Global Growth Falling: First China, Now India

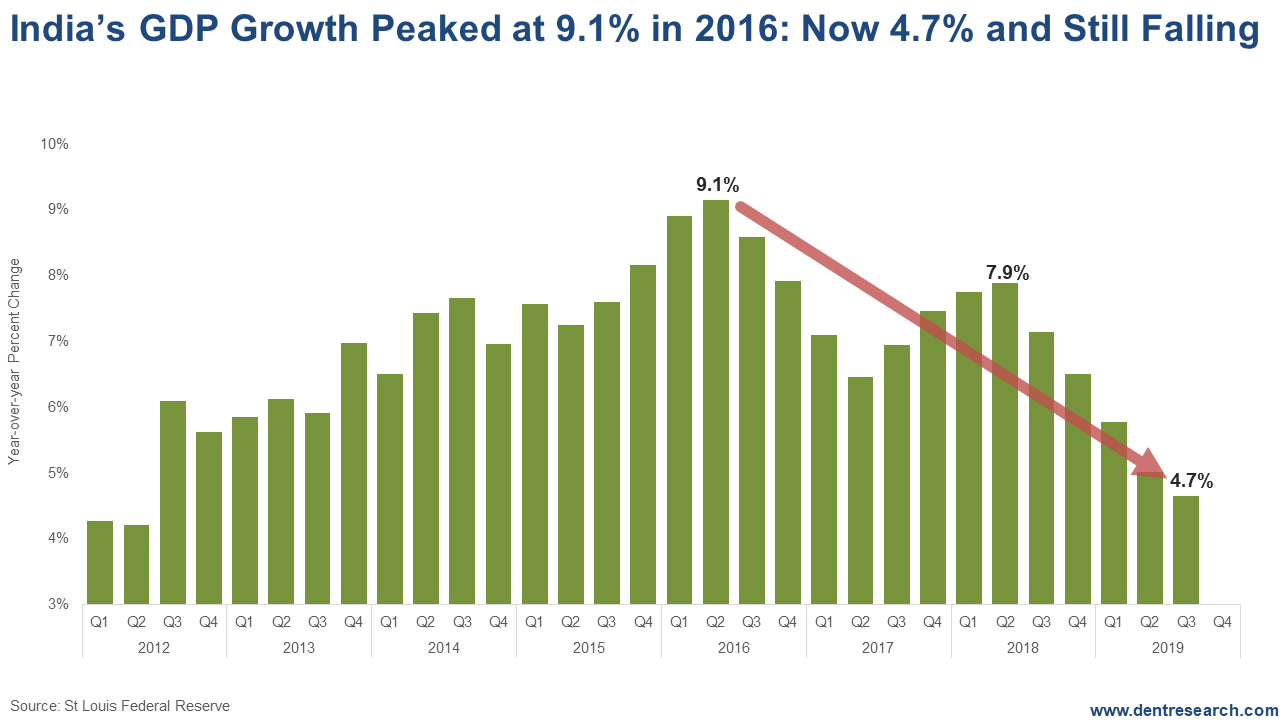

Harry Dent | December 23, 2019 | The central banks’ job of keeping this big, fat ugly bubble going is just going to get harder. Not only are they fighting record debt and falling demographic trends in the developed world – with my hierarchy of indicators all pointing down – they are fighting record debt in the emerging world and slowing growth there near-term, despite favorable longer-term demographic trends. For 2018, the growth rates in the leading emerging countries were lower than we’ve seen for a long time: China 6%, Indonesia 5%, and India 4.7%. China has clearly been both the biggest contributor to global growth and to the eradication of poverty. But they have also been the greatest polluter. China has been on a highly stimulated urbanization explosion since the early 1980s, from 20% to 60% urban at a very rapid rate of just over 1% urban gains per year. But they have seen the greatest explosion of debt of any major country, and overbuilding that makes past orgies in Japan and Southeast Asia look lame. China’s peak growth rate was 15.3% in the 1st quarter of 1993. After falling off into around 2000, it surged again to 15.0% in the 2nd quarter of 2007 with a growth rate of 11.4% for that full year. After the global financial recession (GFC) into 2009 and a fall to 6% (a recession for China), it had one final surge to 12.2% growth into the first quarter of 2010. It has fallen steadily ever since now back to 6.0%, the lowest since 2009. Forecasts are for a fall to 5.6% in 2020. I think it’s likely to be lower than that, and then I see negative rates by 2022. That will be a depression for sure for China. But India took the mantle after the GFC and reached a peak growth rate of 9.1% in 2016. Now that has fallen to 4.7% in the 3rd quarter of 2019. That certainly looks to fall further, although Modi is pushing a $1 trillion infrastructure plan for the coming years to help stimulate.

[Click to Enlarge] China has the highest debt of any major emerging country, especially its whopping 168% of GDP in corporate debt – the most likely to default with $17 billion per year already in 2018 and 2019, and looking to rise rapidly. India is now having a lot of unrest over Modi’s anti-Muslim immigration policies; that can only weigh on its economy and consumer sentiment. | Can You Afford a Repeat of 2008? Are you one of the millions of Americans counting on selling your home to afford retirement and cannot afford another housing crash? Learn the cold hard truth about property prices, what’s really propping them up and what your realtor doesn’t want you to know in Harry Dent’s latest e-book, Real Estate Doomsday. Find out how to get your copy today! | My number one trigger for the next larger global crisis or great financial depression is corporate and government debt defaults in the emerging world… That’s even harder for developed country central banks to fight. How is the Fed going to stop a real estate crash in the most overvalued market in the world when first-time, naïve Chinese households realize that their speculative empty condos are going to fall and panic selling sets in? Have they been able to stop the hyperinflation crisis in Venezuela or the currency crash in Argentina? There are more of these coming until China succumbs, and then it’s game over. I say this bubble peaks sometime in 2020 and what I now call the “tipping point” for short-term and long-term trends – and as early as late January or February. Trump’s the wild card that could attempt to stave it off the latest into the election. Even in that case we will be crashing by early 2021 at the latest. Get ready for the failure of the biggest something for nothing experiment and Ponzi scheme in monetary history. I’m rooting for that, as it’s the only way to get back to a deleveraging, or detox, and a natural cycle of innovation and growth again… No more debt and financial bubble denial!

Harry Dent Trending Stories... Today's rant is a preview of January's Boom & Bust, which we're putting out to subscribers early this round because of the holidays beginning next week. I believe that this upcoming issue is one of the most essential and all-encompassing reports on the current financial bubble, both in terms of how we got to this... Years ago, I can remember my mom coming home from a day of shopping around the holidays and announcing that she'd saved over $600. My dad immediately asked the obvious question. How much had that savings cost? As we peruse the online and brick-and-mortar malls this last week before Christmas, we're barraged with seemingly great... How can the same houses go up far faster than inflation for decades, and that possibly be good for an economy? It only benefits older people who bought earlier, and the affluent who buy the most expensive ones that tend to bubble the most. I was just in Australia speaking to my favorite country and... I haven't worked in a traditional office in a long time. I miss some of the camaraderie, the ability to bounce ideas around, and the occasional happy hour. But I don't miss some of the personnel issues that pop up, like friction among co-workers, bad-smelling lunches wafting through the office, and the annual Secret Santa.... I always remind people and economists that Japan was the first Asian Tiger – the first to urbanize rapidly on an S-Curve to $40,000+ GDP per capita PPP and DC (developing country) status in just under 30 years. When I speak in South Korea, I tell them: You are Japan on a 22-year lag for... |

No comments:

Post a Comment