Most companies state that it's their policy to hire and retain top talent. So watching any company churn through executives should be a big warning sign to investors. Naturally, there is a poster child to keep in mind. In its short time as a publicly-traded company, Tesla Motors (TSLA) has churned through over 50 executives.

|  | Good morning. Most companies state that it's their policy to hire and retain top talent. So watching any company churn through executives should be a big warning sign to investors. Naturally, there is a poster child to keep in mind. In its short time as a publicly-traded company, Tesla Motors (TSLA) has churned through over 50 executives.

The most recent to leave? The Vice President of HR and Diversity, Felicia Mayo, who has left after nearly two years at the beleaguered company. It could be worse. If HR and Diversity required different vice presidents, the company could have lost two executives. |  |  |

Was this email forwarded to you? Get your own! Sign up here. |  | |  |

|  |  |  | DOW 30, 26,504.00 | +0.15% | | |  | S&P 2,926.46 | +0.97% | | |  | NASDAQ 7,953.88 | +1.39% | | |  | | *As of market close |  | | • | Stocks traded flat on Wednesday ahead of the Fed, and made a light gain following the bank's announcement. | | | | • | Most other assets were flat on the day, although gold rallied about 0.5 percent on dovish Fed comments. | | |  |

|  | | Fed Holds Rates Steady |  |

| | Central bank leaves interest rates unchanged. |  | The Federal Reserve announced that it would keep the Fed Funds rate steady at 2.25-2.50 percent on Wednesday, after a two-day meeting.

While most traders were anticipating that rates would stay the same, a growing number of traders were starting to price in a potential quarter-percent cut in rates, following earlier comments by Fed officials that their next move would be to cut.

» FULL STORY |  | | |  |

|  | Beyond Meat Hits $10 Billion Valuation |  |  | | Company soars 600% from IPO. |  | Going public back in May, Beyond Meat (BYND) has seen shares move over 600 percent from its IPO price. At current valuations, the company is now worth over $10 billion, putting it ahead of more than 80 companies in the S&P 500 Index.

Although shares dropped on Wednesday on news that Taco Bell had no interest in pursuing plant-based meat alternatives at this time, the company remains the IPO success story of the year—if not the decade.

» FULL STORY |  | | |  |

|  |  | | Insider Activity: Provention Bio (PRVB) |  | | Insiders buy after shares already triple. |  | Multiple insiders have been buying shares at Provention Bio (PRVB), a clinical stage biopharmaceutical company with a focus on preventing immune-mediated diseases.

On June 18th, President and CEO Ashleigh Palmer bought 4,000 shares, paying over $43,000. And director Anthony Digiandomenico picked up 10,000 shares, paying over $118,000.

» FULL STORY |  | | |  |

|  | Unusual Options Activity: Qualcomm (QCOM) |  |  | | Traders bet on 35 percent jump in shares by midsummer. |  | A large bet is being made that shares of Qualcomm (QCOM) will rally to $95 per share by the middle of August.

On Wednesday, over 4,600 of the August 16th call options contracts had been traded, against an open interest of 278. This bet, with shares currently at $71, implies that shares will move higher by around 33 percent in the next two months.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | AGN | 6.233% | |  | | IQV | 5.89% | |  | | ADBE | 5.214% | |  | | LW | 3.985% | |  | | NWS | 3.939% | |  | | BOTTOM |  | | MAT | 5.39% | |  | | SIVB | 3.198% | |  | | ALB | 2.586% | |  | | SCHW | 2.493% | |  | | MOS | 2.452% | |  | |  |

|  | Top Rated Technology Stocks |  |  |  |  |

|  |  |  | | There was not much support for cutting rates now… we felt it would be better to get a better picture of things before acting. | - Federal Reserve Chairman Jerome Powell, during post-meeting Q&A on why the Fed didn't cut rates today  |  |

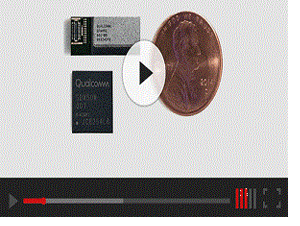

|  | 3 Red-Hot 5G Stocks: The Death of Comcast is Near |  |  |  One penny-sized piece of "plastic" is about to set a massive investment opportunity in motion. It's a tiny modem that makes new 5G technology 100x faster than your home internet... and Comcast is worried. One penny-sized piece of "plastic" is about to set a massive investment opportunity in motion. It's a tiny modem that makes new 5G technology 100x faster than your home internet... and Comcast is worried.

We've identified 3 stocks set to produce returns as high as 3,217% from one of the greatest technological shifts in our lifetime. Get in early and own these 5G stocks on the cheap. Click here for all the details. | |  | |

No comments:

Post a Comment