The Markets Are Screaming…

And It Makes No Sense

Rodney Johnson | June 25, 2019 | Late last week, on the first day of summer, I watched the news and weather for a few minutes before my morning run. It was 85 degrees with 97% humidity. It was 4:40am. The meteorologist said the "feel like" temperature was 99 degrees. I ran anyway. It was awful. Such is life on the Gulf Coast this time of year. We can count on a lot of things, including heat, storms, and mosquitos. And we watch out for bigger things that are possible if not certain, like hurricanes. I've lived through my fair share of the latter living on both sides of the Gulf. We have "go bags," backpacks filled with a few essentials, and we've identified what we'd take in terms of files, photo albums, and computers. We've never implemented the plan, but I don't mind spending the time and money on it because the cost/benefit analysis is compelling. This year I've got a few more things to worry about, like our new golf cart rental business on the coast. In the event of a storm, we'll need to get 30 golf carts over to storage, which is no easy task. And I've got my house on the market. If you're not a coastal dweller, you might not know that insurance companies won't write new coverage on a home if there's a named storm swirling around. It could be 1,000 miles away, but that doesn't matter. This is where the old axiom about separating what you can control from what you can't comes to mind, and it brings me to the markets. We're in a protracted trade spat with China, but the Chinese economy was already slowing before that started. U.S. manufacturing has eased back to almost even between expansion and contraction, and both the Federal Reserve and ECB are signaling easy money ahead. Banks earn about 2.37% lending to each other overnight, which is more than the 2.01% they can earn if they bought 10-year Treasury bonds. The yield curve is partially inverted. The initial bump from tax reform is fading. The Atlanta Fed's GDPNow model shows GDP growth falling from 3.1% in the first quarter to 2.0% in the second. Earnings season is almost here. Corporate earnings fell 2.3% in the first quarter and, in March, analysts expected second-quarter earnings to decline 0.4%. They've now revised that number lower, to -2.6%. Third quarter earnings estimates have been revised from a slight gain to a slight decline. And the equity markets are near all-time highs. One of these things seems glaringly out of place… READ MORE » |

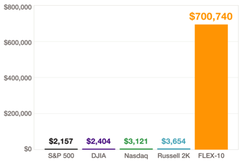

Recession-Proof Profits? In this special presentation, Chief Retirement Strategist Charles Sizemore reveals the strategy that backtesting proves could have crushed all the major indexes during each of the past two recessions. Now, he's developed a custom index that allows you to follow this strategy, COPY the model portfolio and potentially thrive during the next recession. Click here for more information. | Trending Stories... 2019 has turned into the Year of Tech IPOs. Lyft. Pinterest. Zoom. Uber. Fiverr. Slack. And we're only half way through the year. Airbnb, Palantir, Robinhood, and several others have plans to go public before year's end. Some of these fresh listings have been bad (ahem… Uber). Others have shot to the moon (like Slack).... If you don't know by now that Facebook released its libra whitepaper on Tuesday, you're living under a rock. What you may not know is that bitcoin shot up on the news. That's because libra gives credibility to the cryptocurrency market, much like AOL did when it first brought email and the internet to the... They lie, cheat, and steal? No way! In 2014, Puerto Rico issued $3.5 billion in bonds backed by the full faith and credit of the Commonwealth. Now the island's fiscal managers, a group known as the PROMESA board, an entity that Congress created, claims those bonds are worthless. While investors put down their hard-earned cash... As you know, the Federal Open Market Committee (FOMC) meets every six weeks to decide whether they need to change policy to coax our economy in the right direction. You also know that the Fed has a Congressional mandate to provide maximum employment and stable prices, which it works to achieve by manipulating interest rates.... The dark days of 2009 now seem like forever ago. We didn't know which banks would survive. The Fed made all banks take bailout money so that citizens wouldn't know which ones were in trouble and then drain them of deposits. The Fed made bank stocks ineligible for shorting so that investors wouldn't drive their... |

No comments:

Post a Comment