forecasts of these "gravity" guys. I have recently done my own poking around and found that down waves in the Sunspot Cycle have been increasing in length and as a percentage of the cycles after the last major peak in intensity in 1957. Ever since that year, sunspot cycles have peaked lower and taken longer to bottom. When I applied the average ratio of up and down waves since 1957, the upside of this cycle into mid-2014 (at 4.4 years up) would project a downside cycle of 8.8 years and a bottom way out in mid-2023. If that turns out to be the case, the traditional scientific experts would be far off in their forecast for the first time… and this scenario would correlate perfectly with my hierarchy of four primary cycles that suggests the worst for stocks between 2020 and 2022… and for the economy into 2o23. Here's what the middle path would look like… (this is merely an intuitive correlation with the last cycle, which was the longest in history.)

My experience with much cycle analysis has taught me that the intuitive correlations tend to be better than the more analytical ones. This projection would say that the worst for stocks and the economy would hit between 2020 and 2021 – right in Trump's re-election campaign – or just after if he wins. If I were running for president, I would rather lose due to a stock crash that I could blame on the Fed than get re-elected and then get hammered and fully blamed for the next great depression! Following this middle path, it also means that the economy could still be weak into 2022 or 2023, as my primary cycles continue to project. That said, I wouldn't be surprised to see the more extreme projection unfold, giving us a bottom in 2023. That would also be consistent with more lengthy bottoming processes in the last period of three low sunspot intensity cycles in the early 1800s, called the "Dalton Minimum" where they stay at near zero for three to five years before turning up. I'll keep you updated. But I'm more confident betting against the traditional experts this time, although they are close to right most of the time. The falling intensity and lengthening of cycles here isn't typical, and that's where a cycle guy like me can see something the scientists don't. Visit ECONOMY & MARKETS » Trending Stories... All the focus this week, after the Fed rate cut on Wednesday, was on the Democratic debates, and I gotta tell ya… they have been on the disappointing side. One clear trend is that Elizabeth Warren is steadily rising in popularity. Another is that Independents are more powerful than most realize. So today let's talk... At the end of July, Harley-Davidson reported second-quarter results, and it was a bloodbath. Sales slid and profits suffered a 20% drop. None of this is surprising to Harry and me. In fact, we knew well before 2006 that the company would fall from grace because we knew its target audience and what they would... It's been too long since we've shared our Q&As with our readers. So, today we remedy that. Here's what readers have been asking Rodney and me… and how we answered them. Remember, if you have any questions we don't answer below, write to us at economyandmarkets@dentresearch.com. Karen S. Emailed The Following… I have been an... I know it's in vain, but I keep Location Services turned off on my phone when I'm not using Uber or some other mapping app. In my head, this reduces the number of apps that can track my movements, and thereby removes just a bit more of my personal information from the amorphous cloud. Sadly,... Is there no end to talk of how the U.S. dollar will soon be replaced as the world reserve currency by the euro or the yuan or a basket of currencies or gold or bitcoin or Libra? Even Michael Cembalest at JP Morgan is the latest to predict the dollar's rapid demise. The reality is,... |

No comments:

Post a Comment