You Say You Want a Revolution?

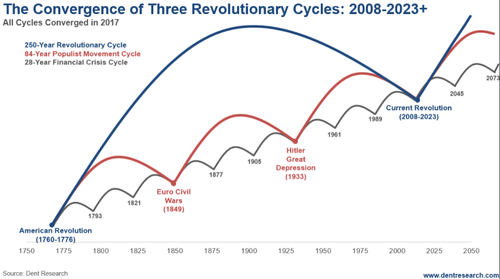

Harry Dent | December 04, 2019 | One of the main themes of my book Zero Hour was that we are in a period of political and social revolution, the likes of which we haven’t seen since the late 1700s, with the convergence of democracy with the American Revolution; free market capitalism; and the Industrial Revolution… 1776 was the year all three came together. We had the Declaration of Independence, the patenting of the steam engine, and the greatest economic book of all times: The Wealth of Nations, by the first real economist, Adam Smith. If you don’t think cycles are important, then ignore that date! Look at this chart from my book:

Our kids are going to look back at this period and say, “What the hell happened here?” Is there anything in human history more important than the convergence of democracy, free market capitalism, and the Industrial Revolution? That made the Agricultural Revolution 10,000 years ago look like nothing. Why? The exponential nature of technology and evolution… And the clean-up hitter home run of the 500-year Mega-Innovation/Inflation Cycle starting in the very late 1800s. Oh, and then the larger 5,000-year Civilization Cycle that first saw the Agricultural Revolution and settling into small towns around 8,000BC; then the advent of cities, writing and the wheel around 3,000BC; and currently, the advent of electricity, computers, the internet and mega cities. When I talk about long-term things like this, people look at me like, “Harry, you need to get a girlfriend.” We have seen more economic progress in the last 120 years than all of human history combined – and we are only half way through that 500-year up-cycle that peaks around 2150. That’s why it’s important to study longer-term cycles. It's also why I make my blockbuster issue of Leading Edge from December 2018 available for all readers as a great resource to give to your kids (who will live through much of this and live much longer), and anyone you want, or they want. When Zero Hour came out, Brexit and Trump were already in play. I talk about 50/50 polarization everywhere in the world. Today, the U.K. is still about 50/50 split on whether to leave the European Union. The U.S., in its modern-day Civil War, is near 50/50 red vs. blue, with little indecision, on whether to impeach Trump as he throws one wrecking ball after the next domestically and globally. | There’s Still Time to Crash-Proof Your Portfolio Over 30 years of dedicated research has led economist, Harry Dent to uncover a once-in-a-lifetime profit opportunity, as we’re on the cusp of a major financial event: “Your entire financial future can change going into 2020, but only if you’re ready to take advantage of this historic event!” Find out how today! | There has been terrorism non-stop since 9/11, and now domestic terrorism leads here with angry white men shooting innocent kids in schools and malls – non-stop! There have been endless civil wars around the world, concentrated in the Middle East after the “Arab Spring,” most of which have largely thus far failed to spawn democracy there due to still largely backward cultures. Now what do we have? A major revolt in Hong Kong against the Neanderthal Chinese communist autocracy in the age of what I call the bottoms-up “Network Revolution” of this very 250-year cycle. Congratulations to those brave revolutionaries there, and they aren’t giving up. I feared that would not happen due to the scarcity of young people who drive such revolutions due to China's One Child policy since the 1970s from that same mafia-like, outdated government. And just this week: major revolts against the even-more Neanderthal government in Iran, where over 200 people have bravely died. Iran has the most educated and pro-western populace in the Middle East, but a government as backward, or more, as Saudi Arabia. This revolution against top-down autocracy and outdated governments and politics will continue to mushroom for years to come, and the greatest financial crisis of our lives between 2020 and 2023 will only exacerbate it… And next comes top-down management in corporations – like the top CEOs buying back their own stocks into the top of the biggest bubble in history. Oh, that will look brilliant in the years ahead. I say: “It’s about time… bring it on!”

Harry Dent Trending Stories... Seven or eight years ago, I gave a speech in L.A. for a friend of mine, Chris Cordoba. Afterwards, we went out to dinner with some of his friends. They asked economic questions, and eventually the conversation turned to concerns about hotspots around the world. I had one big worry… the relationship between China and... Here in late 2019, the 45-year tech cycle is converging on the last top back in late 1972. More important the 90-year Super-Bubble Cycle is converging on that infamous late 1929 anniversary. The crypto/bitcoin hype cycle is also right about where the internet was before the first tech crash, from early 2000 into late 2002.... I just got to New York after two weeks in Australia, and while I'm glad to be back on American soil, I'm still a bit frazzled and jet-lagged from the long flights. So we weren't able to record a rant today. We'll be back with those next week. In its place, I had our video... People in the nine-zeros club rarely make my prayer list. Usually my concerns are closer to home, centered on family members and friends, or sometimes things at work. But billionaires have taken a lot of heat lately, as many people hold them up as examples of all that is wrong in our economy. I disagree.... Dr. Lacy Hunt was the first economist to explain why money velocity is important: It measures whether a country is investing its money productively to create continued growth. When it's above average and growing, that's a sign of productive investment that pays good returns and creates more such investment. Falling indicates increased speculation. Falling and... |

No comments:

Post a Comment