How Far Will Markets Correct?

Two Scenarios for the Dark Window Finale By Harry Dent In my Economy & Markets video on Friday, I discussed why the trade deal has been challenging and likely doomed in the end. I also talked about the impact the "sudden" collapse in negotiations has had on the markets. Investors thought a deal was imminent. Now, they see it's nowhere in sight… and they're storming the exits. Regardless of the reason, a correction was overdue… and I'm glad it's finally taking place because it sets up the Dark Window finale perfectly. As always, I have two scenarios for what comes next…

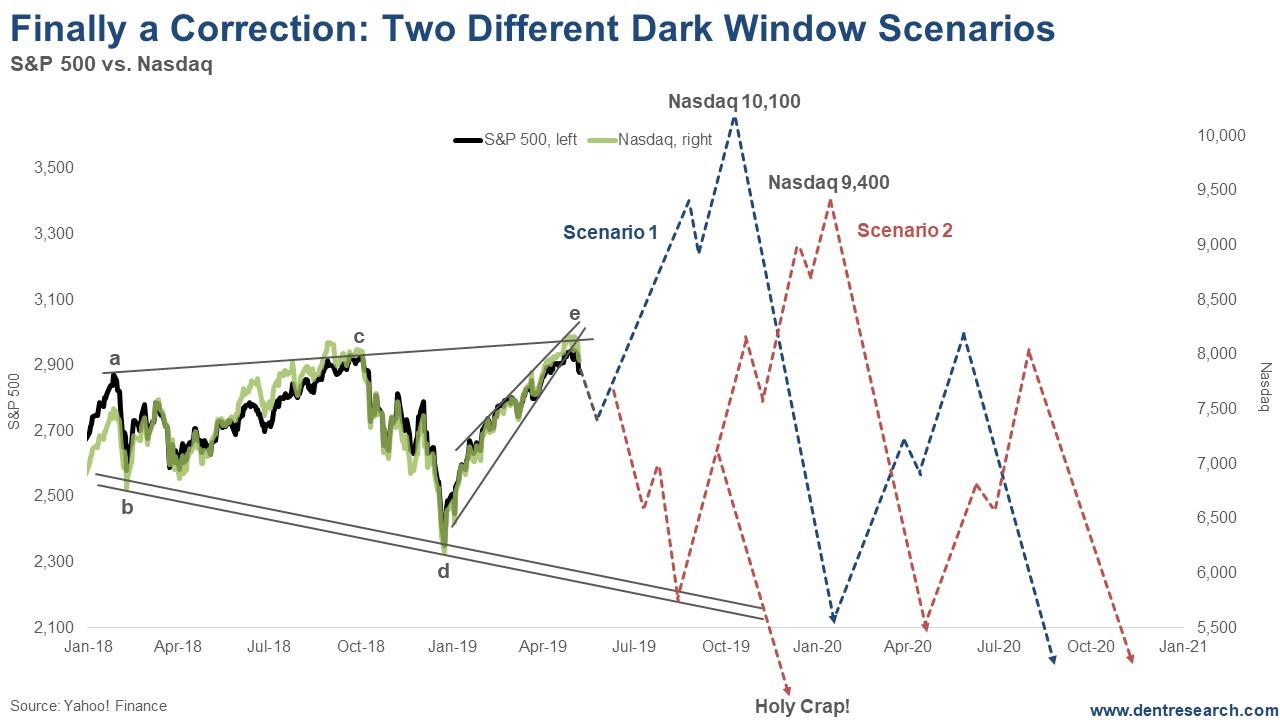

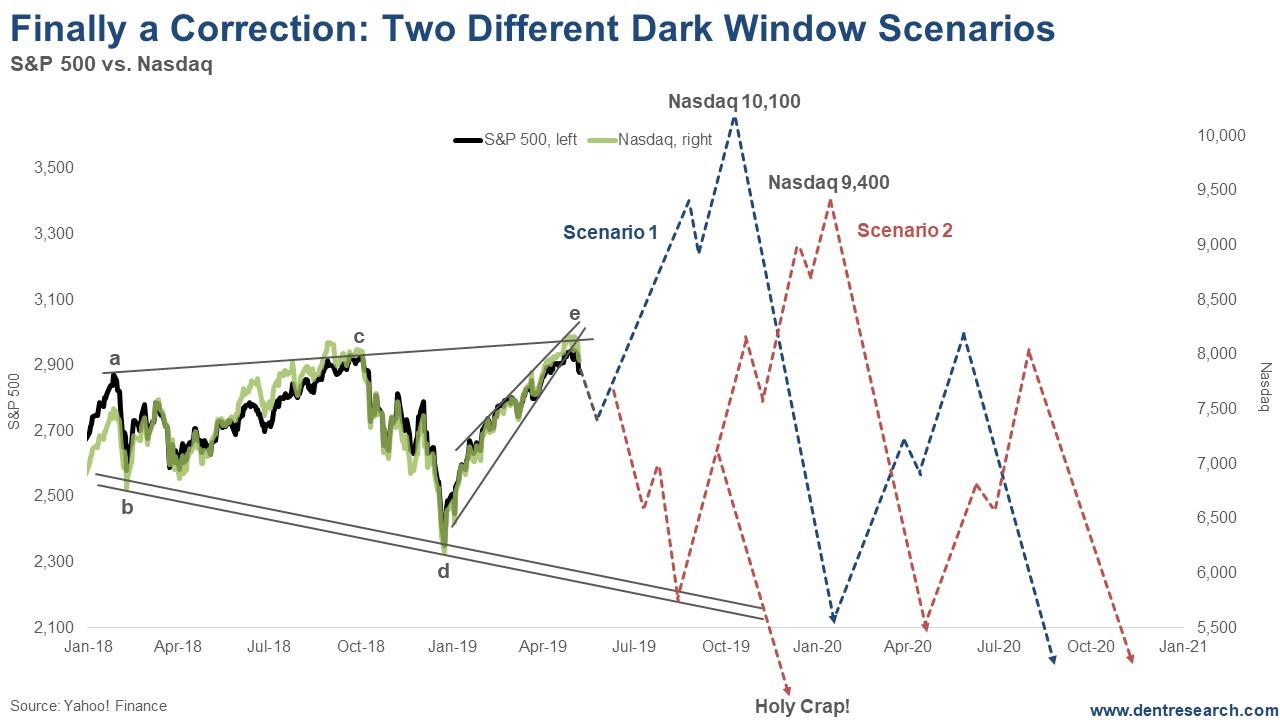

[CLICK TO ENLARGE] This chart may look a little complex because I'm including a number of charting concepts, but just focus on the simplicity of the two scenarios in the blue and red projections. Note that I focus most on the Nasdaq because it's the lead bubble. Scenario #1: Meh… The first scenario sees a shallower correction, not much lower than around 7,350 (down 10%) on the Nasdaq and 2,710 (down 8% or so) on the S&P 500… within about a month. After that, it's a rocket shot to the moon by as early as September. I'm talking 10,100 Nasdaq target and as high as 3,500 for the S&P 500. However, the broader indices may lag like they did into early 2000. Scenario #2: Much Scarier The second scenario tests and likely makes slight new lows into around late July or early August. Then, it turns around and shoots to around 9,400 on the Nasdaq by early January 2020 or so. Where did I get those 10,100 and 9,400 targets? From the exponential progression I have shown in past articles, but starting from different lows. My exponential long-term trendline through the tops comes through around 9,400 later this year… and it would be typical to see an "overthrow" rally to something like that 10,100 target. But look back at the chart and consider the green and black lines to the left. As you can see, the S&P 500 has formed a near-perfect megaphone pattern with higher highs and lower lows. It has completed (or near if there is one more