Video Streaming: The Final Bubble in the 45/90-Year Tech Cycle

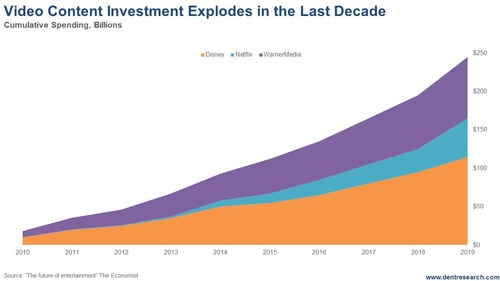

Harry Dent | December 02, 2019 | Here in late 2019, the 45-year tech cycle is converging on the last top back in late 1972. More important the 90-year Super-Bubble Cycle is converging on that infamous late 1929 anniversary. The crypto/bitcoin hype cycle is also right about where the internet was before the first tech crash, from early 2000 into late 2002. The internet shot up like a rocket in the last few years of the broader tech bubble of the 1990s, as bitcoin did into late 2017. But the finale now looks like it might just be the video streaming bubble that's soon to pop. This broader 45-year cycle started with the ascent of portable computers and cell phones, followed by the internet, email, Google, and more recently, social media. But it was broadband that allowed the video streaming finale that is coming to a crescendo now. Netflix was the first big example in 2007 as broadband was maturing in its S-Curve penetration. The company sold cheap monthly subscriptions streamed to undercut more expensive cable services, and then they expanded to smartphones, also maturing. And I love this model for more than the lower price… no advertising! | The Tech Bubble Won’t Be the Only One to Pop Soon… As we head in 2020 and this bull market roars on, several sectors face similar fates as the tech. With markets already at dangerous levels and climbing, Harry Dent outlines what could the “most dangerous period our nation has faced in over a generation.” Get all the details here! | Spotify has led a similar trend in music streaming. So buying and agglomerating content and streaming it appears to be the last great bubble of this super, double or 90-year version of the tech cycle. $650 billion has been invested in the last 5 years, over $100 billion this year alone. This chart shows just the top three companies: Disney, Netflix and Warner Media, which total $250 billion over the last 10 years. Other big players are Comcast, Amazon and Apple.

And of course, most of that was debt, at about $500 billion. This looks like the final disruptive trend in the internet cycle that has caused the winners like Netflix to see stock prices rise 37 times while losers like Viacom have fallen 5% in the greatest tech bubble in history. But now this industry is maturing markedly this year, even for Netflix. Price-cutting will increase, margins will fall, and the industry will quickly consolidate. Bitcoin may yet have one more bubble to new highs in its hype cycle if stocks correct and cause a final all-out stimulus push from the Fed and Trump. But regardless, this bubble alone could pop and trigger the closest thing to the 1929-32 crash we will ever see in our lifetimes, or our kids'. So, I’m going to be watching stocks like Netflix, one of the infamous and leading FAANG stocks. It is off 28% from its 2018 highs. This bubble looks sure to pop in the coming months or year at most… Then Humpty Dumpty comes tumbling down.

Harry Dent Trending Stories... I just got to New York after two weeks in Australia, and while I'm glad to be back on American soil, I'm still a bit frazzled and jet-lagged from the long flights. So we weren't able to record a rant today. We'll be back with those next week. In its place, I had our video... People in the nine-zeros club rarely make my prayer list. Usually my concerns are closer to home, centered on family members and friends, or sometimes things at work. But billionaires have taken a lot of heat lately, as many people hold them up as examples of all that is wrong in our economy. I disagree.... Dr. Lacy Hunt was the first economist to explain why money velocity is important: It measures whether a country is investing its money productively to create continued growth. When it's above average and growing, that's a sign of productive investment that pays good returns and creates more such investment. Falling indicates increased speculation. Falling and... It's that time of year. My wife has been baking up a storm as we get ready for a number of holiday events, including the big family gathering later this week. Black Friday commercials are everywhere as retailers try to pull holiday spending forward as far as possible. Forget Halloween, in a few short years... When I am speaking in Australia, New Zealand, and the U.K., all of whom have big real estate bubbles, I always ask: How do you think this is good for your country that it costs so much to live, and so much investment and attention goes to speculating in real estate instead of producing real... |

No comments:

Post a Comment