The Fastest Growing Renters? Boomers!

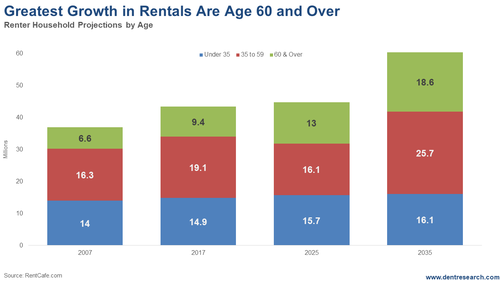

Harry Dent | August 07, 2019 | I am speaking at Brad Sumrok's national conference for Apartment Rentals in Dallas this Saturday, so I've been brushing up on my demographic research in that arena of real estate. There've been some interesting new insights. My consumer life cycle for real estate starts with apartments and multi-family homes for renters; that typically peaks around the age of marriage, which used to be age 26 for the Boomers and now is age 28 (and rising) for Millennials. That has been one of the best segments in a roller-coaster bubble housing market that has made owning a home look much riskier, largely due to the rise of the Millennials born by my rising wave of births definition, from 1976 into 1990. That would create a rising wave of new households and renters from 2003 into 2018. But they aren't peaking yet – and maybe won't for quite a while. First thing to note is that this younger group will extend the rental cycle in the downturn I'm anticipating from around 2020 to 2023 or 2024 as they get even more scared to buy than young folks were during the Great Recession. Under 35 buyers have to date bought at substantially lower rates than Boomers and Gen X did during the same ages. And Millennials will only find themselves trailing the older generations even more as loans get harder to get and the markets swing downside again for a few years. But more important, there is currently a new gang of renters riding into town: Aging Boomers. They have not saved enough for retirement, are increasingly down-sizing from larger homes now that they are empty nesters, and have seen scary volatility in housing markets for the first time in their life. Look at this chart of growth in renters by age groups.

Damn… who would have thought. Renters 60 and older have grown the fastest, at 43% over the last decade. From 2017 to 2035 they will double from 9.4 to 18.6 million, growing faster than the 35–59 age group, and even more so than the slowing rate of those younger than 35. READ MORE » |  What could be the biggest wealth building opportunity of your life is right in front of you. And this wildly popular "how-to" book shows you how to take advantage of it to potentially build a fortune that could last for generations! If you look on Amazon you'll see this book retails for $14.99. But today, you can claim a copy for free. Click here now to see how! What could be the biggest wealth building opportunity of your life is right in front of you. And this wildly popular "how-to" book shows you how to take advantage of it to potentially build a fortune that could last for generations! If you look on Amazon you'll see this book retails for $14.99. But today, you can claim a copy for free. Click here now to see how! | Trending Stories... I'm in the Colorado mountains this week. yet, I must note the significance of the reports this morning that Chinese companies have put a stop to purchases of U.S. agriculture products, moving the lengthy trade war into new territory. I'll turn the rest of today's column to my colleague Chris Scott, an expert on international... When I last met with Richard Mogey years ago, past director of The Foundation for the Study of Cycles, the topic of sunspot cycles came up. Mogey was the first person who totally got it. He had been following these cycles for a long time and understood their impact on the business cycle and agriculture.... All the focus this week, after the Fed rate cut on Wednesday, was on the Democratic debates, and I gotta tell ya… they have been on the disappointing side. One clear trend is that Elizabeth Warren is steadily rising in popularity. Another is that Independents are more powerful than most realize. So today let's talk... At the end of July, Harley-Davidson reported second-quarter results, and it was a bloodbath. Sales slid and profits suffered a 20% drop. None of this is surprising to Harry and me. In fact, we knew well before 2006 that the company would fall from grace because we knew its target audience and what they would... It's been too long since we've shared our Q&As with our readers. So, today we remedy that. Here's what readers have been asking Rodney and me… and how we answered them. Remember, if you have any questions we don't answer below, write to us at economyandmarkets@dentresearch.com. Karen S. Emailed The Following… I have been an... |

No comments:

Post a Comment