quick bounce) an e-wave final top. This puts the correction target at the trend-line through the lower lows. That projects an S&P 500 of around 2,200 in three months or so. This is important because it would potentially break the broader trend-line through the bottoms since 2009 at around 2,350, where the S&P 500 bottomed in December. As I've said many times, that's a "line in the sand" for the index. Maybe it holds near 2,350. That would be optimal for the Dark Window scenario. The bottom megaphone trend-line would suggest a bottom for the Nasdaq around 5,500 to 6,000. The lower number is its line in the sand through longer-term bottoms. Note the "Holy Crap" marker… If we break both of those lines clearly, then this bubble is very likely over. However, this is not a likely scenario at this point because the triple-top between January 2018 and April 2019 doesn't look like a classic major bubble top. I knew in November that the previous September 2018 peak wasn't a top because it wasn't acting like first crashes of past bubbles, where the trend was for losses of 42% on average in the first 2.6 months. Also note the e-wave up to the recent top… It was a classic rising wedge on the leading Nasdaq – and more so on the Nasdaq 100 (NDX) that marks near -erm tops. We have broken down out of that wedge and that increases the odds of a more significant correction near term. In other words, scenario 2. If scenarios 2 is developing, and we see new lows over the next month, it should last three months and look more like the crash on September to December 2018. The first wave of that crash in the first month saw losses of 15% on the Nasdaq and 11% on the S&P 500. That's why its important how much the market goes down in these next several weeks, into say early June. If the markets are down 8% to 10%, we're more likely in scenario 1. If they lose 11% to 15%, we're likely to be in scenario 2. This Dark Window move will surprise almost everyone and be very tricky. That's why its important to keep monitoring it… I'll keep you updated.

Harry Dent

Follow me on Twitter @harrydentjr |

No comments:

Post a Comment