Unpacking the Unusual Activity…

And Considering Which of the 2 Wild Cards Is the Most Dangerous

Harry Dent | June 28, 2019 | I'm coming to you today from Myrtle Beach, where my entire family gets together for their annual reunion. It doesn't matter where I am though, I watch the markets like a hawk. And right now, the markets are in a crucial place… We're back to testing the highs and things can go either way here. Markets could break down 25% in the near term… or they could shoot up 25% in the next several months in the final blow off Dark Window rally before the big crash. But today, while I touch on my market targets for the rest of the year, I really want to talk to you more about the unusual activity we're seeing in bitcoin and bond yields… and even more so, the two wild cards hanging over the markets right now. We all know the U.S.-China trade deal is one of those wild cards… but the second one is much newer and potentially far worse. Watch now to get all the details…

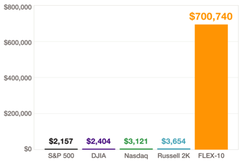

When you're done, do yourself a favor and check out Charles Sizemore's new "Flex-10 Index." His 20-year back test shows how this custom index tracking a basket of 10 stocks could have crushed every major benchmark index, despite market corrections and crashes along the way. Here are the details. VISIT ECONOMY & MARKETS ONLINE» |

Recession-Proof Profits? In this special presentation, Chief Retirement Strategist Charles Sizemore reveals the strategy that backtesting proves could have crushed all the major indexes during each of the past two recessions. Now, he's developed a custom index that allows you to follow this strategy, COPY the model portfolio and potentially thrive during the next recession. Click here for more information. | Trending Stories... The Democratic debates are underway, so if you're a masochist with no hobbies, you now have something to watch at night. This isn't a knock on a particular political party. Watching the Democrats today is just as unenlightening and boring as watching the Republican debates in 2016. Moderators ask candidates questions and they fail to... The world's top political, economic, and investment research experts are travelling to our nation's capital to reveal how the events of the next 18 months could make AND save you a fortune. For a limited time, Dent Research readers can secure a 40% discount on their ticket to the 2019 Irrational Economic Summit... We live in a world where we wake up to news (and a shocking image) of a drowned father and daughter on the banks of the Rio Grande and threats from North Koreans about not letting the U.S. "bring them to their knees." Tensions between the U.S. and Iran are rising all the while politicians... Late last week, on the first day of summer, I watched the news and weather for a few minutes before my morning run. It was 85 degrees with 97% humidity. It was 4:40am. The meteorologist said the "feel like" temperature was 99 degrees. I ran anyway. It was awful. Such is life on the Gulf... 2019 has turned into the Year of Tech IPOs. Lyft. Pinterest. Zoom. Uber. Fiverr. Slack. And we're only half way through the year. Airbnb, Palantir, Robinhood, and several others have plans to go public before year's end. Some of these fresh listings have been bad (ahem… Uber). Others have shot to the moon (like Slack).... If you don't know by now that Facebook released its libra whitepaper on Tuesday, you're living under a rock. What you may not know is that bitcoin shot up on the news. That's because libra gives credibility to the cryptocurrency market, much like AOL did when it first brought email and the internet to the... |

No comments:

Post a Comment